In our last few blog posts, we’ve talked about customer segmentation and different ways to segment your target audience into smaller chunks like demographic and psychographic segmentation to connect with the right people. Customer segmentation enables marketers to focus their marketing efforts on their target customers, improving their marketing targeting strategy.

But what if there was a subset of users that had an even bigger impact when targeted? Enter Super Users – the strategic players who can give your ROI numbers a major boost! It may take some trial-and-error testing to pinpoint these super segments accurately, but knowing how these key individuals interact is essential for any successful marketing targeting strategy.

What is a Super User?

As technology progresses and media consumption grows, a unique group is rising to the top.

Activate Consulting’s Technology & Media Outlook 2023 found that Super Users are powering the digital world, with a strong presence across all major media and technology verticals. This select crowd is made up of young, educated individuals who lead affluent lifestyles – spending more time and money than any other user group!

Why should you add Super Users to your marketing targeting strategy?

Super Users are a highly influential audience with the potential to drive major business growth. They stand out from other users in their commitment and dedication across four key areas:

- Time spent with media

- Spend

- Technology and media adoption

- Emerging eCommerce behaviors

“Over the next years, the imperative for technology and media companies will be to identify, reach, and super-serve Super Users – the single group of power users whose time and spend far surpass those of other users.”

Activate consulting’s technology & media outlook 2023

You can use Super Users as a subset of your marketing targeting strategy. While you may need to reach beyond Super Users to achieve your goals, it’s worthwhile to consider:

