Agencies, platforms, and marketers stand at the crossroads of transformation, as privacy regulations tighten, technology accelerates, and consumer behaviors evolve. Yet these challenges also present extraordinary opportunities.

Our 2025 Digital trends and predictions report highlights five trends that will shape 2025 and digs into:

- What’s changing in the market

- How to keep learning about your customers

- How to reach your customers in different places

- How to measure what’s really working along the way

In this blog post, we’ll give you a sneak peek of three of these trends — from cracking the code of signal loss to tapping into the buzz around connected TV (CTV) and stepping up your omnichannel game. Think of it as a taste test before the main course. Ready for the full menu? Download our report to get the lowdown on all five trends.

1. Signal loss: A rich appetizer of alternate ingredients

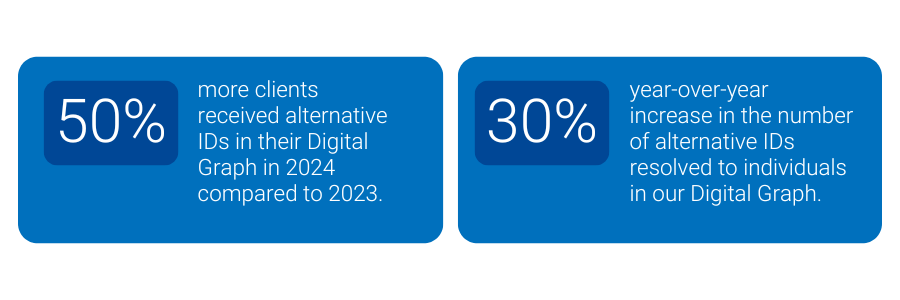

As traditional cookies crumble, marketers need fresh ingredients to keep the flavor coming. Already, about 40% of browser traffic doesn’t support third-party cookies, and marketers are spicing things up with first-party data, alternative identifiers like Unified I.D. 2.0 (UID2) and ID5, and contextual targeting strategies. In fact, 50% more of our clients received alternative IDs (UID2, ID5, Hadron ID) in their Digital Graph in 2024 compared to 2023. The number of alternative IDs resolved to individuals in our Digital Graph increased by 30% year-over-year – as everyone looks beyond the cookie jar.

There is no secret sauce to replace cookies. Instead, expect a multi-ID recipe that brings together different identifiers, unified by an identity graph. This approach turns a fragmented pantry of data into a cohesive meal, giving you a complete view of your customer on every plate.

2. The rising power of CTV: A hearty entrée of opportunities

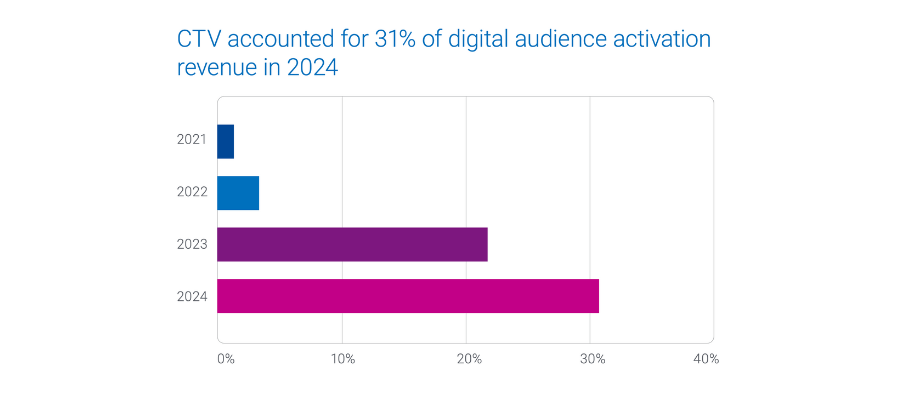

CTV is quickly becoming the main dish on the streaming menu, as viewers load up on their favorite shows. While CTV is slated to make up 20% of daily U.S. media consumption by 2026, advertisers are still holding back on pouring in the ad spend. To unlock its full flavor, marketers need to whip up solutions like frequency capping and unified audience activation.

Although CTV will account for 20% of daily U.S. media consumption by 2026, it’s projected to command only 8.1% of ad spend. Frequency capping and unified audience activation solutions will be key to unlocking CTV’s full potential.

By 2025, nearly half of CTV “diners” will choose free ad-supported streaming TV (FAST). Marketers need strategies to prevent ad overexposure. With 50% of U.S. consumers avoiding products due to ad overload, and 30% of marketers willing to increase their CTV spend if frequency capping improves, unified identity solutions help ensure every impression is served just right.

3. Omnichannel: A flavorful fusion plate

No one likes a one-flavor meal. Marketers are moving beyond single-channel “side dishes” to omnichannel “fusion feasts” that blend direct mail, digital, CTV, and retail media networks (RMNs) into a truly cohesive culinary experience. Even though only 21% of global B2C professionals currently put omnichannel at the top of their shopping list, the growing demand for seamless, audience-first campaigns is heating up.

In 2025, having an audience-first approach will be like having a perfect pairing for every course. Unified identity solutions act as your master sommelier, ensuring that each channel complements the next, and every customer enjoys a well-rounded, memorable journey.

Vertical trends: A dessert sampler from four unique kitchens

Different markets have their own signature flavors.

- In Auto, crossover utility vehicles (CUVs) claim 51% of new vehicle registrations, and consumers in the 35-54 age group and families are the primary buyers. Automotive marketers should prioritize CUV advertising with a strong focus on family-oriented and income-appropriate messaging

- In Financial Services, marketers need to anticipate shifts in consumer behavior tied to economic conditions, such as increasing demand for deposit products when interest rates are high. For insurance, aligning campaigns with life events, like new home purchases or marriage, can maximize engagement.

- In Healthcare, advertisers are prioritizing personalized, regulation-compliant campaigns that address social determinants of health (SDOH).

- In Retail, advertisers are increasingly activating on both CTV and social platforms, with many managing their own in-house campaigns. While larger brands often rely on media agencies, a shift toward in-house media buying is emerging among some bigger players, offering more control over audience targeting and performance metrics.

Our report covers each vertical’s unique menu, helping you select the right “ingredients” for your customers. With the top Experian Audiences on hand, you can create feasts that delight, nourish, and convert.

Hungry for more? Download our full menu

The three “samples” you’ve just tasted are just the starters. Our 2025 Digital trends and predictions report serves up five insights, complete with strategies, data, and tools to help you adapt, scale, and thrive in 2025.

Ready for the full menu? Download our report now and discover all five trends that will shape your marketing “cookbook” in 2025. Bon appétit!

Latest posts

NEW YORK, Sept. 28, 2016 /PRNewswire/ — Tapad, the leader in cross-device marketing technology, today announced a new metric for cross-device marketers, Viewable Exposure Time (VET). Viewable Exposure Time measures across screens and ad formats, identifying the optimal amount of time a consumer spends with an ad before they take action. The announcement coincides with Unify Tech '16, Tapad's third-annual cross-device summit during Advertising Week NY. Frequency caps are currently used to ensure that dollars aren't wasted on redundant ads. Viewable Exposure Time evolves the frequency capping approach to include accelerating a consumer's ad exposure rate up to the optimal time spent with the brand. VET is used in affinity, digital transaction and offline purchase models as a key indicator of marketing budget well-spent. Beta users of VET span every vertical, though interest is especially high from CPG, Automotive, Telecommunications and Retail. Viewable Exposure Time unifies and upgrades marketers' predictors of advertising success by leveraging cross-screen engagement across digital and television, with vendor-agnostic viewability scores for video, rich media and display. "Today's current measurement options, like click-through rate (CTR) and TV gross ratings points (GRP) tell an incomplete story," said Tapad GM of Media Kate O'Loughlin. "Tapad is focused on measuring what really matters to marketers – building an efficient connection with a customer. Innovation in metrics was long overdue." More than just a measurement tool, Tapad also provides clients with VET activation. Factoring in time spent with ads in viewable seconds and minutes, these analytics inform marketers about which audiences are underexposed, enabling them to adjust campaigns and deliver according to optimal viewable exposure time. This effectively increases conversion rates at the lowest cost. Contact us today

Strong Revenue Performance and Thriving Culture Contribute to Industry Recognition NEW YORK, Sept. 15, 2016 /PRNewswire/ — Tapad, the leader in cross-device marketing technology and now a part of Experian, was named a top company on Inc. Magazine’s list of the 5000 fastest-growing private companies in the U.S. In addition, Tapad won the TMCnet 2016 Tech Culture Award. The exclusive Inc. 5000 ranking highlights the fastest-growing privately-held* companies in America. These distinguished companies have achieved success in strategy, service and innovation. TMCnet recognizes talented tech professionals who are committed to building a culture that prioritizes employee growth, collaboration and engagement. Tapad continues to broaden their presence into new markets, having launched in APAC earlier this year, as well as continuing their European expansion. Tapad’s proprietary technology, The Device Graph™ is leveraged by more marketers and brands to understand digital engagement across devices. The company’s rapidly expanding client base includes numerous Fortune 500 company brands as well as all four major advertising holding companies in the U.S. “We have an exceptional team of innovative people who are all working very hard to achieve the kind of results these publications are recognizing,” said Tapad CEO and Founder, Are Traasdahl. “Given that, we have an even greater responsibility to our talent to create an environment that fosters innovation and nurtures open communication. Ultimately, this is how we will continue to reach our very ambitious goals of becoming the world’s leading unified marketing technology provider.” Tapad’s award-winning work culture is defined by its gold-standard benefits which include a six-month parental leave policy, unlimited vacation time, company-sponsored meals and office space designed to facilitate collaboration and open communication. Tapad’s highly talented team has also received multiple customer service awards in 2016. These awards include the iMedia ASPY awards for Best Customer Service and Best Mobile Partner as well as recognition from The Communicator Awards of Excellence in Interactive Media. *Prior to Tapad’s acquisition by Telenor in February 2016. Contact us today!

The Tapad Device GraphTM Had Twice the Precision and Three Times the Scale as Next Competitor New York, September 14, 2016 – Just-released findings of a Hotels.com® study revealed that Tapad’s (part of Experian) cross-screen marketing technology achieved the highest levels of precision and scale among competitors. According to the leading online accommodation booking website, after a rigorous, three-and-a-half month vendor analysis, Tapad achieved twice the precision of the next highest-scoring cross-screen offering and three times greater scale. The two other companies evaluated were not named. Said Helene Cameron-Heslop, Senior Manager of Analytics of the Hotels.com brand, “Our team implemented an extremely rigorous vetting of open, cross-screen technology vendors. At the outset, we assumed we would have to compromise on either scale or accuracy – particularly given the importance to our brand of operating in a privacy-safe setting. We were surprised to find a complete package, but Tapad’s Device Graph won out on scale, accuracy and privacy; making our choice of partners very clear.” In another metric critical to the Hotels.com brand, The Tapad Device GraphTM was eight times more “unique” than the next closest offering, meaning Tapad’s graph was found to have a much greater number of connections not seen in any of the other graphs. In addition to precision, uniqueness and scale, the Tapad Device GraphTM was found to have: ● 100% higher recall● 47% more incremental matches● 53% higher North American market coverage● 101% higher F-Score* “A valuable cross-device solution should enable partners to get everything they’re looking for from a single vendor,” said Tapad Founder and CEO, Are Traasdahl. “We are deeply impressed with how thorough Hotels.com was in their vetting, and we confidently tackle the complex challenges of the martech industry thanks to our superior technology. Everyone loves a bake-off, and Tapad is no exception – delivering best-in-class results in areas that really count.” *F-score is a statistical measurement that takes precision and recall together. The calculation is 2*(precision*recall)/precision + recall). It gives you one number instead of two numbers to look at and judge performance. Contact us today