Can I Increase My Credit Limit on a Secured Credit Card?

Designed for people with poor credit or thin credit files, secured credit cards can be useful tools for building a credit history or repairing your credit. But the credit limit on a secured credit card is typically a few hundred dollars, which doesn't give you much purchasing power. If your secured card's credit limit isn't enough for your needs, you may be able to ask for a higher limit. Here's how a secured credit card limit is set and how to request an increase.

What Is a Secured Credit Card?

Secured credit cards are "secured" by a refundable deposit you make when you apply for the card. Your credit limit is generally equal to the amount of your deposit. The card issuer can use your deposit to pay your balance if you stop paying your bill. Because the deposit reduces the card issuer's risk, secured credit cards are usually easier to get than unsecured credit cards, so they can be a good fit for people with poor or no credit.

Using a secured credit card for small purchases and paying your bills on time may help you improve your credit score if the lender reports your account to credit bureaus. Once you've established a track record of on-time payments, some card issuers will convert your secured card to a regular credit card.

How Secured Credit Cards Work

Here's how to get and use a secured credit card.

- Compare secured credit card offers. Consider the card's security deposit requirements, any rewards such as cash back, fees and the annual percentage rate (APR)—the interest charged on any balance you carry from one billing cycle to the next. Find out if the card issuer reports accounts to all three consumer credit bureaus—Experian, TransUnion and Equifax. A card that reports to all three bureaus will do the most to help you build a credit history.

- Find out what happens to your deposit. How will you get your deposit back? Some card issuers automatically refund your deposit if your card converts to an unsecured card after a period of time. Others return it to you as a statement credit after several months of on-time payments. Still others won't refund it unless you close the card.

- Complete an application. The card issuer's online application will ask for information such as your name, birthdate, Social Security number, contact information, income and employment information.

- Fund your security deposit. After being approved for a secured credit card, you'll have to make your deposit. You can generally do this by transferring money from your bank account, but some issuers also accept personal checks or money orders.

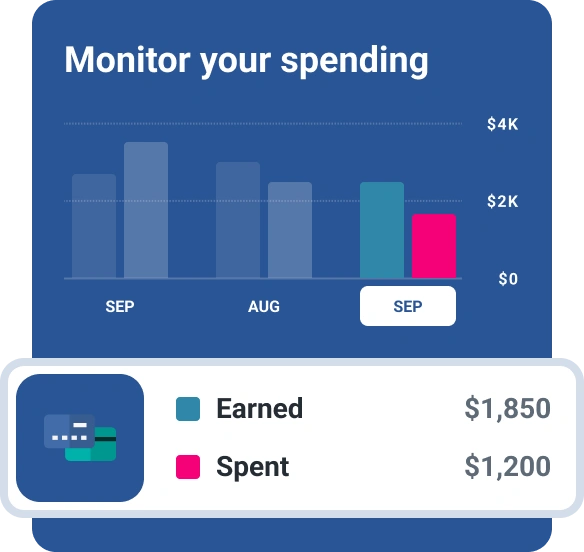

- Start using your card. A secured credit card won't help improve your credit score just sitting in your wallet. Use your secured credit card to make purchases just as you would a regular credit card. As with unsecured credit cards, aim to use less than 30% of your available credit limit. A higher credit utilization ratio can negatively affect your credit score. For a secured credit card with a $300 credit limit, that means keeping your balance below $100.

- Pay your bill on time. At the end of the billing cycle, you'll receive a bill for any purchases made during that cycle. You must make at least the minimum payment to keep your account in good standing, but you can choose to pay the statement balance, the current balance or another amount. If you make the minimum payment, any balance carried over to the next month will incur interest. On-time payment is the biggest factor in your credit score, so consider setting up autopay for your secured credit card. Your security deposit can't be used to pay your credit card bill; you'll need to pay it each month.

- Convert your card. After you've made timely payments for a certain period, such as six to 12 months, the credit card issuer may automatically convert your secured card to an unsecured card or give you the option to apply for an unsecured card. Depending on how much your credit score improves due to the secured card, you may also qualify for unsecured cards from other lenders.

How Is the Credit Limit on a Secured Credit Card Set?

The credit limit on a secured credit card is usually equal to the amount of the security deposit. However, depending on your credit score, some cards may offer credit limits that are higher than your deposit

Security deposits generally start at $200 but can range from $49 to $2,000 or more. When choosing your credit limit, consider how you plan to use the card and how big a security deposit you can afford. Lower credit limits can restrict your ability to use the card without staying below 30% of your credit utilization. Higher credit limits offer more flexibility but require a larger security deposit, which could be a stretch for your budget.

Can You Increase a Secured Credit Card Limit?

Credit card issuers may have different requirements for when you can increase a secured credit card's limit. For example, some may allow you to raise your credit limit by making an additional security deposit. Others may increase your credit limit after a certain number of on-time payments. Review the terms of your credit card agreement to see how you can get an increased credit limit.

What if your lender doesn't offer a straightforward way to raise your secured card limit? If your credit score has improved since you got the secured card, consider applying for an unsecured card with a higher credit limit.

The Bottom Line

Using a secured credit card responsibly can help you build a solid credit history or improve a poor credit score. Bringing late accounts current and paying down high-interest debt are other moves that can benefit your credit. Before applying for any credit card, check your free credit report and credit score to see where you stand.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Karen Axelton specializes in writing about business and entrepreneurship. She has created content for companies including American Express, Bank of America, MetLife, Amazon, Cox Media, Intel, Intuit, Microsoft and Xerox.

Read more from Karen