In this article:

Whether to finance a car with a personal loan or an auto loan depends on your situation. Auto loans are usually the best choice since they typically have lower interest rates, but in some cases a personal loan could make more sense. Buying a car is a major purchase no matter how you slice it, but choosing the right financing can reduce the overall cost.

If you're considering both options to finance your next vehicle purchase, it's important to understand the different features of a personal loan versus an auto loan to make the right choice for you.

| Personal Loan vs. Auto Loan | ||

|---|---|---|

| Personal Loan | Auto Loan | |

| Maximum loan amount | $100,000 | Typically $100,000 |

| APR range | From single digits to 35% or more | From single digits for car buyers with good credit to 20% or more for buyers with poor credit purchasing used cars |

| Repayment term | 12 months to 84 months | 24 to 96 months |

| Secured? | Can be secured or unsecured, but collateral is usually not required | Secured by the financed vehicle |

| Down payment? | Not required | Typically required |

| Fees? | Yes | Yes |

| How to start | Compare personal loan offers | Learn how to get the best auto loan |

Is a Personal Loan Better Than an Auto Loan?

A personal loan isn't necessarily better than an auto loan when financing a car because auto loans typically have lower interest rates. They may also offer special promotional financing that you won't get with a personal loan.

Personal loans are loans you can use for a variety of purposes. They're typically unsecured and have fixed interest rates, although you can find personal loans that are secured by collateral or have variable interest rates. Repayment terms for personal loans generally range from 12 to 84 months, although some lenders offer longer terms, usually for loans requiring collateral.

Pros and Cons of Personal Loans

Personal loans have both benefits and drawbacks to consider.

Pros

- No down payment required: Personal loans don't require down payments, which may be appealing if you can't afford to put any money down.

- No collateral needed: Most personal loans are unsecured, so you don't have to risk any assets or use the vehicle you're financing as collateral.

- May be a good option for a used car: Some lenders won't approve auto loans for used cars past a certain age or mileage amount. If you're purchasing an older used car from a private party, a personal loan could be easier to get than an auto loan and may have similar terms.

- No insurance requirements: To protect the collateral (the vehicle), lenders typically require you to carry collision and comprehensive auto insurance during your auto loan term. There's no such requirement with a personal loan.

- Flexible amounts and uses: Personal loans are available for as much as $100,000, depending on factors such as your income, current debt payments and credit score. You can typically use personal loan funds for nearly any purpose. For instance, you could get a personal loan for $35,000 and use $25,000 to buy a car and $10,000 to pay off credit card debt.

Cons

- Higher interest rates: Personal loans generally charge higher interest rates than auto loans. For those with poor credit, interest rates on personal loans can reach the triple digits, making this an extremely expensive way to finance a car.

- May be harder to get: Because they're unsecured, personal loans are riskier for lenders than auto loans. To borrow the same amount of money with a personal loan, you may need a higher credit score than for an auto loan.

- Interest isn't tax deductible: Interest paid on a personal loan used to buy a car can't be deducted on your taxes.

- Could damage your credit: Your car may not be repossessed if you miss a personal loan payment or two, but your credit will still suffer. If you default on a personal loan, the lender might send your account to collections, sue you or garnish your wages—actions that can seriously damage your credit score.

Learn more >> Personal Loan Do's and Don'ts

How to Get a Personal Loan

Follow these steps to get a personal loan.

- Check your credit. You can review your Experian credit report and FICO® Score☉ for free to see where your credit score stands and what factors affect it. If necessary, taking steps to improve your credit before applying for a personal loan could qualify you for lower interest rates.

- Figure out how much you need to borrow. Research car prices to get an estimated cost for the vehicle you want. Be sure to consider any sales taxes on the vehicle and fees dealers and lenders may charge, such as origination fees. You may need to borrow more than the vehicle's sticker price to cover these additional costs.

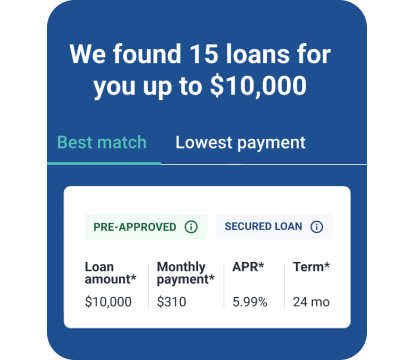

- Get prequalified with several lenders. You can get personal loans from banks, credit unions and online lenders. Getting prequalified by a variety of lenders can give you an idea of whether you'll qualify for a personal loan and the interest rates and terms you may get. Because prequalification doesn't involve a hard inquiry into your credit report, it won't impact your credit score.

- Compare loan offers. In addition to interest rates, consider the loan repayment term, fees and funding speed. For instance, you may want same-day or next-day funding if you're purchasing a car from a private party and need to pay quickly or lose the car to another buyer. Experian's personal loan calculator can help you calculate monthly payments and overall costs for different loans.

- Apply for a loan. This can usually be handled online and may involve providing personal information, pay stubs, tax returns or bank statements. If you're approved, review the loan terms (which may be different than your prequalification). Sign the documents to accept the loan if you're satisfied with the terms.

Find a personal loan matched for you

Pros and Cons of Auto Loans

Before applying for an auto loan, evaluate the pros and cons.

Pros

- Lower interest rates: Because they're secured by the vehicle, auto loans generally have lower interest rates than unsecured personal loans.

- Can use trade-in or down payment to reduce loan amount: If you can make a down payment or trade in a vehicle, you won't need to borrow as much. That means you'll pay less interest over time and may qualify for lower interest rates, too.

- Potential for special financing: Auto dealerships may offer special financing, such as rebates that reduce the cost of the vehicle or 0% introductory annual percentage rate (APR) auto loans for borrowers with good credit.

- Loan interest may be tax deductible: If you're self-employed and use the financed vehicle for business, you may be able to deduct the loan interest on your taxes.

Cons

- Risk of repossession: If you don't repay your auto loan, the lender can repossess your car. Repossession can happen as soon as you miss one payment and stays on your credit report for seven years after the date you stopped paying the loan.

- Restricted use: An auto loan must be used to buy a car. You can't get an auto loan for more than the vehicle's price and use the leftover funds for something else.

- May need a down payment: You don't necessarily have to make a down payment when financing a car, but you may need a down payment to get the best loan terms. A down payment translates to a smaller loan amount, which may qualify you for a lower interest rate and reduce the overall cost of the vehicle.

- Could damage your credit: Like with a personal loan, missing an auto loan payment can result in severe harm to your credit score. Repossession, as well as a voluntary surrender, also results in lasting credit harm.

How to Get an Auto Loan

To get an auto loan, follow these steps.

- Check your credit report and credit score. If your credit score isn't what you'd like, working to improve it could qualify you for lower auto loan interest rates.

- Set a budget. You can use Experian's car payment calculator to see how different loan amounts, APRs and repayment terms impact your car payments. Be sure to consider how your down payment or trade-in will affect your loan amount.

- Investigate different lenders. Evaluate all your options to get the best terms. In addition to banks, credit unions and online lenders, you can also get auto loans from dealerships and manufacturers when buying a new or certified pre-owned vehicle.

- Get prequalified or preapproved. Both prequalification and preapproval can indicate what type of loan you're likely to qualify for. Preapproval also shows a dealer you're conditionally approved to borrow up to the preapproved amount and locks in the loan interest rate, typically for 30 to 60 days. This can give you more bargaining power in negotiating dealer financing.

- Visit the dealership and choose your car. See if the dealer presents better loan terms than your existing offer.

- Finalize the loan. Once you've reached a purchase agreement, you can accept the dealer's loan offer or contact the lender that preapproved you to finalize the loan. This may require submitting additional information.

Learn more >> What Is a High Interest Rate for a Car Loan?

The Bottom Line

Generally, an auto loan is a better option than a personal loan for financing a car because car loans usually offer lower interest rates and possible dealer promotions. But no matter how you intend to finance your new vehicle, a good credit score can make it easier and more affordable. Consider signing up for Experian's free credit monitoring service as you plan your purchase. You'll get alerts to changes in your credit and can track your FICO® Score over time.