Customer Targeting & Segmentation

The largest industry disruptor was a surprise to everyone. Where bets may have been placed on digital transformation, automated decisioning, or better omnichannel programs, no one foresaw the global pandemic of COVID-19 and the corresponding economic fall out that ensued. As financial institutions have spent the past two months scattered and then regrouping, whether with pivoted downturn contingency strategies or with a business-focused Hail Mary, some might argue that the dust is beginning to settle. While the world and the majority of businesses are working to manage and stabilize a new normal against a background of some form of chaos, once federal and state regulations are loosened, the world – and financial institutions in particular – will need a plan forward. So, what comes after COVID-19? With stimulus checks and what everyone hopes will soon be a re-stimulating of the economy, consumers will seek credit. And when that influx comes, there will be a need to strategize what is the right offer for the right consumer. How do you take on more customers while minimizing risk? Non-existent and/or shrinking budgets Many marketing budgets were already small prior to the global pandemic, so coming out of it, to say every marketing dollar counts is an understatement. Traditional prescreen, while a pillar in acquisition operations, is an antiquated strategy. Using hyper-segmentation via a true end-to-end marketing service, pumped up by the right data for decision making, enables financial institutions to not only build the right audience but tailor quality experiences that increase engagement and loyalty. That means ultimately reducing operating costs while improving experiences and take rates. Work from home turned life from home Going virtual has gone viral. Seemingly overnight, most brick and mortar operations went online. Some versions of digital transformation became a need to have, versus a nice to have, and the gap between the financial institutions who were equipped to pivot online, versus those who were not, spread further. As the vast majority of consumers are at home – whether by way of work from home or furlough – our society has quickly embraced everything being online. Reach your consumers where they are, in the digital-first channels to which they have become familiar with and accustomed. As consumers are at the center of every marketing strategy, engaging omnichannel delivery enhances reach across critical touchpoints. Inclusive of social media, email, direct mail, TV, and more, the campaign should provide a seamless experience, all working together in a synchronized fashion. Consistency has always been key, but especially during these volatile times, to reflect stability, empathy and constant messaging is an undertone that can only help strengthen consumers’ view of your organization. Learn fast, grow faster For marketing financial products, it’s a matter of connecting the dots between consumer touchpoints and results data. By making these critical connections, financial institutions will be better positioned to identify the most effective elements in the campaign. By gleaning more insights from campaign performance, organizations can optimize future campaigns and minimize wasted ad spend. These key learnings, delivered at the end of every campaign cycle, help your organization to remain nimble, pivot quickly and execute campaigns that get increasingly better ROI as you hone in on the nuances revealed by data on consumer behavior, preferences, motivations and more. Changing times and even faster-changing needs There’s always been a need for faster decisioning and more results with increasingly fewer resources. The need for speed has been put on hyperdrive as the economy has entered the current environment. How do you keep up with the changing needs of your consumers? Get your marketing right from the start and see results through to the end. Incorporating the right data, advanced analytics and constant access ultimately enable more strategic focus and shorter campaign cycles. As we all navigate the ever-changing “normal,” offering the right support to your consumers is the right thing to do for them and for you. Managing rising consumer needs, while also minimizing risk to your bottom line, is also the right thing to do for your business. Once plans move from managing business operations through the crisis to moving forward, make sure your marketing – how you are reaching out to existing customers and prospective customers for the next steps in their financial journey – is data-driven. To learn more about how Experian can help you execute data-driven marketing that fuels customer acquisition, visit our website. Learn More

When running a credit report on a new applicant, you must ensure Fair Credit Reporting Act (FCRA) compliance before accessing, using and sharing the collected data. The Coronavirus Aid, Relief, and Economic Security (CARES) Act has impacted credit reporting under the FCRA, as has new guidance from the Consumer Financial Protection Bureau (CFPB). Recent updates include: The CARES Act amended the FCRA to require furnishers who agree to an “accommodation,”1 to report the account as current, although it is permitted to continue to report the account as delinquent if the account was delinquent before the accommodation was made. Although not legally obligated, data furnishers should continue furnishing information to the credit reporting agencies (CRAs) during the COVID-19 crisis, and make sure that information reported is complete and accurate. Below is a brief FCRA-related compliance overview2 covering various FCRA requirements3 when requesting and using consumer credit reports for an extension of credit permissible purpose. For more information regarding your responsibilities under the FCRA as a user of consumer reports, please consult your Legal Counsel and the Notice to Users of Consumer Reports: Obligations of Users Under the FCRA handbook located on our website. Before obtaining a consumer report you have… Reviewed your federal and state regulations and laws related to consumer reports, scores, decisions, etc. Made sure you have a valid permissible purpose for pulling the consumer report. Certified compliance to the CRA from which you are getting the consumer report. You have certified that you complied with all the federal and state requirements. After you take an adverse action based on a consumer report you… Provide the consumer with an oral, written or electronic notice of the adverse action. Provide written or electronic disclosure of the numerical credit score used to take the adverse action, or when providing a “risk-based pricing” notice. Provide the consumer with an oral, written or electronic notice, which includes the below information: Name, address and telephone number of CRA that supplied the report, if nationwide. A statement that the CRA did not make the adverse decision and therefore can’t explain why the decision was made. Notice of the consumer’s right to a free copy of their report from the CRA, if requested within 60 days. Notice of the consumer’s right to dispute with the CRA the accuracy or completeness of any information in a consumer report provided by the CRA. Provide the consumer with a “risk-based pricing” notice if credit was granted but on less favorable terms based on information in their consumer report. We understand how challenging it is to understand and meet all your obligations as a data furnisher – we’re here to make it a little easier. Click below to speak with a representative and gain more insight on how the CARES Act impacts FCRA reporting. Download overview Speak with a representative 1An “accommodation” is defined as “an agreement to defer one or more payments, make a partial payment, forbear any delinquent amounts, modify a loan or contract, or any other assistance or relief” granted to a consumer affected by COVID-19 during the covered period. 2This FCRA overview is not legal guidance and does not enumerate all your requirements under the FCRA as a user of consumer reports. Additionally, this FCRA Overview is not intended to provide legal advice or counsel you regarding your obligations under the FCRA or any other federal or state law or regulation. Should you have any questions about your institution’s specific obligations under the FCRA or any other federal or state law or regulation, you should consult with your Legal Counsel. 3This FCRA overview is intended to be used solely by financial service providers when extending credit to consumers and does not include all FCRA regulatory obligations. You are responsible for regulatory compliance when requesting and using consumer reports, which includes adhering to all applicable federal and state statutes and regulations and ensuring that you have the correct policies and procedures in place.

