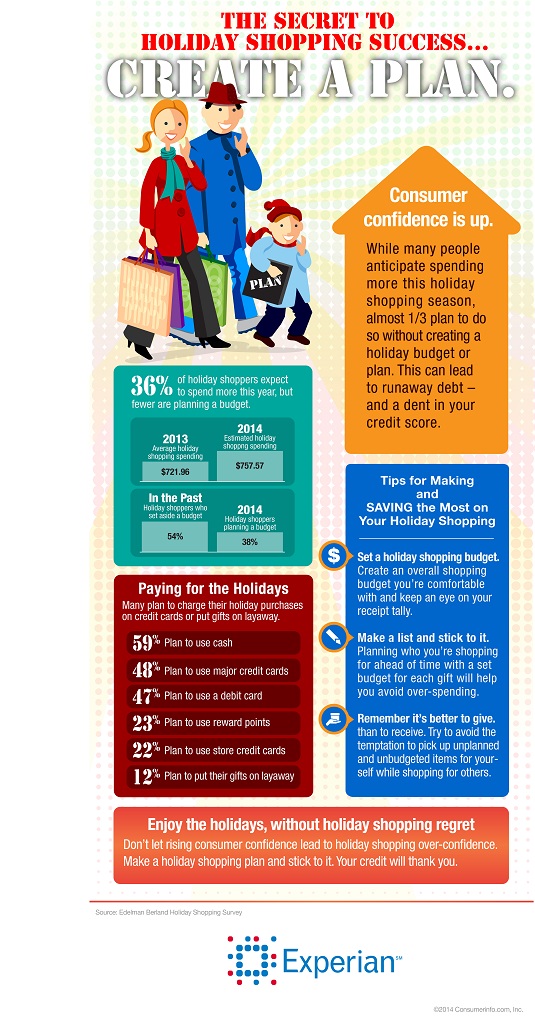

According to a new survey from Experian Consumer Services, consumers are anticipating spending more on gifts this holiday season than they did in 2013. However, only 38 percent of those surveyed plan to set aside a budget for holiday shopping, compared with 54 percent in past surveys.

Lack of budgeting can lead to debt and overzealous spending, as many in the survey plan to charge their holiday purchases on major credit cards (48 percent) or store credit cards (22 percent) while a small percentage will use layaway plans to purchase gifts (12 percent). Lenders can help educate consumers on the impact of debt by providing credit education services or offering credit scores with monthly statements.