Home Equity Loan vs. HELOC: What’s the Difference?

Quick Answer

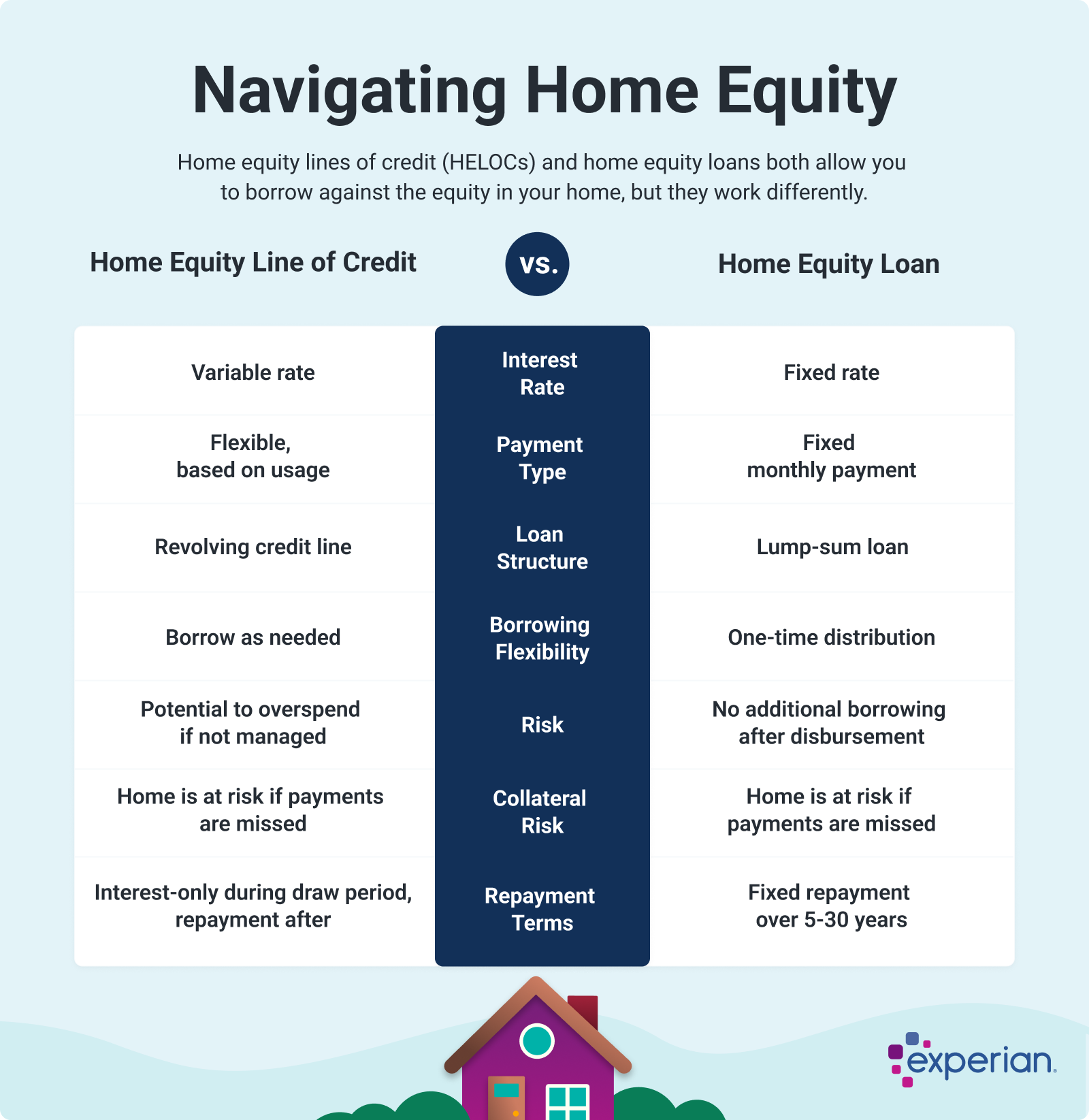

Home equity loans and HELOCs are two options to tap into your home’s equity for cash. With a home equity loan, you receive the funds in a single, lump-sum payment, while a HELOC allows you to draw money as needed, up to your credit limit.

The ability to access cash from your home's equity is just one of many advantages of being a homeowner. Homeowners can use home equity loans and home equity lines of credit (HELOCs) when renovating their homes, paying for higher education, consolidating debt or just about any other purpose.

A home equity loan is a second mortgage that provides you with a one-time lump-sum payment at closing. You repay the loan with a fixed interest rate and monthly payments that stay the same throughout the term.

A HELOC is another type of second mortgage similar to a home equity loan, except it is a revolving line of credit. You can borrow from the credit line as needed up to your credit limit and repay only what you use, typically with a variable interest rate. Here's more on how home equity loans and HELOCs compare, plus how to pick the best option for you.

What Is Home Equity?

Home equity is the value of your property minus what you owe on your mortgage and any other liens. In other words, it's the amount of your home you actually own. You begin building home equity with your down payment when you purchase your home, and it continues to grow as you pay down your mortgage, the market value of your home increases or both.

Example: Say you purchased a $250,000 home with a $50,000 down payment. You now have $50,000 equity—the portion of your home's value you own outright. Over time, you pay your loan balance down to $150,000 while your home value increases to $300,000. In this case, your home equity would now be $150,000: the difference between your home's $300,000 market value and your remaining loan balance of $150,000.

Two common ways to access the available equity in your home are with a home equity loan or a HELOC. While they serve a similar purpose, they're structured differently, affecting how you receive funds and repay the loan.

Learn more: Should You Tap Into Your Home Equity?

HELOCs vs. Home Equity Loans

Deciding whether to use a home equity loan or HELOC may come down to how you intend to spend the money and how you prefer to pay it back. Here are a few situations where a home equity loan could be more beneficial and others where a HELOC might be more suitable.

Consider a home equity loan if:

- You need a lump sum of money upfront for a substantial, one-time expense, such as a home addition or a child's tuition.

- You value the predictability and stability of fixed interest rates and equal monthly payments.

- You like knowing the amount of interest you'll pay from the start.

- You're confident you won't need additional funds after the initial loan disbursement.

Consider a HELOC if:

- You're a DIYer or house flipper who wants to draw on funds when needed without paying for it before then.

- You like borrowing cash on a revolving basis, like using a credit card.

- You want to minimize interest charges by keeping your withdrawals small and paying down your balance before withdrawing funds again.

- You like the option to make interest-only payments during the draw period.

What Is a Home Equity Loan?

A home equity loan is a type of loan that allows you to tap into your home's equity for cash. You may want a home equity loan to help you achieve a financial or lifestyle goal, such as consolidating high-interest debt or renovating your kitchen.

Just like your primary mortgage, a home equity loan is secured by your home. As a result, home equity loan rates are often lower than other credit alternatives. However, using your home as collateral comes with risk since your lender can seize your home if you can't pay back the loan.

How Home Equity Loans Work

With a home equity loan, you receive your funds as a single upfront payment. Then, you'll need to repay the loan in equal monthly installments with fixed interest over a loan term ranging from five to 30 years.

Lenders generally limit home equity loan amounts to 75% to 85% of your total equity (though some may go higher).

Example: If you have $150,000 in home equity, you may be eligible to borrow between 75% to 85% of that equity. That comes out to $112,500 to $120,000.

How to Get a Home Equity Loan

You'll need to meet several common lender requirements to get a home equity loan. Focus on these key qualifications:

- Adequate home equity: Before applying, make sure you have at least 15% to 20% equity in your home. You'll likely need to submit a home appraisal to your lender to verify sufficient equity to qualify for the loan.

- Minimum credit score: You may qualify for a home equity loan with a FICO® ScoreΘ of at least 680, but some lenders like to see higher scores. Certain lenders may approve a lower score if you have excellent equity, low debt or substantial income.

- Outstanding payment history: Like with other loans and credit, lenders strongly consider your creditworthiness when deciding whether to approve your loan. Since your payment history shows how well you manage credit, you're more likely to get a home equity loan with a consistent record of on-time payments than a spotty payment history.

- Proof of income: Be prepared to provide W-2s, income tax returns and other documents that prove you have reliable income sufficient enough to comfortably cover your home equity loan payments each month.

- Low DTI: Lenders strongly consider your debts and income to help determine the likelihood that you'll repay the loan. They measure your debt load by calculating your debt-to-income ratio (DTI)—the percentage of your gross monthly income that goes toward your monthly debt obligations. The maximum DTI most lenders allow is 43%.

Pros and Cons of a Home Equity Loan

A home equity loan can help you access cash at a lower interest rate, but these loans also come with downsides you must consider first.

| Pros of a Home Equity Loan | Cons of a Home Equity Loan |

|---|---|

| Fixed interest rates remain stable throughout the term | Fixed rates prevent benefiting from future rate drops |

| Lower interest rates compared to personal loans | Must refinance to get a lower interest rate |

| Fixed loan amount may help prevent impulse spending | Can't borrow additional funds without a new loan |

| Fixed monthly payments make budgeting easier and more predictable | Risk losing your home if you can't repay your loan |

| Potential for tax deduction if used for home improvements | Closing costs and fees can range from 2% to 5% of the loan amount |

What Is a Home Equity Line of Credit (HELOC)?

A HELOC is a revolving line of credit that typically lets you borrow up to 85% of your home equity. But unlike a home equity loan that distributes funds in a single lump-sum payment, a HELOC works like a credit card. You can draw funds when you need them up to your credit limit and use them to pay for home repairs or renovations, tackle high-interest debt or cover other large expenses.