Amid the fallout of COVID-19, I often find myself thinking about the impact the pandemic has had and will have on businesses in the coming months—particularly those within the automotive industry. The impact has reached all facets of the industry, leaving dealerships to take unprecedented action. Some have temporarily closed, while many have shifted business priorities to focus on maintenance and repair. Like everyone, we in the automotive industry are concerned about the health and safety of our family, friends and communities. Much like the rest of small business owners, those that oversee dealerships are also concerned about the wellbeing of their work families. The automotive industry is a pillar of our economy, and dealerships are staples within our local communities. Experian has an unwavering commitment to help the industry navigate these uncertain times and address challenges as they arise. The pandemic has impacted groups of people differently and at different times. It’s important for those within the automotive industry to understand how consumer sentiment and priorities will shift over the coming months, in order to address their most pressing needs. As such, Experian launched a daily survey of the general population to gain insight into shifting consumer sentiment as a result of the pandemic. The survey reveals how consumers are dealing with the outbreak across key industries, including automotive. As of May 4, 2020, only 20 percent of Americans plan on buying a new car, truck, van or motorcycle within the next few months, and of those, only 50 percent plan to continue the purchase as planned. 26 percent plan to delay the purchase a few months. While car shopping may not be a priority for most in the coming months, there are consumers who will need to replace their vehicle sooner rather than later—perhaps their lease is set to expire, or they’ve experienced car trouble. In these instances, it’s important for dealers to be able to connect with these consumers to help them understand the options available to them. With this urgency in mind, Experian is providing dealers with complimentary access to nationwide and local automotive market trends. The information will be updated weekly to help dealers gain insight into current sales trends and website traffic, better understand in-market car shoppers and identify the most effective communications channels. For instance, during the week of April 27, dealer website traffic was down 11 percent from the same time last year. That said, web site traffic has picked back up over the past few weeks.. With the short- and long-term impacts of the pandemic largely unknown, dealerships must adapt quickly. Consumers' vehicle needs will shift based on circumstance, and it’s important for dealers to continually assess the market. We are all adapting to our new environment, and will need to collaborate to find ways to combat the fallout—it’s a difficult time for many, including dealers. The automotive market will recover, and Experian is committed to helping the automotive industry navigate the recovery and ensure car shoppers can find vehicles that meet their needs. To view the Automotive Trends & Marketing Insights and sign up to receive your complimentary local market trends, click here. To view the Consumer Sentiment Index, click here.

Today’s lending market has seen a significant increase in alternative business lending, with companies utilizing new data assets and technology. As the lending landscape becomes increasingly competitive, consumers have more choices than ever when it comes to lending products. To drive profitable growth, lenders must find new ways to help applicants gain access to the loans they need. How Spring EQ is leveraging Experian BoostTM Home equity lender Spring EQ turned to Experian’s first-of-its-kind financial tool that empowers consumers to add positive payments directly into their credit file to assist applicants with attaining the best loan opportunities and rates. By using Experian BoostTM, which captures the value of consumer’s utility and telecom trade lines, in their current lending process, Spring EQ can help applicants near approval or risk thresholds move to higher risk tiers and qualify for better loan terms and conditions. Driving growth with consumer-permissioned data Over 40 million consumers in the U.S. either have no credit file or have insufficient information in their files to generate a traditional credit score. Consumer-permissioned data empowers these individuals to leverage their online financial data and payment histories to gain better access to loans and other financial services while providing lenders with a more comprehensive view of their creditworthiness. According to Experian research, 70% of consumers see the benefits of sharing additional financial information and contributing positive payment history to their credit file if it increases their odds of approval and helps them access more favorable credit terms. Read our case study for more insight on using Experian Boost to: Make better lending decisions Offer or underwrite credit to more people Promote the right credit products Increase conversion and utilization rates Read case study Learn more about Experian Boost

With new legislation, including the Coronavirus Aid, Relief, and Economic Security (CARES) Act impacting how data furnishers will report accounts, and government relief programs offering payment flexibility, data reporting under the coronavirus (COVID-19) outbreak can be complicated. Especially when it comes to small businesses, many of which are facing sharp declines in consumer demand and an increased need for capital. As part of our recently launched Q&A perspective series, Greg Carmean, Experian’s Director of Product Management and Matt Shubert, Director of Data Science and Modelling, provided insight on how data furnishers can help support small businesses amidst the pandemic while complying with recent regulations. Check out what they had to say: Q: How can data reporters best respond to the COVID-19 global pandemic? GC: Data reporters should make every effort to continue reporting their trade experiences, as losing visibility into account performance could lead to unintended consequences. For small businesses that have been negatively affected by the pandemic, we advise that when providing forbearance, deferrals be reported as “current”, meaning they should not adversely impact the credit scores of those small business accounts. We also recommend that our data reporters stay in close contact with their legal counsel to ensure they follow CARES Act guidelines. Q: How can financial institutions help small businesses during this time? GC: The most critical thing financial institutions can do is ensure that small businesses continue to have access to the capital they need. Financial institutions can help small businesses through deferral of payments on existing loans for businesses that have been most heavily impacted by the COVID-19 crisis. Small Business Administration (SBA) lenders can also help small businesses take advantage of government relief programs, like the Payment Protection Program (PPP), available through the CARES Act that provides forgiveness on up to 75% of payroll expenses and 25% of other qualifying expenses. Q: How do financial institutions maintain data accuracy while also protecting consumers and small businesses who may be undergoing financial stress at this time? GC: Following bureau recommendations regarding data reporting will be critical to ensure that businesses are being treated fairly and that the tools lenders depend on continue to provide value. The COVID-19 crisis also provides a great opportunity for lenders to educate their small business customers on their business credit. Experian has made free business credit reports available to every business across the country to help small business owners ensure the information lenders are using in their credit decisioning is up-to-date and accurate. Q: What is the smartest next play for financial institutions? GC: Experian has several resources that lenders can leverage, including Experian’s COVID-19 Business Risk Index which identifies the industries and geographies that have been most impacted by the COVID crisis. We also have scores and alerts that can help financial institutions gain greater insights into how the pandemic may impact their portfolios, especially for accounts with the greatest immediate exposure and need. MS: To help small businesses weather the storm, financial institutions should make it simple and efficient for them to access the loans and credit they need to survive. With cash flow to help bridge the gap or resume normal operations, small businesses can be more effective in their recovery processes and more easily comply with new legislation. Finances offer the support needed to augment currently reduced cash flows and provide the stability needed to be successful when a return to a more normal business environment occurs. At Experian, we’re closely monitoring the updates around the coronavirus outbreak and its widespread impact on both consumers and businesses. We will continue to share industry-leading insights to help data furnishers navigate and successfully respond to the current environment. Learn more About Our Experts Greg Carmean, Director of Product Management, Experian Business Information Services, North America Greg has over 20 years of experience in the information industry specializing in commercial risk management services. In his current role, he is responsible for managing multiple product initiatives including Experian’s Small Business Financial Exchange (SBFE), domestic and international commercial reports and Corporate Linkage. Recently, he managed the development and launch of Experian’s Global Data Network product line, a commercial data environment that provides a single source of up to date international credit and firmographic information from Experian commercial bureaus and Tier 1 partners across the globe. Matt Shubert, Director of Data Science and Modelling, Experian Data Analytics, North America Matt leads Experian’s Commercial Data Sciences Team which consists of a combination of data scientists, data engineers and statistical model developers. The Commercial Data Science Team is responsible for the development of attributes and models in support of Experian’s BIS business unit. Matt’s 15+ years of experience leading data science and model development efforts within some of the largest global financial institutions gives our clients access to a wealth of knowledge to discover the hidden ROI within their own data.

In the face of severe financial stress, such as that brought about by an economic downturn, lenders seeking to reduce their credit risk exposure often resort to tactics executed at the portfolio level, such as raising credit score cut-offs for new loans or reducing credit limits on existing accounts. What if lenders could tune their portfolio throughout economic cycles so they don’t have to rely on abrupt measures when faced with current or future economic disruptions? Now they can. The impact of economic downturns on financial institutions Historically, economic hardships have directly impacted loan performance due to differences in demand, supply or a combination of both. For example, let’s explore the Great Recession of 2008, which challenged financial institutions with credit losses, declines in the value of investments and reductions in new business revenues. Over the short term, the financial crisis of 2008 affected the lending market by causing financial institutions to lose money on mortgage defaults and credit to consumers and businesses to dry up. For the much longer term, loan growth at commercial banks decreased substantially and remained negative for almost four years after the financial crisis. Additionally, lending from banks to small businesses decreased by 18 percent between 2008-2011. And – it was no walk in the park for consumers. Already faced with a rise in unemployment and a decline in stock values, they suddenly found it harder to qualify for an extension of credit, as lenders tightened their standards for both businesses and consumers. Are you prepared to navigate and successfully respond to the current environment? Those who prove adaptable to harsh economic conditions will be the ones most poised to lead when the economy picks up again. Introducing the FICO® Resilience Index The FICO® Resilience Index provides an additional way to evaluate the quality of portfolios at any point in an economic cycle. This allows financial institutions to discover and manage potential latent risk within groups of consumers bearing similar FICO® Scores, without cutting off access to credit for resilient consumers. By incorporating the FICO® Resilience Index into your lending strategies, you can gain deeper insight into consumer sensitivity for more precise credit decisioning. What are the benefits? The FICO® Resilience Index is designed to assess consumers with respect to their resilience or sensitivity to an economic downturn and provides insight into which consumers are more likely to default during periods of economic stress. It can be used by lenders as another input in credit decisions and account strategies across the credit lifecycle and can be delivered with a credit file, along with the FICO® Score. No matter what factors lead to an economic correction, downturns can result in unexpected stressors, affecting consumers’ ability or willingness to repay. The FICO® Resilience Index can easily be added to your current FICO® Score processes to become a key part of your resilience-building strategies. Learn more

In today’s rapidly changing economic environment, the looming question of how to reduce portfolio volatility while still meeting consumers' needs is on every lender’s mind. So, how can you better asses risk for unbanked consumers and prime borrowers? Look no further than alternative credit data. In the face of severe financial stress, when borrowers are increasingly being shut out of traditional credit offerings, the adoption of alternative credit data allows lenders to more closely evaluate consumer’s creditworthiness and reduce their credit risk exposure without unnecessarily impacting insensitive or more “resilient” consumers. What is alternative credit data? Millions of consumers lack credit history or have difficulty obtaining credit from mainstream financial institutions. To ease access to credit for “invisible” and subprime consumers, financial institutions have sought ways to both extend and improve the methods by which they evaluate borrowers’ risk. This initiative to effectively score more consumers has involved the use of alternative credit data.1 Alternative credit data is FCRA-regulated data that is typically not included in a traditional credit report and helps lenders paint a fuller picture of a consumer, so borrowers can get better access to the financial services they need and deserve. How can it help during a downturn? The economic environment impacts consumers’ financial behavior. And with more than 100 million consumers already restricted by the traditional scoring methods used today, lenders need to look beyond traditional credit information to make more informed decisions. By pulling in alternative credit data, such as consumer-permissioned data, rental payments and full-file public records, lenders can gain a holistic view of current and future customers. These insights help them expand their credit universe, identify potential fraud and determine an applicant’s ability to pay all while mitigating risk. Plus, many consumers are happy to share additional financial information. According to Experian research, 58% say that having the ability to contribute positive payment history to their credit files makes them feel more empowered. Likewise, many lenders are already expanding their sources for insights, with 65% using information beyond traditional credit report data in their current lending processes to make better decisions. By better assessing risk at the onset of the loan decisioning process, lenders can minimize credit losses while driving greater access to credit for consumers. Learn more 1When we refer to “Alternative Credit Data,” this refers to the use of alternative data and its appropriate use in consumer credit lending decisions, as regulated by the Fair Credit Reporting Act. Hence, the term “Expanded FCRA Data” may also apply in this instance and both can be used interchangeably.

