Can I Get an Unsecured Credit Card With a 500 Credit Score?

Your credit scores are three-digit numbers that carry a lot of weight. When it comes to unsecured credit cards, higher scores are associated with better chances of approval and lower interest rates. For that reason, it may be tough to qualify for an unsecured credit card if you have a 500 credit score.

There are many different types of credit scores, but your FICO® ScoreΘ is commonly used by lenders to help them assess risk and decide how creditworthy you are. FICO® Scores range from 300 to 850, and a score of 670 or higher is generally considered a good credit score. A score of 579 or below is viewed as very poor, and may cause lenders to be hesitant to approve you for an unsecured credit card.

If you want an unsecured credit card, there are things you can do now to build your credit and get your score moving in the right direction. Here's what to know when seeking an unsecured credit card with less-than-perfect credit.

What Credit Cards Can You Get With Bad Credit?

Unsecured loans or lines of credit are types of financing that aren't backed by any kind of collateral. Debts like your mortgage or auto loan are tied to assets that can be repossessed if you fail to make good on your payments, but unsecured credit cards have no such backing. Compared with other types of credit, unsecured credit cards present more of a financial risk to lenders, which may cause them to be more discerning when deciding whether to approve you.

Having a good score tells creditors you know how to manage your credit responsibly and indicates you are a low-risk borrower. But if your credit score is hovering around the 500 mark, it might mean you've got negative marks in your credit history, such as missed payments or bankruptcies. That can make it difficult to get approved for an unsecured credit card.

If that's the situation you're in, secured credit cards are worth exploring. They're different from unsecured cards in that borrowers are required to make an upfront, refundable security deposit. In most cases, your deposit determines your credit limit. And it provides the card issuer with peace of mind—if you miss enough payments, they can use that deposit to cover their losses.

The main benefit of using this type of credit card is that the issuer will likely report your activity and payments to the credit bureaus each month, which can help rebuild your credit and boost your score. (When you apply, make sure the card issuer reports your payment history to the credit bureaus, otherwise you won't get credit for your responsible use of the card.) If you maintain good credit habits by keeping debt balances low and paying every bill on time, eventually your credit score may improve enough that you're able to qualify for an unsecured credit card.

What to Do if You're Denied a Credit Card

If you're denied a credit card, the issuer is required to give you an explanation as to why you were rejected. This is called an adverse action letter and must include your credit score, the reasons for the denial and other information. This letter will also explain that you're entitled to a free copy of your credit report from the bureau that provided the credit report the lender used to make their decision.

Getting declined can be frustrating, but understanding the reasons why can help you build a plan of action that could make getting approved more likely the next time you apply. If you were denied based on your credit, familiarize yourself with the different factors that shape your credit scores. After all, you can be more effective in improving your credit scores if you know what's holding them back.

- Payment history: This is the most important factor in your credit scores. One missed payment could stay on your credit report for up to seven years. Make sure you understand when your bill payments are due as well as the minimum payment that's required. If you're past due on any accounts, get caught up ASAP.

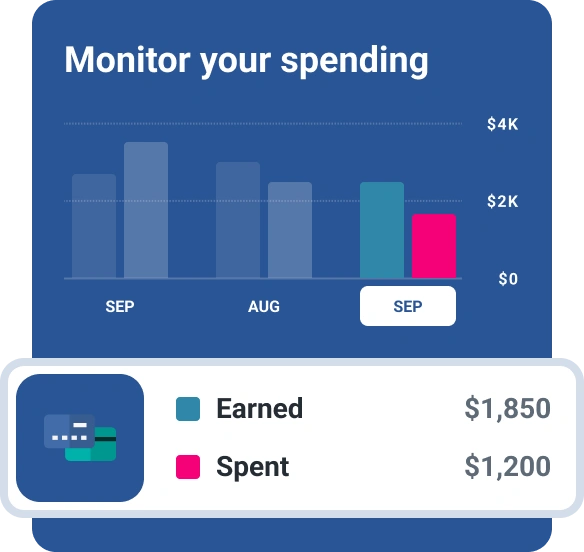

- Credit utilization: Your credit utilization ratio refers to the percentage of your available credit that you're actually using. Exceeding 30% usually reflects negatively on your credit scores. In terms of its impact on your credit scores, lower your utilization, the better.

- Credit length: The age of your credit accounts matters too. A short credit history could be holding your scores back. Unfortunately, there's not much you can do to quickly address this factor, other than be patient.

- Credit mix: Lenders like to see a good mix of diversity in your credit profile. This can include credit cards, student loans, and other kinds of accounts.

- New credit: Scoring models also consider how many accounts you've opened recently, as well as how many credit applications you've submitted. Applications for new credit usually result in hard inquiries, which appear on your credit reports and factor into your scores.

But your FICO® Score and credit report information aren't the only things credit card issuers consider when you apply for a new account. For instance, those who cannot demonstrate steady income may find it difficult to get approved for an unsecured credit card.

In some cases, bringing on a cosigner could make the difference between getting approved and getting declined. This is someone who's willing to add their name to your account. You'll still be the primary cardholder—and the credit activity will reflect on your credit report as well as the co-signer's—but the cosigner is agreeing to step in and take responsibility should you fail to make your payments.

How to Improve Your Score Before Applying for a Credit Card

Improving your credit can take time, but it's more than possible for those who are serious about turning things around. Getting a secured credit card or partnering with a cosigner can certainly help. Aside from that, there are other things you can do to increase your credit score over time. Consider doing the following:

- Always pay your bills on time. Your payment history makes up 35% of your FICO® Score. Getting in the habit of making timely payments is one of the most effective ways to improve your credit.

- Pay down high balances on revolving accounts. Remember, using more than 30% of your available credit can do harm on your scores. If you have credit accounts that are going unused, keeping them open can help you improve your overall utilization ratio, just be sure to keep an eye on them.

- Be mindful of opening new accounts. Having lots of recent credit applications and new accounts on your credit report can cause lenders to think you're a heightened lending risk.

- Periodically check your credit report. Experian lets you check your credit report and scores for free without affecting your credit score. Review your report carefully; if you spot information you believe to be inaccurate, dispute it right away. Having incorrect information removed could instantly increase your score.

The Bottom Line

Getting an unsecured credit card with a 500 credit score may prove difficult. If your application is denied, carefully read through the reasons why so that you can better position yourself to be approved in the future. In the meantime, opting for a secured credit card could be a viable workaround that also helps repair your credit. You can also check out Experian Boost®ø to add accounts such as cellphone, utility and even Netflix® payments to your credit report, which could instantly raise your FICO® Score.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Marianne Hayes is a longtime freelance writer who's been covering personal finance for nearly a decade. She specializes in everything from debt management and budgeting to investing and saving. Marianne has written for CNBC, Redbook, Cosmopolitan, Good Housekeeping and more.

Read more from Marianne