Today, Experian is excited to introduce our Offline Graph as a standalone product that clients can license, marking a significant step in our commitment to powering data-driven advertising through connectivity. Offline Graph empowers advertisers and advertising technology companies to build and refine consumer profiles, contributing to data connectivity, more offline audience reach, and improved offline measurement accuracy.

As a result of consumers engaging with content across more channels, there are more disparate data points than ever before. When you couple that with ongoing signal loss, the need for a unified identity solution has never been greater.

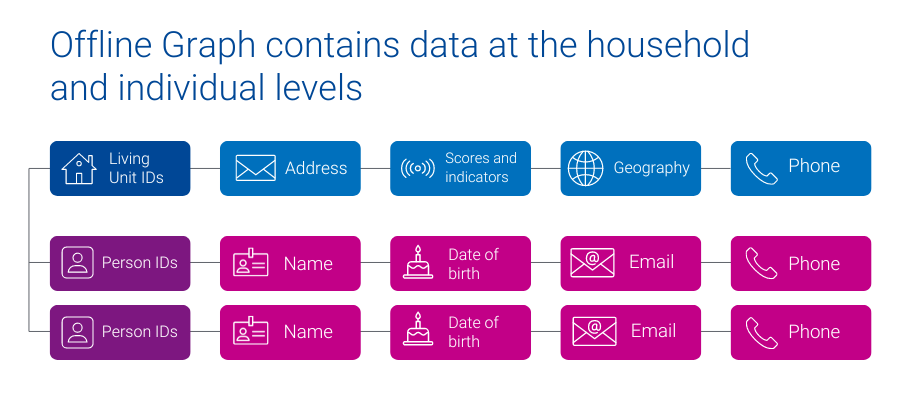

Experian’s Offline Graph offers companies a license of stable offline data points, like name, address, phone number, email, geographic information, date of birth, and additional attributes that provide a complete view of household and individual identities. The Offline Graph integrates known offline identity information from reliable deterministic sources like property ownership records, public records, and marketing data to provide access to all United States consumers and households.

How customers can use the Offline Graph

- A big box retailer fills in the blanks of their existing customer data and builds a database of prospects.

- A media platform more effectively onboards advertisers’ segments, enabling advertisers to reach more of their customers.

- A retail brand better understands their customer’s demographic and behavioral make-up, by licensing Offline Graph with Marketing Attributes.

- A connected TV (CTV) manufacturer increases audience reach and accurately quantifies the campaign impact for their advertising partners.

Experian’s Offline Graph is already driving value across industries. Here’s some in-depth client success stories:

Fusion92 licenses Offline Graph to help their clients transform their marketing

Fusion92 is a marketing partner that fuels business transformation in today’s digital economy and delivers exponential returns for brands.

Fusion92 licenses Experian’s Offline Graph to power their strategy: from research and discovery to audience creation, activation, and measurement. With access to our Offline Graph, Fusion92 ensures their clients get the insights, targeting, reach, and measurement they need to achieve their business goals.

“At Fusion92, we are always pushing the envelope to develop solutions that lead to success for our clients. Our desire to innovate pushed us to find an industry-leading partner in data and identity. This led to us licensing Experian’s Offline Graph product, which we use to build more complete audience profiles for our clients. In doing so, we help brands target, activate, and measure their marketing campaigns more effectively, leading to superior results.”

dave nugent, executive vice president of data and analytics, fusion92

Using Offline Graph to deliver relevant messaging to multiple audience cohorts

A leading direct-to-consumer (DTC) company with strong customer relationships built a robust first-party data set, enabling effective customer retention. To attract new customers, they partnered with Experian to access offline identity data from Experian’s Offline Graph. The Offline Graph provides them with the data needed to validate their first-party data and with the keys to unlock new customers.

With this data, the DTC company delivered the right message to both sets of consumers: existing customers and new prospects. By integrating Experian’s Offline Graph they broadened their reach, personalized their messaging, and improved their marketing.

What sets Experian’s Offline Graph apart from the competition

- Stability of data: With data from deterministic sources, our Offline Graph ensures that your view of consumers – and your ability to connect with them – is stable over time.

- Connected digital and offline data: Seamlessly connect offline data with digital identifiers through our Digital Graph, enabling a holistic approach to marketing, while ensuring consumer privacy is prioritized.

- Tailor made for your use cases: Build the Offline Graph to fit your specific needs, selecting the exact offline identity information required for your campaigns.

- Expanded consumer insights: Connect more data points to enrich your understanding of consumer demographics and behavior, using Experian’s Marketing Attributes and Audiences data.

Offline Graph: Your gateway to consumer connectivity

As signals fade, there is a large emphasis on procuring and having accurate consumer data. Experian’s Offline Graph delivers the connectivity and insights necessary to stay ahead. Whether you aim to strengthen your existing data or access entirely new data sets, Experian’s Offline Graph offers a solution tailored to your needs. Transform your data strategy with Experian’s Offline Graph — your gateway to a unified consumer identity solution.

Latest posts

In 2013 and beyond, marketers will have to work even harder to gain and maintain position in organic search results. They’ll also need to spend more effectively on paid search ads by knowing how their target customers use search, and by applying insight into their behaviors and attitudes to plan and execute better content and campaigns. Here’s an excerpt on the search landscape from the upcoming 2013 Digital Marketer Report: Five Websites captured 20 percent of all search activity in Q4 2012, while the top 500 captured nearly 50 percent. Expansion to the top 1,000 Websites reached nearly 75 percent, highlighting the challenges for marketers to reach potential customers through search, even for those with a large Web presence. Top five Websites to capture search clicks Websites Domain Q4 2012 – share of search clicks Facebook www.facebook.com 8.48% YouTube www.youtube.com 5.55% Yahoo! www.yahoo.com 2.63% Wikipedia www.wikipedia.org 2.01% Amazon.com www.amazon.com 1.40% Source: Experian Marketing Services’ Hitwise Source: Experian Marketing Services’ Hitwise Even through paid search, the landscape changes very little — the top 10 Websites captured 16 percent of all paid search clicks, and the top 500 captured 56 percent. Top five Websites to capture paid search clicks Websites Domain Q4 2012 – share of paid search clicks Amazon www.amazon.com 4.19% eBay www.ebay.com 3.46% eHow www.ehow.com 2.44% BestBuy www.bestbuy.com 1.06% Yahoo! Shopping shopping.yahoo.com .85% Source: Experian Marketing Services’ Hitwise Source: Experian Marketing Services’ Hitwise Breaking through the clutter is key to reaching customers who are in the market for your product and services. Understanding who your ideal customers are can help to focus your search campaigns on these consumers and see greater campaign effectiveness. For more digital consumer insights, pre-order The 2013 Digital Marketer Report today.

With so many New Year resolutions about losing weight, many Americans have turned to the Internet to help. See what diets they’re searching for.

With the busy holiday marketing season in full swing, Experian Marketing Services has released its online retail round-up for the week ending Dec. 22.