Credit Union vs. Bank Mortgage: What’s the Difference?

If you're in the market for a new home, you'll likely finance the purchase with a mortgage. Banks and credit unions both offer home loans, but it's important to understand how they're alike and different. That's because each one has its own benefits and drawbacks. The right option for you will depend on what you're looking for in a mortgage lender.

Here's a quick overview of how a credit union and bank mortgage differ.

| Credit Union Mortgage | Bank Mortgage | |

|---|---|---|

| Ownership | Credit unions typically write mortgages and manage them for the duration of the loan term | Banks are more likely to sell your mortgage to another servicer |

| Eligibility | A credit union may have more flexible credit score requirements | Banks tend to have stricter eligibility criteria for mortgages |

| Interest rates | Mortgage interest rates tend to be lower | You can expect a higher interest rate with a bank mortgage |

| Fees | Fees are typically on the lower side when compared with banks | Banks typically charge higher mortgage fees than credit unions |

| Loan options | Your mortgage loan options may be more limited | You'll likely have a wider range of loan options |

| Customer service | Credit unions are community-based organizations that may provide more personalized customer service | Banks have a lot of account holders, so the customer service experience may feel less personal |

What Is a Credit Union Mortgage?

Credit unions are member-owned, not-for-profit financial institutions that offer all kinds of financial products. That includes checking and savings accounts, certificates of deposit (CDs), auto loans and mortgages. Like a bank mortgage, a home loan from a credit union may have a fixed rate or an adjustable rate. You'll also have to meet the credit union's eligibility criteria to get approved.

There are several different types of mortgages, and each credit union will have its own menu of options. If your application is approved, you'll pay closing costs and receive funding.

Pros and Cons of a Credit Union Mortgage

Getting a mortgage from a credit union comes with benefits and downsides. Here's an overview of what you can expect so you can make an informed decision.

Pros

-

Interest rates are usually lower. Credit unions are member-owned, so they don't have to pass their profits on to shareholders in the traditional sense. Instead, credit union members benefit by often receiving lower rates on loans, including mortgages.

-

You might pay fewer fees. Mortgage fees, which are also called closing costs, generally amount to 2% to 5% of the home sale price—but they may be lower with a credit union mortgage.

-

It may be easier to qualify. Credit unions may be more willing to work with borrowers who have less-than-perfect credit. That's because their mission is to serve their members. But the trade-off may be higher rates and fees.

-

Customer service may be more personalized. Credit unions tend to have higher customer satisfaction ratings, thanks to their member-focused structure. As a shareholder, you also have the right to vote on policies and leadership changes.

Cons

-

You must be a member to get a mortgage. You'll have to join a credit union to apply for a mortgage, and each one has its own membership requirements. You may have to work for a specific type of employer, belong to a certain labor union, or live or worship in a specific area.

-

Brick-and-mortar locations may be limited. Your credit union may not have a physical branch nearby. That might be important to you if you want quick access to in-person customer service.

-

You may have fewer loan options. Every credit union is different, but your mortgage options may be limited at a credit union. Large banks, on the other hand, will likely have a wide range of home loan options.

-

Their online account services may be a letdown. It can be tough for credit unions to compete with big banks when it comes to the online customer experience. Their website or app may feel limited.

What Is a Bank Mortgage?

Banks are for-profit financial institutions that don't require memberships. That means anyone can apply for a mortgage. Banks typically operate regionally or nationally, and you'll likely find a wide range of other financial products and services. Like a credit union mortgage, you'll need to meet a bank's underwriting standards to get approved for a home loan. Closing costs also come with the territory.

Pros and Cons of a Bank Mortgage

Banks and credit unions operate a bit differently. If you're considering a mortgage from a bank, it can be helpful to have these pros and cons on your radar.

Pros

-

More loan options: You can expect a wider variety of mortgage options from a major bank. That can include conventional loans and different government-backed mortgages.

-

Greater accessibility: Most banks have a robust network of brick-and-mortar locations. That may prove valuable if you have questions about your mortgage or need help with an issue.

-

Better online resources: Most well-known banks have user-friendly websites and intuitive apps, making it easy to make a payment, check your home equity or download important tax forms.

Cons

-

Higher interest rates: Banks tend to charge higher mortgage interest rates than credit unions. When you're borrowing hundreds of thousands of dollars, that could translate to a major cost.

-

Potentially more fees: You can also expect higher mortgage fees with a bank mortgage. Unlike credit unions, banks are for-profit organizations and don't have a member-first philosophy.

-

Stricter credit requirements: The minimum credit score to qualify for a mortgage will depend on the bank and the type of home loan you're applying for. You'll likely need a score of at least 620 for a conventional loan—or 700 for a jumbo loan.

Credit Union vs. Bank Mortgages

Is it better to get a mortgage loan through a bank or credit union? Let's unpack the main similarities and differences so you can decide for yourself.

Ownership

When you take out a mortgage, your loan will be funded by your lender—but that doesn't mean they'll keep your loan for the duration of the loan term.

