Free credit monitoring

Monitor your credit to help detect possible identity fraud sooner and prevent surprises when you apply for credit.

No credit card required

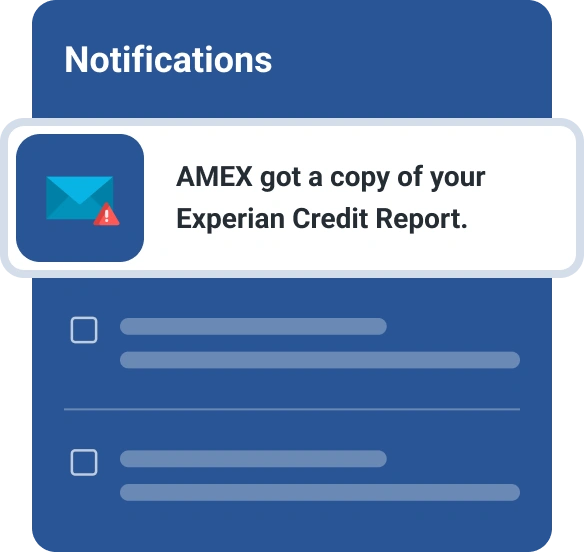

Stay on top of your credit

Get customized alerts about new inquiries, accounts and changes to personal info.

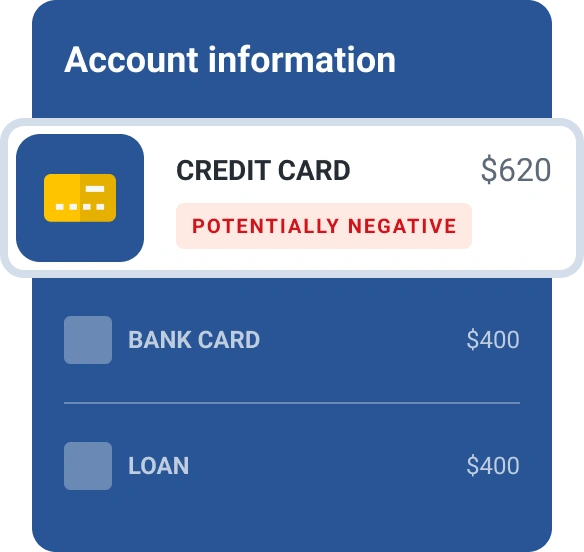

Monitor your spending

Know when there are changes to your spending or credit utilization ratio.

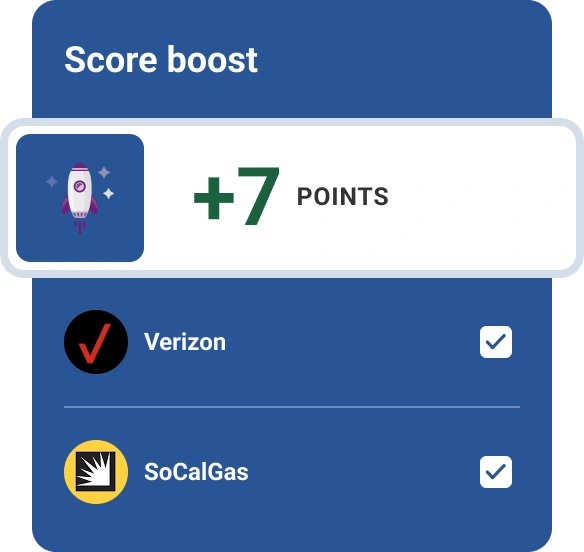

Track your FICO® Score*

See your progress over time and get alerts about changes to your credit.

Why monitor your credit with Experian?

What else can you do with Experian?

Scan the dark web for free

Check thousands of sites and millions of data points on the dark web for your personal info, like your Social Security number, email and phone number, with a one-time free scan.

Get a free personal privacy scan

Try a one-time free personal privacy scan to check for your info on covered people finder sites and see if your address, age, phone number, relatives and more are available to the public.

Freeze your credit file

Limit access to your Experian credit report by freezing your credit file. Unfreeze or schedule a thaw at any time and get alerts when your freeze status changes.

Manage your credit

See what’s affecting your personal credit and discover tips on how to improve it. It could help you make financial decisions with a better understanding of your credit history.