Innovation

At Experian, we are continually innovating and using technology to find solutions to global issues, modernize the financial services industry and increase financial access for all. Read about our latest innovation news below:

Experian’s culture of innovation continues to be a remarkable differentiator for our people, products and solutions. Our innovation is driven by the confluence of data with creative, critical thinking that enables each worker and the company as a whole to tackle complex problems. Our capability to collect, analyze and employ data lies at the very heart of our business at Experian. We go to extraordinary lengths to ensure that our sources, models, and processes are unimpeachable. Given Experian’s decades-long background in curating massive amounts of data, knowing the proper questions to ask regarding how to collect, analyze, and manage data is vital. Answering those questions lies at the heart of an article that recently appeared in the HBR (Harvard Business Review) Guide to Critical Thinking book to help business leaders navigate their most challenging issues. The article highlights Experian Boost and our work in the cloud as key innovations that help our customers, and poses four critical questions that businesses must ask themselves about their use of data to ensure positive outcomes: 1. How was the data sourced?The quality and care with which data is collected varies widely. Poor-quality data, or data used in the wrong context, can actually be worse than no data at all. Managers shouldn’t just assume their data is accurate and of good quality. Auditing data transactions is becoming as common as auditing financial transactions. 2. How was the data analyzed?Even when data is accurate and well maintained, the quality of analytic models can vary widely. Errors and lapses are relatively common and can lead to serious consequences. At Experian, we constantly scrutinize our models to ensure they achieve their specific objectives and their output reflects the real world. 3. What doesn’t the data tell us?Data models are a lot like humans: they tend to base judgments on the most readily available information — sometimes, the data you don’t have can affect decision making as much as the data you possess. And human designers often pass it on to automated systems. In the article, Experian Boost is cited as an example of adding key data to a credit history to help “thin-file” consumers raise their scores to help qualify them to buy a car, rent an apartment, or get a credit card. 4. How can we gain full advantage from the data? For example, by using it to redesign products, services or business models.Companies have learned how data can help run business more efficiently by automating processes, predicting when machines need maintenance, and improving customer service. Real opportunities come when data enables a company to completely re-imagine its business. We’ve leveraged the cloud to shift from only delivering processed data in credit reports to a service that gives our customers near real-time access to far more granular data. That may seem like a subtle transition, but it’s become one of the fastest-growing parts of Experian’s business. Check out the full article, “Data-Driven Decisions Start with These 4 Questions,” written by Eric Haller, Executive Vice President and General Manager, Identity, Fraud & DataLabs at Experian, and Greg Satell, an international keynote speaker, adviser and bestselling author.

Healthcare providers are struggling to address the high volume of insurance claims denials. It’s one of the top contributors to wasted dollars to the tune of more than $250 billion per year, according to industry reports. A denied claim means healthcare providers, like hospitals, are not getting reimbursed for care, leaving much-needed funds on the table. The cause of a denied claim is often due to incorrect data. The result? An endless cycle of submissions and resubmissions, which not only affects providers’ financial stability, but also puts pressure on the issue of staffing shortages with rounds of rework. You could even argue patients experience pains with this administrative burden, as inefficiencies could result in higher out-of-pocket costs. It’s no surprise that reducing claim denials is at the top of many healthcare leaders’ wish lists. In fact, a recent Experian Health survey among healthcare executives found that 72 percent said reducing denials was their highest priority. Experian Health aims to simplify the administrative aspects of healthcare and we recognize the claims process is currently one of the most challenging for providers. From the perils experienced with manual data entry to payer codes changing frequently to the decentralization of data and lack of staffing, the industry must adopt new ways to tackle the claims denial conundrum. We believe the solution involves tapping into the benefits of using artificial intelligence and are proud to announce the launch of AI Advantage™, an artificial intelligence engine in our #1 KLAS ranked ClaimSource® suite. With two new claim reimbursement products for the pre- and post-submission process, AI Advantage - Predictive Denials™ and AI Advantage - Denial Triage™, these products offer real-time intelligence and predictive modeling to prevent avoidable denials and prioritize re-submissions, leading to greater efficiencies and faster recouped revenue. This is an example of how Experian Health is using AI, analyzing and processing data and information in ways others can’t to solve problems. The next frontier in healthcare is upon us and the industry must embrace the technologies that make administrative processes faster and more efficient to allow providers to be more financially solvent and, most importantly, be in a better position to focus on patient care. For more information about AI Advantage, click here.

