Today, Experian is excited to introduce our Offline Graph as a standalone product that clients can license, marking a significant step in our commitment to powering data-driven advertising through connectivity. Offline Graph empowers advertisers and advertising technology companies to build and refine consumer profiles, contributing to data connectivity, more offline audience reach, and improved offline measurement accuracy.

As a result of consumers engaging with content across more channels, there are more disparate data points than ever before. When you couple that with ongoing signal loss, the need for a unified identity solution has never been greater.

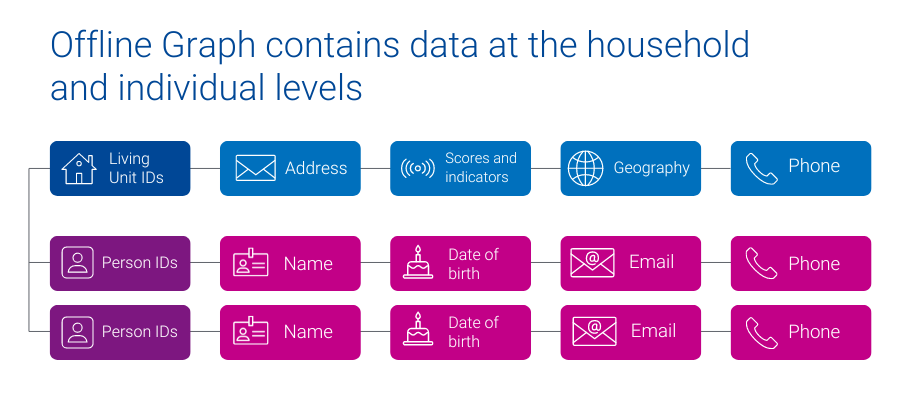

Experian’s Offline Graph offers companies a license of stable offline data points, like name, address, phone number, email, geographic information, date of birth, and additional attributes that provide a complete view of household and individual identities. The Offline Graph integrates known offline identity information from reliable deterministic sources like property ownership records, public records, and marketing data to provide access to all United States consumers and households.

How customers can use the Offline Graph

- A big box retailer fills in the blanks of their existing customer data and builds a database of prospects.

- A media platform more effectively onboards advertisers’ segments, enabling advertisers to reach more of their customers.

- A retail brand better understands their customer’s demographic and behavioral make-up, by licensing Offline Graph with Marketing Attributes.

- A connected TV (CTV) manufacturer increases audience reach and accurately quantifies the campaign impact for their advertising partners.

Experian’s Offline Graph is already driving value across industries. Here’s some in-depth client success stories:

Fusion92 licenses Offline Graph to help their clients transform their marketing

Fusion92 is a marketing partner that fuels business transformation in today’s digital economy and delivers exponential returns for brands.

Fusion92 licenses Experian’s Offline Graph to power their strategy: from research and discovery to audience creation, activation, and measurement. With access to our Offline Graph, Fusion92 ensures their clients get the insights, targeting, reach, and measurement they need to achieve their business goals.

“At Fusion92, we are always pushing the envelope to develop solutions that lead to success for our clients. Our desire to innovate pushed us to find an industry-leading partner in data and identity. This led to us licensing Experian’s Offline Graph product, which we use to build more complete audience profiles for our clients. In doing so, we help brands target, activate, and measure their marketing campaigns more effectively, leading to superior results.”

dave nugent, executive vice president of data and analytics, fusion92

Using Offline Graph to deliver relevant messaging to multiple audience cohorts

A leading direct-to-consumer (DTC) company with strong customer relationships built a robust first-party data set, enabling effective customer retention. To attract new customers, they partnered with Experian to access offline identity data from Experian’s Offline Graph. The Offline Graph provides them with the data needed to validate their first-party data and with the keys to unlock new customers.

With this data, the DTC company delivered the right message to both sets of consumers: existing customers and new prospects. By integrating Experian’s Offline Graph they broadened their reach, personalized their messaging, and improved their marketing.

What sets Experian’s Offline Graph apart from the competition

- Stability of data: With data from deterministic sources, our Offline Graph ensures that your view of consumers – and your ability to connect with them – is stable over time.

- Connected digital and offline data: Seamlessly connect offline data with digital identifiers through our Digital Graph, enabling a holistic approach to marketing, while ensuring consumer privacy is prioritized.

- Tailor made for your use cases: Build the Offline Graph to fit your specific needs, selecting the exact offline identity information required for your campaigns.

- Expanded consumer insights: Connect more data points to enrich your understanding of consumer demographics and behavior, using Experian’s Marketing Attributes and Audiences data.

Offline Graph: Your gateway to consumer connectivity

As signals fade, there is a large emphasis on procuring and having accurate consumer data. Experian’s Offline Graph delivers the connectivity and insights necessary to stay ahead. Whether you aim to strengthen your existing data or access entirely new data sets, Experian’s Offline Graph offers a solution tailored to your needs. Transform your data strategy with Experian’s Offline Graph — your gateway to a unified consumer identity solution.

Latest posts

Study reveals that brands with more mature identity programs were significantly more likely to be successful in achieving their key objectives Tapad, a part of Experian, a global leader in cross-device digital identity resolution and a part of Experian, has commissioned Forrester Consulting, part of a leading research and advisory firm, to conduct a new study that evaluates the current state of customer data-driven marketing and explores how marketers can use identity solutions to deliver privacy safe and engaging experiences, in an evolving data landscape. The study highlights the changing ground rules for digital marketing and the threat that poses to marketers’ ability to deliver against long standing KPIs and campaign goals. Nearly two-thirds (62%) of respondents said that the forces of data deprecation will have a significant (40%) or critical (21%) impact on their marketing strategies over the next two years. Among those surveyed, identity resolution strategies have surfaced as an opportunity to create more powerful customer experiences, with 66% aiming to have it help improve customer trust and implement more ethical data collection and use practices, while nearly 60% believe it will point the way to more effective personalization and data management practices. Although organizations are eager to implement identity resolution strategies, a complex web of solutions and partners makes execution a challenge. For example, respondents report using at least eight identity solutions on average, across nearly six vendor partners, and they expect that fragmentation to persist in the ‘cookieless’ future. Additionally, brands’ identity resolution technologies typically represent a patchwork of homegrown and commercial solutions. Eighty-one percent of respondents use both in-house and commercial identity resolution tools today, and 47% use a near-equal blend of the two. Despite the challenges, many brands have the foundation for a strong identity resolution strategy in place, and they are thriving as a result. Specifically, more mature brands were 79% more successful at improving privacy safeguards to reduce regulatory and compliance risk, 247% more successful at improving marketing ROI, and over four times more effective at improving customer trust compared to their low-maturity peers. Additional insights include: Marketers Are Increasingly Playing a Key Strategic Role Within the Organization, But There is a Mandate to Demonstrate Value. Nearly three-quarters of respondents in our study agree the marketing function is more strategically important to their organization than it used to be, while almost two-thirds agree there’s more pressure than ever to prove the ROI or business performance of their activities. Consumers Expect Brands to Deliver Engaging Experiences Across Highly Fragmented Journeys: Tapad, a part of Experian found that 72% of respondents agree that customers demand more relevant, personalized experiences at the time and place of their choosing. At the same time, 67% of respondents recognize that customer purchase journeys take place over more touchpoints and channels than ever, and 59% of respondents agree that those journeys are less predictable and linear than they once were. Marketing Runs on Data, But the Rules Governing Customer Data Usage are Ever-Evolving: According to the study, 70% of decision-makers agree that consumer data is the lifeblood of their marketing strategies – fueling the personalized, omnichannel experiences customers demand. At the same time, 69% of respondents recognize that customers are increasingly aware of how their data is being used. At least two-thirds agree that data deprecation, including tighter restrictions on data use (66%), as well as operating system and browser changes impacting third-party cookies (68%) means that legacy marketing strategies are unlikely to remain viable in the long-term.“ Our latest survey findings give us a better understanding of how our customers and other companies around the world are trying to master the relationship between people, their data and their devices,” said Mark Connon, General Manager at Tapad, a part of Experian. “This research shows why it's fundamental for the industry to continuously work to develop solutions that are agnostic. Tapad, a part of Experian has worked tirelessly to deliver on this with our Tapad Graph, and by introducing solutions like Switchboard to help the evolving ecosystem and in turn helping customers reap the benefits of better identity in both short and long-term.” The study is founded on an online survey of over 300 decision-makers at global brands and agencies, which was fielded from March to April, 2021. Data deprecation and identity are fast-developing, moving targets, so this study delivers targeted insights and recommendations for how to prepare for coming shifts in customer data strategies – whether they manifest tomorrow or a year from now. Get started with The Tapad Graph For personalized consultation on the value and benefits of The Tapad Graph for your business, email Sales@tapad.com today!

Mike Richardson, Manager of Analytical Delivery, explains campaign audience testing from planning to measurement.

To navigate the challenge of 2021, Experian’s Marketing Analytics team is sharing Back-to-School shopping season insights with you. Download the free eBook.