Many homeowners prefer the flexibility of a HELOC over other loans or credit products. They're ideal when paying for a home improvement project as they can make multiple withdrawals as expenses arise. You might prefer borrowing strictly when you need funds without taking a single large payment all at once. However, repayment can be challenging depending on interest rates and the amount you borrow.

How HELOCs Work

Most HELOCs feature variable rates and are structured into two periods:

- Draw period: As its name suggests, this period, which typically lasts 10 years, is when you can borrow money on your credit line. Payments are often for only the interest on the loan during the draw period, though some lenders may require you to pay a portion of the principal. Once the draw period ends, you may no longer withdraw funds.

- Repayment period: When the draw period ends, the HELOC moves into the repayment period, which usually lasts 20 years. You'll now make larger payments that cover both principal and interest. Some lenders require a large balloon payment to pay off the remaining loan balance. Knowing the repayment terms upfront is critical to help you avoid any surprises down the road.

HELOCs also differ from home equity loans because they usually offer variable interest rates that may adjust monthly. Each month, your lender will add a margin to a fluctuating index, like the prime rate, to calculate your interest rate. As the index rate rises or falls, so does your interest rate.

How to Get a HELOC

Getting a HELOC is much like qualifying for a home equity loan and comes with many of the same requirements. Here's a breakdown of what you'll need to qualify for a HELOC.

- Acceptable home equity: HELOC lenders usually require you to obtain a professional appraisal to get an accurate estimation of your home's value. They'll compare this value against your outstanding balance and other liens to calculate how much equity you have in the home. Generally, you must have 15% to 20% home equity to qualify for a HELOC.

- Strong credit: Minimum credit score requirements vary from one lender to another. Most look for credit scores of 680 or higher, but the higher your score, the better.

- History of consistent on-time payments: On top of your credit score, lenders will also review your credit report to see if you pay your credit and loan accounts on time. If there are any recent late payments on your credit report, it could harm your odds of approval.

- Reliable income: Your HELOC application will require you to provide details about your income from your job and other sources. Before applying, gather documents that support your income claims, such as recent pay stubs, W-2s and tax returns. Ask your lender which documents they need so you can collect them in advance and avoid any processing delays.

- Low debt-to-income ratio: Lenders gauge your ability to repay a new line of credit, in part, by reviewing your debts against your income. Specifically, your DTI should be below 43%. In other words, your total monthly debt payments shouldn't account for more than 43% of your gross monthly income.

Pros and Cons of a HELOC

Weighing the benefits and downsides of a home equity line of credit could help you decide if it's your best option to achieve your financial goals.

| Pros of a HELOC | Cons of a HELOC |

|---|---|

| Lower interest rates compared to most unsecured loans | Variable interest rates can increase and raise your monthly payments |

| Borrow only what you need during the draw period | Your home is used as collateral and you risk losing it if you default |

| Flexible repayment options, like interest-only payments or introductory rates | Reduces the equity you've built in your home |

| Access to funds over a 10-year draw period | Lenders can reduce or freeze your credit line if your home value drops or finances change |

| Option to refinance after the draw period ends | Payments can significantly increase when you start repaying the principal, and you could face a balloon payment |

Personal Loans: An Alternative Option

While home equity loans and HELOCs are popular options to access cash quickly, they're not for everyone. Using your house as collateral carries a significant risk—namely, that your lender could foreclose on and take possession of your home if you can't keep up with your payments.

A personal loan could give you the money you need without using your home as collateral and risking foreclosure. Loan amounts typically range from a few hundred dollars to $100,000, which you can repay with a fixed interest rate over a term from one to seven years. As an unsecured loan, interest rates tend to be higher than those for home equity lending options.

Depending on your credit, income and other factors, you may qualify for interest rates between 8% and 36%. As with home equity loans and credit lines, your lender could charge an origination fee ranging from 1% to over 10% of the loan amount, but shop around because some lenders don't charge origination fees.

Bolster Your Credit Before Applying for a Loan

Home equity loans and HELOCs are two options that could help you get cash from your home's equity. Deciding which one benefits you the most depends on your plan to use and repay the funds.

Whether you go with a home equity loan, HELOC or another type of credit or loan, a good credit score can help you secure lower interest rates and favorable terms. Before proceeding, check your credit report and FICO® Score for free with Experian and take steps to improve your credit score if needed.

Curious about your mortgage options?

Explore personalized solutions from multiple lenders and make informed decisions about your home financing. Leverage expert advice to see if you can save thousands of dollars.

Learn moreAbout the author

Tim Maxwell is a former television news journalist turned personal finance writer and credit card expert with over two decades of media experience. His work has been published in Bankrate, Fox Business, Washington Post, USA Today, The Balance, MarketWatch and others. He is also the founder of the personal finance website Incomist.

Read more from Tim