- Targeting them separately

- Spending more on media

- Reaching them at a higher frequency

Time spent with media

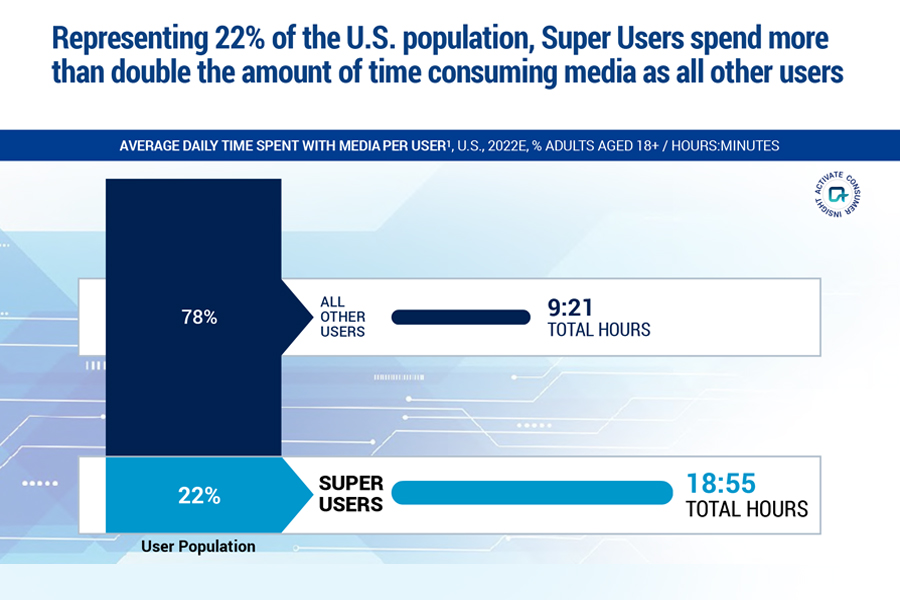

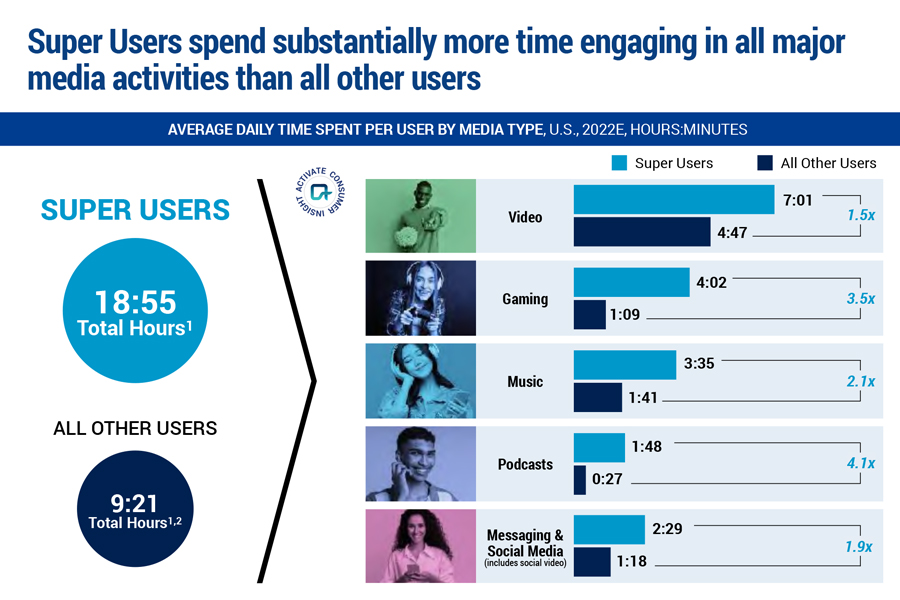

Super Users make a powerful impact, despite comprising only 22% of the U.S. population. They are incredibly influential in terms of media consumption and engagement – spending more than double the amount of time interacting with content compared to other users.

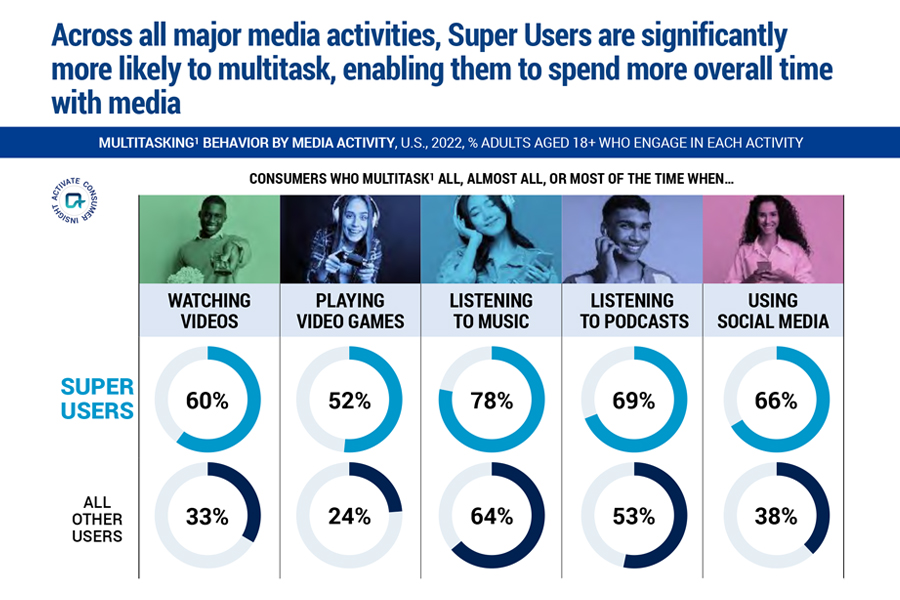

Inclined to multitask

Super Users take multitasking to the next level. Not only do they spend more time with electronics, but they excel in the art of juggling multiple activities. While watching videos and playing video games on one device, Super Users might also be busy engaging with social media on another. This makes them an unstoppable force when it comes to getting the most out of their digital experiences!

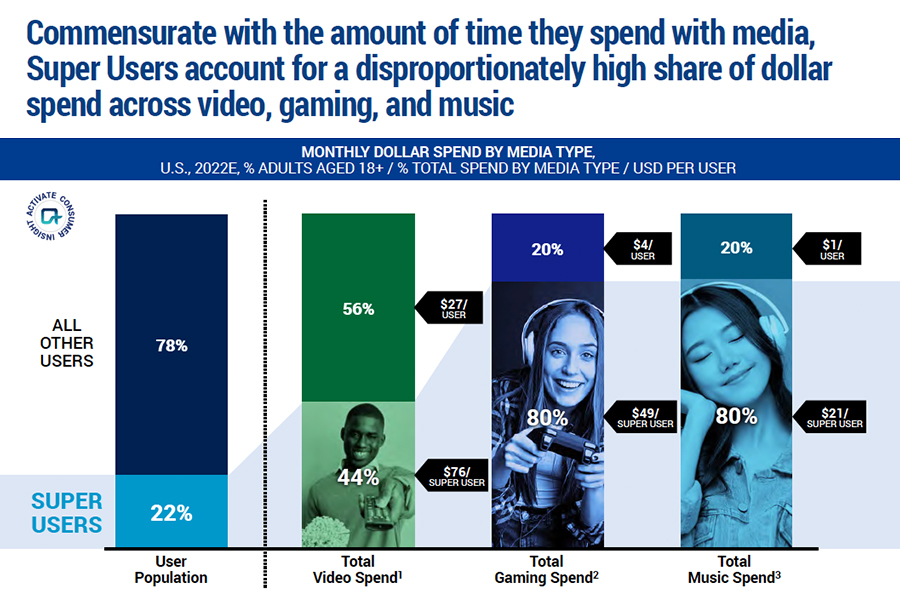

High share of dollar spend

Super Users are big spenders when it comes to media, particularly in gaming and music. Compared with all other users, Super Users’ average video spend is close to triple the amount ($76 vs $27). However, their biggest increases come from gaming and music; they’re collectively spending 12x more on games and shelling out 21x as much for tunes!

With 60% of eCommerce spend coming from Super Users, they are driving the industry forward with their enthusiasm and willingness to test out cutting-edge shopping trends like buying through social media, live streaming purchases, and trying on products virtually. Super Users are setting the tone for this dynamic industry.

Technology and media adoption

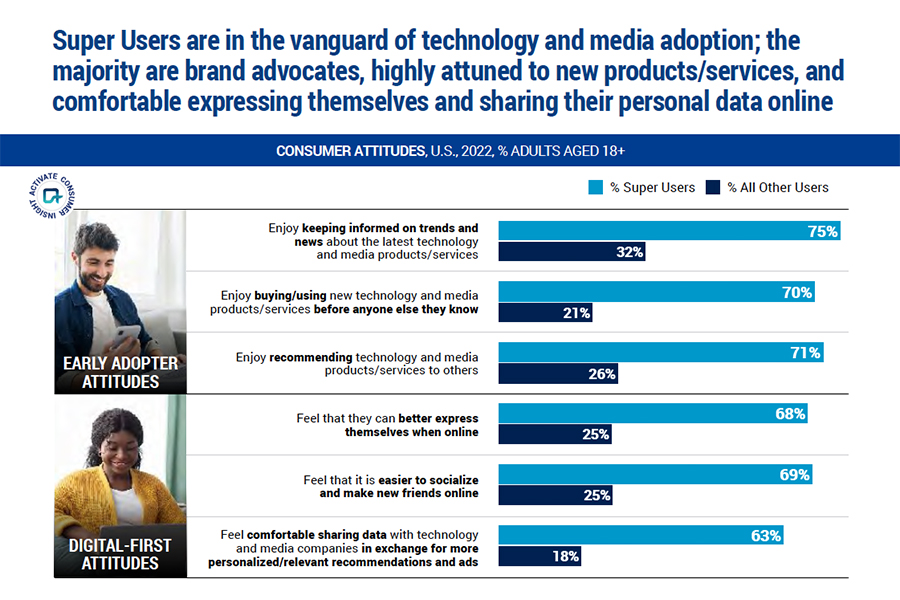

Most Super Users are brand advocates. They’re trendsetting individuals who stay ahead of the curve on media and technology. They eagerly take advantage of new products, services, and data-sharing opportunities to receive tailored ads that fit their lifestyle.

