Today, Experian is excited to introduce our Offline Graph as a standalone product that clients can license, marking a significant step in our commitment to powering data-driven advertising through connectivity. Offline Graph empowers advertisers and advertising technology companies to build and refine consumer profiles, contributing to data connectivity, more offline audience reach, and improved offline measurement accuracy.

As a result of consumers engaging with content across more channels, there are more disparate data points than ever before. When you couple that with ongoing signal loss, the need for a unified identity solution has never been greater.

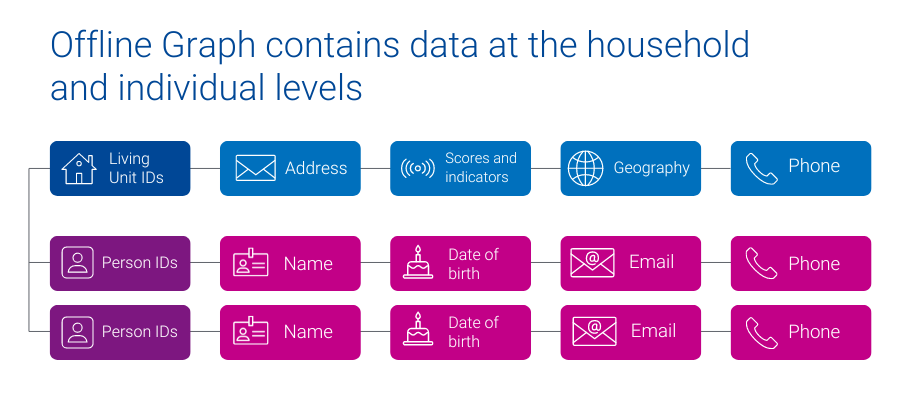

Experian’s Offline Graph offers companies a license of stable offline data points, like name, address, phone number, email, geographic information, date of birth, and additional attributes that provide a complete view of household and individual identities. The Offline Graph integrates known offline identity information from reliable deterministic sources like property ownership records, public records, and marketing data to provide access to all United States consumers and households.

How customers can use the Offline Graph

- A big box retailer fills in the blanks of their existing customer data and builds a database of prospects.

- A media platform more effectively onboards advertisers’ segments, enabling advertisers to reach more of their customers.

- A retail brand better understands their customer’s demographic and behavioral make-up, by licensing Offline Graph with Marketing Attributes.

- A connected TV (CTV) manufacturer increases audience reach and accurately quantifies the campaign impact for their advertising partners.

Experian’s Offline Graph is already driving value across industries. Here’s some in-depth client success stories:

Fusion92 licenses Offline Graph to help their clients transform their marketing

Fusion92 is a marketing partner that fuels business transformation in today’s digital economy and delivers exponential returns for brands.

Fusion92 licenses Experian’s Offline Graph to power their strategy: from research and discovery to audience creation, activation, and measurement. With access to our Offline Graph, Fusion92 ensures their clients get the insights, targeting, reach, and measurement they need to achieve their business goals.

“At Fusion92, we are always pushing the envelope to develop solutions that lead to success for our clients. Our desire to innovate pushed us to find an industry-leading partner in data and identity. This led to us licensing Experian’s Offline Graph product, which we use to build more complete audience profiles for our clients. In doing so, we help brands target, activate, and measure their marketing campaigns more effectively, leading to superior results.”

dave nugent, executive vice president of data and analytics, fusion92

Using Offline Graph to deliver relevant messaging to multiple audience cohorts

A leading direct-to-consumer (DTC) company with strong customer relationships built a robust first-party data set, enabling effective customer retention. To attract new customers, they partnered with Experian to access offline identity data from Experian’s Offline Graph. The Offline Graph provides them with the data needed to validate their first-party data and with the keys to unlock new customers.

With this data, the DTC company delivered the right message to both sets of consumers: existing customers and new prospects. By integrating Experian’s Offline Graph they broadened their reach, personalized their messaging, and improved their marketing.

What sets Experian’s Offline Graph apart from the competition

- Stability of data: With data from deterministic sources, our Offline Graph ensures that your view of consumers – and your ability to connect with them – is stable over time.

- Connected digital and offline data: Seamlessly connect offline data with digital identifiers through our Digital Graph, enabling a holistic approach to marketing, while ensuring consumer privacy is prioritized.

- Tailor made for your use cases: Build the Offline Graph to fit your specific needs, selecting the exact offline identity information required for your campaigns.

- Expanded consumer insights: Connect more data points to enrich your understanding of consumer demographics and behavior, using Experian’s Marketing Attributes and Audiences data.

Offline Graph: Your gateway to consumer connectivity

As signals fade, there is a large emphasis on procuring and having accurate consumer data. Experian’s Offline Graph delivers the connectivity and insights necessary to stay ahead. Whether you aim to strengthen your existing data or access entirely new data sets, Experian’s Offline Graph offers a solution tailored to your needs. Transform your data strategy with Experian’s Offline Graph — your gateway to a unified consumer identity solution.

Latest posts

With Tapad, part of Experian, technology, AdsWizz AudioMatic is the first Audio buying platform to offer cross-device identity resolution across the U.S. and EMEA NEW YORK and LONDON, July 17, 2019 /PRNewswire/ — Tapad, part of Experian and a global leader in digital identity resolution, today announced a new joint capability with AdsWizz , the leading technology provider for digital audio advertising solutions. The partnership combines Tapad's digital cross-device technology with AdsWizz's AudioMatic buying platform, enabling the ability to connect audio ad experiences across screens. AudioMatic, AdsWizz's audio-centric buying platform, supports programmatic audio buying and entirely new audio ad experiences for listeners. The integration of The Tapad Graph onto its platform enables new opportunities for marketers to reach, engage and measure each interaction with their desired consumers on digital radio and podcasts channels, and across devices. This partnership makes AdsWizz the first audio buying platform to offer this enhanced cross-device identity capability in the US and EMEA markets. "Marketers need privacy-safe digital identity resolution to reach their consumers," says Tom Rolph, VP of EMEA at Tapad. "With audio becoming an increasingly powerful medium for engagement, it's important that our technology extends to this channel, which is why we are excited to announce our integration with AdsWizz's AudioMatic platform." Digital audio is experiencing high growth, with 84% of advertisers and agencies saying it will play a bigger role in their media plans in the future. Today, 60% of digital audio is consumed via a mobile device.* The Tapad Graph is the largest digital identity resolution graph with differentiated global scale. The partnership enables audio advertisers to leverage The Tapad Graph for enhanced attribution, analytics, and targeting. Alexis van der Wyer, CEO at AdsWizz, added, "Digital audio is increasingly becoming ubiquitous in our media consumption and in our daily digital interactions, and because of that, audio advertising offers tremendous opportunity to personally interact with consumers in every moment of their daily lives. By integrating with Tapad, we enable our advertising partners to increase the effectiveness and the relevance of their marketing messages across audio channels." To learn more about Tapad and our digital identity resolution products, visit our identity solutions page. *Digital Audio Exchange, "The Rise of Digital Audio Advertising," https://thisisdax.com/wp-content/uploads/2019/07/DAX-Whitepaper.pdf Contact us today! About Tapad Tapad, Inc. is a global leader in digital identity resolution. The Tapad Graph, and its related solutions, provide a transparent, privacy-safe approach connecting brands to consumers through their devices globally. Our one-of-a-kind Graph Select offering enables marketers the flexibility and freedom of choice to correlate devices to varied objectives, driving campaign effectiveness and business results. Tapad is recognized across the industry for its product innovation, workplace culture and talent, and has earned numerous awards including One World Identity's 2019 Top 100 Influencers in Identity Award. Headquartered in New York, Tapad also has offices in Chicago, London, Oslo, Singapore and Tokyo. About AdsWizz: AdsWizz has created the end-to-end technology platform that is powering the digital audio advertising ecosystem. AdsWizz powers well-known music platforms, podcasts and broadcasting groups worldwide with a comprehensive digital audio software suite of solutions that connect audio publishers to the advertising community. From dynamic ad insertion to advanced programmatic platforms to innovative new audio formats, AdsWizz efficiently connects buyers and sellers in digital audio. AdsWizz is headquartered in San Mateo, California, with an IT Development hub in Bucharest, Romania, and presence in 39 markets around the world. About AudioMatic: AdsWizz Demand Side, audio-centric DSP and audio buying platform, AudioMatic, enables programmatic audio buying and entirely new audio ad experiences that are proven to be more engaging and more effective, and have delivered measurable results for agencies and their brands all over the world. All the biggest ad agencies have used our programmatic trading platform, including Omnicom, GroupM, Havas, Publicis, Mobext, and more.

