How to Build Credit: A Comprehensive Guide

Quick Answer

Some steps you can take to build credit include paying your bills on time, minimizing unnecessary debt, maintaining a diverse mix of credit and monitoring your credit score over time.

Building a good credit score can take time, but the benefits of doing so are numerous. Even if you don't expect to apply for credit anytime soon, working on it now can help ensure you have a good score when you need it.

Ultimately, the steps you take to build credit should be based on your unique situation and credit profile. However, there are some general guidelines you can follow to build and maintain a good credit score.

Here's what you need to know about the different factors that determine your credit score, plus how to start building credit.

How Does Credit Work?

Your credit history is a reflection of how you've managed debt in the past and is primarily represented by your credit reports and credit scores. Your credit reports contain information reported by your creditors that credit scoring models then use to calculate your scores.

Here's a deeper look at how credit works and what to pay attention to as you build your credit history.

Types of Credit

Credit accounts come in many forms, but when it comes to your credit reports and scores, there are three major types of credit that you will encounter:

- Revolving credit: Revolving credit accounts come with a line of credit that you can draw on, pay back and draw on again. Credit cards and lines of credit are the most popular forms of revolving credit.

- Installment credit: Installment credit provides you with a lump-sum disbursement, which you pay back in fixed monthly installments. This includes personal loans, student loans, auto loans and mortgages.

- Service credit: Service credit is the type of account you have with anyone who provides you with a service and bills you monthly. Your utility and cellphone bills are examples of service credit accounts (which you can also add to your Experian credit file with Experian Boost®ø).

Getting a credit card is one of the most common ways to begin building credit, but it's not the only way. Here are two approaches to building credit:

| How to Build Credit With a Credit Card | How to Build Credit Without a Credit Card |

|---|---|

| Open your first credit card | Pay your loans on time |

| Become an authorized user | Consider an installment loan |

| Pay your bills on time | Add monthly bills to your Experian credit report |

| Maintain a low credit utilization rate | |

| Request a credit limit increase |

How to Build Credit With a Credit Card

Credit cards are one of the best credit-building tools available, primarily because they make it possible to establish a positive credit history without paying interest.

Using your credit card to make everyday purchases and paying your bill on time every month can demonstrate to lenders that you can responsibly manage debt. However, if you rack up a large balance or miss a payment, it could leave you worse off than before.

Here are four strategies for responsibly building good credit using a credit card.

Open Your First Credit Card

Applying for your first credit card can feel daunting, but knowing your options can help make the process go more smoothly. Here are some to compare:

- Secured credit card: Secured credit cards are designed for people with poor credit and limited or no credit histories. They require an upfront security deposit—often a minimum of $200—that's usually equal to your credit limit. The best secured cards have no annual fees, and some even offer rewards. With responsible use, you may also be able to get your deposit back without needing to close your account.

- Student credit card: If you're a college student, a student credit card may be better than a secured card because it doesn't require a deposit. Student credit cards may also offer rewards and other perks to encourage you to develop good credit habits.

- Hybrid card: Debit-credit hybrid cards are relatively new, but they can provide a good opportunity to build credit. They typically don't require a credit check to get approved, and while some require a security deposit, you'll typically get more flexibility compared to a traditional secured card.

Once you have your first card, use it to make small everyday purchases that you can easily afford. Pay your balance in full each month to start building a history of on-time payments, showing lenders that you're a responsible borrower.

Learn more: An Essential Guide to Your First Credit Card

Become an Authorized User

If you're having trouble qualifying for a credit card on your own, becoming an authorized user could be a helpful solution. As an authorized user, you'll be added to an existing account and be given your own card to use.

The account's positive payment history is then added to your credit report and factored into your credit scores. However, since you're not responsible for managing the account and making payments, the degree to which it can help your creditworthiness is limited.

Learn more: Will Being an Authorized User Help My Credit?

Pay Your Bills on Time

If you already have a credit card, there are ways you can make sure you're getting the most benefit out of it—starting with making on-time payments. Payment history is the most important factor of your credit score, making up 35% of FICO® ScoresΘ. Therefore, it's essential to pay all of your credit card bills on time. To have positive payments added to your credit report, you'll need to make at least your minimum payment by your due date. That said, it's best to pay your bill in full to avoid potential interest charges.

Learn more: What Happens if You Only Pay the Minimum on Your Credit Card?

Maintain a Low Credit Utilization Rate

Another key credit score factor is credit card utilization rate, which is the ratio of your card balances to your credit limits. Maintaining a low credit utilization rate is important when your goal is to build your credit. When your credit utilization nears and climbs above 30%, the more harm it can do to your scores. As a general guideline, the lower your credit utilization, the better. So if you have a $10,000 credit limit, for example, make sure your balance stays well under $3,000.

Request a Credit Limit Increase

If you've had your card for several months or longer, consider requesting a credit limit increase. Doing so could help improve your credit utilization rate.

