Contextual ad targeting paves the way for new opportunities

Advertisers and marketers are always looking for ways to remain competitive in the current digital landscape. The challenge of signal loss continues to prompt marketers to rethink their current and future strategies. With many major browsers phasing out support for third-party cookies due to privacy and data security concerns, marketers will need to find new ways to identify and reach their target audience. Contextual ad targeting offers an innovative solution; a way to combine contextual signals with machine learning to engage with your consumers more deeply through highly targeted accuracy. Contextual advertising can help you reach your desired audiences amidst signal loss – but what exactly is contextual advertising, and how can it help optimize digital ad success?

In a Q&A with our experts, Jason Andersen, Senior Director of Strategic Initiatives and Partner Solutions with Experian, and Alex Johnston, Principal Product Manager with Yieldmo, they explore:

- The challenges causing marketers to rethink their current strategies

- How contextual advertising addresses signal loss

- Why addressability is more important than ever

- Why good creative is still integral in digital marketing

- Tips for digital ad success

By understanding what contextual advertising can offer, you’ll be on the path toward creating powerful, effective campaigns that will engage your target audiences.

Check out Jason and Alex’s full conversation from our webinar, “Making the Most of Your Digital Ad Budget With Contextual Advertising and Audience Insights” by reading below. Or watch the full webinar recording now!

Macro impacts affecting marketers

How important is it for digital marketers to stay informed about the changes coming to third-party cookies, and what challenges do you see signal loss creating?

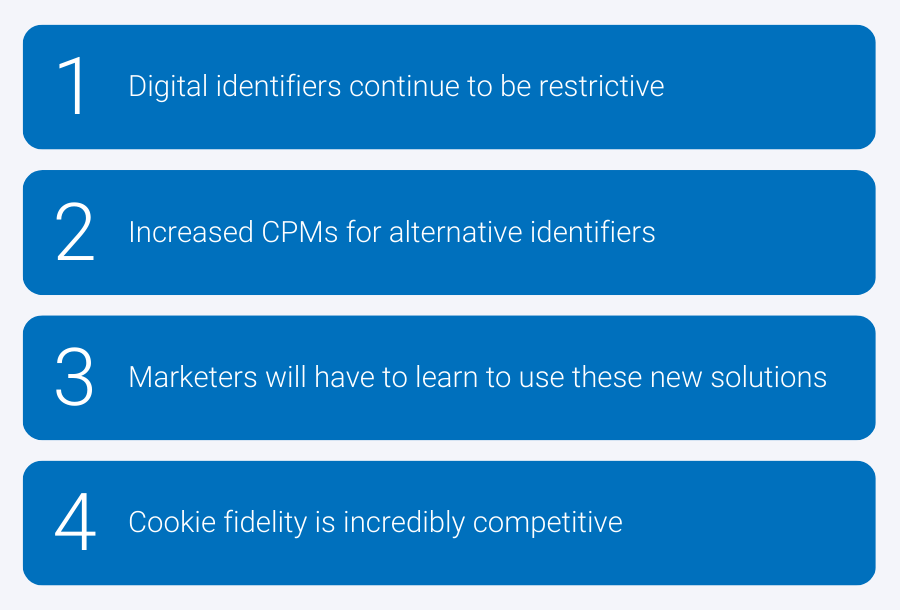

Jason: Marketers must stay informed to succeed as the digital marketing landscape continuously evolves. Third-party cookies have already been eliminated from Firefox, Safari, and other browsers, while Chrome has held out. It’s just a matter of time before Chrome eliminates them too. Being proactive now by predicting potential impacts will be essential for maintaining growth when the third-party cookie finally disappears.

Alex: Jason, I think you nailed it. Third-party cookie loss is already a reality. As regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) take effect, more than 50% of exchange traffic lacks associated identifiers. This means that marketers have to think differently about how they reach their audiences in an environment with fewer data points available for targeting purposes. It’s no longer something to consider at some point down the line – it’s here now!

Also, as third-party cookies become more limited, reaching users online is becoming increasingly complex and competitive. Without access to as much data, the CPMs (cost per thousand impressions) that advertisers must pay are skyrocketing because everyone is trying to bid on those same valuable consumers. It’s essential for businesses desiring success in digital advertising now more than ever before.

Contextual ad targeting: A solution for signal loss

How does contextual ad targeting help digital marketers find new ways to reach and engage with consumers? What can you share about some new strategies that have modernized marketing, such as machine learning and Artificial Intelligence (AI)?

Jason: We’re taking contextual marketing to the next level with advanced machine learning. We are unlocking new insights from data beyond what a single page can tell us about users. As third-party cookies go away, alternative identifiers are coming to market, like RampID and UID2. These are going to be particularly important for marketers to be able to utilize.

As cookie syncing becomes outdated, marketers will have to look for alternative methods to reach their target audiences. It’s essential to look beyond cookie-reliant solutions and use other options available regarding advertising.

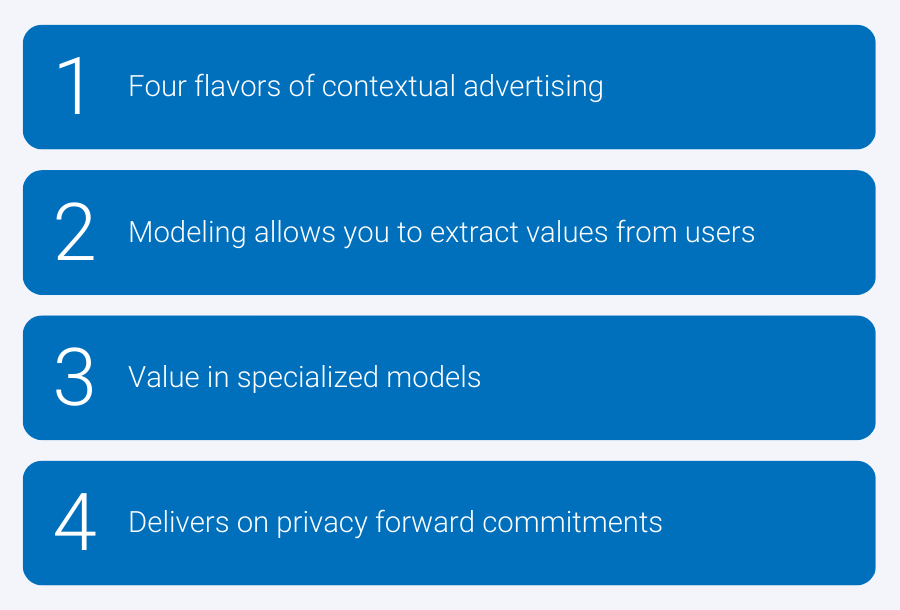

Alex: I think, as Jason alluded to, there’s a renaissance in contextual advertising over the last couple of years. If I were to break this down, there are three core drivers:

- The loss of identity signals. It’s forcing us to change, and we must look elsewhere and figure out how to reach our audiences differently.

- There have been considerable advances in our ability to store and operate across a set of contextual signals far more extensive than anything we’ve ever worked with in the past and in far more granular ways. That’s a huge deal because when it comes to machine learning, the power and the impact of those machine learning models are entirely based on how extensive and granular the data set is that you can collect. Machine learning can pull together critical contextual signals and figure out which constellations, or which combinations of those signals, are most predictive and valuable to a given advertiser.

- We can tailor machine learning models to individual advertisers using all those signals and find patterns across those in ways that were previously impractical or unfeasible. The transformation is occurring because of our ability to capture much more granular data, operate across it, and then build models that work for advertisers.

Addressability: Connect your campaigns to consumers

How does advanced contextual targeting help marketers reach non-addressable audiences?