To set your brand apart from the competition (and thrive!), you need to get to know and communicate with your customers on a more personal level—this means knowing more than just their email or mailing address. It means building a relationship with them to turn them into loyal customers who keep coming back. To make this happen, retail marketers must engage with customers across all verticals and invest in true data-driven advertising. Consider the following: What do my customers do? If you know more about your customers’ lifestyles, interests and spending habits, you will have a better understanding of how they choose to spend their money and free time. Once you understand your core customer base, you can move on to how and when you should reach them. This starts with segmenting your customers and then reaching them across their preferred channels. You should then learn what motivates your customers in order to understand their buying behavior. Do they buy items spontaneously or do they spend a lot of time researching? Do they only buy things with a coupon or is free shipping more important? Lastly, determine what marketing is showing ROI so you can optimize your marketing campaign. To ensure your efforts are showing results and your marketing budget is getting the most bang for the buck, attribution is critical. Retailers should strive to get more value out of existing data, supplement it with third-party sources, and find better ways to manage it and extract valuable insights. Experian’s Customer Data Engine is the perfect solution to assist retailers with this challenge. This customer data platform helps provide you with a complete picture of online and offline customer engagement and delivers the data, tools, and insights needed to make decisions on reaching customers and lookalike prospects. Customer Data Engine is a centralized platform where first- and third-party data is managed and updated on an ongoing basis in a secure environment, providing retail marketers with analytical tools, lookalike prospects, campaign management, audience distribution and closed-loop measurement. Once retail marketers have a deeper understanding of what they need to know about their customers, they can create customized audiences using this data. Retailers value first-party data and often look at it first. Usually, this refers to online data about customer activity on a website or app, and can come from form and email submissions, views of merchandise or devices and things people searched for online. Although first-party data is gold, there is almost always additional information needed to fill in gaps. For instance, the need for recency, frequency and monetary (RFM) data is crucial. RFM data is a way for retailers to analyze their customers by using recency (how recent the customer made a purchase), frequency (how often a customer makes a purchase) and monetary data (how much money a customer spends on purchases). It gives the retailer the details of when the last time the customer made a purchase, how often does the customer make a purchase and how much did the customer spend. With this information, they will know who their most valuable customers are and be able to create customized audiences. To get a deeper understanding of your customers, solutions such as Experian’s ConsumerViewSM database can be leveraged to provide you with demographics, life event triggers, purchase data, lifestyle segmentation data and more. With thousands of data attributes available, it can take any business to the next level. According to global research firm, Coresight Research, retailers in the United States have announced 5,994 store closures in just the first 15 weeks of 2019. Changing consumer demands, and a volatile economy have made it difficult for retailers to keep pace. However, retail is not going to go away, and brands just need to be smarter about how they conduct business. Making sure you know and understand your customers is one of the ways to ensure repeat visits and set yourself apart from the competition. By enriching your data with 3rd party data from Experian, Customer Data Engine allows you to know and target your customer the same way that Direct to Consumer brands and retailers can and provides you with a full 360-degree view on what your customers are doing and how they are interacting with your brand. To learn more about Experian’s Customer Data Engine, contact us at (877) 902-4849 or experianmarketingsolutions@experian.com to learn more.

For decades, financial institutions relied on direct mail marketing and mass media for credit card offers and invitations to apply (ITA) for loans. Today however, credit marketing is going digital. In fact, according to Statista, financial services ranks 3rd in total digital ad spend this year. Lenders need to deliver relevant credit offers to consumers in the spaces and platforms where they interact. Below are three best practices to help financial services marketers make the most of their digital budgets and strategies. 1. Test new acquisition channels Consumers are no longer just in one place. They are constantly moving around and business strategies need to encompass that. Today’s consumers have multiple devices – a mobile phone, a TV, a laptop, a smartwatch, etc. and each of these devices uses a different tactic to attract consumers. Marketers need to reach their audience across all the channels with which they are engaging. To maximize performance and profitability, lenders need to leverage multiple channels to target and re-target their intended audience. They need to expand the reach of tailored prescreen ad campaigns by adding email, digital display ads, or other online channels to the traditional direct mail channel. This will help increase response rates, decrease length of time to conversation, and provide insight on consumer behaviors and preferences that cannot be achieved with a direct mail offer alone. 2. Target an audience that is right for you. Through a streamlined credit criteria selection process, and Experian’s expertise in audience creation, you now have the power to target the best consumers for your business needs in a fully customized approach. Financial services marketers should isolate appropriate populations – enabling you to make unique offers for different consumer segments and target them in the channels they leverage. In addition, you need to ensure your data is accurate and compliant. Fresh, accurate data enables you to pre-select the best prospects for your business need—right when they are most motivated to respond—and avoid making preapproved offers to nonqualified consumers. Also critical is that while we are able to use regulated data sets to reach consumers, we need to do so with extra caution while meeting FCRA guidelines. It is imperative to honor consumer opt-outs across all channels and ensure you have audit rights with media publishers. The Experian Ascend Technology Platform gives financial institutions the power to integrate client data, industry-specific data feeds and the power of Experian’s unique capabilities in data, analytics, machine learning and advanced AI to deliver enhanced opportunities throughout the customer lifecycle, including lending offers to acquire new customers and cross-sell to existing ones. 3. Test and adjust your campaigns Before the world of digital, it was difficult for financial institutions to track campaign impact on audiences. By employing online promotions, lenders can see how much interaction consumers are having with their promotional media. Financial services marketers should take processes and campaigns that have worked in the past and perform small, iterative tests using different channels. We believe that by adding a digital touch to a client's direct mail prescreen campaign, there is the potential to experience a lift above direct mail response rates; decreased length of time to conversion, and we can provide insight on consumer behaviors and preferences that cannot be achieved with a direct mail offer alone. It is important to test and optimize accordingly. Experian is also at the forefront of the digital credit revolution with Amplified Prospecting™. Experian’s Amplified Prospecting empowers lenders to deliver relevant firm offers of credit to prescreened consumers via multiple digital channels, including email, online display advertising and social media. Simply put, it allows you to timely engage the most desirable consumers where they’re increasingly consuming information and media today – improving your response rates and return on marketing investment. Experian is a leader in the credit revolution, offering more ways for consumers to secure credit including the industry-first Text for Credit™, which allows users to initiate and complete the credit application process within minutes with a simple text message. In addition, Experian recently introduced Experian Boost, a revolutionary new online tool that can instantly improve your credit scores and help the 100 million Americans that don't have access to credit today, either because their credit scores are too low, or because they don't have enough credit history. With faster, more efficient data integration and processing you can more accurately target leads, achieve better response rates, and optimize your marketing spend. To learn more about Experian’s Financial Services solutions, contact us at (877) 902-4849 or experianmarketingsolutions@experian.com to learn more!