Can I Raise My Credit Score by 100 Points Overnight?

While you can't raise your credit score by 100 points overnight, there are steps you can take to improve it over time. Understanding how credit scores work and what factors influence them can help you develop a realistic plan for building better credit. Here's what you need to know about the credit rebuilding process.

Can I Raise My Credit Score by 100 Points Overnight?

It's not possible to raise your credit score by 100 points literally overnight. Credit scores are calculated based on information in your credit reports, and it takes time for changes to be reported and reflected in your score. Even if you take positive actions like paying off debt or disputing errors, creditors and credit bureaus need time to update your credit file.

How quickly your credit score can improve depends on several factors, including your starting score, your credit history and the specific actions you take. While dramatic overnight changes are unlikely, consistent positive credit behaviors can lead to meaningful improvements over weeks and months.

How Long Does It Take to Improve Your Credit Score?

There's no set timeframe for how long it will take to improve your credit score by a certain number of points. Several factors go into calculating your credit score, and some carry more weight than others. What you can do to improve these factors depends on what's in your unique credit history.

Improving your score takes time and requires patience and discipline. The sooner you start the process, though, the earlier you'll reach your goal. If your credit score is low, a few major factors may influence how long it takes to build your score:

- You're new to credit. When you're just starting to build credit, it takes at least six months of using credit to meet the criteria to receive a FICO® ScoreΘ, the credit score used by 90% of top lenders. As long as you start on a positive note, developing good credit habits will help you build your credit history and score in the coming months and years.

- You have negative information on your reports. If you've experienced bankruptcy, foreclosure, repossession or another significant negative credit event, it can take more work to improve your credit score. Establishing positive credit behaviors going forward can eventually outweigh the negative, but those items will remain on your credit reports for up to seven years or more, so it may take more time.

- You have high credit utilization. If you're using a large percentage of your available credit on credit cards, paying down balances can help improve your score. However, the impact depends on how much debt you're carrying and how quickly you can reduce it.

- You have a limited credit mix. Having only one type of credit account may limit your score potential. Adding different types of accounts responsibly over time can help diversify your credit mix, but this is a gradual process.

Learn more: How to Improve Your Credit Score Fast

What Factors Affect Your Credit Score?

There are five major factors that affect your credit scores. Even though some have more influence on your score than others, it's important to take a holistic approach in your efforts to build credit.

- Payment history: On-time payments are crucial to building and maintaining good credit. If you have late payments on your credit reports, get caught up as soon as possible. Make it a goal to pay your bills on time and in full every month. If you're worried you might miss a payment, contact your creditor as soon as possible to understand your options and discuss possible accommodations so your credit isn't affected.

- Amounts owed: The total amount you owe in debt matters because it shows lenders you're making progress on your existing accounts. This factor also focuses on your credit utilization rate, which measures the percentage of your available credit on credit cards that you're using. The lower your balance is relative to your credit limit, the better your utilization rate will be for your credit score.

- Length of credit history: The longer you've been using credit, the more data lenders have to determine how well you manage your credit accounts. Your credit score calculation also includes the average age of your accounts, so frequently opening new accounts can have a negative impact on your score.

- New credit: Every time you apply for credit, the lender will typically run a credit check to gauge your creditworthiness. This results in a hard inquiry on your credit report, which can knock a few points off your score temporarily. If you apply for multiple accounts in a short period—except when you're shopping around for a loan—it can have a compounding negative impact on your score.

- Credit mix: Being able to manage multiple types of credit, such as credit cards, auto loans, mortgages and student loans, can have a positive impact on your credit score. However, it's not wise to open several new credit accounts solely to improve your credit mix. Diversifying your credit mix often happens naturally over time.

Learn more: What Is a Good Credit Score?

How to Improve Your Credit Score

The steps required to improve credit can vary from person to person. While some may apply to you, others may not. However, here are some general guidelines that can help you increase your credit score:

- Pay all bills on time. Consider setting up automatic payments or payment reminders to avoid missing due dates. Also, get caught up on past-due payments, including charge-offs and collection accounts.

- Lower your credit utilization rate. Pay down credit card balances and keep them low relative to their credit limits. You could also request a credit limit increase on existing cards to improve your utilization rate, but avoid increasing your spending.

- Apply for credit only when necessary. Minimize hard inquiries by spacing out credit applications and taking advantage of rate-shopping windows for loans.

- Avoid closing older, unused credit cards. Even if you aren't using these accounts, they contribute to your credit history length, so it's best to avoid closing old credit cards.

- Consider becoming an authorized user. Consider asking a family member to add you as an authorized user on their credit card. If they use the card responsibly, it can help improve your credit.

- Review your credit reports for inaccuracies. It's important to regularly review your credit reports for errors. If you find anything amiss, you have the right to file a dispute with the credit bureaus.

It's difficult to determine exactly how much your credit score will improve with each of these steps because every credit profile is different. But as you develop good credit habits, you'll see positive results over time.

Tip: It's a good idea to monitor your credit score regularly to understand how your actions impact your score and to spot potential issues that could threaten your progress.

