In today’s consumer lending environment, financial services institutions are seeing increasingly intense competition during a favorable economic climate. For example, it is common for many lenders to have similar credit approval criteria such that the same consumer may receive multiple pre-approved solicitations for credit from different lenders. Mintel Comperemedia estimated that 391 million direct mail pieces soliciting a credit card were sent to US consumers in November 2018, an increase of over 32% from June of that year. However, during that same period, credit card applications declined 21% (Streeter, 2019). With this increasingly competitive environment, it is critical that financial institutions find ways to reach an emerging group of consumers that have a need for access to credit, but do not have established credit history and are not typically found using standard prescreen criteria.

In today’s consumer lending environment, financial services institutions are seeing increasingly intense competition during a favorable economic climate. For example, it is common for many lenders to have similar credit approval criteria such that the same consumer may receive multiple pre-approved solicitations for credit from different lenders. Mintel Comperemedia estimated that 391 million direct mail pieces soliciting a credit card were sent to US consumers in November 2018, an increase of over 32% from June of that year. However, during that same period, credit card applications declined 21% (Streeter, 2019). With this increasingly competitive environment, it is critical that financial institutions find ways to reach an emerging group of consumers that have a need for access to credit, but do not have established credit history and are not typically found using standard prescreen criteria.

In an Invitation to Apply (or “ITA”) campaign, consumers are targeted using relevant selection techniques and sent a communication encouraging them to apply for a specific lending product. There is no obligation for the institution to extend credit; the consumer completes a credit application, and the financial institution reviews the credit of the consumer to determine whether they meet the lender’s threshold for approval.

The benefit of reaching these emerging consumers is significant, as the lender can establish a new consumer relationship, generate new sources of fee income, grow balances and extend other lending products as the consumer moves through different life stages.

There are several challenges for a financial institution to succeed in this space:

- Leveraging data to identify a targeted audience. In a heavily regulated environment, identifying data elements and attributes that are both compliant and predictive can be difficult.

- Achieving approval rates to justify marketing costs. In the ITA environment, response rates may be higher than similar prescreen campaigns because the communication is reaching a consumer not actively pursued through prescreen campaigns but could be offset by a lower approval rate since the consumer may not meet the campaign’s criteria.

- Choosing the right marketing channel. In the past, financial institutions relied heavily on direct mail marketing, where the individual receiving the communication has a high likelihood of reaching the specific individual. However, in a multi-channel world where consumers increasingly prefer online or digital communication, communicating effectively to the right consumer through the preferred channel at the right time requires profiling with unique data sources.

Experian has helped lenders overcome these many challenges. Through our deep industry expertise, rigorous analytical process, advanced model development techniques, and unique data assets, we have helped industry-leading brands achieve successful ITA campaigns by focusing on these areas throughout the end-to-end engagement process.

Develop two-stage predictive models to predict response and approval.

Ultimately, lenders are trying to attract new applicants that have the likelihood of being approved. Look-alike models have historically been developed by taking a sample of current customers and using statistical modeling to identify a set of prospects that look like those consumers. However, this may skew the audiences towards a set of consumers that have previously been selected and reached by many lenders. Developing a look-alike model that identifies individuals to respond to an application may generate a target audience more likely to apply, but not necessarily be approved. Experian recommends using a two-stage model, where we develop a consumer’s propensity to respond, and their propensity to be approved given a response. Then, both models are used together to identify those consumers more likely to respond AND be approved.

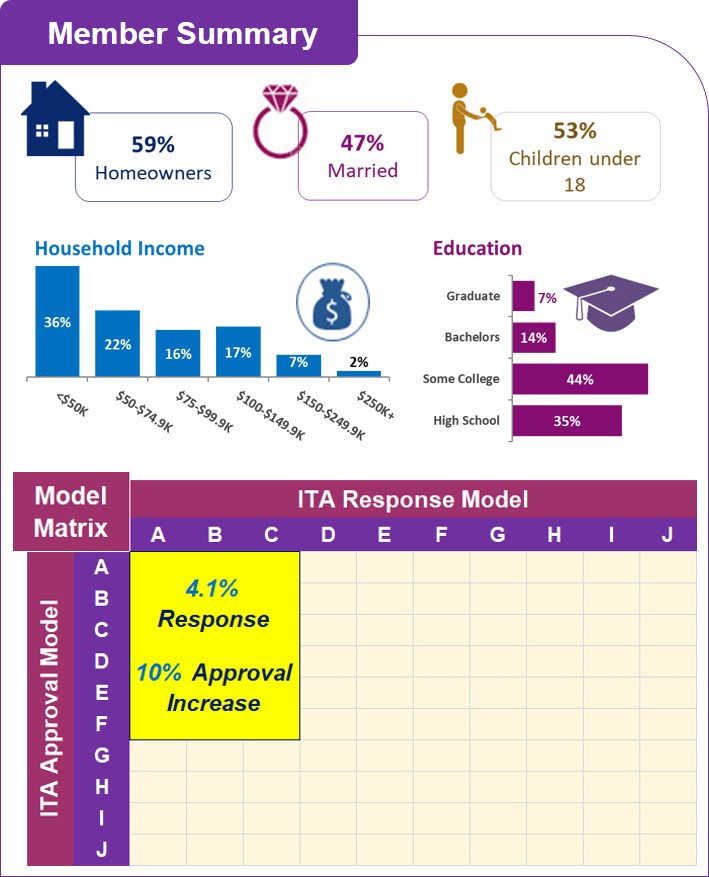

The figure at the right shows how Experian applies these models. In this example, response model tiers A-C, and approval model tiers A-F were used to create the target audience for the ITA campaign and generated higher response and a 10% increase in approval rate for the campaign.

The figure at the right shows how Experian applies these models. In this example, response model tiers A-C, and approval model tiers A-F were used to create the target audience for the ITA campaign and generated higher response and a 10% increase in approval rate for the campaign.

Reach your consumer with the most effective communication.

In the current multi-channel marketing environment, consumers have definite preferences on how they obtain information and their decision-making styles. Financial Services consumers are no different. During 2018, 50% of all credit card solicitations were made digitally, and 73% of applications were received digitally (Streeter, 2019). Knowing the preferred media channel for engagement, and the decision-making styles of your ideal consumers, can greatly improve your marketing effectiveness.

Experian profiles your target consumers using TrueTouchSM to determine the following:

- Consumer engagement channels. TrueTouchSM Engagement Channels attribute your audience’s preferred communication channels (e.g., direct mail, email, mobile display, etc.) to help build a cross-channel strategy and improve advertising placement. This helps you reach consumers in channels where they are personally more receptive to learn about brands, to build brand reputation and foster and customer relationships.

- Consumer decision making styles. TrueTouchSM Decision Making Styles are 10 unique personas with different communication references that help identify the optimal motivational messaging style for your audience. This informs and validates your message development to make highly personalized offers that stimulate interest in your products and services and deliver profitable responses.

ITA campaigns can successfully enable portfolio growth from emerging consumers through proactive and strategic targeting, but only if it overcomes some of the challenges unique to this space. By employing processes as we have outlined, you’ll know what data assets are used for identifying consumers, and you can use data and predictive modeling techniques to create a targeted audience that is optimized both on likelihood to respond and likelihood to be approved, to satisfy your cost per enrollment criteria. Finally, you can determine what engagement channel and decision-making style your targeted consumers prefer so that you can communicate the right offer to the right consumer in the right media channel.

Source: https://thefinancialbrand.com/80322/credit-card-marketing-trends/