Crypto & NFTs

Super Users blaze the trail for cryptocurrency and non-fungible tokens (NFTs)! This group is five times more likely to explore, engage with, and embrace new digital-monetary technologies.

Pioneers of the Metaverse

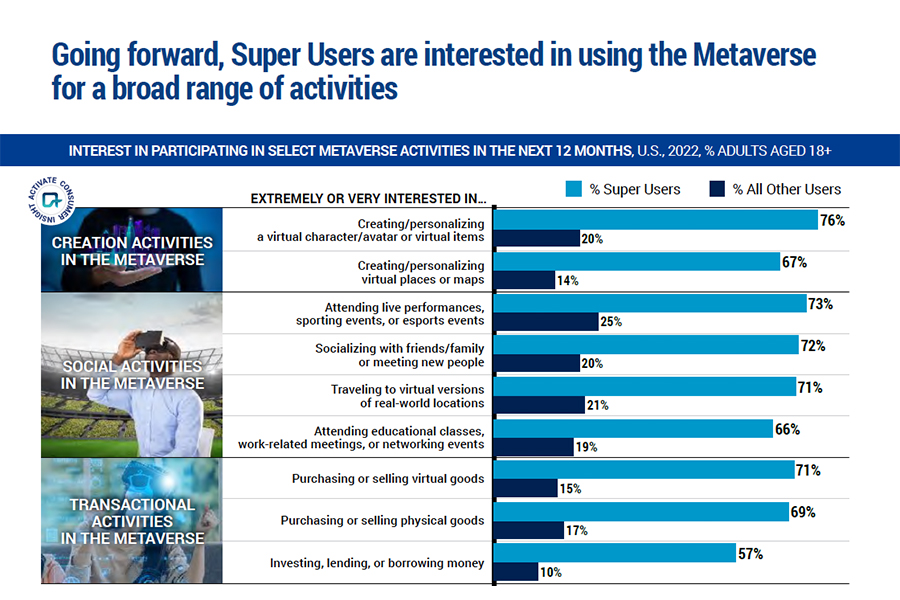

As Metaverse usage continues to rise, Super Users are leading the way. Over 80% of these trailblazers have embraced these digital spaces within just the last year. We’re seeing accelerated interest from them as they seek out new opportunities for creativity, connections, and transactions within their favorite Metaverses. Many express interest in Metaverse experiences such as purchasing physical items to creating virtual havens. In fact, they’re 5x more interested in all things meta-related!

How Experian can help you identify and target Super Users

So how can you find your Super Users and include them in your marketing targeting strategy? Whether you want to build or acquire highly addressable audiences, we can help you precisely reach the right individuals and households in any channel you desire with Consumer View.

Consumer View

It all starts with data. Delivering the right message in the right place at the right time means truly knowing your prospects and customers as individuals – their lifestyles, behaviors, and shopping preferences. Consumer View data can provide a deeper understanding of your customers.

Consumer View is the world’s largest consumer database that contains over 3,900 attributes for 250 million adult consumers in the U.S. with coverage of 126 million (98%) of U.S. households. Consumer View can help you find out:

- What do your customers look like?

- What do your customers do?

- How and when should you reach your customers?

- What motivates your customers?