Originally posted by Experian Global News blog At Experian, we have an unwavering commitment to helping consumers and clients manage through this unprecedented period. We are actively working with consumers, lenders, lawmakers and regulators to help mitigate the potential impact on credit scores during times of financial hardship. In response to the urgent and rapid changes associated with COVID-19, we are accelerating and enhancing our financial education programming to help consumers maintain good credit and gain access to the financial services they need. This is in addition to processes and tools the industry has in place to help lenders accommodate situations where consumers are affected by circumstances beyond their control. These processes will be extended to those experiencing financial hardship as a result of COVID-19. As the Consumer’s Credit Bureau, our commitment at Experian is to inform, guide and protect our consumers and customers during uncertain times. With expected delays in bill payments, unprecedented layoffs, hiring freezes and related hardships, we are here to help consumers in understanding how the credit reporting system and personal finance overall will move forward in this landscape. One way we’re doing this is inviting everyone to join our special eight-week series of #CreditChat conversations surrounding COVID-19 on Wednesdays at 3 p.m. ET on Twitter. Our weekly #CreditChat program started in 2012 to help the community learn about credit and important personal finance topics (e.g. saving money, paying down debt, improving credit scores). The next several #CreditChats will be dedicated to discussing ways to manage finances and credit during the pandemic. Topics of these #CreditChats will include methods and strategies for bill repayment, paying down debt, emergency financial assistance and preparing for retirement during COVID-19. “As the consumer’s credit bureau, we are committed to working with consumers, lenders and the financial community during and following the impacts of COVID-19,” says Craig Boundy, Chief Executive Officer of Experian North America. “As part of our nation’s new reality, we are planning for options to help mitigate the potential impact on credit scores due to financial hardships seen nationwide. Our #CreditChat series and supporting resources serve as one of several informational touchpoints with consumers moving forward.” Being fully committed to helping consumers and lenders during this unprecedented period, we’ve created a dedicated blog page, “COVID-19 and Your Credit Report,” with ongoing and updated information on how COVID-19 may impact consumers’ creditworthiness and – ultimately – what people should do to preserve it. The blog will be updated with relevant news as we announce new solutions and tactics. Additionally, our “Ask Experian” blog invites consumers to explore immediate and evolving resources on our COVID-19 Updates page. In addition to this guidance, and with consumer confidence in the economy expected to decline, we will be listening closely to the expert voices in our Consumer Council, a group of leaders from organizations committed to helping consumers on their financial journey. We established a Consumer Council in 2009 to strengthen our relationships and to initiate a dialogue among Experian and consumer advocacy groups, industry experts, academics and other key stakeholders. This is in addition to ongoing collaboration with our regulators. Additionally, our Experian Education Ambassador program enables hundreds of employee volunteers to serve as ambassadors sharing helpful information with consumers, community groups and others. The goal is to help the communities we serve across North America, providing the knowledge consumers need to better manage their credit, protect themselves from fraud and identity theft and lead more successful, financially healthy lives. COVID-19 has impacted all industries and individuals from all walks of life. We want our community to know we are right there with you. Learn more about our weekly #CreditChat and upcoming schedule here. Learn more

There are more than 100 million people in the United States who don’t have a fair chance at access to credit. These people are forced to rely on high-interest credit cards and loans for things most of us take for granted, like financing a family car or getting an apartment. At Experian, we have a fundamental mission to be a champion for the consumer. Our commitment to increasing financial inclusion and helping consumers gain access to the financial services they need is one of the reasons we have been selected as a Fintech Breakthrough Award winner for the third consecutive year. The Fintech Breakthrough Awards is the premier awards program founded to recognize the fintech innovators, leaders and visionaries from around the world. The 2020 Fintech Breakthrough Award program attracted more than 3,750 nominations from across the globe. Last year, Experian took home the award for Best Overall Analytics Platform for our Ascend Analytical Sandbox™, a first-to-market analytics environment that promised to move companies beyond just business intelligence and data visualization to data insights and answers they could use. The year prior, Experian won the Consumer Lending Innovation Award for our Text for Credit™ solution, a powerful tool for providing consumers the convenience to securely bypass the standard-length ‘pen & paper’ or keystroke intensive credit application process while helping lenders make smart, fraud protected lending decisions. This year, we are excited to announce that Experian has been selected once again as a winner in the Consumer Lending Innovation category for Experian Boost™. Experian Boost – with direct, active consumer consent – scans eligible accounts for ‘boostable’ positive payment data (e.g., utility and telecom payments) and provides the means for consumers to add that data to their Experian credit reports. Now, for the very first time, millions of consumers benefit from payments they’ve been making for years but were never reflected on their credit reports. Since launching in March 2019, cumulatively, more than 18 million points have been added to FICO® Scores via Experian Boost. Two-thirds of consumers who completed the Experian Boost process increased their FICO Score and among these, the average score increase has been more than 13 points, and 12% have moved up in credit score category. “Like many fintechs, our goal is to help more consumers gain access to the financial services they need,” said Alex Lintner, Group President of Experian Consumer Information Services. “Experian Boost is an example of our mission brought to life. It is the first and only service to truly put consumers in control of their credit. We’re proud of this recognition from Fintech Breakthrough and the momentum we’ve seen with Experian Boost to date.” Contributing consumer payment history to an Experian credit file allows fintech lenders to make more informed decisions when examining prospective borrowers. Only positive payment histories are aggregated through the platform and consumers can remove the new data at any time. There is no limit to how many times one can use Experian Boost to contribute new data. For more information, visit Experian.com/Boost.

Update: After closely monitoring updates from the WHO, CDC, and other relevant sources related to COVID-19, we have decided to cancel our 2020 Vision Conference. If you had the chance to experience tomorrow, today, would you take it? What if it meant you could get a glimpse into the future technology and trends that would take your organization to the next level? If you’re looking for a competitive edge – this is it. For more than 38 years, Experian’s premier conference has connected business leaders to data-driven ideas and solutions, fueling them to target new markets, grow existing customer bases, improve response rates, reduce fraud and increase profits. What’s in it for you? Everything to gain and nothing to lose. Are you a marketer? These sessions were made to drive your conversion rates to new heights: Know your customers via omnichannel marketing: Your customers are everywhere, but can you reach them? Learn how to drive business-expansion strategy, brand affinity and customer engagement across multiple channels. Plus, gain insight into connecting with customers via one-to-one messaging. By invitation only, the future of ITA marketing: An evolving landscape means marketers face new challenges in effectively targeting consumers while staying compliant. In this session, we’ll explore how you can leverage fair lending-friendly marketing data for targeting, analysis and measurement. Want the latest in technology trends? Dive into discussions to transform your customer experience: Credit in the age of technology transformation: Machine learning and artificial intelligence are the current darlings of big data, but the platform that drives the success of any big data endeavor is crucial. This session will dive into what happens behind the curtain. Put away your plastic – next-generation identity: An industry panel of experts discusses the newest digital identity and authentication capabilities – those in use today and also exciting solutions on the horizon. How about for the self-proclaimed data geeks? Analyze these: Alternative data: Listen in on an in-depth conversation about creative and impactful examples of using emerging data assets, such as alternative and consumer-permissioned data, for improved consumer inclusion, risk assessment and verification services. The next wave in open data: Experian will share their views on the potential of advanced data and models and how they benefit the global value chain – from consumer scores to business opportunities – regardless of local regulations. And the risk masters? Join us as we kick fraud to the curb: Understanding and tackling synthetic ID fraud: Synthetic IDs present a serious challenge for our entire industry. This expert panel will explore the current landscape – what’s working and what’s not, the expected impact of the next generation SSA eCBSV service, and best practice prevention methods. You are your ID – the new reality of biometrics: Consumers are becoming increasingly comfortable with biometrics. Just as CLEAR has transformed how we use our biometric identity to move through airports, sports venues and more, financial transactions can also be made friction-free. The point is, there’s something for everyone at Vision 2020. It’s not just another conference. Trade in stuffy tradeshow halls and another tri-fold brochure for the insights and connections you need to take your career and organization to the next level. Like technology itself, Vision 2020 promises to connect us, unify us and enable us all to create a better tomorrow. Join us for unique networking opportunities, one-on-one conversations with subject-matter experts and more than 50 breakout sessions with the industry’s most sought-after thought leaders.

For financial marketers, long gone are the days of branded coffee mugs, teddy bears and the occasional print ad. Financial marketers are charged with customizing messaging and offerings at a customer level, increasing conversion rates, and moving beyond digital while keeping an eye on traditional channels. Additionally, financial marketing teams are having to do it all with less; according to CMO Survey, marketing budgets have remained stagnant for the last 6 years. Accordingly, competing in today’s world requires transforming your organization to address rapidly increasing complexity while containing costs. Here are four tactics leading-edge firms are using to respond to changes in the market and better serve customers. More data, fewer problems Financial institutions ingest a mind-boggling variety of data, transaction details, transaction history, credit scores, customer preferences, etc. It can be difficult to know where to start or what to do with what is often terabytes of data. But the savviest teams are mining their unique data, along with bureau data, and other alternative and third-party data for rich decision making that drives differentiation. Getting analytical In financial institutions, advanced analytics has traditionally lived with lenders, underwriters, risk and fraud, departments, etc. But marketers too can find the value in the volume, velocity and variety of new data sources available to financial institutions. Using advanced analytics allows the most forward-thinking financial marketers to better target customers, personalize experiences, respond in near-real-time or even predict actions, and measure the impact of marketing investments. Customized quality time with customers Thanks to the likes of Google and Amazon, consumers have become accustomed to individualized interactions with firms they utilize. And this desire is just as present when it comes to their financial institution. But banks, credit unions and fintechs have been historically slow to respond. According to a recent Capgemini study, 70% of US consumers feel like their financial institution doesn’t understand their needs. The most dynamic financial marketing teams tailor quality experiences that increase consumer engagement and long-term relationships. All the channels, all the time The financial marketer’s job doesn’t stop at creating bespoke experiences for customers. Firms are also having to leverage an omnichannel approach to reach these clients, across an ever-growing number of channels and touchpoints. If that wasn’t enough, campaign cycles are shortening to match consumers changing demands and need for instant gratification—again, thanks Amazon. But the best teams determine which media or interaction resonates most effectively with clients, whether face-to-face, via an app, chatbot, or social media and have conversations across all of them seamlessly. It’s clear, financial firms must transform their approach to address increasing market complexity without increasing costs. Financial marketers are saddled with stagnant marketing budgets, proliferating media channels and shorter campaign cycles, with an expectation to continue delivering results. It’s a very tall order, especially if your financial institution is not leveraging data, analytics and insights as the differentiators they could be. CMOs and their marketing teams must invest in new technologies, strategies and data sources that best reflect the expectations of their customers. How is your bank or credit union responding to these financial marketing challenges? Watch our 2020 Credit Marketing Trends On-Demand Webinar

It may be a new decade of disruption, but one thing remains constant – the consumer is king. As such, customer experience (and continually evolving digital transformations necessary to keep up), digital expansion and all things identity will also reign supreme as we enter this new set of Roaring 20s. Here are seven of the top trends to keep tabs of through 2020 and beyond. 1. Data that does more – 100 million borrowers and counting Traditional, alternative, public record, consumer-permissioned, small business, big business, big, bigger, best – data has a lot of adjectives preceding it. But no matter how we define, categorize and collate data, the truth is there’s a lot of it that’s untapped, which is keeping financial institutions from operating at their max efficiency levels. Looking for ways to be bigger and bolder? Start with data to engage your credit-worthy consumer universe and beyond. Across the entire lending lifecycle, data offers endless opportunities – from prospecting and acquisitions to fraud and risk management. It fuels any technology solution you have or may want to implement over the coming year. Additionally, Experian is doing their part to create a more holistic picture of consumer creditworthiness with the launch of Experian LiftTM in November. The new suite of credit score products combines exclusive traditional credit, alternative credit and trended data assets, intended to help credit invisible and thin-file consumers gain access to fair and affordable credit. "We're committed to improving financial access while helping lenders make more informed decisions. Experian Lift is our latest example of this commitment brought to life,” said Greg Wright, Executive Vice President and Chief Product Officer for Experian Consumer Information Services. “Through Experian Boost, we're empowering consumers to play an active role in building their credit histories. And, with Experian Lift, we're empowering lenders to identify consumers who may otherwise be excluded from the traditional credit ecosystem,” he said. 2. Identity boom for the next generation Increasingly digital lifestyles have put personalization and frictionless transactions on hyperdrive. They are the expectation, not a nice-to-have. Having customer intelligence will become a necessary survival strategy for those in the market wanting to compete. Identity is not just for marketing purposes; it must be leveraged across the lending lifecycle and every customer interaction. Fragmented customer identities are more than flawed for decisioning purposes, which could potentially lead to losses. And, of course, the conversation around identity would be incomplete without a nod to privacy and security considerations. With the roll-out of the California Consumer Privacy Act (CCPA) earlier this month, we will wait to see if the other states follow suit. Regardless, consumers will continue to demand security and trust. 3. All about artificial intelligence and machine learning We get it – we all want the fastest, smartest, most efficient processes on limited – and/or shrinking – budgets. But implementing advanced analytics for your financial institution doesn’t have to break the bank. And, when it comes to delivering services and messaging to customers the way they want it, how to do that means digital transformation – specifically, leveraging big data and actionable analytics to evaluate risk, uncover industry intel and improve decisioning. One thing’s for certain, financial institutions looking to compete, gain traction and pull away from the competition in this next decade will need to do so by leveraging a future-facing partner’s expertise, platforms and data. AI and machine learning model development will go into hyperdrive to add accuracy, efficiency, and all-out speed. Real-time transactional processing is where it’s at. 4. Customer experience drives decisioning and everything Faster, better, more frictionless. 2020 and the decade will be all about making better decisions faster, catering to the continually quickening pace of consumer attention and need. Platforms and computing language aside, how do you increase processing speed at the same time as increasing risk mitigation? Implementing decisioning environments that cater to consumer preferences, coupled with best-in-class data are the first two steps to making this happen. This can facilitate instant decisioning within financial institutions. Looking beyond digital transformation, the next frontier is digital expansion. Open platforms enable financial institutions to readily add solutions from numerous providers so that they can connect, access and orchestrate decisions across multiple systems. Flexible APIs, single integrations and better strategy and design build the foundation of the framework to be implemented to enhance and elevate customer experience as it’s known today. 5. Credit marketing that keeps up with the digital, instant-gratification age Know your customer may be a common acronym for the financial services industry, but it should also be a baseline for determining whether to send a specific message to clients and prospects. From the basics, like prescreen, to omni-channel marketing campaigns, financial institutions need to leverage the communication channels that consumers prefer. From point of sale to mobile – there are endless possibilities to fit into your consumers’ credit journey. Marketing is clearly not a one-and-done tactic, and therefore multi-channel prequalification offers and other strategies will light the path for acquisitions and cross-sell/up-sell opportunities to come. By developing insights from customer data, financial institutions have a clear line of sight into determining optimal strategies for customer acquisition and increasing customer lifetime value. And, at the pinnacle, the modern customer acquisition engine will continue to help financial institutions best build, test and optimize their customer channel targeting strategies faster than ever before. From segmentation to deployment, and the right data across it all, today and tomorrow’s technology can solve many of financial organizations’ age-old customer acquisition challenges. 6. Three Rs: Recession, regulatory and residents of the White House Last March, the yield curve inverted for the first time since 2007. Though the timing of the next economic correction is debated, messaging is consistent around making a plan of action now. Whether it’s arming your collections department, building new systems, updating existing systems, or adjusting rules and strategy, there are gaps every organization needs to fill. By leveraging the stability of the economy now, financial institutions can put strategies in place to maximize profitability, manage risk, reduce bad debt/charge-offs, and ensure regulatory compliance among their list of to-do’s, ultimately resulting in a more efficient, better-performing program. Also, as we near the election later this year, the regulatory landscape will likely change more than the usual amount. Additionally, we will witness the first accounts of what CECL looks like for SEC-filing financial institutions (and if that will suggest anything for how non-SEC-filing institutions may fare as their deadline inches closer), as well as see the initial implications of the CCPA roll out and whether it will pave a path for other states to follow. As system sophistication continues to evolve, so do the risks (like security breaches) and new regulatory standards (like GDPR and CCPA) which provide reasons for organizations to transform. 7. Focus on fraud (in all forms) With evolving technology, comes evolved fraudsters. Whether it’s loyalty and rewards programs, account openings, breaches, there are so many angles and entry points. Synthetic identity fraud is the fastest-growing type of financial crime in the United States. The cost to businesses is estimated to grow to $1.2 billion by 2020, according to the Aite Group. To ensure the best protection for your business and your customers, a layered, risk-based approach to fraud management provides the highest levels of confidence in the industry. Balance is key – while being compliant with regulatory requirements and conscious of user experience, ensuring consumers’ peace of mind is priority one. Not a new trend, but recognizing fraud and recognizing good consumers will save continue to save financial institutions money and reputational harm, driving significant improvement in key performance indicators. Using the right data (and aggregating multiple data sets) and digital device intelligence tools is the one-two punch to protect your bottom line. For all your needs in 2020 and throughout the next decade, Experian has you covered. Learn more

