789 Credit Score: Is it Good or Bad?

Your FICO® ScoreΘ falls within a range, from 740 to 799, that may be considered Very Good. A 789 FICO® Score is above the average credit score. Borrowers with scores in the Very Good range typically qualify for lenders' better interest rates and product offers.

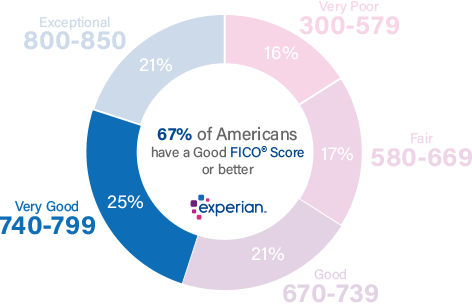

25% of all consumers have FICO® Scores in the Very Good range.

In statistical terms, just 1% of consumers with Very Good FICO® Scores are likely to become seriously delinquent in the future.

Improving your 789 Credit Score

A FICO® Score of 789 is well above the average credit score of 714, but there's still some room for improvement.

Among consumers with FICO® credit scores of 789, the average utilization rate is 10.7%.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you'll receive information about ways you can boost your score, based on specific information in your credit file. You'll find some good general score-improvement tips here.

Why a Very Good credit score is pretty great

A credit score in the Very Good range signifies a proven track record of timely bill payment and good credit management. Late payments and other negative entries on your credit file are rare or nonexistent, and if any appear, they are likely to be at least a few years in the past.

People with credit scores of 789 typically pay their bills on time; in fact, late payments appear on just 8.6% of their credit reports.

People like you with Very Good credit scores are attractive customers to banks and credit card issuers, who typically offer borrowers like you better-than-average lending terms. These may include opportunities to refinance older loans at better rates than you were able to get in years past, and chances to sign up for credit cards with enticing rewards as well as relatively low interest rates.

How to keep on track with a Very Good credit score

To achieve a 789 credit score, you're probably disciplined in your financial habits, with solid debt-management skills. You can still increase your score, however, and of course you'll want to avoid losing ground. To those ends, it's a good idea to keep an eye on your score, and avoid behaviors that can bring it down.

Factors that affect credit scores include:

Credit usage. To determine your credit utilization rate on a credit card, divide the outstanding balance by the card's credit limit, and then multiply by 100 to get a percentage. Calculate the utilization for all your cards, and then figure out your total utilization rate by dividing the sum of all your balances by the sum of all your borrowing limits (including those for cards with zero balances). You probably know credit scores will slip downward if you “max out” your credit limit on one or more cards by pushing utilization toward 100%. You may not know that most experts recommend keeping your utilization rate below 30% for each of your cards and for all your revolving accounts overall. Credit usage is responsible for about 30% of your FICO® Score.

Timely bill payments. This may seem obvious, but there's no greater influence on your FICO® Score: Late and missed payments hurt your credit score, and on-time payments benefit your score. Payment history accounts for as much as 35% of your FICO® Score.

Credit mix. The FICO® scoring system generally favors borrowers with a variety of credit, including both installment loans (e.g., mortgages and car loans, with fixed payments and finite repayment schedules) and revolving credit (e.g., credit cards, which let you borrow within a specific credit limit and pay back using variable payment amounts). Credit mix can influence up to 10% of your FICO® Score.

62% of individuals with a 789 FICO® Score have credit portfolios that include auto loan. 56% have a mortgage.

Recent credit activity. When you apply for a loan or credit card, the lender requests your credit score (and often your credit report as well) to help decide if they want to issue you credit. This, process known as a hard inquiry, typically has a short-term negative effect on your credit score. (Checking your own credit is a soft inquiry and does not impact your credit score.) Your score typically recovers from hard inquiries within a few months, as long as you keep up with your bills. Recent credit activity can account for up to 10% of your FICO® Score.

Length of credit history. Age has some rewards, and one of them may be a boost in credit score. The longer you've been using credit and paying bills, the better your credit score will tend to be, when all other factors are the same. If you're new to the credit market, there's little you can do to control this. But if you build a record of timely payments and good credit decisions, your score will tend to rise over time. Length of credit history can constitute up to 15% of your FICO® Score.

Public records can outweigh all other factors and severely lower your credit score. These entries, which can include bankruptcies, do not appear in every credit report, so they cannot be compared to other score influences on a percentage basis. But a bankruptcy, for example, can persist on your credit report for 10 years, and many lenders may refuse to do business with you for much of that time, no matter how well you manage the other behaviors that affect your credit score.

Shield your credit score from fraud

For hackers and identity thieves, people with Very Good credit scores are attractive targets. Your score could enable crooks to open and exploit sizable bogus loan or credit-card account in your name, and then disappear, leaving you to sort out the mess with the lender. To help avoid this, consider credit-monitoring and identity theft protection services. These services can alert you when they detect applications for new credit or other unexpected changes in your credit report.

Credit monitoring is also useful for tracking changes in your credit scores. It can prompt you to action in case your score starts to slip downward, and help you mark progress toward a FICO® Score in the Exceptional range (800-850).

Consumers reported $905 million in total fraud losses in 2017, a 21.6% increase over 2016 with an average of $429 lost.

Learn more about your credit score

A 789 credit score is Very Good, but it can be even better. If you can elevate your score into the Exceptional range (800-850), you could become eligible for the very best lending terms, including the lowest interest rates and fees, and the most enticing credit-card rewards programs. A great place to begin is getting your credit score to find out the specific factors that impact your score the most. Read more about score ranges and what a good credit score is.