Use Other Accounts to Increase Your FICO® Score

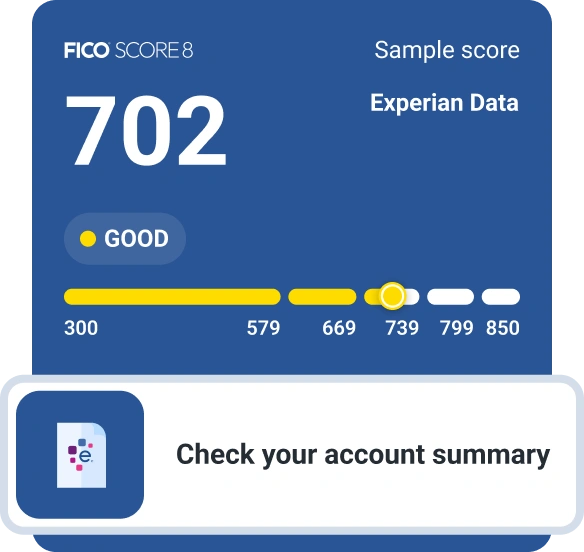

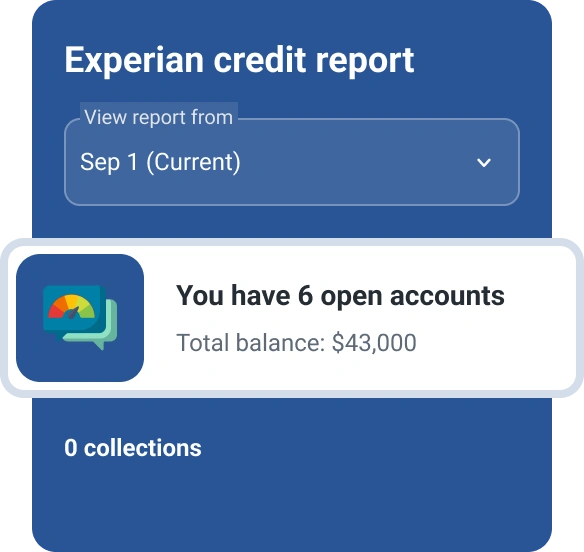

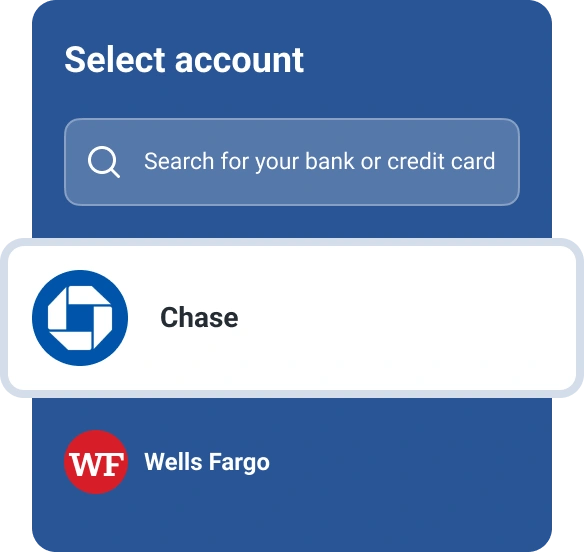

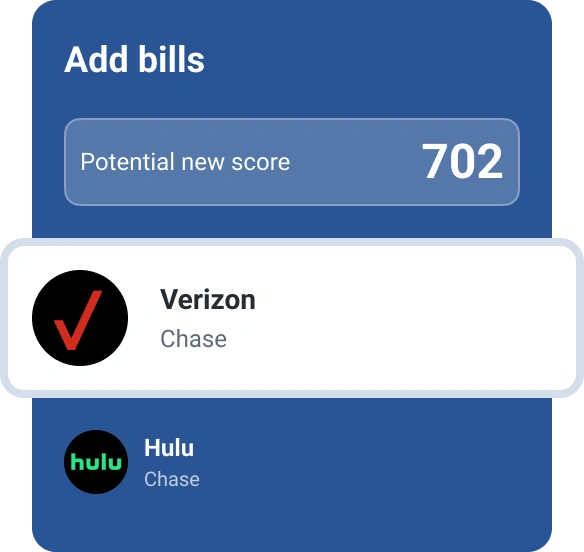

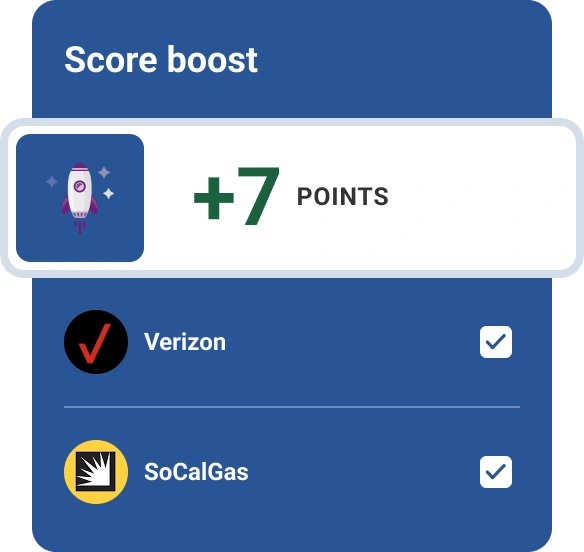

Another way to potentially increase your credit scores quickly is through Experian Boost®ø. This feature allows you to get credit for eligible rent, utility, phone, insurance and streaming payments that otherwise would not be included on your credit report. Simply connect your financial accounts that you use to pay your bills, and Experian will identify qualifying payments and add.

You'll then confirm which payments you want to add to your Experian credit report, and your FICO® Score will be updated immediately. Experian Boost could be one more quick way to improve your credit scores.

Instantly raise your FICO® Score for free

Use Experian Boost® to get credit for the bills you already pay like utilities, mobile phone, video streaming services and now rent.

No credit card required

About the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben