The AdTech industry is undergoing rapid changes as it adjusts to the impacts of data deprecation and ever-changing privacy regulations. At the same time, there are fears of a potential economic downturn. How should you handle marketing in a recession? What should your marketing mix look like? In this blog post, we’ll cover how to navigate this uncertainty and three essential ingredients for your marketing mix.

First, we’ll look at the complexity and uncertainty facing marketers.

Turbulence with Twitter

After Elon Musk’s Twitter takeover in October 2022, half of Twitter’s top 100 advertisers left the platform and started to seek out alternatives.

The retail media boom

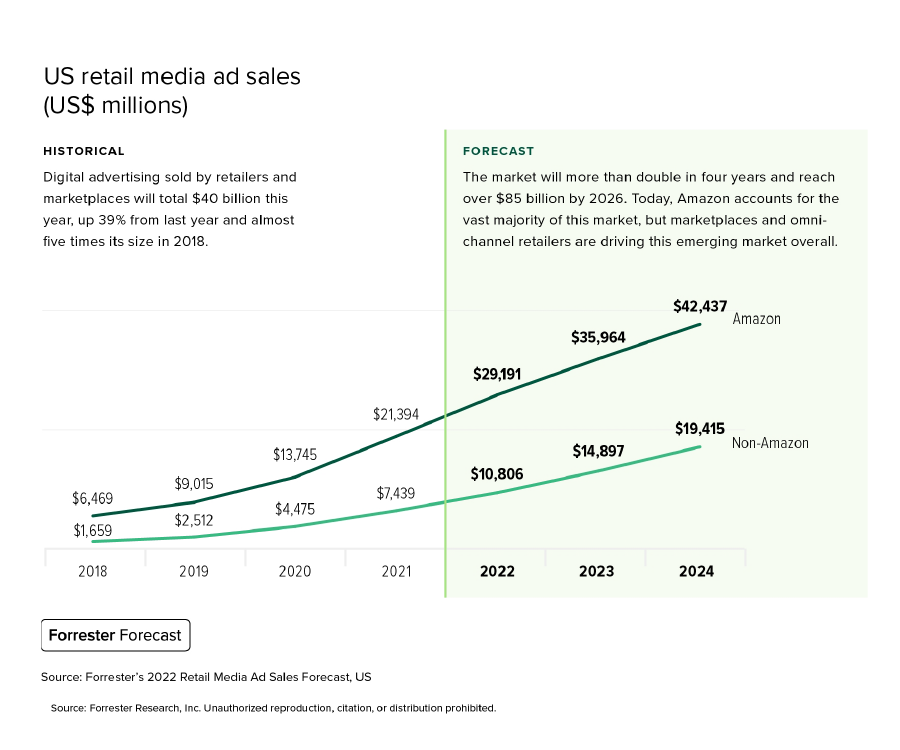

In the next four years, Forrester Research projects that U.S. retail media ad sales will double to reach 85 billion by 2026.1

Most of this growth is catalyzed by CPG and consumer electronic brands that have a scarcity of zero- and first-party data; they need more media closer to the point of purchase, especially as CFOs are scrutinizing budgets.

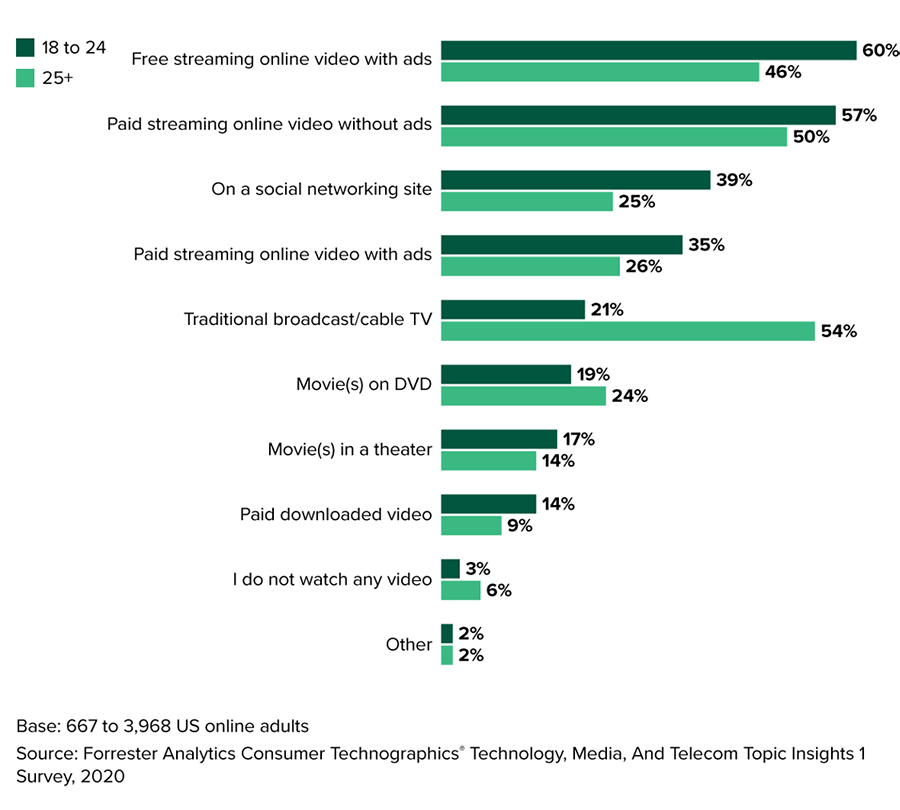

Consumption continues to fragment

It’s becoming harder than ever to reach the right person, at the right time, predict their intent, and get a 360-degree view of your customer.2

Data deprecation is top of mind

According to Forrester Research, updating their data strategy to address data deprecation is the number one priority for marketers. Addressing data deprecation is also a priority for consumers, who increasingly feel that audience targeting is more intrusive than beneficial.3

Data deprecation affects identity solutions

Third-party data and mobile ad IDs (MAIDs) are the connective tissue for identity solutions. As we see those signals go away, there are fewer linkages to resolve identity and it’s leading to a rise in fragmented, duplicated, and shallow identity.

Recession fears

In addition to everything happening in AdTech, there are also fears of a possible recession. According to Forrester, 40% of Gen Z and 41% of Millennials believe fears of an upcoming recession are greatly exaggerated. On the other hand, only 24% of Gen X and 12% of Baby Boomers agree.4

Navigate uncertainty and marketing in a recession

With the current macroeconomic conditions, data deprecation, and fragmented consumption in mind, what should your strategy look like for marketing in a recession? Forrester recommends three strategies:

- People-led planning

- Test creative

- Optimize for marginal costs

People-led planning

Planning doesn’t have to be fragmented. Map offline and online media exposures to consumer decision journeys. Strategies like lifetime value (LTV) driven audience segmentation to correlate awareness at top of the funnel layered with demand generation exposures harvested later in the funnel. To do this, it’s crucial to work with providers that give you visibility into the audience buyer’s journey to awareness, intent, consideration, and purchase, all the way through to loyalty.5

Test creative

Make your creative work harder for you. Apply the same rigor with your creative that you applied to segmentation. Utilize multivariate testing to identify creative that is winning or losing. When you understand how each variable performs, you can scale the variables with creative optimization to have a material impact on performance.

Optimize for marginal costs

Optimize for marginal costs of acquisition, not just the average. Adjust for incrementality – what is the cost to acquire one more customer, rather than the average cost of acquisition.

Find the right marketing mix in a recession

With these changes in mind, how can you find the right marketing mix in a recession? We can show you the way.

You can create the right marketing mix with three key ingredients:

- Audiences

- Identity

- Activation

Let’s explore each ingredient to start you down the path toward marketing campaign success.

Audiences: Know your customer

The first ingredient to add to your marketing mix in a recession is your audience. Knowing your customer is key to targeting the right audiences successfully. Data-driven targeting can help you find your best audiences based on demographics, modeled lifestyles, and behaviors to improve marketing campaign performance.

Not sure where to start when it comes to developing your target audience strategy? We can help. We track digital usage of our data used by advertisers and identified the top four digital audiences that advertisers purchased over the last four years.

Four digital audiences to consider

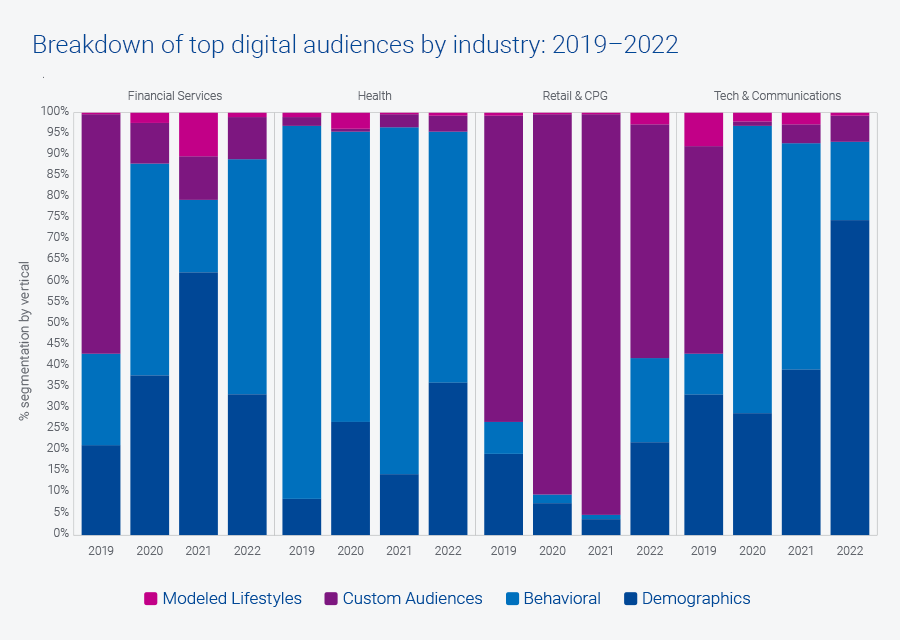

Marketing strategies are only as strong as the data foundation they’re built on. The top four digital audiences that advertisers are purchasing from Experian include:

- Demographics

- Behavioral

- Modeled Lifestyles

- Custom Audiences

Demographics

Examples include age, gender, relationship status, living situation, life experience, and employment.

Behavioral

This audience allows marketers to identify households that are more likely to engage in certain activities or belong to certain groups.

Modeled Lifestyles

Experian’s Mosaic® USA segmentation. This is a household-based consumer lifestyle segmentation system that classifies all U.S. households and neighborhoods into 71 unique types and 19 overarching groups, providing a 360-degree view of consumers’ choices, preferences, and habits.

Custom Audiences

This is an audience blended from multiple sources or derived from first-party look-alike modeling.

Changes in digital audience strategies

Over the last four years, Modeled Lifestyles and Custom Audience purchases represented the smallest share of digital activation, while Behavioral and Demographic segments were more popular with advertisers.

When the U.S. rolled out the COVID-19 vaccine, consumers became more active. People were shopping in stores, returning to the gym, and taking trips that they had postponed during the height of the pandemic. Marketers turned to higher compositions of Demographic and Modeled Lifestyles to reach these audiences between April and December of 2021.

Sustained growth in Demographic audience activation could suggest a move back to tried and true audience strategies as signals continue to decline and amid evolving regulation. With economic uncertainty, marketers return to what they know. Traditional targeting methods like Demographics and Modeled Lifestyles are the baseline of many marketing strategies and we predict that we will continue to see marketers activating against these data sets.

Download our 2023 digital audience trends and predictions report to discover our full insights on how digital activation has changed and where we’re headed.

Identity: Understand the customer journey

Identity resolution is the next ingredient that you should add to your marketing mix in a recession. It should be a foundational element of every marketer’s strategy.