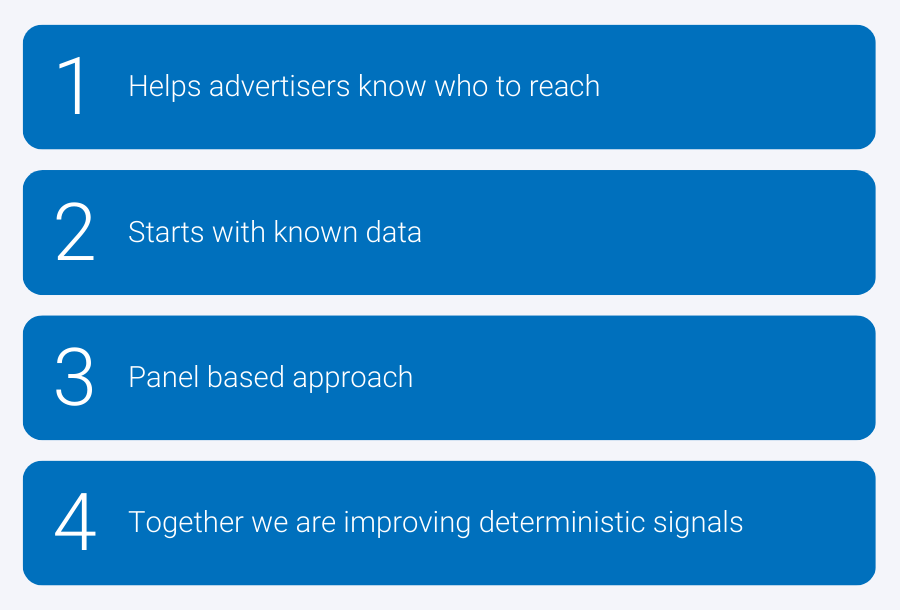

Jason: Advanced contextual targeting allows us to take a set of known data (identity) and draw inferences from it with all the other signals we see across the bitstream. It’s taking that small seed set of either, customers that transacted with you before that you have an identity for, or customers that match whom you’re looking for. We can use that as a seed set to train these new contextual models. We can now look at making the unknown known or the unaddressable addressable. So, it’s not addressable in an identity sense, it is addressable in a contextual or an advanced contextual sense that’s made available to us, and we can derive great insight from it.

One of the terms I like to use is contextual indexing. This is where we take a set of users we know something about. So, I may know the identity of a particular group of households, and I can look at how those households index against any of the rich data sets available to us in any data marketplace, for example, the data Yieldmo has. We can look at how that data indexes to those known users to find patterns in that data and then extrapolate from that. Now we can go out and find users surfing on any of the other sites that traditionally don’t have that identifier for that user or don’t at that moment in time and start to be able to advertise to them based on the contextually indexed data.

Historically, we’ve done some contextual ad targeting based on geo-contextual, and this is when people wanted to do one to one marketing, and geo-contextual outperformed the one to one. But marketers weren’t ready for alternatives to one to one yet. We want marketers to start testing these solutions. Advertisers must start trying them, learning how they work, and learn how to optimize them because they are based on a feedback loop, and they’re only going to get better with feedback.

Alex: Jason, you described that perfectly. I think the exciting opportunity for many people in the industry is figuring out how to reach your known audience in a non-addressable space, that is based on environmental and non-identity based signals, that helps your campaign perform. Your known audience are people that are already converting – those who like your products and services and are engaged with your ads. Machine learning advancements allow you to take your small sample audience and uncover those patterns in the non-addressable space.

It’s also worth noting that in this world in which we are using seed audiences, or you are using your performing audiences to build non-addressable counterpart targeting campaigns, having high-quality, privacy-resilient data sets becomes incredibly important. In many cases, companies like Experian, who have high quality, deep rich training data, are well positioned to support advertisers in building those extension audiences. As we see the industry evolve, we’re going to see some significant changes in terms of the types of, and ways in which, companies offer data, and make that available to advertisers for training their models or supporting validation and measurement of those models.

Jason: Addressable users, the new identity-based users, are critical to marketers’ performance initiatives. They’re essential to training the models we’re building with contextual advertising. Together, addressable users and contextual advertising are a powerful combination. It’s not just one in isolation. It’s not just using advanced contextual, and it’s not just using the new identifiers. It’s using a combination to meet your performance needs.

It’s imperative to start thinking about how you can begin building your seed audiences. What can you start learning from, and how do you put contextual into play today? You are looking to build off a known set and build a more advanced model. These can be specialized models based on your data. You can hone in and create a customized model for your customer type, their profile, and how they transact. It’s a greenfield opportunity, and we’re super excited about the future of advanced contextual targeting.

Turn great creative into measurable data points

Why does good creative still play an integral part in digital advertising success?

Jason: Good creative has always been meaningful. It’s vital in getting people to click on your ad and transact. But it’s becoming increasingly important in this new world that we’re talking about, this advanced contextual world. The more signal that we can get coming into these models, the better. Good creative in the proper ad format that you can test and learn from is paramount. It comes back to that feedback loop. We can use that as another signal in this equation to develop and refine the right set of audiences for your targeting needs.