- Credit union mortgages: A credit union will likely maintain the mortgage for the entirety of the loan term. In most cases, you can expect them to service your loan from start to finish, which can be a good thing if you're happy with your servicer and are used to the customer experience there.

- Bank mortgages: Banks generally write mortgages, then sell them to investors. That often includes Freddie Mac and Fannie Mae, the government-sponsored entities that buy most U.S. mortgages. Selling home loans provides more cash for banks to fund new mortgages.

Eligibility

Every financial institution has its own eligibility criteria, which you'll need to satisfy to qualify for a mortgage.

- Credit union mortgages: Credit unions tend to have looser credit score requirements when compared to large banks. Remember that most credit unions embrace a member-first philosophy. As a result, they may be more willing to look at the big picture and approve borrowers who don't have perfect credit.

- Bank mortgages: A poor credit score could stand in the way of getting a bank mortgage. That's because banks tend to require higher minimum credit scores than credit unions. Requirements vary by lender and loan type, but some may require a score of 660 or higher for a conventional loan.

Learn more: What Factors Do Mortgage Lenders Consider?

Interest Rates

Interest is tacked on to your monthly mortgage payment. The rate you pay will depend on your credit history and lender.

- Credit union mortgages: Credit unions often pass savings on to their members by way of lower interest rates on loans and higher yields on savings accounts. A lower mortgage rate could save you a significant amount of money over a 15- or 30-year loan term.

- Bank mortgages: Again, banks are for-profit financial institutions. Their main focus is generating gains—and loan interest is a primary way they do that.

Fees

Mortgage fees can include loan origination fees, application fees and more—and these charges can add up quickly during the homebuying process.

- Credit union mortgages: Credit unions have a reputation for charging fewer fees due to their not-for-profit status. Remember that closing costs generally add up to 2% to 5% of the purchase price among all lenders. If you're buying a $300,000 home, that works out to $6,000 to $15,000. Credit unions may be at the lower end of this range.

- Bank mortgages: Banks, on the other hand, are known to charge higher mortgage fees. Every lender will have its own loan processing costs, but you could pay more with a large bank.

Learn more: Can You Negotiate Closing Costs?

Loan Options

There are several types of mortgages to choose from. Some are backed by the federal government; others, like conventional loans, are not. Every lender will have its own menu of loan offerings.

- Credit union mortgages: Credit unions may have fewer mortgage options. Navy Federal Credit Union, for example, offers mortgages that cater largely to veterans and military service members.

- Bank mortgages: Banks are more likely to offer a wider selection of loan products, which may include mortgages for investment properties.

Customer Service

This is an important thing to consider when comparing lenders. If you have issues or questions regarding your loan, customer support can make all the difference.

- Credit union mortgages: Credit unions are known for offering customer service with a personal touch. That can be a big advantage if you go with a local credit union. Also, they are more likely to service your loan for its duration, which simplifies support for borrowers. Just be aware that physical branches may be limited.

- Bank mortgages: Big banks are corporate entities. That means there may be more red tape to cut through if you have any questions or concerns about your home loan. The customer service experience may feel less personal, but not always.

Should You Get a Credit Union Mortgage or a Bank Mortgage?

The right lender for you will depend on your preferences and financial situation. Having said that, you'll want to consider the following.

