sdfsad sddfs sdfsdf sdsf sd sfsdfsdf s

asdf sa dsdfdsf ds dsf sdfsdf sdfsd sdf

In this article…

Millions of Americans face economic hardships today due to the financial crisis. The Great Recession made a big impact on the financial lives of consumers. Unemployment was high and many struggled to make ends meet, forcing them to tap into their savings and live off credit to survive. Now that our economy is recovering, we believe that education is the key for consumers to unlock the door that leads to financial success and opportunity.

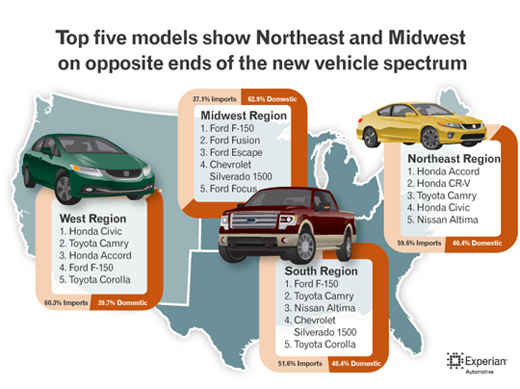

Grab a pen and paper. Jot down some differences between the Northeast and Midwest. What came to mind? Maybe it was the bright city lights of the Northeast versus the Midwest’s starlit farms? Or maybe it’s the city’s busy streets compared to quiet open fields? What you may or may not have written down is that Northeasterners prefer to drive more import vehicles than the folks in the Midwest.

According to Experian Automotive’s mid-year review of automotive market trends, in the first half of 2013, the top five new vehicle models in the Northeast region were all import brands. Conversely, as one might have guessed, American-made vehicles dominated the Midwestern roads. In the Northeast, the list was made up of the Honda Accord, Honda CR-V, Toyota Camry, Honda Civic and Nissan Altima. Out in the Midwest, Ford vehicles made up four of the top five and the Chevrolet Silverado 1500 filled out the list. The top five in order included the F-150, Fusion, Escape, Silverado 1500 and the Focus.

Grab a pen and paper. Jot down some differences between the Northeast and Midwest. What came to mind? Maybe it was the bright city lights of the Northeast versus the Midwest’s starlit farms? Or maybe it’s the city’s busy streets compared to quiet open fields? What you may or may not have written down is that Northeasterners prefer to drive more import vehicles than the folks in the Midwest.

According to Experian Automotive’s mid-year review of automotive market trends, in the first half of 2013, the top five new vehicle models in the Northeast region were all import brands. Conversely, as one might have guessed, American-made vehicles dominated the Midwestern roads. In the Northeast, the list was made up of the Honda Accord, Honda CR-V, Toyota Camry, Honda Civic and Nissan Altima. Out in the Midwest, Ford vehicles made up four of the top five and the Chevrolet Silverado 1500 filled out the list. The top five in order included the F-150, Fusion, Escape, Silverado 1500 and the Focus.

In the personal finance world, credit is one of the hottest topics to talk about and there are many resources available to consumers.

To further empower consumers to take a more active role in managing their credit, Experian provides a number of solid consumer education programs.

As a positive extension to those, in 2011 we developed Experian Credit Educator, a consumer-education service that offers personalized, live, one-on-one, telephone-based credit education sessions to consumers and customers of Experian’s clients.

Experian recently announced that we’ve added new features to this service in order to give consumers insights into specific actions which may produce an improvement to their credit score.

In the personal finance world, credit is one of the hottest topics to talk about and there are many resources available to consumers.

To further empower consumers to take a more active role in managing their credit, Experian provides a number of solid consumer education programs.

As a positive extension to those, in 2011 we developed Experian Credit Educator, a consumer-education service that offers personalized, live, one-on-one, telephone-based credit education sessions to consumers and customers of Experian’s clients.

Experian recently announced that we’ve added new features to this service in order to give consumers insights into specific actions which may produce an improvement to their credit score.

Today I’ve been reading sensational and very misleading headlines saying things like “Experian Sold Consumer Data to ID Theft Service” and “Experian Duped into Selling Social Security Nos.”

Let me share with you the actual – and factual – events that led to the investigation and subsequent arrest of the suspect in the case surrounding Court Ventures and US Info Search.

The suspect in this case obtained access to US Info Search data through Court Ventures prior to the time Experian acquired the company.

To be clear, no Experian database was accessed.

Today I’ve been reading sensational and very misleading headlines saying things like “Experian Sold Consumer Data to ID Theft Service” and “Experian Duped into Selling Social Security Nos.”

Let me share with you the actual – and factual – events that led to the investigation and subsequent arrest of the suspect in the case surrounding Court Ventures and US Info Search.

The suspect in this case obtained access to US Info Search data through Court Ventures prior to the time Experian acquired the company.

To be clear, no Experian database was accessed.

![]()

This guest post is from Rod Ebrahimi, CEO of ReadyForZero

At ReadyForZero, our focus has always been on helping people pay off debt and take control of their finances so they can begin building wealth. It’s a mission that has inspired us since our very first user. We started out very small, when I helped my girlfriend make a spreadsheet to organize her student loans. After that, my co-founder Ignacio Thayer and I realized that many of our friends and loved ones had debt. We decided it was our challenge to create a tool that would help them. Focusing on this mission has helped us create the best debt management tool in the industry. Our users are regular people all across the U.S. who are tired of being burdened by their debt and ready to become debt free.

Underscoring Experian’s goal to help consumers and be an advocate for credit education, the National Foundation for Credit Counseling (NFCC) last week awarded Victor Nichols, CEO of Experian North America its “Making the Difference” award from at their Annual Leaders Conference in Denver.

This prestigious award is presented to organizations that have made significant contributions to assisting consumers with financial literacy, awareness and education, furthering the NFCC’s mission, visions and programs through a national presence.

Mr. Nichols attended the conference to accept the award and to speak to the attendees about Experian’s vision and commitment to financial literacy and consumer empowerment.

Underscoring Experian’s goal to help consumers and be an advocate for credit education, the National Foundation for Credit Counseling (NFCC) last week awarded Victor Nichols, CEO of Experian North America its “Making the Difference” award from at their Annual Leaders Conference in Denver.

This prestigious award is presented to organizations that have made significant contributions to assisting consumers with financial literacy, awareness and education, furthering the NFCC’s mission, visions and programs through a national presence.

Mr. Nichols attended the conference to accept the award and to speak to the attendees about Experian’s vision and commitment to financial literacy and consumer empowerment.

test