Today we released our annual Future of Fraud Forecast to help consumers and businesses stay one step ahead of emerging fraud trends and scams. Here’s what we expect in 2023: Fake texts from the boss: Given the prevalence of remote work, Experian predicts there’ll be a sharp rise in employer text fraud. This occurs when the “boss” texts the employee to buy gift cards using a bogus reason, and then asks the employee to email the gift card numbers and codes. Fraudsters then use the gift cards, leaving the employee and/or the company with the expense.Beware of fake job postings and mule schemes: Amid uncertain economic conditions, Experian predicts fraudsters will create fake remote job postings, specifically designed to lure consumers into applying for the job and providing private details like a social security number and date of birth on a fake employment application. The job never materializes, and the fraudsters use the information provided to commit identity theft. Experian also predicts that consumers could fall prey to mule recruiting schemes. This happens when people sign up for work from home jobs and unintentionally act as a re-shipper of stolen goods or help move money through their personal bank accounts on behalf of fraudsters.Frankenstein shoppers spell trouble for retailers: Synthetic identity fraud is the fastest growing financial crime in the United States, according to The Federal Reserve. This type of fraud involves a fraudster creating a synthetic or “Frankenstein” identity by combining real and false information and opening and building up lines of credit, eventually maxing out their credit limit and never paying it back. Experian predicts a new version of this fraud could result in major losses for retailers in the coming year. Fraudsters can create online shopper profiles using synthetic identities so that the fake shopper’s legitimacy is created to outsmart retailers’ fraud controls. As the shopper’s profile matures, criminals add stolen payment cards to the accounts. When the fraud eventually occurs, a single synthetic identity will have multiple credit lines to burn through across retailers.Social media shopping fraud: Experian predicts in-app social commerce fraud could result in millions of dollars in losses. These apps are designed to make shopping easy, intuitive and compelling for consumers to make purchases without leaving the app. This means legitimate brands are racing to make social commerce a part of their sales strategy. However, social commerce currently has very few identity verification and fraud detection controls in place, making the retailers that sell on these platforms easy targets for a surge in fraudulent purchases.Peer-to-peer payment problems: Consumers love the convenience of peer-to-peer payments and usage continues to grow. Fraudsters also love peer-to-peer payment methods because they’re an instantaneous and irreversible way to move money, enabling fraudsters to get cash with less work and more profit. Experian predicts fraudsters will gain even more unauthorized access to peer-to-peer payments by using multiple social engineering techniques. Consumers will be duped into buying fake items, sending the money to fraudsters and then never receiving their orders. They’ll also be tricked into giving their account credentials, enabling fraudsters to send cash to themselves. Experian is at the forefront of fraud prevention and identity verification. We offer a full suite of automated tools that harness data and analytics to prevent fraud and mitigate losses. Learn more about Experian’s fraud prevention tools here.

When people think about the automotive industry, data probably isn’t the first thing that comes to mind. But make no mistake: data is one of the underlying currents keeping the automotive industry running. Data answers all sorts of questions for OEMs, lenders, dealers, and consumers. And recently, with electric vehicles (EVs) growing in popularity, a new set of questions around battery health has emerged for dealers and consumers alike. Understanding battery health is particularly crucial for dealers when assessing trade-ins, and for dealers or consumers purchasing a used EV. Oftentimes, battery health is a more informative metric than those traditionally looked to assess a vehicle, such as milage, or vehicle age. This information hasn’t been readily available for dealers or consumers, until now. To that end, Experian announced a strategic alliance with Recurrent, the battery range and analytics company, to offer Recurrent’s Battery Report alongside Experian’s AutoCheck® vehicle history report (VHR). The Recurrent Battery Report offers additional data and attributes on an EV’s battery health that no other VHR presently offers, including current and future range estimates, climate impact, remaining battery warranty, and more. Offering the Recurrent Battery Report with an AutoCheck vehicle report will bring a level of assurance dealers have been previously unable to attain when buying or selling used EVs, increasing transparency and easing range anxiety for consumers. Through this alliance, we’re doubling down on our commitment to helping dealers buy and sell used vehicles with confidence, and this commitment extends to used EVs, as well. The data shows that EVs have reached a tipping point, comprising more than 5% of new vehicle registrations in 2022, and growing. Dealers are going to see them come back to the showroom as trade-ins more frequently, and being able to quickly assess them, as well as sell them with transparency will be key to longevity in the market. Experian is on the forefront and has been leading the charge in EV data, leveraging vehicle registration data to help OEMs, lenders and dealers understand where EV market share is growing the fastest, model popularity, and more. Additionally, we have EV audiences, built with our extensive marketing resources, that help dealers find the most interested potential EV buyers. But this is just the beginning. As EVs continue to penetrate the market, Experian is committed to innovating and constantly pursuing new data sources to anticipate market needs and help inform strategic decision-making.

