Jump-start your credit

Build your credit for free with Experian Go™ so you can start reaching your financial goals.

Scan to download the app and sign up for your free Experian membership.

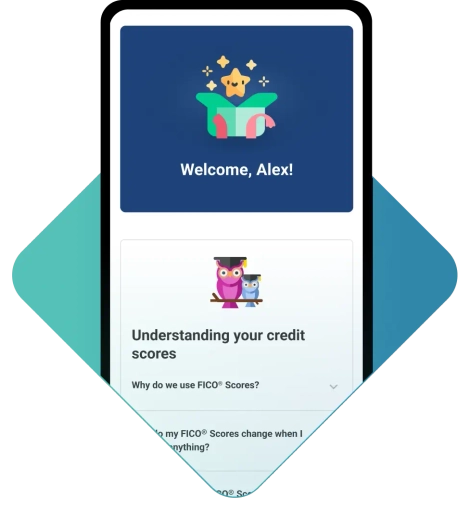

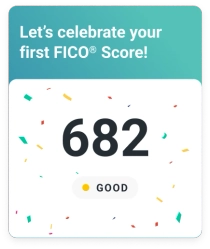

Establish a credit profile

This is your first step to building positive credit history.

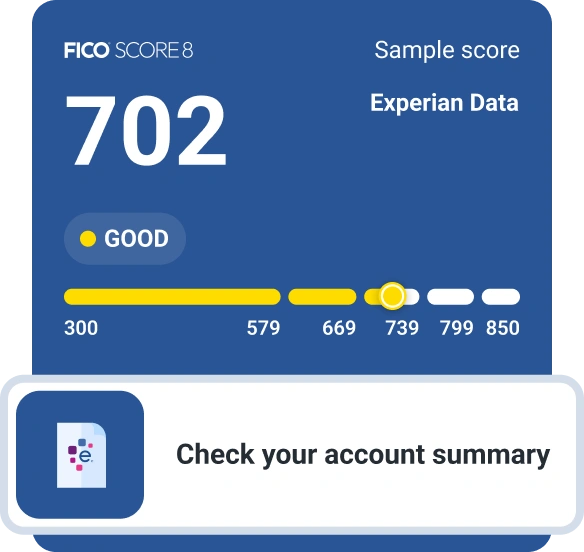

Understand how credit works

See how your financial decisions can impact your credit.

Boost your credit scores

Get credit for bills you already pay like your cell phone, utilities, streaming and rent.ø

How it works

Why your credit matters

Be financially independent

From applying for a credit card to renting an apartment, your credit history plays a big role in your life.

Get better chances of approval

Building your credit can give you a better chance of approval for your first car loan and beyond.

Create healthy credit habits

Establishing good credit habits like paying bills on time could give you more financial options, lower rates and better terms.

Find a credit card or loan

Grow your credit from the ground up with the right credit card or loan.

FREE Credit E-BOOK

Your guide to credit

Get tips on understanding and improving your credit profile with our free e-book — available in English o español.