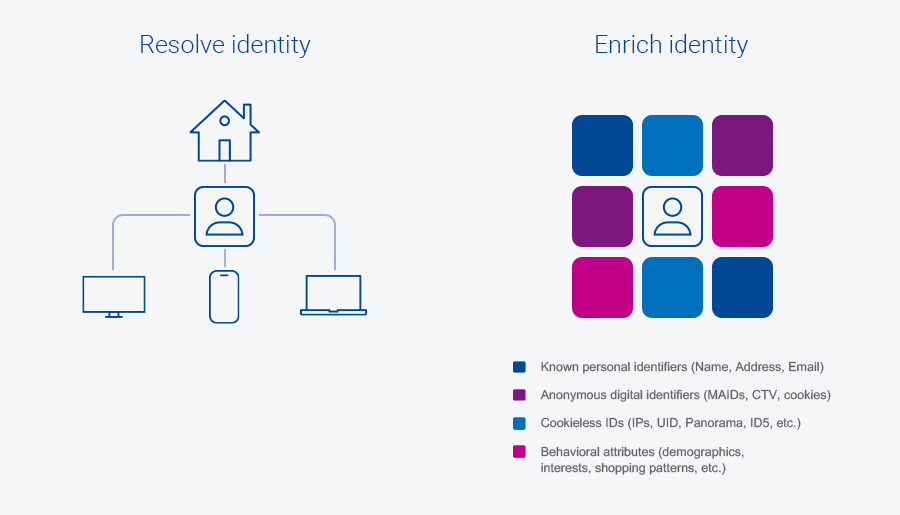

What is identity resolution? In the simplest terms, identity resolution is the process of matching different devices, IDs, and touchpoints back to a single person. Identity resolution expands marketers’ addressability and reach of their target audience and helps inform and measure accurate customer journeys.

Identity resolution challenges

Identity resolution faces two main challenges:

- Making the data actionable. Humans are complex. We have behaviors that change based on our current social groups and life events, we use dozens of internet-connected devices in a single day, and we exhibit distinct behaviors that happen online and in the physical world. This means marketers have mounds of data being collected from different channels based on that dynamic behavior of people, making it feel impossible to organize the data in a way that makes it feel actionable, know how it ties back to real humans, and ensure they’re doing it in a responsible and compliant way.

- Signal loss. Marketers continue to lose important signals that they’ve previously been able to rely on to inform their next move. Signals are being lost as our industry places more privacy regulations and restrictions on what can be tracked and as consumers themselves change behaviors to protect their privacy.

As consumer behaviors continue to change and signals disappear, identity resolution gets exponentially harder.

Expand addressability and reach with identity resolution

Data deprecation adversely affects identity solutions, but identity resolution should be a key ingredient in your marketing mix. Identity resolution ensures that consumers experience more relevant products, offers, and messaging – allowing you to reap the ROI benefits of hitting consumers at the perfect point in their journey.

Finding an identity resolution partner

When selecting an identity resolution partner, you should understand the data and processes that are implemented behind the scenes. It’s important to know:

- What makes up their consumer database?

- How fresh is their data?

- What identifiers can they match?

- How do they protect consumer privacy?

At Experian, we’re rooted in deterministic offline data which creates a stable foundation. We then layer in digital and behavioral touchpoints. We have decades of experience managing consumer data safely. We have insights on 250 million individuals, three billion devices, and one trillion device signals. Our databases evolve as quickly as the human behavior powering them does.

Our approach to identity resolution is open and agnostic. This means we can collect and ingest nearly all available offline and online identifiers. We can do this in all types of environments, including connected TV (CTV), mobile, and cookieless. We have two types of identity resolution:

- Offline

- Digital

This ensures we control how known and anonymous data points are connected for consumer privacy purposes.

Identity resolution in action

Our depth of data gives our clients access to see the whole human and gain the context around singular data points.

Let’s walk through an example of our identity resolution capabilities.

Challenge

Our TV media platform client needed to measure the effectiveness of an ad campaign they were running on behalf of a leading consumer electronics brand. The TV platform wanted to be able to accurately report on which consumers made a purchase after seeing the brand’s TV commercial on their platforms.

Solution

Using our digital identity resolution services, our client could capture online purchases made on the brand’s website and link them back to a consumer profile. In addition to online transactions, our client used our offline resolution services to resolve email addresses of consumers that purchased offline, using warranty registration details.

