Can I Buy a House With a 700 Credit Score?

A 700 credit score meets the minimum requirements for most mortgage lenders, so it's possible to purchase a house when you're in that range.

However, lenders look at more than just your credit score to determine your eligibility, so having a 700 credit score won't guarantee approval. A credit score of 700 also might not qualify you for the best interest rate on your mortgage loan, you may still want to work on improving your credit scores to save on interest.

Here's what you need to know about the credit requirements for a mortgage loan.

Is 700 a Good Credit Score?

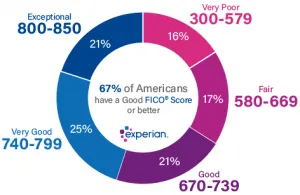

FICO® ScoresΘ fall within a range of 300 to 850, with the range that's considered "good" starting at 670. Beyond that, your FICO® Score is considered very good if it's 740 or higher and exceptional at 800 or above.

Your credit score provides a snapshot of your overall credit health, so a higher credit score is an indicator that you've responsibly managed your credit in the past. As a result, the higher your credit score is, the less risky you'll appear as a borrower and the more confidence lenders will have that you'll repay your debts as agreed.

What Credit Score Do You Need to Buy a House?

The minimum credit score required for a mortgage loan can vary based on the type of loan and the lender offering it. That said, here's a general idea of what you can expect with different types of mortgage loans:

- Conventional loans: The most popular loan type typically comes with a 620 minimum credit score.

- Jumbo loans: These loans exceed the maximum amount for conforming loans, jumbo loans typically have a higher credit score requirement at 680 or above.

- Federal Housing Administration (FHA) loans: With a 3.5% down payment, homebuyers may be able to get an FHA loan with a 580 credit score or higher. If you can manage a 10% down payment, though, that minimum goes as low as 500.

- U.S. Department of Veterans Affairs (VA) loans: VA loans don't technically have a minimum credit score, but lenders will typically require between 580 and 620.

- U.S. Department of Agriculture (USDA) loans: In general, lenders require a minimum credit score of 640 for a USDA loan, though some may go as low as 580.

Remember, though, that while meeting the minimum credit score requirement is crucial, it doesn't guarantee that you'll be approved for a mortgage loan. Lenders review several aspects of your financial situation to determine whether you qualify for a loan and what your interest rate will be.

What Do Mortgage Lenders Consider When Determining Your Interest Rate?

A mortgage loan is a major financial commitment, both for you and your lender. As such, mortgage lenders look at many different factors during the underwriting process to determine your eligibility and, if approved, your interest rate.

- Credit score: Again, your credit score is an important indicator of how you've managed credit in the past, and how a lender can expect you to manage your debt payments in the future. The higher your credit score, the better your chances of getting approved and scoring a lower interest rate.

- Down payment: A down payment reduces some of the risk associated with lending because you're borrowing less money. Most lenders have a minimum down payment requirement, but the more money you put down, the higher your chances of getting a reduced rate.

- Debt-to-income ratio: Your debt-to-income ratio (DTI), or the percentage of your monthly income that goes toward debt payments, shows how much flexibility you have to take on another debt payment. If it's too high—lenders prefer 36% or less, but some may allow for higher—it could make it difficult to get approved. And the lower your DTI, the less of a risk you pose to the lender, which can result in a lower interest rate.

- Loan term and loan size: Higher loan amounts and longer repayment terms present more risk to lenders, so they may be associated with higher interest rates. But if you reduce your loan amount by making a large down payment or buying a cheaper home and choose a 15-year mortgage over a 30-year mortgage, it could help you qualify for a lower rate.

- Loan type: Government-backed loans typically allow for lower credit scores because they're at least partially insured by a government agency if you default. However, the trade-off is that they may end up costing you more in the form of mortgage insurance and other fees, which can impact your loan's annual percentage rate (APR).

- Home location: The cost of doing business and competition can vary by state and even by city. As a result, some regions may naturally come with lower mortgage rates than others, even if you're working with a national lender.

These are just a few of the factors that go into the underwriting process. Lenders may also consider your type of employment (self-employed versus working for a company), other debts and information on your credit reports, recent credit applications, cash reserves and more.

Check Your Credit Before Applying For a Mortgage

Mortgage lenders take an extremely close look at your credit reports before accepting your mortgage application, so it's essential that you know what's on them and how they might impact your chances of getting approved with favorable terms.

More specifically, mortgage lenders will look for the following things:

- Payment history, including past-due payments, defaults and collection accounts

- Past foreclosures, repossessions and bankruptcies

- Authorized user accounts versus accounts where you're the primary cardholder

- Credit utilization (how much of your available credit on credit cards you're currently using)

- Recent credit applications

- Disputes

If you're thinking of buying a home soon, it's a good idea to start checking your credit report at least three months before you apply. This will give you enough time to look for your risk factors and any red flags that could keep you from getting the financing you need.

How to Improve Your Credit Score Before Applying for a Mortgage

Even if your credit score is high enough to meet the minimum requirements, it's still wise to work on improving your credit score before applying for a mortgage loan.

To start, check your credit report and credit score to see where you stand. Both can give you an idea of which areas could impact your chances of getting approved and how to address them.

Other ways to get your credit ready for a mortgage include:

- Stop applying for new credit.

- Limit large purchases on your credit cards.

- Pay down credit card debt to reduce your credit utilization rate.

- Make sure you pay your bills on time and get caught up on any past-due payments and collection accounts.

- Avoid closing old credit card accounts.

- Search for and dispute inaccurate information on your credit reports.

Some of these steps can take some time to start reflecting on your credit score. But if it means shaving even a fraction of a percentage point off your interest rate, making the effort can save you thousands of dollars over the life of your loan.

Keep Up the Good Work During the Mortgage Process

Mortgage lenders typically run a credit check when you first apply for a loan, then again shortly before closing. Because of this, it's critical that you continue to monitor your credit and practice good credit habits during the mortgage process.

The last thing you want is to get approved upfront, find a house then have to back out because a new credit application or a missed payment spooks the lender.

But as you continue to practice good credit habits during the mortgage process, it can help ensure you get into the house you want with favorable financing terms.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben