All posts by Kelly Ward

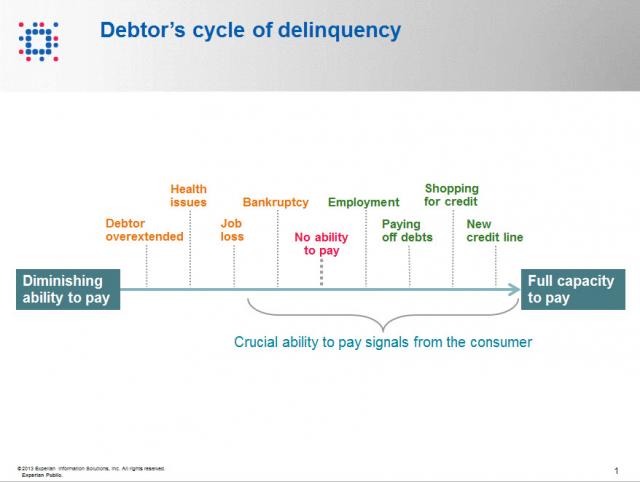

Contact information such as phone numbers and addresses are fundamental to being able to reach a debtor, but knowing when to reach out to the debtor is also a crucial factor impacting success or failure in getting payment. As referenced in the chart below, when a consumer enters the debtor life cycle, they often avoid talking with you about the debt because they do not have the ability to pay. When the debtor begins to recover financially, you want to be sure you are among the first to reach out to them so you can be the first to be paid. According to Don Taylor, President of Automated Collection Services, they have seen a lift of more than 12% of consumers with trigger hits entering repayment, and this on an aged portfolio that has already been actively worked by debt collection staff. Monitoring for a few key changes on the credit profiles of debtors provides the passive monitoring that is needed to tell you the optimal time to reach back to the consumer for payment. Experian compiled several recent collection studies and found that a debtor paying off an account that was previously past due provided a 710% increase in the average payment. Positive improvement on a consumers’ credit profile is one of those vital indicators that the consumer is beginning to recover financially and could have the will—and ability—to pay bad debts. The collection industry is not like the big warehouse stores—quantity and value do not always work hand in hand for the debt collection industry. Targeting the high value credit events that are proven to increase collection amounts is the key to value, and Experian has the expertise, analytics and data to help you collect in the most effective manner. Be sure to check out our other debt collection blog posts to learn how to recover debt more quickly and efficiently.

What does the mortgage interest rate, currently at an all time low of 3.55% (for 30 yr. fixed), mean for financial institutions? According to the latest Experian-Oliver Wyman Market Intelligence Report, 75% of the mortgage originations are refinancing vs. purchasing loans. As mortgage rates decrease, financial institutions face losing mortgage loans to other lenders in the refinance climate. Consumers are looking to save money and mortgage payments are generally the largest monthly expense. Economic indicators, such as decreasing credit card and mortgage delinquency rates, reveal that consumers are more watchful of their spending and more closely managing their debt. Overall consumer debt has come down 11% from the peak in 2008, with a majority coming from the lowest VantageScore® model credit populations. Consumer confidence continues to drop, indicating consumer pessimism due to increasing gas prices and declining job growth. Given the mixed trends in the economic landscape, we can conclude that some consumers are still doubtful on economic recovery and will seek ways to save more and pay down their debt. Consumers with existing mortgages will most likely take advantage of the lower mortgage rates and refinance. So how can financial institutions help prevent attrition? With the current economic situation, managing retention efforts on a daily basis is imperative to retaining consumers. By monitoring their portfolio and receiving information daily, financial institutions are quickly informed if an existing mortgage client is shopping for a new mortgage with another lender, enabling them to act swiftly to retain the business. Information obtained from daily monitoring of accounts helps financial institutions speak with customers more intelligently about their needs. Because of this competitive environment, and often irrelevance of brand loyalty, financial institutions need to build relationships and increase customer loyalty by quickly meeting the financial needs of their most profitable customers. To demonstrate how taking daily actions can help boost loyalty, reduce attrition, and increase profitability, the Technology Credit Union recently revealed how they obtained a 788% ROI. Access the case study here. What efforts has your institution taken to reduce attrition over the past year? VantageScore is a registered trademark of VantageScore Solutions, LLC.