In this article:

If your credit report lists you under one or more names you no longer use, do you need to correct it by filing a dispute? Not necessarily, but there are cases when you should. To find out when you need to dispute a name on your credit report and how to do so, read on.

Why Does My Credit Report Show Variations of My Name?

It's not uncommon for your credit report to list your accounts under multiple versions of your name.

Your accounts may reflect different variations of your name that you used on credit applications—Suzanne Smith, Sue Smith and Suzanne A. Smith, for instance.

If you've ever changed your name (through marriage or divorce, for instance), past versions of your name also may be reflected in your credit reports. That's especially true of accounts that are no longer active: A student loan or car loan you paid off before you got married will be listed under your unmarried name, for instance, and will stay that way even after you marry.

With open accounts, when you inform creditors of a name change, your new name should eventually be reflected in your credit reports. It may take a few months, however, for each creditor to update all three national credit bureaus (Experian, TransUnion and Equifax), and then for the bureaus to post the changes to your credit report.

If you have a hyphenated last name (or adopt one when you marry), it may appear on your credit reports in its correct form (Smith-Jones) as two words (Smith Jones) or as a single word without a hyphen (Smithjones). The way it appears reflects the way lenders' automated systems handle (or don't handle) hyphens.

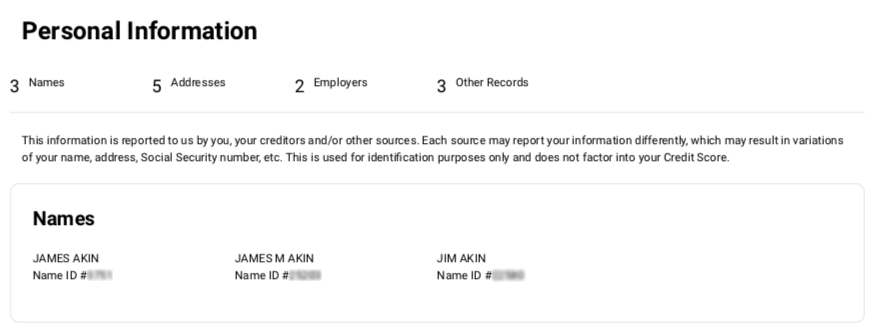

The national credit bureaus recognize that people may use different names at different times. As a result, your credit report from each bureau lists all the various names under which your accounts are listed. Credit reports are formatted differently at each bureau, but here's an idea of what the name list looks like on an Experian credit report:

When Is It Necessary to Dispute a Name?

If your credit reports list accounts that belong or belonged to you and are under names you no longer use, it's probably not necessary to file a dispute to correct them. One exception, though, is if you've informed a current creditor about a name change, and it's reflected in their communications with you (monthly statements, updated credit cards, etc.) but your credit reports aren't updated after several months. If this were to happen, you may want to submit a dispute with the credit bureaus to bring the reports current. (More on how to go about that below.)

But sometimes names you've used could be connected with account information that isn't yours—and that's when it becomes important to dispute the information. This isn't a common occurrence, but it can happen accidentally or under suspicious circumstances, such as identity theft.

You're particularly at risk if:

- You share a name with a parent or child—particularly if neither of you uses a suffix (Jr., Sr., III, etc.) with your name.

- Your name is fairly common, and someone who shares your name also shares your date of birth—a situation that's atypical, but also not as rare as you might think.

Accidental mixture of your credit data with those of another person who shares your name creates what's known in the industry as a "mixed credit file," or mixed credit report. A mixed credit file distorts your credit history and can lead to erroneous credit score calculations.

A mixup with someone who manages credit poorly could lead to an inaccurately low score. But even a credit history merged with a responsible credit manager can also cause grief: A lender that sees an extra student loan or mortgage mistakenly listed on your credit report, for instance, could determine (even if the loan is in good standing) that your debt-to-income ratio is too high for you to qualify for a new loan.

Unfamiliar loans or credit accounts listed in your name on your credit report also can be a sign of criminal activity. Identity thieves commonly use a person's stolen personal information (such as their name, date of birth or Social Security number) to open bogus credit accounts, "borrow" money and then disappear without repaying it, leaving a negative mark on the victim's credit history.

If your credit report lists an account in your name that you didn't open, you should alert the national credit bureaus immediately and notify the lender that issued the account, using the contact information that appears on your credit report. You should also consider reporting the potential identity theft to authorities and taking action to protect your credit reports from criminal abuse.

How to File a Dispute

If you need to correct your name on your credit reports, you must file a dispute with each credit bureau that lists the name incorrectly. The process differs somewhat for each of the national credit bureaus. The Experian Dispute Center webpage explains procedures for submitting disputes online, by phone or by mail.

How Does Disputing a Name Affect Credit Score?

The national credit bureaus use personal information—name(s), address, date of birth, Social Security number and the like—to associate you with the loans and credit accounts for which you are responsible. That information does not factor into the calculation of a credit score, so correcting your name through a credit report dispute has no direct impact on your credit score.

If you dispute a credit account incorrectly listed in your name and it's removed from your credit report, the payment information for that account will no longer factor into your credit score. In that case, you may see some shift in credit scores. Of course that information never should have contributed to your score to begin with, so any score adjustment will mean a more accurate reflection of your credit history.

Playing the Name Game

Using the dispute process to correct an outdated or inaccurate name on your credit reports is not always necessary, but the appearance of new accounts under your current name or one you no longer use can be a sign of criminal activity. That's why it's wise to check your credit reports regularly. Experian's free credit monitoring service can also notify you automatically whenever new accounts appear in your credit file, to help you detect suspicious activity before it can do harm to your credit history.