Bloor Research recently named Experian a Champion in the latest Data Quality Market Update 2022. Bloor’s Market Update specifically provides individuals with a technology update and ranking of vendors based on their products and progress in the market. Experian was the only vendor placed in the Champion category. Data quality is the foundation for any data-driven organization. However, many organizations still struggle to achieve the needed quality data necessary to feed critical initiatives. In our most recent research report, we discovered that 85% of businesses believe poor quality contact data for customers negatively impacts their operational processes and efficiency. To solve these challenges, data quality solutions continue to evolve. Leveraging trustworthy data equips organizations with the power to make their data actionable and fit for a purpose. Our research also showed: 89% say that implementing data quality best practices has improved their business agility 87% believe that data quality is fundamental to the core of business operations 91% say investing in data quality has positively impacted business growth In effect, this empowers business leaders to make better and faster decisions when outlining key operational strategies and initiatives. Since three quarters of businesses who have improved their data quality in the last year say they have exceeded their goals in some manner, we find that organizations that emphasize data maturity are more likely to experience success. Experian has a long history in the data quality space, starting with our address validation solutions. However, as data usage has evolved, so have our solutions. We incorporate cutting edge technology paired with an easy-to-use interface that allows individuals at all levels of the business to better understand the quality of their data and improve this important asset. A high degree of automation and precision will be required as businesses tackle today’s challenges related to data quality. At Experian, the overarching goal is to help clients maximize their potential with the power and confidence supplied by superior quality data—the cornerstone of success in today’s digital-forward realm of business operations. Explore our data quality solutions today to find out for yourself what makes us data quality experts. Click here to start your free trial.

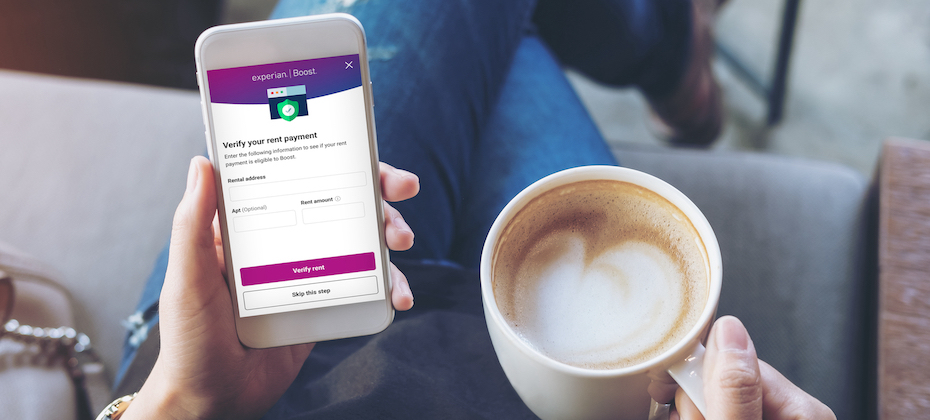

I recently came across a quote that said, “The world you see is created by what you focus on.” As I look back on my last 16 years with Experian, I see a lot of truth in this. While Experian has historically been recognized as a business-to-business organization, over the last several years, we’ve had a transformational shift in focus that’s fundamentally changed our business. This shift has made our world look a lot different than it used to. Today, consumers are at the center of everything we do. They’re the driving force behind our innovation and growth. Every day, millions of consumers come to Experian looking for ways to improve their financial health and we’ve been building one of the largest global member bases. These direct relationships put us in a unique position. We can listen to consumers to hone our focus – and we do. Just like in everyday relationships, listening builds trust and respect. It helps us understand what consumers want and allows us to innovate to meet them where they are on their financial journey. In 2019, we heard consumers’ call for more control of their data and responded with Experian Boost®[1]– a first-of-its-kind feature that allows consumers to contribute information directly to their Experian credit file. To date, we’ve helped 8.6 million consumers instantly improve their FICO® Scores[2] with an average increase of 13 points. Since launch, we’ve continued to listen and enhance the feature to maximize the number of consumers who can benefit. Shortly after we brought Experian Boost to market, we wanted to ensure consumers who paid their monthly telecom and utility bills from their savings or credit cards could benefit alongside those who paid these reoccurring bills through their checking account, and we did. Against the backdrop of the COVID-19 pandemic, at a time when television streaming had skyrocketed, we wanted to ensure consumers who subscribed to video streaming services, including Netflix®, Hulu™, HBO Max™, Disney+™ and others, could use these monthly payments to build their credit histories, and we did. We regularly connect new streaming service partners to Experian Boost. Most recently, consumers who subscribe to Paramount+, Peacock, Showtime® and ESPN+ can also contribute their on-time bill payments directly to their Experian credit file through Experian Boost. Earlier this year we introduced Experian Go™ - a free, first-of-its-kind program to help “credit invisibles,” or people with no credit history, begin building credit. Within minutes, credit invisibles who enroll in the program can have an authenticated Experian credit report, tradelines and a credit history by using Experian Boost and instant access to financial offers through Experian Go. Since launch, more than 84,000 consumers have established an Experian credit report through Experian Go and become visible to potential lenders. As a next step, today we’ve announced a new beta release of Experian Boost that allows consumers to contribute qualifying, “positive” residential rent payments directly to their Experian credit file. This capability makes Experian Boost the only feature that can instantly improve a consumer’s FICO® Score 8through positive rent payments at no cost. This is the next step in our commitment to helping consumers get the credit they deserve. With the beta release, consumers who rent from over 1,500 of some of the largest U.S.-based property management companies, and who pay their rent directly to their property management company or through platforms like AppFolio Property Management, Buildium®, Yardi® Breeze and Zillow® Rental Manager, can add qualifying positive rent payments to their Experian credit file through Experian Boost. Based on preliminary analysis[3] highlighting the potential impact of positive residential rent payment reporting through Experian Boost, we estimate 66% of consumers will see an instant increase to their FICO® Score 8, a FICO® Score 8 improvement of nearly 10 points on average for those who receive a boost and are new to using Experian Boost. And we’re not done yet. To ensure more renters can benefit, we’ll continue to add new property management companies over time. In later phases, we’ll update the feature further to add individual landlords and smaller property management companies over time. I’m proud of what we’ve accomplished so far and, as we look ahead, I’m excited for the ways we can help consumers that are yet to come. With our focus on consumers and our ability to listen and innovate, I believe we’ve just scratched the surface in terms of our capacity to help bring financial power to all. [1] Results will vary. Not all payments are boost-eligible. Some users may not receive an improved score or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost®. Learn more. [2] Credit score calculated based on FICO® Score 8 model. Your lender or insurer may use a different FICO® Score than FICO® Score 8, or another type of credit score altogether. Learn more. [3] Analysis completed using FICO® Score 8 with Experian data. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand. Other product and company names mentioned herein are the property of their respective owners. Licenses and Disclosures.

As any online merchant knows, the past few years have seen a rapid increase in digital transactions but unfortunately, fraudsters have adapted quickly and taken advantage of this. With booming online sales, retailers strive to provide a seamless shopping experience while simultaneously recognizing legitimate customers and keeping an eye out for fraud. It’s a balancing act that becomes more perilous as transaction volumes grow. Perhaps one of the most frustrating challenges for online merchants is false declines. In fact, Aite-Novarica Group’s The E-Commerce Fraud Enigma: The Quest to Maximize Revenue While Minimizing Fraud Report found the average false decline rate is 1.16%. With over $960 billion in U.S. online sales in 2021, lost sales resulting from false declines is substantial, totaling more than $11 billion. False declines occur when a good customer is suspected of fraud and then prevented from completing a purchase. This happens when a company’s fraud prevention solution provides inadequate insight into the identity of the customer, flagging them as a potential bad actor. The result is a missed sale for the business and a frustrating transaction and experience for the customer. Merchants use a variety of tools to prevent fraud while ensuring they minimize friction during the purchase experience, but many legacy fraud solutions fail to provide the confidence needed to sufficiently assess the risk of the identity presented by the customer. As identities become more complex, Experian recognizes that identity is personal. We are committed to creating new and innovative solutions to manage this complexity, and to addressing the constantly evolving opportunities for fraud that come along with it. Our newest offering, Experian Link, is the most recent example. It allows merchants to augment their real-time payment risk decisions with a perspective that links customer identity to the credit card being presented for payment. Aite-Novarica’s report showed that nearly half of the e-commerce merchants surveyed are tolerating fraud rates between 20 and 49 basis points. Experian Link can improve that as it provides a positive match rate of 85% for major credit card brands, and when an identity is verified against a credit card, fraud rates can drop to as low as 10 basis points with no added customer friction. As the digital landscape continues to evolve, online merchants need the right tools to help them meet consumer expectations and support their growth now and in the future. Leveraging a strong identity verification solution like Experian Link in the authorization process will be critical for merchants, providing additional data that paints a more complete picture of their customer and leads to fewer false declines. For more information on how Experian Link helps businesses enhance their identity verification solutions, please visit https://www.experian.com/business/products/experian-link.

