How Does Credit Work?

Quick Answer

Credit is an agreement between you and a lender to borrow money that you’ll repay later. Credit can also refer to your individual credit history, which is used to assess your creditworthiness.

Credit is an agreement between you and a lender allowing you to obtain certain goods or services for which you'll pay at a later date or over time, usually with interest.

On the other side of the credit coin, the term credit can refer to your individual credit history, which lenders typically consider when you apply for different forms of credit. Understanding how the two facets of credit interact can help you make the most of your financial plan.

What Are the Types of Credit Accounts?

There are several different types of loans and credit cards you can use to accomplish your financial goals, but they all generally fall under two umbrellas: installment credit and revolving credit.

Here's how installment and revolving credit work:

| Installment Credit | Revolving Credit | |

|---|---|---|

| Definition | Installment credit provides you with a lump-sum amount, which you'll repay in regular installments over a fixed period. | Revolving credit allows you to borrow up to a certain limit, pay it back and borrow again. |

| Examples | Loans, including mortgages, auto loans, student loans and personal loans | Credit cards, lines of credit |

What Is a Credit Report?

A credit report is a history of your dealings with credit. If you've used credit, you likely have three credit reports, one from each of the three national credit reporting agencies: Experian, TransUnion and Equifax.

Your credit report lists several important details about your dealings with creditors and other entities that furnish data to the credit bureaus, including:

- Personal information: In this section, you'll find information you've provided to creditors when applying for credit. This includes your name and any aliases and past names you've used, current and previous addresses and phone numbers, your date of birth and current and previous employers.

- Credit accounts: Also called tradelines, these entries include important details about accounts you've opened and closed in the recent past. Information may include open and close dates, original and current loan balances, monthly payment amounts and payment history.

- Collections: If you've defaulted on a debt, the creditor may sell it to a collection agency, which may report the past-due debt to the credit bureaus as a separate account.

- Inquiries: When a company reviews your credit report—with or without your authorization—it'll result in a hard or soft inquiry. In this section, you'll be able to see which companies have run inquiries on your credit reports. It's important to note that soft inquiries, which can occur without your permission or knowledge, won't impact your credit scores.

- Public records: If you file for bankruptcy, the public record will show up on your credit reports and remain there for up to 10 years from the filing date.

How Does Credit Reporting Work?

The national credit reporting agencies collect information from lenders who report it. For example, if you have a credit card, it's likely that your card's issuer reports your account activity to one or more credit reporting agencies once a month.

The agencies then collect and organize the information into tradelines. Depending on the type of credit, you may see several different pieces of data, including:

- Recent payment history

- Monthly payment

- Balance

- Original loan amount

It's important to note that institutions with which you have a credit relationship—or a non-traditional credit relationship, such as with a landlord or utility company—aren't legally required to report account information to the credit reporting agencies.

As a result, not all credit activity helps improve your credit history. Most banks, credit unions and other lenders, however, report to the agencies regularly.

How Do I Get My Credit Report?

You can get a copy of your credit reports from all three credit bureaus for free at AnnualCreditReport.com on a weekly basis. If you want more frequent access to your credit reports, however, you can typically get it from a free or paid service.

For example, Experian offers free access to your credit report anytime, along with real-time alerts when changes are made to your report, making it easier to keep track of your credit profile.

Learn more: Understanding Your Experian Credit Report

What Is a Credit Score?

Your credit score is a three-digit number that provides you and others with a snapshot of your overall credit health.

While there are many different types of credit scores, the most widely used scoring models are the FICO® ScoreΘ and the VantageScore®, both of which have a range of 300 to 850. In general, a higher credit score indicates that you manage your credit relationships responsibly.

How Is a Credit Score Calculated?

Credit scoring companies use proprietary algorithms to evaluate your credit report information and calculate a score. As such, it's impossible to know exactly how your credit score is calculated.

That said, FICO and VantageScore provide a list of factors they use to determine your score, along with guidelines for how much influence each factor has.

| FICO® Score | VantageScore |

|---|---|

|

|

Reviewing each scoring factor can help you get a better understanding of your credit scores.

- Payment history: The most influential factor in both credit scoring models, payment history shows your ability to make on-time payments and avoid delinquent and collection accounts.

- Amounts owed: With FICO, this factor includes the total amount you owe, as well as your credit utilization rate, which is the percentage of available credit you're using on each credit card, as well as across all of your credit card accounts. With a VantageScore credit score, it's broken up into credit utilization, balances, recent credit and available credit.

- Length of credit history: This element takes into account both how long you've been using credit in general and the average age of all your accounts. Your length of credit history is one component of your depth of credit with VantageScore.

- Credit mix: This credit factor considers the different types of credit accounts you have, such as credit cards, student loans, mortgage loans, auto loans and more. Your credit mix is incorporated into your depth of credit with VantageScore.

- New credit: Every time you apply for credit and a creditor runs a hard inquiry on your report, it could knock a few points off your credit score. Your recent credit also looks at how many accounts you've opened recently.

Learn more: What Affects Your Credit Scores?

