At Experian, one of our priorities is consumer credit and finance education. This post may contain links and references to one or more of our partners, but we provide an objective view to help you make the best decisions. For more information, see our Editorial Policy.

In this article:

American Express recently launched "Pay It Plan It," a new feature that makes it easier to pay off your credit card purchases via your smartphone. The tool lets users pay off smaller purchases immediately and, for a small fee, break up larger purchases into installments you can pay off over time. If you're likely to carry a balance, this process could save you money instead of paying interest. Terms apply.

How "Pay It Plan It" Works

Here's how to use the "Pay It Plan It" feature: Start by downloading the Amex mobile app and logging into your account. There, you'll see your credit card indicating your total balance. Below that, you will find a list of purchases you've made.

Purchases under $100 will feature an icon reading Pay ItSM, while purchases over $100 will feature an icon reading Plan ItSM. (There are some purchases that won't have either icon—a few types of transactions are not eligible for this feature, such as fees charged by AmEx, purchases that incurred foreign transaction fees, or cash advances.)

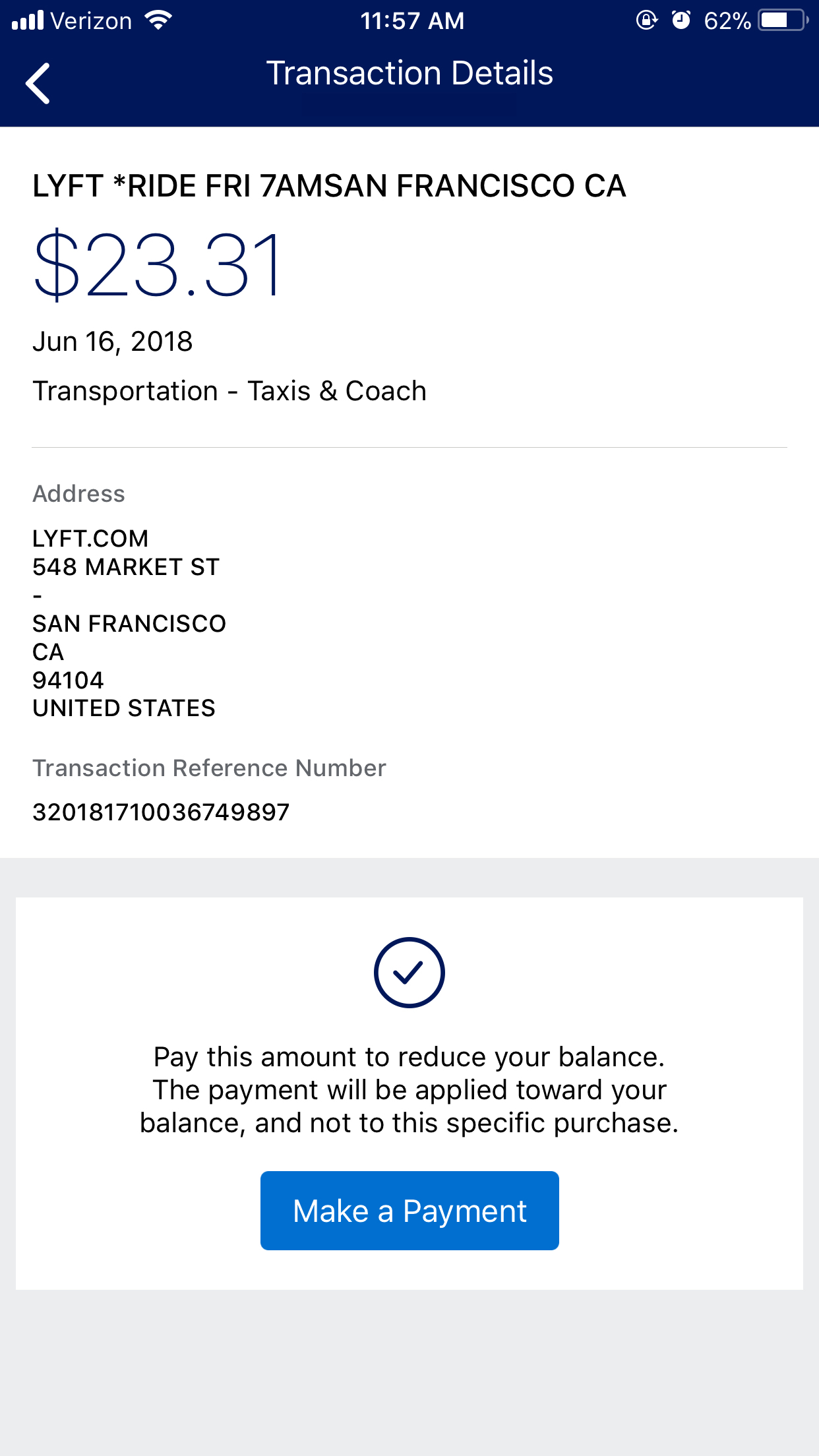

If you click on "Pay It" for small purchases, you'll have the option to make a payment immediately. The payment will post to your account within 48 hours. You can make up to five payments per day.

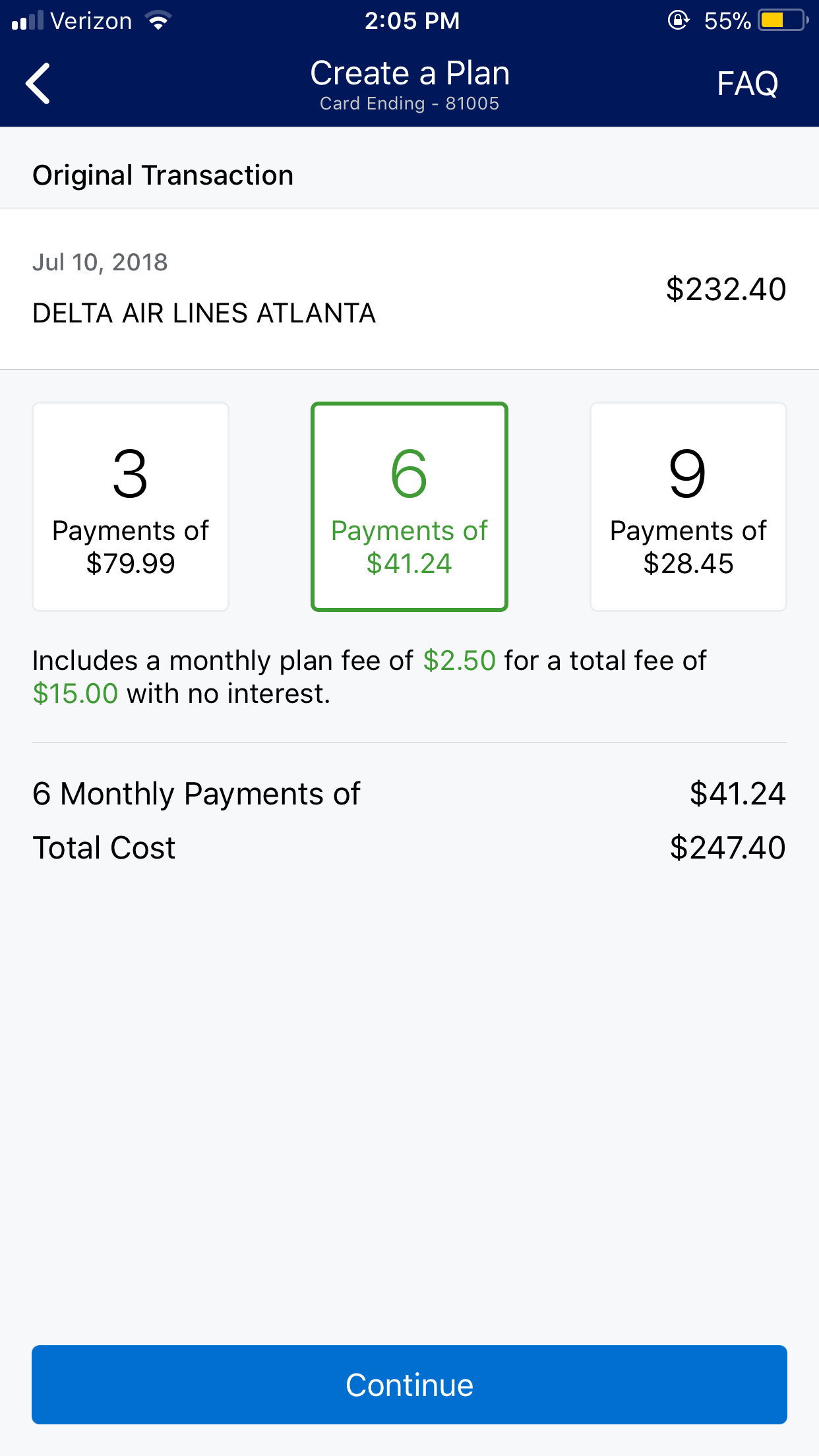

If you click on "Plan It" for large purchases, you'll have the opportunity choose an installment plan from three different options, ranging from three months to 24 months. These options (and the fees associated with them) vary by customer.

With each plan, however, you will pay a small monthly fixed fee. The app will display the total fee amount you will pay over the installment period. When you choose a plan, the monthly plan payment will be added to your minimum payment due each month. You will generally save money paying the installment loan fee rather than paying interest on your purchases.

For example, the purchase below of $232.40 can be divided into six monthly payments of $41.24. That includes a monthly plan fee of $2.50, for a total fee of $15. If you chose to make the minimum $35 payment each month, on a credit card with a 26.49% APR, it would take you eight months to pay off the purchase, and you would have paid a total of $21.74 in interest.

Is This New Feature Worth It?

If you pay off your credit card balance each month, this feature is not for you. But there are situations in which it could be helpful. For example, you can use "Pay It" to maintain a lower balance on your credit card, all while reaping the rewards you earn for a purchase.

This is especially useful if you tend to keep your credit card balances close to your credit limit, which can have a negative effect on your credit scores. Maintaining a lower balance may likely result in a boost in your credit scores.

"Plan It" can be useful if you are making a big purchase that you can't pay off immediately. You'll almost always save money by using the installment feature and paying the monthly fees, rather than incurring interest on the purchase. And if you are able to pay off your balance early, you won't be charged the future fees.

However, if you have a 0% purchase offer on your account, then you won't want to use the "Plan It" feature. Instead, you should just pay down your balance during the 0% period without incurring any fees or interest altogether.

Regardless of whether you use the Pay It or Plan It features, you will be able to pay your bill at the end of the billing cycle: the minimum due, the full amount, or anything in between.

Currently, this feature is available on all American Express consumer credit cards, but not on consumer charge cards or cards that must be paid in full each month. Terms apply.