Note that card issuers may not approve a request for a credit line increase if you have a sizable balance, so it's best to pay down as much of your debt as possible before asking. If you are approved for a limit increase, resist the urge to ramp up your credit card spending.

Learn more: When to Request a Credit Limit Increase

How to Build Credit Without a Credit Card

While credit cards are a great tool for building credit, they aren't your only option. Since your credit score is a reflection of how well you've managed debt in the past, any credit accounts you have that are reported to credit bureaus have the potential to help you boost your score.

Even if you're just starting out and don't yet have any credit accounts, there are other ways you can build your score over time. Here are three strategies for building credit without a credit card:

Consider an Installment Loan

If you don't have a long credit history, an installment loan could help you build your score. Auto, mortgage, personal and student loans are all types of installment credit. That means the loan you might use to buy a car or pay for your education has the added benefit of helping you build credit, assuming you make all your payments on time.

Keep in mind, though, that it's not advisable to take out a traditional loan simply to build your credit. If you don't need to borrow money, however, you could consider a credit-builder loan. This is a relatively low-cost option that's designed specifically to help you improve your credit standing. Just make sure the lender reports to all three credit bureaus (Experian, TransUnion and Equifax); not all do.

Pay Your Loans on Time

As we mentioned, your payment history is the most important aspect of your credit score, so pay close attention to your existing debt. Make it a priority to submit all your payments in full and on time to maintain a good payment history.

Another factor in your scores is the progress you've made on paying down your loans. Getting loan balances closer to zero indicates to lenders that you're able to repay your debt.

Add Monthly Bills to Your Experian Credit Report

While you may have a long history of paying bills on time, non-debt payments won't automatically help you build your credit score. The good news is that you can request to have certain bills added to your credit report by using Experian Boost.

Experian Boost works by allowing Experian to connect to your bank account and add eligible on-time payments for rent, utility, phone, insurance and streaming service bills to your credit report so they can be instantly reflected in your FICO® Score powered by your Experian report.

Get a Cosigner

If you need an auto loan, student loan or other type of credit you can't get on your own, consider asking a loved one with good credit to cosign your application. In doing so, your cosigner agrees to repay the debt if you can't, alleviating some of the concerns a lender might have if you were to apply on your own.

That said, it's important to make sure your cosigner understands their obligations. They should also be aware that the loan or credit card will show up on their credit reports and may impact their ability to obtain credit.

Consider a Credit-Builder Loan

As previously mentioned, a credit-builder loan can be a great starting point for someone with limited or no credit history.

While terms can vary by lender, credit-builder loans typically range from $300 to $1,000 and have a repayment term of six to 24 months. Instead of disbursing the loan proceeds upon approval like a traditional installment loan, the lender will hold on to the funds until you've completed your repayment term.

The lender will report your monthly payments to the credit bureaus and then give you the loan funds once you complete your term. Just make sure the lender you choose reports to all three credit bureaus.

What Factors Affect Your Credit Score?

There are five key factors that make up your FICO® Score. Here's a quick breakdown of each one and their impact on your score:

- Payment history: 35%. When you apply for a loan or credit card, the lender's top priority is ensuring that you can repay your debt on time. As such, your payment history is the most influential factor in your FICO® Score. If you miss even a single payment by 30 days or more, it could have drastic consequences for your credit score. The longer a debt goes unpaid, the more damage it does. If you stop paying a bill and a collection account is opened in your name, this could appear on your credit report and negatively impact your score for up to seven years.

- Amounts owed: 30%. The total amount you owe, along with the current loan balances compared to their original amounts are important factors in your FICO® Score. Your credit utilization rate is another important element of this factor because it indicates how much you rely on debt for your everyday spending.

- Length of credit history: 15%. The longer your history of managing credit responsibly, the better. Length of credit history not only refers to the ages of your oldest and newest accounts but also the average age of all of your accounts.

- Credit mix: 10%. Your credit mix indicates how diverse your credit accounts are, showing whether you can effectively manage both installment and revolving credit. This factor likely won't make or break a credit application, but having different types of credit under your belt can help take a good credit score to the next level.

- New credit: 10%. Each time you apply for credit, the lender will typically run a hard inquiry on one or more of your credit reports. Additionally, opening new credit accounts will result in new tradelines on your credit reports. While taking on new credit may be necessary at times, it's important to avoid applying too frequently to avoid overextending yourself.