Modeled and syndicated audiences

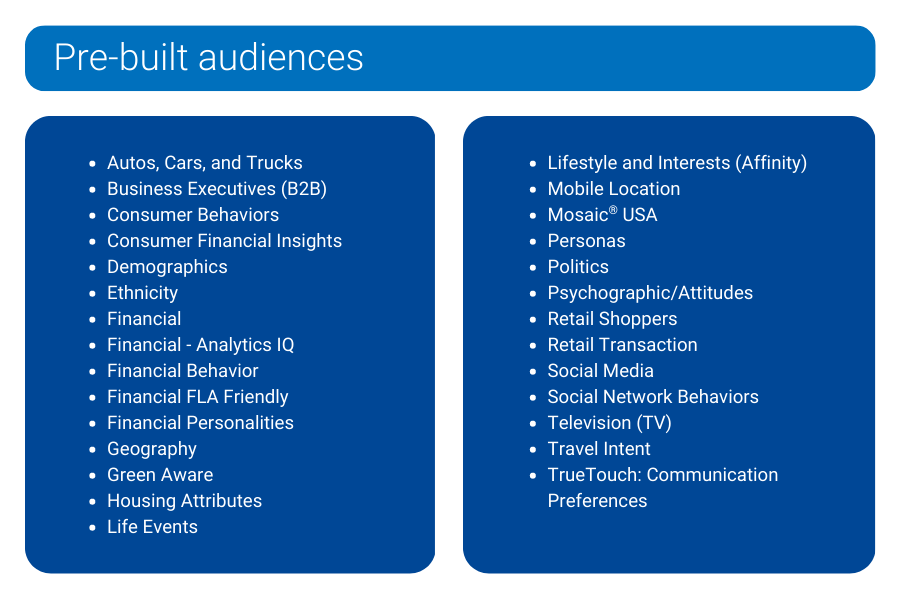

We have over 2,500 pre-built audiences that are privacy-safe and built using advanced data science and the most comprehensive consumer data available. These digital audiences are readily available via major publishers, data management platforms (DMPs), advanced TV operators, and demand-side platforms (DSPs).

Our pre-built audiences can be used consistently across multiple distribution partners – making sure you can quickly find the right audience for the right campaign without having to build your own consumer personas. In addition to being available as digital audiences, our segmentation products are also available to use across all consumer touchpoints to enable consistent omnichannel campaign targeting.

There are infinite data combinations and selections we can help you with for optimal audience targeting. Using our comprehensive inventory of data, we can find even the most unusual of audiences to help you connect with new prospects. From demographics to behavioral and psychographic information, we draw on a massive base of knowledge accumulated during five decades in business.

Mosaic® USA

Experian’s Mosaic® USA is a household-based consumer lifestyle segmentation system that classifies all U.S. households and neighborhoods into 71 unique types and 19 overarching groups, providing a 360-degree view of consumers’ choices, preferences, and habits. Using Mosaic lifestyle segmentation, you can anticipate the behavior, attitudes, and preferences of your best customers and reach them in the most effective traditional and digital channels with the right message in the right place at the right time.

Tailored Segmentation uses a sophisticated data-driven clustering system that leverages the 71 Mosaic types that match to first-party data like yours. Tailored Segmentation allows you to regroup Mosaic types based on the attributes you weigh as more impactful to your business. Have you designed your own segments in-house? You can apply Tailored Segmentation to those segments for deeper insights through a tailored analysis. Are you still looking for a way to segment your market even though you understand your typical best customer? Tailored Segmentation can weigh these attributes and develop a custom clustering and analysis of your market.

We can help you find your Super Users

Super Users are an important segment of any market. Marketers need to be able to identify them quickly and act upon their insights. Our marketing solutions provide the necessary data and analytical capabilities to easily find and target your potential Super Users for an effective marketing targeting strategy.

With Experian, you can deliver messages that are more in line with what matters to this influential group of customers. We understand how challenging it can be to find these customers and ensure they get the tailored, personalized messaging they deserve – so let us help you do just that! We can provide deep insights beyond the generic customer persona that allows marketers to look into the effectiveness of their marketing strategies from multiple angles. We want to help you gain an edge over your competitors by helping you identify, target, and engage Super Users for increased revenue growth. Ready to find your Super Users?

Sources

Activate Technology & Media Outlook 2023. Activate Consulting.

Latest posts

Fluctuation in consumers' behaviors and preferences during the pandemic has prompted a shift in the practices and patterns that we are accustomed to. Powerful market forces are emerging as society builds a new normal, forcing marketers to rethink their strategy, activation, and measurement. It is important for marketers to understand the forces that influence the industry, and to learn about alternative approaches that can be applied to help reach their goals. In our recent webinar, ‘How to Adjust to the New World of Advertising,’ Experian’s Chris Feo and guest speaker Tina Moffett, Principal Analyst at Forrester Research, lead an in-depth discussion of the market dynamics and developments guiding us to this new era of advertising. They talked about: The pandemic changing consumer behavior Emerging media channels Data deprecation The pandemic and increased media consumption The pandemic caused seismic shifts in consumer behaviors and business operations. Work from home became the norm, consumers made drastic changes in their routines, and businesses had to adjust to new operating models as local economies shrank and supply chains strained. As stay-at-home orders were put into effect, consumers increased their media consumption drastically as more time was spent at home in front of their devices. According to Forrester, by June 2020, 48% of US online adults subscribed to at least one streaming service, while 34% had signed up for multiple. Forrester contends that: Social and online video/OTT will grow fastest among other categories of ad spend Connected TV outpaces other video advertising channels 55% of consumers plan to continue watching movies at home rather than in theatres after the pandemic Data deprecation The ways that marketers can personalize content and measure the effectiveness of campaigns is changing with data deprecation. Consumer preferences, regulations, and technology providers are evolving the way advertisers understand consumers, causing changes to existing identity-based marketing strategies. According to Forrester, 66% of marketers are investing in first-party data collection strategies to adapt to these market forces. Marketers need to adjust Demand for a new advertising approach Changes in consumer behavior, evolving media consumption patterns, and data deprecation have marketers looking at new approaches to targeting and measurement. However, with the future uncertain in many of these areas, marketers need to test and experiment to determine which approach is best for them in particular use cases. Shifting to a new world of experimentation Advertisers need to start by assessing their current environment to determine where they have exposure today, which methods of identification they are using, and how those channels may be impacted by the market forces outlined earlier. From there, they need to start asking themselves how they can assess identity in the future or if there is another way to approach advertising in that specific channel. There are specific areas where marketers can look to make investments in terms of experimentation: Adoption of cleanrooms to support analytics and audience targeting Investment in first-party data to overcome the issue of data deprecation Shifting to a value-based, omni-channel advertising mindset to address customers’ needs Investment in data-savvy resources to manage media insights Adoption of consistent cross-platform advertising metrics and currencies to inform better planning If you missed our recent webinar ‘How to Adjust to the New World of Advertising,’ you can listen to the full discussion here.

Hashed Email is a privacy-safe digital identifier that can further enrich and expand the functionality and utility of The Tapad Graph with access to Tapad + Experian’s universe of email data. This provides maximum coverage for targeting and measurement when combined with household and individual IDs such as Cookies, MAIDs, CTV IDs, and IP Addresses. Gain back a clearer view Recent data from DMA shows that 51% of people have held the same email address for over 10 years. Email address data by its nature is authenticated and reliable due to its longevity. When leveraging Hashed Email as an extended functionality of The Tapad Graph, we are able to link on average 5 email addresses to each individual, reaching up to 90% of households across the US. Hashed Email expands the customer view by adding new email address identifiers into The Tapad Graph that associate with traditional digital IDs and cookie-less IDs emerging in the marketplace. Reduce fragmentation; and instead of viewing the emails as multiple customers, with Hashed Email they can be viewed as one user profile. When enabled, clients who wouldn’t traditionally have access to first-party customer emails are able to associate and link privacy-safe emails to individuals and their households. Brands and retailers can use Hashed Email to extend these linkages across offline purchases associated with each email; connecting traditional digital identifiers between walled gardens, activation in programmatic media buys, and addressable TV. With the holiday season quickly approaching, access to Hashed Emails will instantly increase scale, connectivity and improve measurement when efficiency, personalization and holistic attribution are pivotal to marketing strategies. Let’s visualize how quickly the customer journey can become fragmented when email addresses that belong to the same person are not associated. Mary has 3 email addresses that she frequently uses. One for social media accounts Email ID 1, one for shopping accounts Email ID 2, and another for work Email ID 3. Mary is a brand loyalist to a top national retailer and whenever there is a new season, there is a high likelihood that she will purchase the latest seasonal decor from that store. She recently did some holiday shopping in-store where she purchased nearly the whole holiday line. Email ID 2 was used to send her a receipt. However, Mary annoyingly receives the store's ads on Facebook for holiday decor that she had already purchased. This is because the retailer has not yet identified that Email ID 1 and Email ID 2 belong to the same consumer. If the retailer were to leverage Hashed Email, they would be able to identify that both email addresses used belong to Mary. This association connects her multiple email addresses together, enables her offline purchases to sync with her online activity, and helps to determine the most accurate ROAS. Hashed Email is a cookie-free added view into consumer behavior for control over messaging and for measurement. When leveraging it’s possible to report back across all channels and devices in a universal format to know when and how conversions are taking place. Don't leave valuable data on the table Hashed Email has use cases beyond reducing wasted media impressions. Hashed Email’s full capabilities extend to campaign measurement and attribution modeling. When utilizing The Tapad Graph combined with Hashed Email, know from the first touchpoint to the last where your customers are engaging. But more importantly, know where households and the individuals inside of those households are converting across all of their digital devices, by using traditional digital IDs, cookie-less IDs, and Hashed Email to associate, measure, and correlate online and offline purchases. Imagine what your campaigns could look like this holiday season if you expanded your graph with up to 5 additional IDs per household. This impact could be a game-changer to scale this holiday season. Hashed Email is a reliable cookie-less digital identifier that expands your customer universe that connects online and offline activity while improving the customer experience and reducing wasted media spend. Enabling Hashed Email for the holiday season is not an opportunity that should be passed on. Where do you sign up, you ask? Get started with The Tapad Graph For personalized consultation on the value and benefits of The Tapad Graph for your business, email Sales@tapad.com today!

Identified in The 2021 Digital Advertising Trends Report published by Postclick, marketers are striving to improve and enhance their segmentation and targeting strategies in their digital ad campaigns. Carlos Lopez, SVP of Brand Planning at Digitas Health predicted that in 2021, the challenge will be to overcome the death of third-party cookies and still deliver a personalized advertising experience. It’s fair to say that his prediction will still be impacting marketers past 2021 with the delay of cookie deprecation. These goals along with the constantly changing digital landscape paint a challenging picture for even the most advanced marketers. Marketers can be prepared for the next era of digital marketing by finding the right mix of partners that offer privacy-safe, cookie-free solutions. Smart marketers will employ these solutions and compare these results with data from cookies. The Tapad + Experian Take The Tapad Graph enables brands, agencies, and ad tech platforms to identify and target individuals and households across their digital touchpoints. With this data, they can personalize messages across devices, measure and optimize throughout the customer journey, and then report back on conversions at the individual and household levels. Tapad, now part of Experian, leverages a machine learning algorithm that determines these connections at scale by using probabilistic models with authenticated, privacy-safe, real-time data. There are a myriad of cookieless IDs emerging in the marketplace, and it’s not likely going to be a one size fits all situation. In order to be prepared for the next era of digital marketing, marketers should diversify ID partners and be proactive with testing while the cookie is still around to benchmark against. With Switchboard, a module within The Tapad Graph, we’ve been able to develop connections between traditional digital identifiers (IP Addresses, MAIDs, CTV IDs) and the new wave of cookieless IDs (UID2.0, Panorama ID, ID5 ID) that will be utilized in the future. Here’s an example of what The Tapad Graph and Switchboard looks like at the Household level with various traditional digital identifiers and cookieless IDs. Get started with The Tapad Graph For personalized consultation on the value and benefits of The Tapad Graph for your business, email Sales@tapad.com today!