This article was updated on September 11, 2023. According to research, only 15% of American consumers have swapped out their go-to credit card in the past year and spend more money both online and offline with the card they designate as their top-of-wallet card. With over 578 million existing credit card accounts in the U.S., here are four top-of-wallet strategies to keep your card top of mind: Go digital In today’s digital world, the rules of customer engagement are changing – and card issuers must develop their digital capabilities, including identity resolution, to keep pace. Cardholders enjoy (and expect) the convenience of being able to apply for credit, track their purchases, make payments and view their monthly statements on-the-go. Another popular phenomenon? Digital wallets. Also known as e-wallets, these house digital versions of credit or debit cards and are stored in an app or a mobile device. Digital wallets can be used in conjunction with mobile payment systems, allowing customers to store digital coupons and pay for purchases with their smartphones. Financial institutions that digitally transform and adapt to these new dynamics can more efficiently service and retain their customers. Prioritize fraud prevention As customers’ affinity for e-commerce rises and cyberthieves grow smarter and more sophisticated, card issuers must improve their security measures and increase their focus on cutting-edge fraud management solutions. Not only should you be familiar with the many ways that criminals steal customer payment information, but you should ensure customers that you have multiple lines of defense against cyber threats. Many financial institutions have added digital “on/off switches,” allowing customers to remotely turn off their credit or debit card should they have misplaced it or suspect that they’re a victim of identity theft. With credit card fraud being the most prevalent in identity theft cases, failing to properly safeguard your customers impacts not only their experience but also your ability to grow revenue. Create a single customer view A single customer view is a consolidated, consistent and holistic representation of the data known by an organization about its customers. And according to Experian research, 68% of businesses are currently attempting to implement this type of strategy. By achieving a consolidated customer view, you can attain better consumer insight and fully understand your cardmembers’ needs and buying preferences. Careful tracking of all customer interactions enables you to target more accurately and implement effective marketing strategies. Provide incentives According to Experian research, 58% of consumers select credit cards based on rewards. The top incentives when selecting a rewards card include cashback, gas rewards and retail gift cards. Rewarding loyalty with ongoing benefits goes a long way to encourage customers to keep your credit card top of wallet but it’s also important to figure out what works – and what doesn’t. Bonus tip: Optimize credit limit management Managing credit limits is just as important as setting optimal credit limits from the get-go. Consumer credit needs will evolve over time along with their income and ability to pay. The key here is being able to identify qualified customers who can take on higher spending limits and also have a need. Leveraging advanced analytics models and a proactive credit limit management strategy can help you uncover areas of opportunity to increase wallet share and push your card toward that coveted top-of-wallet spot — or remain there. We recommend reviewing your credit limits at a regular cadence, but especially ahead of periods of increased spending such as the holiday season. In today’s competitive marketplace, getting your credit card top of wallet isn’t easy. That’s why we’re here to help. Experian’s comprehensive view of consumer credit data and best-in-class account management solutions help you target higher-spending customers and promote top-of-wallet use. Learn more

The challenges facing today’s marketers seem to be mounting and they can feel more pronounced for financial institutions. From customizing messaging and offerings at an individual customer level, increasing conversion rates, moving beyond digital while keeping an eye on traditional channels, and more, financial marketers are having to modernize their approach to customer acquisition. The most forward-thinking financial firms are turning to customer acquisition engines to help them best build, test and optimize their custom channel targeting strategies faster than ever before. But what functionality is right for your company? Here are 5 capabilities you should look for in a modern customer acquisition engine. Advanced Segmentation It’s without question that targeting and segmentation are vital to a successful financial marketing strategy. Make sure you select a tool that allows for advanced segmentation, ensuring the ability to uncover lookalike groups with similar attributes or behaviors and then customize messages or offerings accordingly. With the right customer acquisition engine, you should be able to build filters for targeted segments using a range of data including demographic, past behavior, loyalty or transaction history, offer response and then repurpose these segments across future campaigns. Campaign Design With the right campaign design, your team has the ability to greatly affect customer engagement. The right customer acquisition engine will allow your team to design a specific, optimized customer journey and content for each of the segments you create. When you’re ready to apply your credit criteria to the audience to generate a pre-screen, the best tools will allow you to view the size of your list adjusted in real-time. Make sure to look for an acquisition engine that can do all of this easily with a drag and drop user experience for faster and efficient campaign design. Rapid Deployment Once you finalize your audience for each channel or offer, the clock starts ticking. From bureau processing, data aggregation, targeting and deployment, the data that many firms are currently using for prospecting can be at least 60-days. When searching for a modern customer acquisition engine, make sure you choose a tool that gives you the option to fetch the freshest data (24-48 hours) before you deploy. If you’re sending the campaign to an outside firm to execute, timing is even more important. You’ll also want a system that can encrypt and decrypt lists to send to preferred partners to execute your marketing campaign. Support Whether you have an entire marketing department at your disposal or a lean, start-up style team, you’re going to want the highest level of support when it comes to onboarding, implementation and operational success. The best customer acquisition solution for your company will have a robust onboarding and support model in place to ensure client success. Look for solutions that offer hands-on instruction, flexible online or in-person training and analytical support. The best customer acquisition tool should be able to take your data and get you up and running in less than 30 days. Data, Data and more Data Any customer acquisition engine is only as good as the data you put into it. It should, of course, be able to include your own client data. However, relying exclusively on your own data can lead to incomplete analysis, missed opportunities and reduced impact. When choosing a customer acquisition engine, pick a system that gives your company access to the most local, regional and national credit data, in addition to alternative data and commercial data assets, on top of your own data. The optimum solutions can be fueled by the analytical power of full-file, archived tradeline data, along with attributes and models for the most robust results. Be sure your data partner has accounted for opt-outs, excludes data precluded by legal or regulatory restrictions and also anonymizes data files when linking your customer data. Data accuracy is also imperative here. Choose a marketing and technology partner who is constantly monitoring and correcting discrepancies in customer files across all bureaus. The best partners will have data accuracy rates at or above 99.9%.

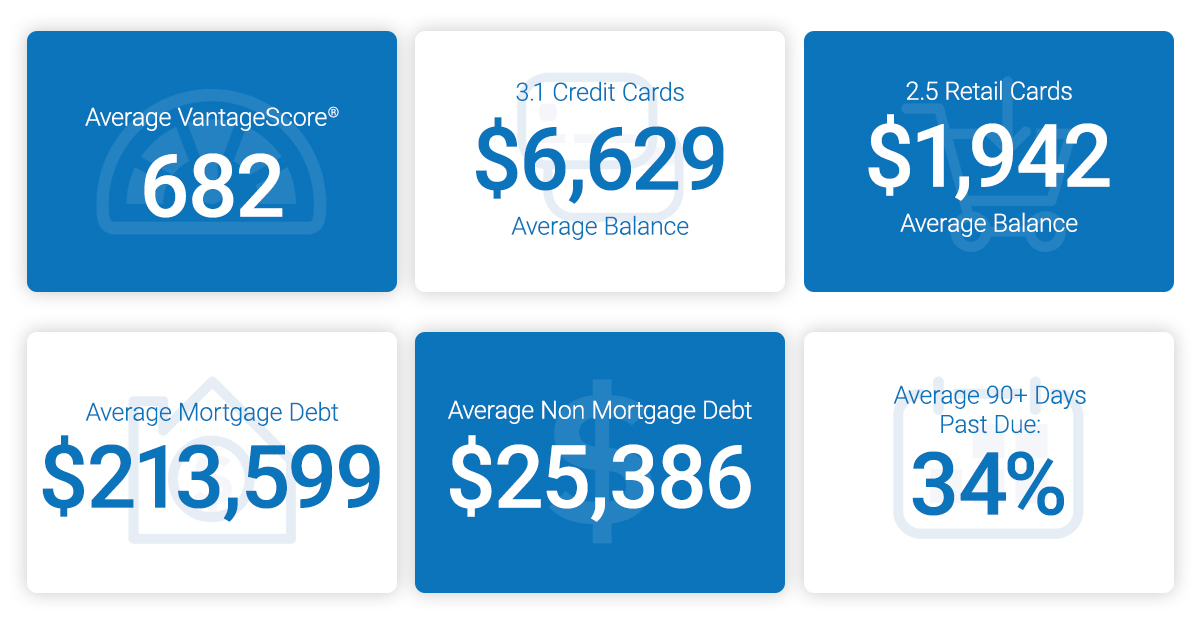

As consumers prepare for the next decade, we look at how we’re rounding out this year. The results? The average American credit score is 682, an eight-year high. Experian released the 10th annual state of credit report, which provides a comprehensive look at the credit performance of consumers across America by highlighting consumer credit scores and borrowing behaviors. And while the data is spliced to show men vs. women, as well as provides commentary at the state and generational level, the overarching trend is up. Even with the next anticipated economic correction often top of mind for financial institutions, businesses and consumers alike, 2019 was a year marked by more access, more spending and decreasing delinquencies. Things are looking up. “We are seeing a promising trend in terms of how Americans are managing their credit as we head into a new decade with average credit scores increasing two points since 2018 to 682 – the highest we’ve seen since 2011,” said Shannon Lois, Senior Vice President and Head of EAS, Analytics, Consulting & Operations for Experian Decision Analytics. “Average credit card balances and debt are up year over year, yet utilization rates remain consistent at 30 percent, indicating consumers are using credit as a financial tool and managing their debts responsibly.” Highlights of Experian’s State of Credit report: 3-year comparison 2017 2018 2019 Average number of credit cards 3.06 3.04 3.07 Average credit card balances $6,354 $6,506 $6,629 Average number of retail credit cards 2.48 2.59 2.51 Average retail credit card balances $1,841 $1,901 $1,942 Average VantageScore® credit score[1, 2] 675 680 682 Average revolving utilization 30% 30% 30% Average nonmortgage debt[3] $24,706 $25,104 $25,386 Average mortgage debt $201,811 $208,180 $231,599 Average 30 days past due delinquency rates 4.0% 3.9% 3.9% Average 60 days past due delinquency rates 1.9% 1.9% 1.9% Average 90+ days past due delinquency rates 7.3% 6.7% 6.8% In the scope of the credit score battle of the sexes, women have a four-point lead over men with an average credit score of 686 compared to 682. Their lead is a continued trend since 2017 where they’ve bested their male counterparts. According to the report, while men carry more non-mortgage and mortgage debt than women, women have more credit cards and retail cards (albeit they carry lower balances). Generationally, Generations X, Y and Z tend to carry more debt, including mortgage, non-mortgage, credit card and retail card, than older generations with higher delinquency and utilization rates. Segmented by state and gender, Minnesota had the highest credit scores for both men and women, while Mississippi was the state with the lowest average credit score for females and Louisiana was the lowest average credit score state for males. As we round out the decade and head full-force into 2020, we can reflect on the changes in the past year alone that are helping consumers improve their financial health. Just to name a few: Experian launched Experian BoostTM in March, allowing millions of consumers to add positive payment history directly to their credit file for an opportunity to instantly increase their credit score. Since then, there has been over 13 million points boosted across America. Experian LiftTM was launched in November, designed to help credit invisible and thin-file consumers gain access to fair and affordable credit. Long-standing commitments to consumer education, including the Ask Experian Blog and volunteer work by Experian’s Education Ambassadors, continue to offer assistance to the community and help consumers better understand their financial actions. From what we can tell, this is just the beginning. “Understanding the factors that influence their overall credit profile can help consumers improve and maintain their financial health,” said Rod Griffin, Experian’s director of consumer education and awareness. “Credit can be used as a financial tool. Through this report, we hope to provide insights that will help consumers make more informed decisions about credit use as we prepare to head into a new decade.” Learn more 1 VantageScore® is a registered trademark of VantageScore Solutions, LLC. 2 VantageScore® credit score range is 300 to 850. 3 Average debt for this study includes all credit cards, auto loans and personal loans/student loans.