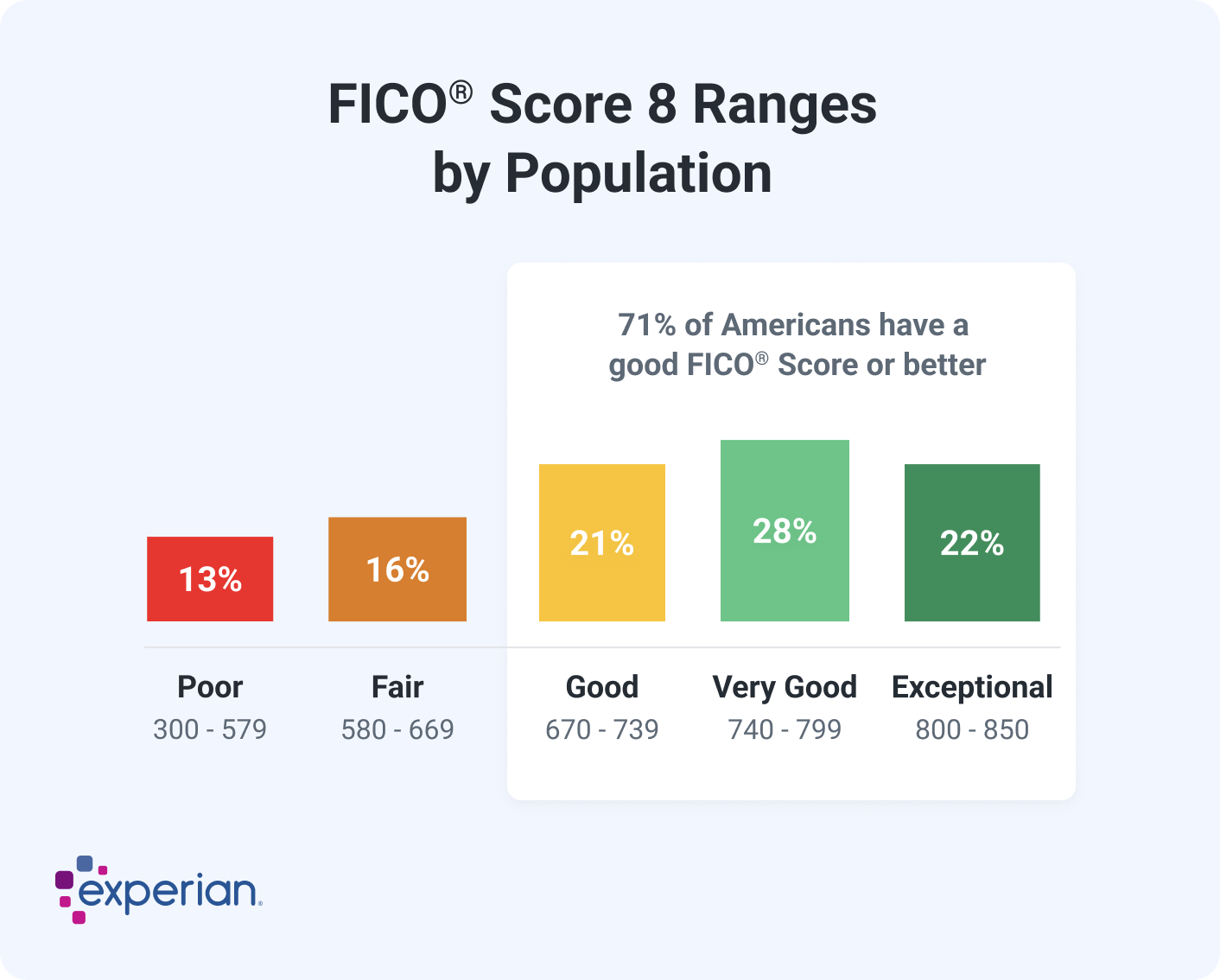

What Is a Good Credit Score?

Lenders use different criteria to evaluate creditworthiness. In general, though, a good credit score is one that's 700 or above. Here's a quick breakdown of the credit score ranges, according to FICO:

Why Do You Want Good Credit?

Having good credit is crucial if you plan on applying for a loan or credit card because it can make it easier to qualify for lower interest rates and fees, as well as better credit card rewards and benefits.

It can also make it easier to qualify for low insurance rates, get into an apartment and even obtain certain jobs.

How Long Does It Take to Build Credit?

There's no set timeline for building your credit history, primarily because every credit profile is unique. If you're just starting out, it'll take at least six months to establish a FICO® Score. Beyond that, it can take several years to build and maintain an excellent credit history.

If you have poor credit due to some past missteps, it could take even longer. Negative items can remain on your credit reports for seven or even 10 years in the case of Chapter 7 bankruptcy. While the impact of negative items diminishes over time, it can still take more effort than if you were building credit from scratch.

Frequently Asked Questions

Monitor Your Credit to Track Your Progress

Regardless of whether you're building your credit from scratch or rebuilding a struggling score, regularly monitoring your credit is critical to make sure your efforts are paying off.

To keep your eye on your credit reports and scores, consider using Experian's free credit monitoring tool so you can regularly log in to check on your progress. You can also get a copy of your credit report and credit score for free from Experian.

Instantly raise your FICO® Score for free

Use Experian Boost® to get credit for the bills you already pay like utilities, mobile phone, video streaming services and now rent.

No credit card required

About the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben