All posts by Guest Contributor

Identity theft is frustrating. Not just for people, but for businesses too. According to our recent survey, many Americans are unknowingly engaging in risky behaviors online. Some of the insights that cause concern include: U.S. adults have large digital footprints, storing an average of 3.4 types of personally identifiable information (PII) online. Half don’t think they’re likely to ever experience identity theft because they believe poor credit makes them unappealing targets. A quarter have shared their credit card number or PIN with friends and family. When fraudsters capture your customers’ PII, it impacts them as well as your business. That’s just one of many reasons why you should be helping your customers protect their information. PII security tips for your customers >

Weekend getaways, beach vacations and summer camp are all part of the beauty of summer. But they can come with a hefty price tag, and many consumers delay payment by placing summer fun costs on a credit card. In a recent study by Experian and Edelman Berland, travelers rely heavily on credit for vacation purchases and unexpected costs, and many charge more than half of their vacation this summer. A whopping 86 percent spent money on a summer vacation in 2016—an average of $2,275 per person with $1,308 of that amount on credit card spending. And 35 percent of those surveyed had not saved in advance. Even consumers who budgeted for vacation typically accrue unexpected costs. Sixty-one percent of those who set a budget ended up spending more than they planned. Accumulated debt doesn’t bode well for consumers. In the first quarter of 2016, consumers had an average of $3,910 in credit card debt, according to Experian data. That's $44 less than in the fourth quarter of 2015, but up $142 year over year. Overspending on vacation puts consumers in a more hazardous position to rack up debt during the holiday season and carry even higher balances into 2017 and beyond. Many consumers who are overspending consolidate summer debt, and proactive lenders can take advantage of that activity by making timely offers to consumers in need. At the same time, reactive lenders may feel the pain as balances transfer out of their portfolio. By identifying consumers who are likely to engage in card-to-card balance transfers, lenders can prepare for these consumer bankcard trends. Insights can then be used to acquire new customers and balances through prescreen campaigns, while protecting existing balances before they can transfer out of an existing loan portfolio. Lenders can also use tools to estimate a consumer’s spend on all general purpose credit and charge cards over the past year, and then target high-spending consumers with customized offers. With Memorial Day and the end-of-the-school-year fast approaching, card balances are likely already on the rise. Now is the time for lenders to prepare.

Experian’s ID Fraud Tracker, a quarterly analysis of fraud rates across consumer financial products, found that British families who are struggling financially — about 4 million people — are increasingly becoming prime targets of financial fraud. The research performed on data from 2014 to 2016 in the United Kingdom also revealed: There has been a 203% increase in the total number of fraudulent credit applications over the past two years. Current account, credit card and loan fraud were the most common types of credit products fraudsters applied for in other people’s names, making up 94% of the total. 35% of all third-party fraud came from households with high salaries and large disposable incomes. Fraud’s increasing around the world. We all have a responsibility to be vigilant and take measures to protect our business and customers, online and offline. Protect your customers >

There are about as many definitions for people-based marketing as there are companies using the term. Each company seems to skew the definition to fit their particular service offering. The distinctions are vast, and especially for financial services companies running regulated campaigns, they can be incredibly important. At Experian, we define people-based marketing in its purest form: targeting at the individual level across channels. This is a practice we’re very familiar with in offline marketing, having honed arguably one of the most accurate views of U.S. consumers over the past three decades. And now we’re taking those tried and true principals and applying them to digital channels. It’s not as easy as it sounds. The challenge with people-based marketing With direct mail, people-based marketing was easy. Jane Doe lives at 123 Main St. If I want to reach her, I can simply send her a direct mail piece at that address. To help, I can utilize any number of services, including the National Change of Address database, to know where to reach her if she ever moves. People-based marketing through digital channels is exponentially more difficult. While direct mail has one signal with which you use to identify a consumer (the address), digital channels offer countless signals. And not all of those signals can be used, either individually or in conjunction with other signals, to reliably tie a consumer to a persistent offline ID. A prime example of this is cookies. The problem with cookies A cookie, in and of itself, isn’t the problem. The problem is the linkage. How was a cookie associated with the person to whom the ad is being served? As marketers, we need to make sure that we are reaching the right people with the right ad … and more importantly not reaching those people who have opted out. This is especially true in the world of regulated data, where you need to know who you are targeting. And cookie-based linkage is controlled by a handful of companies, many of which are walled gardens who don’t share how they link offline people to online cookies and don’t collect this information directly. They rely on other third-party websites to gather PII, and connect it to their cookies. In some cases, the data is very accurate (especially with transaction data). In some cases, it is not (think websites that collect PII when giving surveys, offering coupons, etc.). In short, in order for you to use cookie-based targeting accurately, you need to have insight into the source of the base linkage data that was used to connect the offline consumer record to the online cookie. This same concept applies to all forms of digital linkage that drive people-based marketing. Why does people-based marketing matter in digital credit marketing? With campaigns that utilize non-regulated data, such as “Invitation to Apply” campaigns that are driven from demographic and psychographic data, the consequences of not reaching the consumer you meant to target are negligible. But with campaigns that utilize regulated data, you must ensure you’re targeting the exact consumer you meant to reach. More importantly, you must make sure you’re not targeting an ad to a consumer who had previously opted out of receiving offers driven with regulated data (prescreen offers, for example). Even if you’ve already delivered a direct mail piece with the same offer, this doesn’t negate your responsibility to reach only approved consumers who have not opted out. --- Bottom line, the world of 1:1 marketing is growing more sophisticated, and that’s a good thing. Marketers just need to understand that while regulated data can be powerful, they must also take great responsibility when handling it. The data exists to deliver firm offers of credit to your very specific target in all-new mediums. People-based marketing has its place, and it can now be done in a compliant, digitally-savvy way – in the financial services space, nonetheless. Register for our webinar on Credit Marketing Strategies to Drive Today's Digital Consumer.

Credit reports provide a wealth of information. But did you know credit attributes are the key to extracting critical intelligence from each credit report? Adding attributes into your decisioning enables you to: Improve acquisition strategies and implement policy rules with precision. Segment your scored population for more refined risk assessment. Design more enticing offers and increase book rates. Attributes can help you make more informed decisions by providing a more granular picture of the consumer. And that can make all the difference when it comes to smart lending decisions. Video: Making better decisions with credit attributes

Although the average mortgage rate was more than 4% at the end of the first quarter*, Q1 mortgage originations were nearly $450 billion — a 5% increase over the $427 billion a year earlier. As prime homebuying season kicks off, lenders can stay ahead of the competition by using advanced analytics to target the right customers and increase profitability. Revamp your mortgage and HELOC acquisitions strategies>

In a May 4 speech before the ACA International Conference in Washington, FCC Commissioner Michael O’Rielly criticized the FCC’s past decisions on Telephone Consumer Protection Act (TCPA) and outlined his vision on the direction that the new Commission should head to provide more certainty to businesses. Commissioner O’Rielly noted that prior decisions by the FCC and courts have “expanded the boundaries of TCPA far beyond what I believe Congress intended.” He said that the new leadership at the Commission and a new Bureau head overseeing TCPA, provides the FCC with the opportunity to “undo the misguided and harmful TCPA decisions of the past that exposed legitimate companies to massive legal liability without actually protecting consumers.” O’Rielly laid out three principles that he thought would help to frame discussions and guide the development of replacement rules. First, he said that legitimate businesses need to be able to contact consumers to communicate information that they want, need or expect to receive. This includes relief for informational calls, as well as valid telemarketing calls or texts. Second, Commissioner O’Rielly said that FCC should change the definition of an autodialer so that valid callers can operate in an efficient manner. He went on to say that if FCC develops new rules to clarify revocation of consent, it should do so in a clear and convenient way for consumers, but also does not upend standard best practices of legitimate companies. Third, O’Rielly said that the FCC should focus on actual harms and bad actors, not legitimate companies. While Commissioner O’Rielly’ s comments signal his approach to TCPA reform, it is important to note that FCC action on the issue us unlikely to happen overnight. A rule must be considered by the Commission, which will have to allow for public notice and comment. Experian will continue to monitor regulatory and legislative developments on TCPA.

Experian and Creative Strategies share survey results about Apple’s AirPods, Google Home, Amazon Echo and Echo Dot for consumer behavior with voice devices.

During our recent webinar, Detect and Prevent: The current state of e-commerce fraud, Julie Conroy, Aite Group research director, shared 5 key trends relating to online fraud: Rising account takeover fraud. Targeting of loyalty points. Growing global transactions. Frustrating false declines. Increasingly mobile consumers. Fraud is increasing. Be prepared. Protect your business and customers with a multilayered approach to fraud prevention. For more trends and predictions, watch the webinar recording.

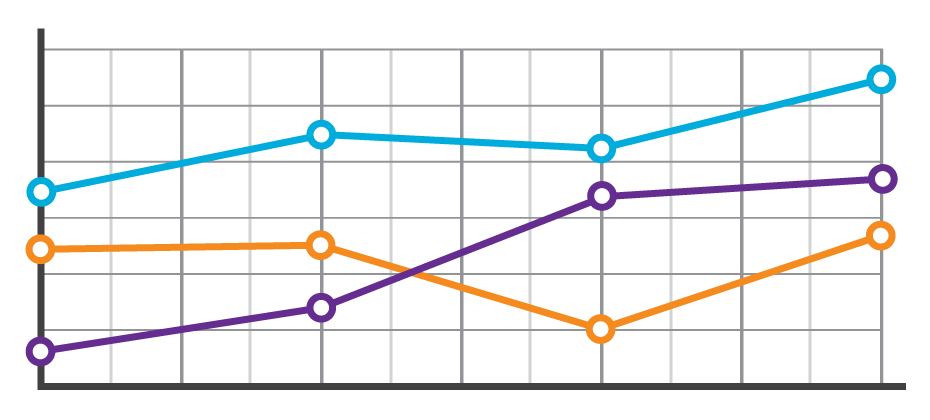

Sometimes life throws you a curve ball. The unexpected medical bill. The catastrophic car repair. The busted home appliance. It happens, and the killer is that consumers don’t always have the savings or resources to cover an additional cost. They must make a choice. Which bills do they pay? Which bills go to the pile? Suddenly, a consumer’s steady payment behavior changes, and in some cases they lose control of their ability to fulfill their obligations altogether. These shifts in payment patterns aren’t always reflected in consumer credit scores. At a single point in time, consumers may look identical. However, when analyzing their past payment behaviors, differences emerge. With these insights, lenders can now determine the appropriate risk or marketing decisions. In the example below, we see that based on the trade-level data, Consumer A and Consumer B have the same credit score and balance. But once we see their payment pattern within their trended data, we can clearly see Consumer A is paying well over the minimum payments due and has a demonstrated ability to pay. A closer look at Consumer B, on the other hand, reveals that the payment amount as compared to the minimum payment amount is decreasing over time. In fact, over the last three months only the minimum payment has been made. So while Consumer B may be well within the portfolio risk tolerance, they are trending down. This could indicate payment stress. With this knowledge, the lender could decide to hold off on offering Consumer B any new products until an improvement is seen in their payment pattern. Alternatively, Consumer A may be ripe for a new product offering. In another example, three consumers may appear identical when looking at their credit score and average monthly balance. But when you look at the trend of their historical bankcard balances as compared to their payments, you start to see very different behaviors. Consumer A is carrying their balances and only making the minimum payments. Consumer B is a hybrid of revolving and transacting, and Consumer C is paying off their balances each month. When we look at the total annual payments and their average percent of balance paid, we can see the biggest differences emerge. Having this deeper level of insight can assist lenders with determining which consumer is the best prospect for particular offerings. Consumer A would likely be most interested in a low- interest rate card, whereas Consumer C may be more interested in a rewards card. The combination of the credit score and trended data provides significant insight into predicting consumer credit behavior, ultimately leading to more profitable lending decisions across the customer lifecycle: Response – match the right offer with the right prospect to maximize response rates and improve campaign performance Risk – understand direction and velocity of payment performance to adequately manage risk exposure Retention – anticipate consumer preferences to build long-term loyalty All financial institutions can benefit from the value of trended data, whether you are a financial institution with significant analytical capabilities looking to develop custom models from the trended data or looking for proven pre-built solutions for immediate implementation.

Data is the cornerstone of retail success today. Yet only 39% of retailers trust their data when making important business decisions. Your organization — whether retail or not — can start depending on your data and gain actionable insights with these data management tips: Put the right people in place. Get the tools you need. Enrich your data. Collect accurate customer information Arranging for the right people, tools and processes to maintain accurate information helps you stay on top of your data now and lets you leverage that data to stay ahead of the curve. Learn more tips>

It should come as no surprise that reaching consumers on past-due accounts by traditional dialing methods is increasingly ineffective. The new alternative, of course, is to leverage digital channels to reach and collect on debts. The Past: Dialing for dollars. Let’s take a walk down memory lane, shall we? The collection approach used for many years was to initially send the consumer a collection letter recapping the obligation and requesting payment, usually when an account was 30 days late. If the consumer failed to respond, a series of dialing attempts were then made, trying to reach the consumer and resolve the debt. Unfortunately, this approach has become less effective through the years due to several reasons: The use of traditional landlines continues to drop as consumers shift to cell and Voice Over Internet Protocol (VOIP) services. The cost of reaching consumers by cell is more costly since predictive dialers can’t be used without prior consent, and the obtaining and maintaining consent presents its own set of tricky challenges. Consumers simply aren’t answering their phones. If they think a bill collector is calling, they don’t pick up. It’s that simple. In fact, here is a breakdown by age group that Gallup published in 2015, highlighting the weakness of traditional phone-dialing. The Present: Hello payment portal. With the ability to get the consumer on the phone to negotiate a payment on the wane, the logical next step is to go digital and use the Internet or text messaging to reach the consumer. With 71 percent of consumers now using smartphones and virtually everyone having an Internet connection, this can be a cost-effective approach. Some companies have already implemented an electronic payment portal whereby a consumer can make a payment using his or her PC or smartphone. Usually this is prompted by a collection letter, or if permitted by consumer consent, a text message to their smartphone. The Future: Virtual negotiation. But what if the consumer wants to negotiate different terms or payment plans? What if they want to try and settle for less than the full amount? In the past – and for most companies operating today – this translates into a series of emails or letters being exchanged, or the consumer must actually speak to a debt collector on the phone. And let’s be honest, the consumer generally does not want to speak to a collector on the phone. Fortunately, there is a new technology involving a virtual negotiator approach coming into the market now. It works like this: The credit grantor or agency contacts the consumer by letter, email, or text reminding them of their debt and offering them a link to visit a website to negotiate their debt without a human being involved. The consumer logs onto the site, negotiates with the site and hopefully comes to terms with what is an acceptable payment plan and amount. In advance, the site would have been fed the terms by which the virtual negotiator would have been allowed to use. Finally, the consumer provides his payment information, receives back a recap of what he has agreed to and the process is complete. This is the future of collections, especially when you consider the younger generations rarely wanting to talk on the phone. They want to handle the majority of their matters digitally, on their own terms and at their own preferred times. The collections process can obviously be uncomfortable, but the thought is the virtual negotiator approach will make it less burdensome and more consumer-friendly. Learn more about virtual negotiation.

With the recent switch to EMV and more than 4.2 billion records exposed by data breaches last year*, attackers are migrating their fraud attempts to the card-not-present channel. Our recent analysis found the following states to be the riskiest for e-commerce fraud in 2016. Delaware Oregon Florida New York Nevada Attackers are extremely creative, motivated, and often connected. Prevent e-commerce fraud by protecting all of your customer contact points. Fraud Heat Map>

Investors and financial institutions continue to invest in fintech to help meet the dynamic expectations of consumers who want fast, easy and hassle-free access to new financial products and services. Just last week, in his annual letter to shareholders, JP Morgan Chase CEO Jamie Dimon noted that the bank has invested approximately $600 million “on emerging fintech solutions – which include building and improving digital and mobile services and partnering with fintech companies.” Meanwhile, policymakers in Washington continue to grapple with how to spur responsible innovation and how fintech fits into the existing regulatory paradigm. The Office of the Comptroller of the Currency (OCC) continues to move forward with the development of a special purpose national charter for fintech lenders. On March 15, the OCC issued a draft supplement to its existing Licensing Manual that describes how the agency “will apply the licensing standards and requirements in its existing regulations and policies to fintech companies applying for a special purpose national bank charter.” The draft manual, which is open for a 30-day public comment period ending April 14, 2017, would prohibit fintech lenders from offering products “with predatory features” or entities that inappropriately mingle banking and commerce. The agency also defended its legal authority to make the move without a new law from Congress or any formal rulemaking process, saying it’s doing nothing more than expanding a longstanding practice. At the same time, a group of House Republicans, led by House Financial Services Committee Chairman Jeb Hensarling (R-Tex.), has asked Comptroller of the Currency Thomas Curry to slow down plans to grant special charters to fintech firms. In the letter, the lawmakers state that OCC should provide “full and fair opportunity” for public comment on standards for granting fintech charters and allow President Trump’s pick for the next comptroller to weigh in. The lawmakers go on to say that if OCC “proceeds in haste” to create new limited-purpose charter for fintech, Congress will examine the agency’s actions and “if appropriate, overturn them.” The issue will likely continue to bubble under the surface as Congress and the Trump Administration tackle larger issues such as tax reform, infrastructure spending and possibly wider financial services reform. However, the fintech charter is a legacy item for Comptroller Curry and he is likely to seek to move this to closure given that his term expires at the end of April (although he would remain in place until President Trump nominates and confirms his replacement).

Setting new records isn’t just for racecar drivers. The auto finance industry continues to achieve its own new highs. According to Experian’s State of the Automotive Finance Market report, the average amount financed for a new vehicle in Q4 2016 was $30,261 — up $710 from Q4 2015 and the highest amount on record. The report also shows that the number of consumers opting for auto loans with longer terms (73 to 84 months) increased from 29% in Q4 2015 to 32.1% in Q4 2016. These findings underscore the importance of closely monitoring consumer credit trends to stay competitive, meet consumer demands and set your own new records. Webinar: Latest consumer credit trends>