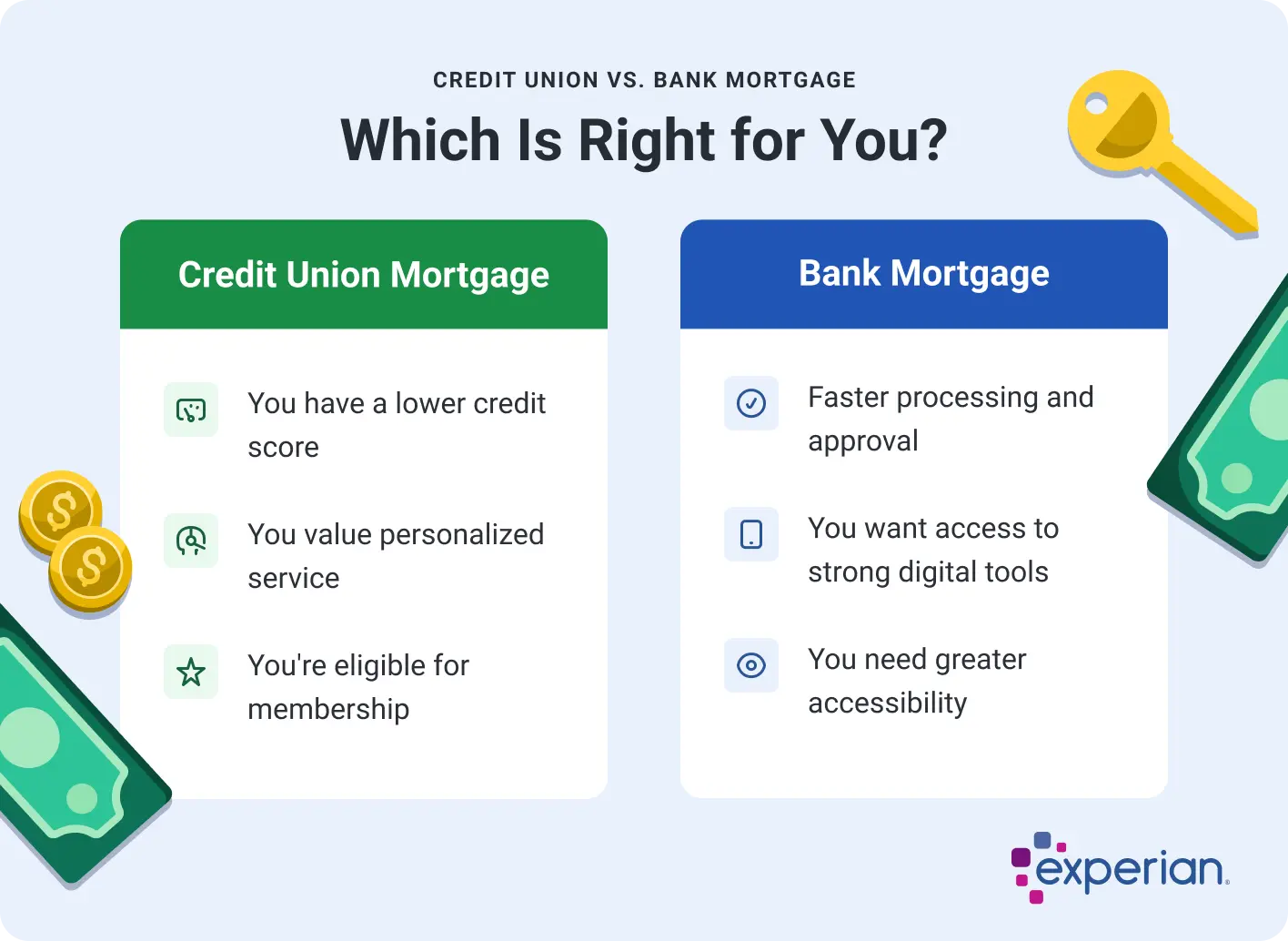

When a Credit Union Mortgage Might Be Best

- You have a lower credit score. You may be more likely to get approved for a mortgage with a credit union, assuming your financial health is otherwise strong and you have an adequate down payment.

- You value personalized service. You're looking for a local experience from a member-centered financial institution.

- You're eligible for membership. Every credit union serves a unique population. That can include everyone from veterans to school teachers to local community members. If you belong to a qualifying group, a credit union could be a great place to get a mortgage and do your everyday banking.

When a Bank Mortgage Might Be Best

- You need fast processing and approval. Most large banks are well-oiled machines. If you have all your documents ready, the mortgage approval process could move along more swiftly at a bank versus a credit union.

- You want access to strong digital tools. Banks are known for their user-friendly website and easy-to-use digital apps. That can help make your financial life a little bit easier.

- You need greater accessibility. While credit union locations may be limited, bank branches are often much more accessible. That can be valuable when applying for a mortgage and managing your loan.

How to Get a Mortgage

Whether you choose to go through a bank or a credit union, there are a few universal tips to help you get a mortgage.

- Review your credit. Your lender will consider your credit health when determining your eligibility. That includes your credit history, credit score and debt-to-income (DTI) ratio. You can check your FICO® ScoreΘ for free with Experian. It's wise to check your credit beforehand and take steps to improve your credit if necessary.

- Save a solid down payment. The amount you'll need to put down will depend largely on the type of mortgage you're applying for. It's possible to get approved for a conventional loan with a down payment as low as 3%.

- Get preapproved. Preapproval involves a hard credit inquiry, which can ding your credit score by a few points, and you'll have to provide some basic information about your income, assets and debts. If everything looks good, the lender will give you a preapproval letter stating your expected loan amount and interest rate. This can help you fine-tune how much you can afford on a house.

- Compare offers from multiple lenders. Shopping around and comparing loan amounts, interest rates and fees from several lenders can help you find the best mortgage.

Learn more: The Complete Guide on How to Get a Mortgage

Frequently Asked Questions

The Bottom Line

Banks and credit unions are two of the options homebuyers can use to get a mortgage. Each has its pros and cons, and the right choice for you will ultimately depend on what you want from a mortgage lender. If you already belong to a credit union, you might find a lower interest rate and fewer fees there. But banks typically offer more loan options and better digital resources.

No matter what you choose, knowing what's on your credit report will be an important step in the journey. You can get your FICO® Score and credit report for free from Experian, which can give you an idea of where you stand.

Curious about your mortgage options?

Explore personalized solutions from multiple lenders and make informed decisions about your home financing. Leverage expert advice to see if you can save thousands of dollars.

Learn moreAbout the author

Marianne Hayes is a longtime freelance writer who's been covering personal finance for nearly a decade. She specializes in everything from debt management and budgeting to investing and saving. Marianne has written for CNBC, Redbook, Cosmopolitan, Good Housekeeping and more.

Read more from Marianne