Getting the best credit card comes down to figuring out which cards you're likely to qualify for and what type of card aligns with your current goals. From there, you can narrow down the options based on your preferences and then compare current offers to find the best one.

How to Find the Right Credit Card in 4 Steps

While some cards clearly have better benefits than others—such as a card that has lower fees than a comparable card—there's no single best card for everyone. In part, this is because your preferences impact what's best for you.

If you know you want a card from your bank, for example, you may only be choosing from a handful of options. However, you don't need to get a card from your bank or current card issuer, and you may find cards from other issuers that better align with your goals.

While there are hundreds of cards to compare, these four steps can help minimize how much research you need to do and help you find the best card for you.

1. Check Your Credit Score and Report

To start, you'll want to check your credit report and score to see where you stand. Experian offers free access to your Experian credit report and a credit score based on that report. You can get an updated report and score every month and receive free credit monitoring with immediate notifications when there are important changes in your report.

Credit card issuers will usually consider the information in your credit report and a credit score when deciding whether to approve your application. Your creditworthiness can also impact the interest rate and credit limit on your new card.

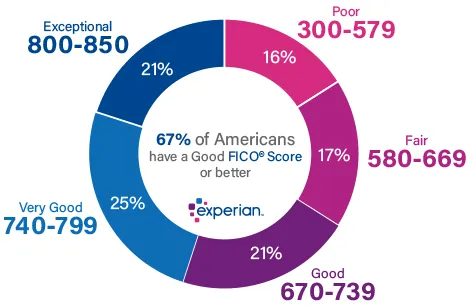

Most credit scores range from 300 to 850, with a higher credit score indicating you're a less-risky borrower. A higher credit score can help you qualify for the best cards and offers, but the minimum required score can vary depending on the card.

2. Consider Why You Want a Credit Card

The reason you want a credit card will also help determine which cards you should seriously consider.

Credit cards are often categorized based on a prominent feature or benefit—such as no annual fee, travel rewards or a special interest rate offer. These categories may align with common reasons for getting a new credit card, and you can use them to quickly narrow down your options.

To Build Credit: Secured Cards

When you're brand new to credit or trying to rebuild your credit, you may want to start with a secured credit card. Secured cards don't require a high credit score, but you'll need to send the card issuer a refundable security deposit to open the card.

Using a secured card and paying your bill on time each month can help you build credit, but some cards offer few benefits and have high fees. Look for better options, such as a secured card with rewards and no annual or monthly fees. Some card issuers will even let you transition to an unsecured account after you've shown you can manage a secured card well.

For Everyday Expenses and Travel Deals: Rewards Cards

If you have good credit and regularly pay your credit card bills in full, a rewards card could be a good option.

For those who prefer a hands-off approach, a flat-rate rewards card will give you the same amount of rewards on every purchase. However, if you tend to spend a lot of money on specific categories (travel or dining, for example), take a closer look at the cards that offer bonus rewards on certain purchases. Some rewards enthusiasts have several different rewards credit cards, and they'll use whichever card gives them the most rewards on any given purchase.

If you want a card for everyday expenses but occasionally carry a balance, you might be better off with a low-interest card. While some of these cards don't offer any rewards, a rewards card with a high interest rate could wind up costing you more than you earn in rewards anyway.

To Make Large Purchases: 0% APR Cards and Cards With Large Intro Offers

When you have a large purchase coming up, you might want a card that has an introductory 0% APR (annual percentage rate) offer. These can let you pay off the purchase over time without accruing interest during the intro promotional period.

Even if you can afford to pay off the balance in full right away, you may still want to look for a new card that has a large intro bonus. These offers are generally restricted to new cardholders and may require you to spend a certain amount within the first few months with the card. Once you reach the card issuer's spending requirement, you could be rewarded with a large amount of cash back, points or miles.

To Help Manage Credit Card Debt: Balance Transfer Cards

Balance transfer cards are any credit card that offers a low or 0% intro APR offer on balances that you transfer to the card. These offers can make managing your credit card debt easier by allowing you to consolidate multiple debts into one. You also might be able to pay off the debt faster because you won't be paying interest on the transferred balance during the initial promotional period. And while there's commonly a 3% or 5% balance transfer fee, you could still come out ahead and save money overall.

3. Compare Credit Card Offers and the Fine Print

Once you determine which type of card aligns with your plans, start looking into options from different card issuers. Some specifics you may want to compare are:

- Annual fees: An annual fee isn't necessarily bad if the card comes with lots of benefits. However, some people prefer cards that don't have annual fees.

- Foreign transaction fees: If you plan to use the card while traveling abroad or for online purchases in foreign currencies, look for an option that doesn't have a foreign transaction fee. You might want to start with travel credit cards.

- Interest rates: Ideally, you can afford to pay your credit card bill in full each month to avoid paying interest charges. However, you may need or want to occasionally carry a balance, and all else being equal, a lower interest rate may be best.

- Rewards: There are many types of reward credit cards. Consider what type of rewards—such as cash back, miles, points or frequent traveler rewards—you want to earn, and the different cards' rewards rates.

- Intro bonus offers: Many credit cards also offer bonus points, miles or cash back that you can receive after making qualifying purchases or for a limited time. However, you might only be able to get an intro bonus the first time you open the credit card. You also might not be eligible if you've recently gotten a different card from the same product line or "family."

- Intro interest rate offers: Compare the intro offers' promotional periods and consider how long you'll need to pay off the balance. If you're looking for a balance transfer card, see if it also offers an intro 0% APR on purchases and, if not, how making purchases will impact your interest charges.

You can also read expert reviews and comparisons of credit cards, and get insight on how you can best use specific cards or card issuers' rewards programs.

4. Prepare to Apply

Once you've identified which card you want, you can submit an application online and you may get an immediate response. To increase your chances of approval, make sure you know what you can include as income on the application and, if you frequently open new credit cards, any issuer-specific rules. For example, regardless of your credit score and income, some card issuers will deny applications from people who opened several cards recently.

Applying for a new credit card also will generally lead to a hard inquiry, which could hurt your credit score slightly and stay on your credit report even if you don't get approved for the card. Some card issuers let you see which cards you'll likely get with a prequalification that uses a soft inquiry—the type that doesn't impact your credit scores.

Compare Cards Side-by-Side and Find Your Match

Once you have your goals and a type of card in mind, you can also do one last comparison of similar cards to narrow in on the best card for you. Experian CreditMatchTM lets you filter cards by type and credit score requirement. You can also enter your information and you'll be matched with credit card offers based on your unique credit profile.