With online and offline purchase data now resolved back to an individual ID, we also performed identity resolution on viewers in their TV subscriber files that had also been exposed to the TV commercial. This allowed us to identify subscribers that had both seen the ad and purchased a product.

We provided our client with a packaged report that they could white-label and pass along to the brand.

Results

By providing this attribution reporting to the brand, the TV platform could validate the ROI spent on their platform. The brand was extremely satisfied with the results, and they transitioned the one-off TV commercial into an ongoing campaign and purchased quarterly measurement. This led to solid recurring revenue for the TV platform.

Activation: Experiment and measure the impact

The third and final ingredient to finding the right marketing mix in a recession is activation. Experimentation is the best way to determine which channels work best for your business and provide the most ROI.

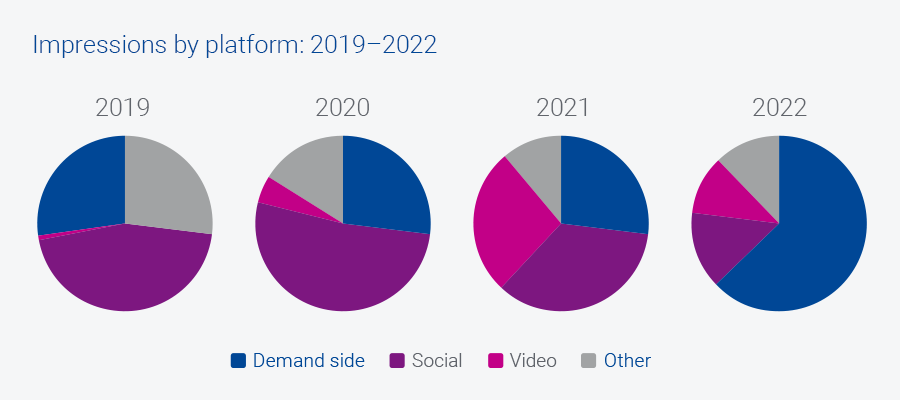

Demand-side platforms (DSP), video platforms, and sell-side targeting are three important activation channels that you should consider experimenting with.

Demand-side platforms

We continue to see increased demand for environments where alternative identifiers are being transacted (like DSPs and video). Social channels are decreasing; this can be attributed to changes in privacy, security, and concerns around brand safety.

Amazon’s DSP is catching up with Google and Meta to become a top ad platform.

Video platforms

Digital video and other video channels like over-the-top (OTT) and CTV will continue to grow. Digital video will capture the most ad spend in 2023 (22.4% in 2023 vs 19.3% in 2022). Because of this, advertisers are placing bigger bets on the combination of addressable and CTV.

Sell-side targeting

Data sharing relationships will become strongest on the sell-side as we move toward consented first-party data. Ad dollars are shifting to channels that use the sell-side approach, like retail media and CTV.

Sell-side targeting enables brands to access large amounts of inventory across publishers and retailers. By getting closer to the ad inventory, advertisers can future-proof their strategies by having more access to better data signals. Direct relationships like these will be necessary as privacy regulations increase and signal loss continues.

We can help you find the right marketing mix in a recession

Now is the time to be opportunistic. Gaining share of voice during a downturn is cost-effective. Proactive marketing builds pent-up demand.

Delivering the right message in the right place at the right time means truly knowing your prospects and customers as individuals. At Experian, we bring you the highest-resolution picture of people, so you and your customers can connect with confidence.

You can turn prospects into customers with the right audience. By understanding your customers better, you can find more like them. Together we can power better results.

Find the right marketing mix

Check out our webinar, “Find the right marketing mix with rising consumer expectations.” Guest speaker, Nikhil Lai, Senior Analyst from Forrester Research, joined Experian experts Erin Haselkorn and Eden Wilbur. Watch the recording to learn:

- New data on the complexity and uncertainty facing marketers

- Consumer trends for 2023

- Recommendations on finding the right channel mix and the right consumers

Sources

- 2022 Retail Media Ad Sales Forecast, US. Forrester Research, Inc. 2022.

- Forrester Analytics Consumer Technographics® Technology, Media, and Telecom Topic Insights 1 Survey. Forrester Research, Inc. 2020.

- CMO Pulse Survey. Forrester Research, Inc. July 2021.

- Forrester’s Consumer Energy And Retail Online Survey. Forrester Research, Inc.

- People-Led Planning Solves Customer Problems to Drive Growth. Forrester Research, Inc. August 2, 2021.

Latest posts

With the long-term effects to the economy unknown, many consumers are feeling the financial impact, while others are looking for opportunities, resulting in a transformational shift in spending. Some brands are experiencing decreased or paused marketing budgets, and you may be trepidatious about making the right decisions in your efforts to grow share of wallet. Recent events have been an impetus for change and we’re seeing brands make modifications to traditional marketing strategies. Some are developing innovative technologies and utilizing new sources of data and analytics. As we look at how these changes impact marketing results, we see the gap grow between those brands who are equipped to pivot and implement new strategies quickly, versus those who are not. So what steps can your organization implement now to make the smartest choices for both your customers and your business to secure more share of wallet? Here are four ideas to accelerate the success of your next financial marketing campaign: 1. Meet your customers wherever they are: Digital-first strategies have never been more relevant than they are right now. While consumers have fully embraced online engagement, marketers are even more focused on reaching high-value segments in the channels they utilize. By using an informed, data-driven strategy that includes preferred marketing communication channels and decision-making styles, engagement increases across those channels your target audience frequents the most. For example, are they heavy social media users? Do they prefer streaming TV? Or do they tend to rely on financial advice vs. performing their own research? To drive take rates, your audience must be exposed to a tailored message, in the right channel, and possibly multiple times. 2. Use messaging that resonates: As consumers refocus priorities, their expectations of brands with whom they do business are ever-increasing. Reflecting an understanding of the current needs and interests of your customers and prospects is an undertone that can only help strengthen their view of your brand. Consumer behavior has changed and is unlikely to revert to what was, so you want to be relevant, but you also do not want to be seen as ‘tone deaf’. As a result, consider revising your segmentation strategy to leverage predictive insights, such as household economic indicators, financial behaviors, lifestyle propensities and interests to help shape your message into one that truly makes an impact. 3. Prove the worth of your campaign: New consumer journeys are being formulated and showing ROI is imperative as your marketing budget is scrutinized. Having the right industry-relevant metrics and reports to analyze and share with leadership are key. Demonstrate that your campaigns are contributing to bottom-line success—and justify future campaigns—by using data-driven measurement insights collected across multiple reads and countless touchpoints. Marketing budgets are being scrutinized now more than ever, so showing ROI is critical. Having the right metrics and reports to analyze and share with leadership are key. 4. Follow government regulations—leverage Fair Lending-friendly audiences: Whether you’re cross-selling or prospecting, now is the time to identify the right audiences with rich data insights to not only execute impactful campaigns but adhere to government regulations that protect consumers and your organization. Trusting that the data you are activating follows Fair Lending Laws, including the Equal Credit Opportunity Act (“ECOA”) and the Fair Housing Act (“FHA”) is crucial. The Federal ECOA prohibits creditors from discriminating against credit applicants on the basis of several prohibited factors. Developing people-based segments that are not derived using these factors positions you to follow these regulations. Check out our previous blog post about Fair Lending-friendly audiences here. As you transition to new operating models, access to current and accurate consumer data can provide confidence in campaign potential, help you avoid business risk, enable you to respond to market changes and make better decisions. Experian can help you implement these strategies and put your brand unique position for growth. From start to finish, we provide the marketing solutions you need to plan, build and execute successful, Fair Lending-friendly campaigns to cross-sell to existing customers and acquire new customers. Learn more about Experian’s financial services marketing solutions here. *Experian Fair Lending-friendly audiences do not constitute legal advice or otherwise assure compliance with the FHA, ECOA, or any other applicable laws. It’s recommended to seek legal advice with respect to the use of data in connection with lending decisions or application and compliance with applicable laws.

There’s no question that COVID-19 has changed the shopping landscape forever. While the initial onset of quarantines and lockdowns negatively impacted brick and mortar retailers, online shopping soared to levels higher than 2019’s Black Friday/Cyber Monday extravaganza, accounting for $153 billion in spending over April and May1. Many consumers will continue to shop online for the foreseeable future for various reasons, which means marketers must have a greater focus on providing a positive online customer experience. Despite MSN Money’s claim that COVID may have made holiday shopping extinct2—in part because retailers such as Walmart, Target, Best Buy and more are keeping their doors closed on Thanksgiving—it turns out that’s not the case. According to polls taken by Chain Store Age, the pandemic hasn’t impacted consumers’ holiday spending plans, but it has affected how they intend to shop. This sentiment is echoed by Radial, who shared that 60% of consumers plan to shop less in-store this season. Even so, Salesforce noted that respondents to their poll found that consumers value safety and health above all else in their in-store shopping experiences, with 60% stating that social distancing measures were important to them3. So how can you navigate this new shopping normal and make the most of the 2020 holiday season? 1. Leverage data to strengthen communicationsData has always been an important component to a successful marketing plan, but it’s even more important now that shoppers are scattered across multiple devices and shifting their preference from offline to online—or a hybrid of the two. Connecting consumer identities across devices and channels means you can reach customers more effectively, promoting events, items and experiences that are most relevant to them on the channels they frequent most. You can also leverage mobile location data to understand consumer traffic patterns, including understanding which competitors they may visit. Not only will this help you to anticipate their behaviors, but you’ll learn more about their habits and preferences, which in turn helps you to craft messaging that speaks directly to their needs—and encourages their loyalty. 2. Be transparent in your messagingBrick and mortar holiday shopping isn’t totally out of the question this year, it’s just going to look a little different. If you’re still offering customers an offline experience, be open and honest with them about what they can expect. Use your outreach to share information about how you’re protecting employees, sanitizing the store, and making for a safer in-store experience so your customers feel comfortable walking through your doors. (The NRF has excellent resources to help you navigate this as required by state guidelines.)Also, let them know if there are any changes to shopping policies, such as wearing masks, contactless payment, the number of people allowed in the store at one time, return windows and more. The more transparent you can be in your messaging, the more comfortable customers will feel in keeping you in mind for their holiday shopping plans. And if your online business is booming, make sure you communicate any changes in fulfillment or shipping due to safety measures or delivery delays. This will be important messaging to those who may not be traveling to see family this year and are shopping online to have gifts shipped to their loved ones. 3. Offer positive new experiences and perksWhether you’re online or offline or both, customers will feel encouraged to shop when you offer them a little something extra to help make their shopping experience more enjoyable. Curbside pick-up has become an important aspect of this new normal in retail, so make sure you share with your customer whether that option is available to them. If “try before you buy” isn’t available like it may have been in the past, see what you can do to offer a similar experience—for example, many fashion retailers are offering virtual styling services that allow customers to connect with an expert for further insight on fits and cuts that may work for them (or the friends and family they’re shopping for). Some home furnishing retailers provide the ability to “visualize” an accessory or piece of furniture in your home.Free gift-wrapping services are always appreciated, as are in-store experiences for shoppers with kids (but they must be socially distant, of course). Be creative and use data to help inform your decisions so you can create perks and experiences that will really connect with your customer. Even with new challenges, retailers have the opportunity to offer a positive shopping experience through the holiday season and beyond, whether online or offline. And given the stressors of the season, it’s likely consumers will be shopping for themselves as much as they’re shopping for friends and family. As Business Insider put it, “…retailers will need to be more targeted and creative in their approach to Black Friday to get customers to spend,” and having the right data will be key. Download our new Holiday Marketing eBook for trends, tips and tricks to help you plan and execute powerful holiday marketing campaigns. 1https://theblog.adobe.com/online-shopping-during-covid-19-exceeds-2019-holiday-season-levels/ 2https://www.msn.com/en-us/money/companies/covid-19-may-have-made-thanksgiving-day-holiday-shopping-extinct/ar-BB17fmtm 3https://www.zdnet.com/article/covid-19-has-permanently-changed-shopping-behavior/

Cross-device matching and pixel-based foot traffic attribution reporting empower digital marketers with greater control of location-based campaigns.RALEIGH, N.C. (PRWEB) AUGUST 04, 2020 Tapad, part of Experian a global leader in digital identity resolution, and Reveal Mobile, a leader in location-based marketing, today announced a collaboration that combines Tapad's digital cross-device matching technology and pixel-based attribution features with Reveal Mobile’s VISIT Local, the software that hundreds of digital agencies and brands use for location-based analytics. The partnership is designed to drive improved performance by optimizing ad targeting and messaging for location-based campaigns. Powered by Tapad’s privacy-safe cross device matching, marketers using VISIT Local to power location-based campaigns can enhance how they reach shoppers. When one member of a household shops for groceries, clothes, household goods or any other consumer item, a conversation between multiple members of the household typically takes place beforehand. With cross device matching, marketers can reach everyone who has influence over what to buy and where to buy it. VISIT Local users can expand location-based services with a single click to include devices that share the same household, including targeting across multiple devices owned by the same user, allowing advertisers to maximize messaging and increase their share of wallet among consumers. “VISIT Local has always given our customers access to high-intent location-based audiences. With the addition of cross device matching from Tapad, advertisers can boost audience sizes up to 300 percent while maintaining full confidence in quality and relevance,” says Brian Handly, CEO of Reveal Mobile. “VISIT Local users can now apply multiple criteria and attributes to a single location-based audience, giving them the advanced control and transparency they need.” As reliable attribution becomes increasingly complex for marketers and ad buyers who need to prove value, the addition of Tapad’s pixel-based foot traffic attribution to VISIT Local enables the measurement of actual campaign effectiveness by tying ad views to in-store foot traffic. This new feature, which will be available in VISIT Local this fall, lets Reveal Mobile customers understand who visited a retail location as a result of being served an ad, providing a more accurate view into return on ad spend during and after advertising campaigns. “Tapad’s goal is to empower marketers with digital advertising efficiencies at scale across devices,” says Mark Connon, COO of Tapad. “With cross device matching and pixel-based foot traffic attribution, marketers using VISIT Local can better address the consumer’s preferences and habits, and deliver them consistently actionable information on user behavior. These capabilities advance location-based advertising in ways marketers need and want.” In addition to these new features, VISIT Local’s location-based audience builder now enables marketers to create custom audiences made up of people who have visited different places on different dates. This gives VISIT Local users the ability to segment and create the most highly targeted audiences possible. For example, a marketer who wants to advertise for a chain of restaurants can easily target visitors of different competitors in different cities. Or a marketer who wants to advertise vacation destinations can target people who have been to various resorts at different times of year. Or a marketer who wants to advertise the release of new music can target people who have been to concert venues in different cities on different dates. “Many of our customers need to create highly custom audiences so they can run experiments, test messaging, and run increasingly competitive campaigns,” says Handly. “Everyone who uses VISIT Local can now apply multiple criteria and attributes to a single location-based audience, giving them the advanced control and transparency they need.”To learn more about Tapad’s digital identity resolution products, visit our identity solution page. To learn more about Reveal Mobile’s location-based marketing offerings, visit http://www.revealmobile.com. About TapadTapad, Inc. is a global leader in digital identity resolution. The Tapad Graph, and its related solutions, provide a transparent, privacy-safe approach connecting brands to consumers through their devices globally. Our one-of-a-kind Graph Select offering enables marketers the flexibility and freedom of choice to correlate devices to varied objectives, driving campaign effectiveness and business results. Tapad is recognized across the industry for its product innovation, workplace culture and talent, and has earned numerous awards including One World Identity's 2019 Top 100 Influencers in Identity Award. Headquartered in New York, Tapad also has offices in Chicago, London, Oslo, Singapore and Tokyo. About Reveal MobileReveal Mobile is a leader in location-based marketing, analytics, audiences, and attribution. Creator of VISIT Local, VISIT Match and VISIT Data, the company’s products help digital agencies, brands and retailers of any size leverage location data to understand and reach the right audiences. Reveal Mobile is CCPA compliant and a member of the Network Advertising Initiative, which conducts an annual privacy certification. The company is based in Raleigh, NC. For more information, visit https://revealmobile.com. Contact us today