As we head into the holiday season, one of the many capabilities Experian Hitwise has is the ability to segment web-users that performed a Black Friday-related search (e.g. ‘Walmart Black Friday,’ ‘Black Friday sales,’ ‘ad for black Friday’) OR visited a Black Friday website (e.g., blackfridayads.com, Bfads.com). We analyzed data for Black Friday shoppers between October 1, 2011 and January 7, 2012 and here’s what we learned about those shoppers as compared to the overall online population.

Younger, middle income group and less credit-worthy

This group is evenly split by gender, which is similar to the online population. Their age skewed younger, with 18-34 year-olds making up the largest share of visits and the greatest difference versus the online population. This audience also skewed younger when compared to the visitors to the Retail 500 during this time.

Source: Experian Hitwise

Source: Experian Hitwise

Demographic summary Black Friday shoppers for the week ending November 26, 2011

In terms of income, the highest concentration of Black Friday shoppers was in the $30-$99k income range, and they over indexed versus the online population in terms of visits from the $60-99k income bracket. This skews less affluent when compared with the Retail 500, which over indexes on visits from those with household incomes of $100k+.

With regard to Vantage Score, the concentration is fairly evenly distributed amongst those with scores of B, C, D and F, while the smallest share comes from A, the most credit worthy group. Black Friday shoppers over-indexed slightly in visits from the least credit worthy groups versus the online population. This is also in contrast to Retail 500 shoppers – 44% of them are in the A or B Vantage Score range while just 35% of Black Friday 2011 shoppers fell within those groups.

Concentrated in large DMA markets and Midwest

Source: Experian Hitwise

Demographic summary Black Friday shoppers for the week ending November 26, 2011

Geographically, the highest concentration of visits comes from large DMA markets and states – CA, NY, TX and IL. Among the top 10 states by visits share, those with the highest index versus the online population were from Ohio and North Carolina. Overall the highest index of Black Friday shoppers was from Kentucky and West Virginia.

Lifestyle segmentation of Black Friday shoppers

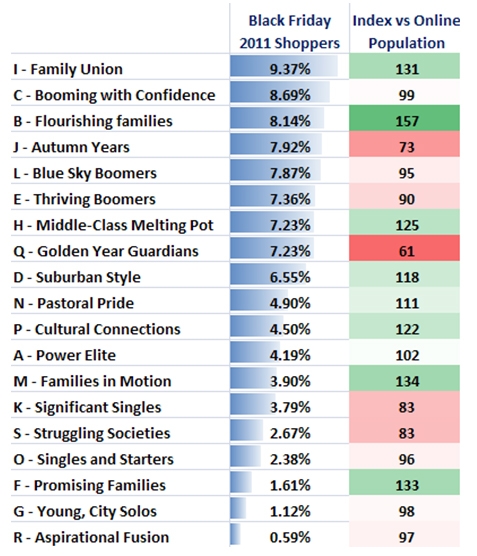

To learn a little more we’ve looked at the Mosaic® USA groups of Black Friday shoppers the week of Thanksgiving and Black Friday, along with the index for each group against the online population.

Source: Experian Hitwise

Demographic summary Black Friday shoppers for the week ending November 26, 2011

The Family Union group accounts for just over 9% of the Black Friday 2011 shopper segment and over-indexes against the online population – the segment is 31% more likely than the online population to fall within this Mosaic group. Family Union is described as mid-scale, middle-aged and somewhat ethnically diverse families who work in blue collar occupations. This group is value conscious and financially cautious.

We also see Group B – Flourishing Families – at the top of the list with the highest index versus the online population. These folks are more affluent than their Family Union counterparts, although they are similarly middle-aged. While this group is brand aware and financially secure, they too are deal seekers when it comes to holiday shopping.

Watch our recent webcast with Black Friday and Cyber Monday insights as our experts shared traffic drivers, search trends and critical insights that will improve your ability to target and engage high value consumer segments. Learn more about what, how and when consumers search and buy online during the holiday season.