A personal loan is a loan with short- to moderate-term repayment options you can use to fund a wide variety of financial goals, such as consolidating high-interest debt, starting a business or paying for a home renovation project.

While personal loans can benefit you in numerous ways, there are many misconceptions surrounding them. Let's debunk these personal loan myths, so you know the facts about how they work.

Find a personal loan matched for you

1. Myth: You Can't Get a Personal Loan With Bad Credit

Your credit is certainly a loan requirement, but lenders take other considerations into account when reviewing your loan application.

Fact: Lenders Review Multiple Factors When Deciding Whether to Approve a Loan

While a good credit score makes it easier to qualify for personal loans, it's not a strict requirement. Many lenders work with borrowers with bad credit to get personal loans.

Remember, lenders consider more than just your credit score when reviewing your loan application; factors like income, employment history and debt-to-income ratio (DTI) also play a crucial role. DTI ratio assesses how much of your gross income goes toward your total monthly debts, and lenders generally prefer a DTI below 36%. The loan amount and term you request may also factor into your lender's approval decision. As such, you may be able to overcome a less-than-stellar credit score by demonstrating strong income, steady employment, a low DTI and a lower loan amount.

Still, a poor credit score can lead to a smaller lending amount and higher interest rates. Since rates and terms vary widely from lender to lender, it pays to shop and compare multiple personal loan lenders to find the best rates and terms available to you.

2. Myth: Personal Loans Are Only Offered by Banks

For years, brick-and-mortar banks and credit unions were the primary institutions to take out a personal loan, but that's no longer the case.

Fact: Online Lenders Are a Popular Personal Loan Option

While traditional lenders still offer personal loans, many borrowers are taking advantage of the benefits online lenders and loan platforms now provide. Without the expenses of maintaining physical local branches, operating costs for online lenders are typically lower than their traditional counterparts, and they often pass on these savings to borrowers.

As such, many online lenders offer lower interest rates, fewer fees and a more simplified application process compared to traditional lenders. Depending on your loan amount and repayment term, these savings could amount to hundreds or even thousands of dollars over the life of the loan.

3. Myth: Personal Loans Require Collateral

Although some lenders require collateral to secure a personal loan, these loans usually don't require security.

Fact: Most Personal Loans Are Unsecured and Don't Require Collateral

Unsecured personal loans come with higher risk since you don't need to offer collateral for the loan. If you can't repay the loan, your lender can't claim collateral to recoup their loss. However, defaulting on your loan could harm your credit score, making it more difficult to get approved for new credit in the future.

Putting up collateral on a loan can deliver benefits in certain scenarios. For example, you may improve your loan approval odds with lower annual percentage rates (APRs) by offering collateral, such as cash in a deposit account or a car.

4. Myth: You Can't Have Multiple Personal Loans

Don't believe the myth that you can't get a personal loan if you already have one.

Fact: You Can Have Several Personal Loans if You Meet Your Lenders' Policy Requirements

When you apply for a personal loan, the lender will consider multiple factors, including how well you manage your current debt and your DTI ratio. Also, the lender may have policy restrictions to adhere to. For example, your lender may cap your loan limit if you already have personal loans with them.

However, many lenders don't have such policy restrictions and make loan decisions based not on the number of loans you have, but on your financial ability to repay them. While loan approval is never guaranteed, a good credit score, strong payment history, sufficient income and a low DTI ratio can improve your chances of obtaining a personal loan on favorable terms.

5. Myth: Personal Loans Have High Interest Rates

Personal loans are often misunderstood as having consistently high interest rates, but in reality, they can be more affordable than credit cards and other forms of credit.

Fact: Personal Loan Interest Rates May Vary Depending on the Lender and Your Creditworthiness

Generally, personal loans have lower interest rates than credit cards, which explains why they are a popular option for consolidating high-interest credit card debt. As of July 2023, the average APR on a 24-month personal loan is 11.48%, while the average credit card rate is nearly double at 22.16%.

If you're looking for lower interest rates and have good credit, a 0% Introductory APR credit card may be an option. If you own a home with equity, you could explore options such as a home equity loan or home equity line of credit (HELOC). Keep in mind, however, home equity options involve putting your home at risk as collateral.

6. Myth: Personal Loans Always Hurt Your Credit Score

This myth is partially true, as a new loan could have a negative effect on your credit, but there's more to the story.

Fact: Responsible Credit Behavior May Improve Your Score More Than Harm It

Adding a new credit account may lower the average age of your accounts, and credit inquiries for personal loans can result in a temporary dip in your credit score, usually by only a few points. However, these negative credit factors may be more than offset by other positive factors.

For example, consistent, on-time payments on your personal loan help to build a positive payment history, which accounts for 35% of your FICO® Score☉ , the credit score used by 90% of top lenders. If you don't already have an installment loan, taking out a new one could improve your credit mix, which makes up 10% of your credit score. Finally, paying off credit cards with a personal loan may lower your credit utilization ratio and positively influence your credit score.

7. Myth: It's Difficult to Get a Personal Loan

While some lenders have strict lending requirements, it can be easy to get a personal loan as long as you meet the lender's qualifications.

Fact: The Personal Loan Application Process Is Usually Simple and Fast

The personal loan process is significantly more straightforward when you compare the personal loan application process to that for a car loan or home mortgage. You can complete the application in a few minutes and receive a decision within a few minutes or by the next business day. Once approved, lenders deposit the funds directly to your checking account, often within one business day or even the same day.

According to 2022 Experian data, over 25 million people have personal loans, up 16% from 2021. With credit card interest rates rising, many borrowers are using lower-interest personal loans to consolidate their credit card debt.

The Bottom Line

Ultimately, deciding whether to get a personal loan depends on how a new debt will impact your unique financial situation. For example, if you're struggling to afford your monthly debt payments, adding more debt to your budget may not make sense. By contrast, a personal loan may be a viable option to consolidate debt or pay off a large unexpected expense.

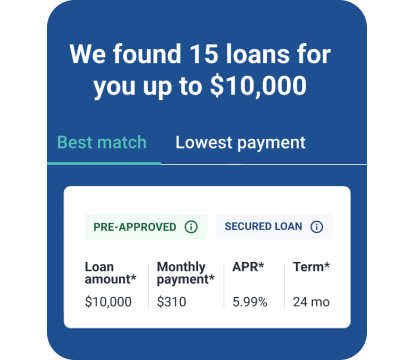

Before applying for a personal loan, it's always smart to compare multiple loan offers. Experian CreditMatch™ can help simplify the process by showing you the best loans matched to your credit profile. Checking your credit report and credit score for free ahead of time allows you to see what potential lenders will see, giving you the opportunity to correct any inaccuracies you find as needed.