Alex: If you imagine within the broader context of identity and signal loss, creative and ad format becomes incredibly powerful signals in understanding how different audiences interact with and engage with different creative. In the case of the formats that serve on the Yieldmo exchange, we’re collecting data every 200 milliseconds around how individual users are engaging with those ads. Interaction data like the user scrolling back or the number of pixel seconds they stay on the screen, fills this critical gap between video completes and clicks. Clicks are sparse and down the funnel, and views and completes are up the funnel. All those attention and creative engagement type metrics occupy the sweet spot where they’re super prevalent, and you can collect them and understand how different audiences engage with your ads. That data lets you build powerful models because they predict all kinds of other downstream actions.

Throughout my career, I learned that designing or tailoring your creative to different audience groups is one of the best ways to improve performance. We ran many lift studies with analysis to understand how you can tailor creative customized for individual audiences. That capability and the ability to do that on an identity basis is starting to deteriorate. The ability to do that using a sample of data or using a smaller set of users, either where you’re inferring characteristics or you’re looking at the identity that does exist in a smaller group, becomes powerful for being able to customize your creative to tell the right story to the right audience. When you layer together all the interaction data collected at the creative level on top of all the contextual and environmental signals, you can build powerful models. Whether those are driving proxy metrics, or downstream outcomes, puts us in a powerful position to respond to the broader loss of identity that we’ve relied on for so many years.

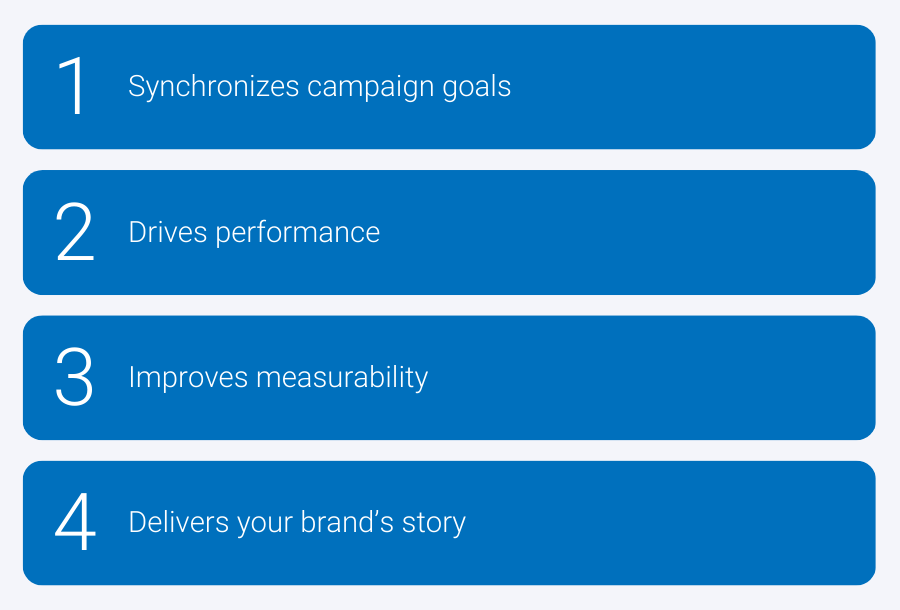

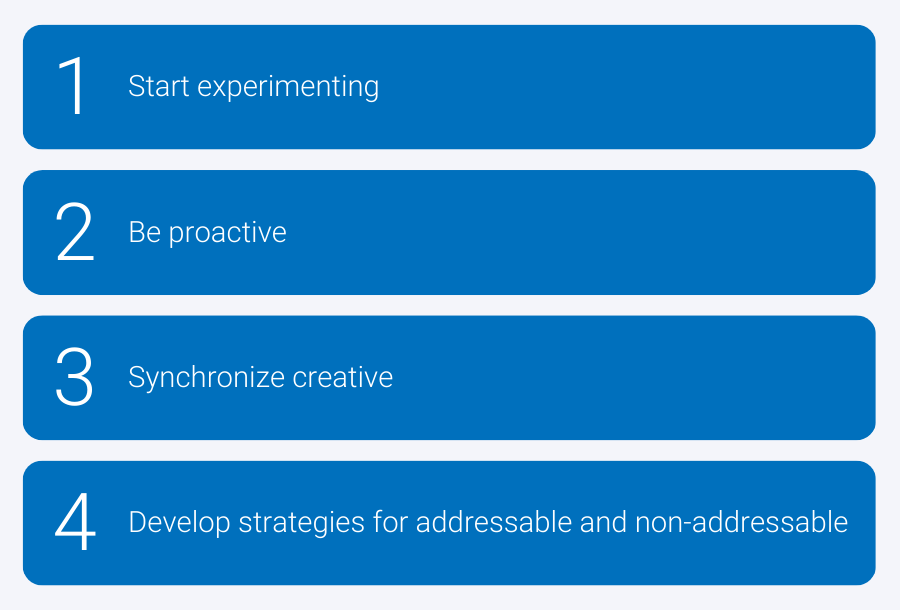

Our recommendations for marketers for 2023 and beyond

Do you have recommendations for marketers building out their yearly strategies or a campaign strategy?

Jason: Be proactive and start testing and learning these new solutions. I mentioned addressability and being in the right place at the right time. That’s easier in today’s third-party cookie world. But as traditional identity is further constricted, you will have these first-party solutions that will not be at scale, so you’re less likely to find your user at the scale you want. It would be best if you thought about how to reach that user at the right place at the right time. They may not be seen from an identity basis. They might not be at the right place at the right time when you were delivering or trying to deliver an ad. But you increase your chance of reaching them by building these advanced contextual targeting audiences using this privacy-safe seed ‘opted-in’ user set; this is a way to cast that wider net and achieve targeted scale.

Alex: Build your seed lists, test your formats with different audiences, and understand what’s resonating with whom. Take advantage of some of the pretty remarkable advances in machine learning that are allowing us, really, for the first time to fully uncork the potential and the opportunity with contextual in a way that we’ve never done before.

Jason: At the end of the day, it’s making the unaddressable addressable. So, it’s a complementary strategy; having that addressable piece will feed the models. But also, that addressable piece still needs to be identity-based, addressable still needs to be part of your overall marketing strategy, and you need to complement it with other strategies like advanced contextual targeting. The two of them together are super complimentary. They learn from each other, and it’s a cyclical loop. Now is the time to take advantage and start testing and understanding how these solutions work.

We can help you get started with contextual ad targeting

Contextual advertising can help you stay ahead of the curve, identify your target audience, and continue to drive conversions despite signal loss. We’ve partnered with Yieldmo to help make sure that your marketing campaigns are reaching the right target audiences on the platforms that are most relevant. To get started with contextual ad targeting to reach the right audience at the right time and drive conversions, contact our marketing professionals. Let’s get to work, together.

Find the right marketing mix in 2023

Check out our webinar, “Find the right marketing mix with rising consumer expectations.” Guest speaker, Nikhil Lai, Senior Analyst from Forrester Research, joins Experian experts Erin Haselkorn, and Eden Wilbur. We discuss:

- New data on the complexity and uncertainty facing marketers

- Consumer trends for 2023

- Recommendations on finding the right channel mix and the right consumers

About our experts

Jason Andersen, Senior Director, Strategic Initiatives and Partner Solutions, Experian

Jason Andersen heads Strategic Initiatives and Partner Enablement for Experian Marketing Services. He focuses on addressability and activation in digital marketing and working with partners to solve signal loss. Jason has worked in digital advertising for 15+ years, spanning roles from operations and product to strategy and partnerships.

Alex Johnston, Principal Product Manager, Yieldmo

Alex Johnston is the Principal Product Manager at Yieldmo, overseeing the Machine Learning and Optimization products. Before joining Yieldmo, Alex spent 13 years at Google, where he led the Reach & Audience Planning and Measurement products, overseeing a 10X increase in revenue. During his time, he launched numerous ad products, including YouTube’s Google Preferred offering. To learn more about Yieldmo, visit www.Yieldmo.com.

Latest posts

Understand the importance of identity resolution and data clean rooms in AdTech, as well as how Experian can help you address these challenges.

Discover how supply-side advertising can help you overcome the challenges of signal loss to deliver high-quality audience targeting and ad placement.

Learn how Experian and Microsoft Advertising’s collaboration enhances addressability, broadening reach and extending the value of first-party data.