Consumers generate hundreds, if not thousands, of digital interactions every day when they do things like shop on the internet, play games, manage their finances or stream entertainment. As businesses look to differentiate their brands and create positive consumer experiences, they need to reconcile these data points. Proper reconciliation of identity leads to insightful data that helps augment the way brands market to consumers, manage risk, and deliver secure, personalized experiences. Fulfilling the promise of identity can be a challenge, though, given the massive volumes of data that these consumer interactions generate, and the need to ensure privacy-compliant use. To help companies meet this challenge, Experian introduced an integrated suite of identity solutions, products and services called Experian Identity. It combines Experian’s sophisticated information technology systems and vast accumulation of consumer data to enable businesses to engage with consumers on a more perceptive, personalized basis. This recent Global News Blog entry addresses this topic well. Experian Identity is an ideal choice for companies that need identity resolution and fraud management solutions to further strengthen their customer relationships. One example of the innovative use of identity data is how it can give people with limited-to-no credit history access to a variety of useful financial instruments. By incorporating expanded data sources that contain identity information, such as rent, utilities, telecom, and video streaming services, as well as buy now, pay later data into credit reports, consumers who are underrepresented in the current credit reporting system can provide a more comprehensive view into their ability and willingness to repay outstanding debt. Lastly, Experian Identity is laser-focused on compliance for consumer consent and control around identity. A recent advertorial in the news outlet AXIOS offers more background on how businesses can use identity data to stay relevant with their target audiences and create a positive and safe consumer experience. Click here to read more. For more information on how Experian Identity helps optimize identity solutions, visit www.experian.com/identity-solutions. To learn how making identities personal builds trust and helps organizations create improved experiences for consumers and businesses, download the Making Identities Personal white paper.

Back in October 2021, we announced our partnership with Code First Girls, who teach women to code for free and develops female talent in tech. We have shared their journey where four female students worked as paid interns with Experian while studying for their Code First Girls’ Nanodegree for the last nine months. My colleagues in the UK will be continuing the partnership with Code First Girls this year. As part of the partnership, Experian will be sponsoring four courses in Python and Data, and our employees are volunteering to co-lead these courses. Experian will also be sponsoring 10 Code First Girls’ Nanodegrees, with the aim of hiring these 10 graduates via our Software Engineering graduate programme in the UK. The four interns who recently completed their internships with us came from diverse backgrounds and introduced fresh perspectives. They've helped to drive our financial inclusion agenda by working on our United for Financial Health programme in South Africa and Italy, amongst other innovative projects. Watch the videos where our interns talked about their internship experience: Nicole Ngina, born, raised and currently in Kenya, and a recent diploma graduate of Strathmore University where she studied Business Information Technology. Betty Abate, originally from Ethiopia but grew up in the UK. Chelsi Goliath, a Computer Science student from South Africa. Kamile Sudziute, originally from Lithuania, but studied in London, where she just graduated from King’s College London with a degree in Philosophy, Politics and Economics. We are committed to developing women in tech and I’m pleased to welcome more talented young women to start their careers in tech with us. This year’s extension of our partnership with Code First Girls enables us to create a better tomorrow for more women to kickstart their careers in tech. Stay tuned for more updates on our journey with Code First Girls by following us on Facebook, Instagram, LinkedIn and Twitter.