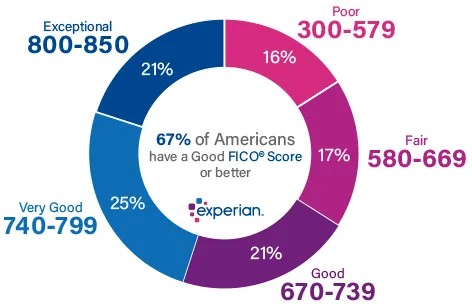

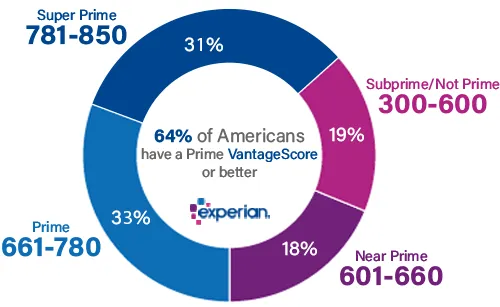

What Is a Good Credit Score?

A good credit score is 670 to 739, according to the FICO scoring model, and 661 to 780, according to VantageScore. Scores higher than these are considered exceptional (FICO) or excellent (VantageScore). Having good credit can open a lot of opportunities when it comes to getting credit, as well as in other areas of your financial life.

Why Is Credit Important?

For most consumers, building a solid credit history is an important step in establishing financial security. More specifically, here are the different ways a solid credit history can help you:

- Better access to affordable financing: Not only will you have more credit options, but you'll also have improved odds of securing favorable interest rates and fees when you borrow money.

- Potential for lower insurance rates: Many auto and homeowners insurance carriers use a credit-based insurance score to calculate your premiums. While they typically won't use poor credit as the sole reason to hike your rate, it could be a factor if there are other areas that need improvement, such as your driving record.

- Reduced chance of needing a utility deposit: When setting up a new account with a utility company, you may be required to put up a security deposit if your credit score is low or your credit history is limited. Having good credit can eliminate that requirement.

- Better odds of securing a lease: When you apply for an apartment, condo or home lease, the landlord may review your credit reports and credit score as part of their evaluation of prospective tenants. Having good credit means you're more likely to pay rent on time, resulting in an edge over other applicants with less-than-stellar credit.

- Improved chance of getting certain jobs: Some employers may run a credit check when you apply for a job, especially if the position involves access to company funds.

Learn more: Can You Live Without Credit?

How to Apply for Credit

Whether you're applying for a loan or a credit card, the application process can vary slightly by type of credit and lender. In general, though, here are some steps you can take to evaluate all of your options and ensure you get the best offer available:

- Check your credit score. Before you apply for credit, it's important to know where you stand. Checking your credit score is the simplest way to gauge your creditworthiness.

- Review your credit reports. If your credit score needs some work, take some time to review your credit reports to pinpoint which areas need some attention. If your financing need isn't urgent, consider taking time to improve your credit based on what you find in your reports.

- Evaluate your options. Depending on your situation, you may be considering different types of credit. For example, if you want to consolidate debt, you may consider a balance transfer credit card, personal loan, home equity loan or home equity line of credit. Research and weigh each option carefully to determine which one is best suited for your situation and needs.

- Shop around. Once you've decided on the type of credit you want, shop around and compare offers from multiple lenders. Depending on the type of credit, you may be able to get prequalified without any impact on your credit score, allowing you to compare interest rates, fees and other terms with no commitment.

- Submit an application. After you compare your options, choose the lender that offers the best deal for your needs and goals. In most cases, you can submit an application through the lender's website, but some financial institutions may also allow you to apply over the phone or in person. You'll typically need to provide information about yourself, your financial situation and your desired terms. Some loan types and lenders may also require documentation to prove your identity, income and residence.

- Accept the loan. With credit cards, your account will typically be opened immediately upon approval. If you're applying for a loan, however, you should be able to review the loan terms before accepting the agreement.

How to Build Credit

Establishing a solid credit history can take time, effort and a lot of patience. Fortunately, knowing what goes into your credit score can give you ideas on how to build credit. Here are some of the steps you can take:

- Keep track of your credit score and reports. It's a good idea to monitor your credit score and reports regularly to make sure everything is running smoothly. If you notice a sudden drop in your score, it's best to address it sooner than later. If you find inaccurate information on your reports, you have the right to dispute it with the credit bureaus.

- Use credit regularly. It can be difficult for lenders to know how responsible you are with credit if you never use it. In fact, FICO requires that you have credit-related activity in the past six months to even qualify for a score.

- Pay on time. Making your payments on time every month is essential to building credit, so make that a goal. If you've missed a payment, you'll typically have 30 days before it gets reported, so get caught up quickly. The longer a loan or credit card bill goes unpaid, the more damage it will do.

- Keep your credit card balances low. Credit cards are excellent tools for building credit because as long as you pay off your bills on time and in full each month, you can establish a history without ever paying interest. But if you rack up a high balance, it could be a sign that you're overextended financially. Even if your credit limit is only a few hundred dollars, try to keep your utilization rate as low as possible.

- Borrow wisely. Applying for multiple loans or credit cards in a short period can hurt your credit, and taking on too much debt can make it more difficult to keep up with your payments. As a result, it's a good idea to avoid borrowing unless you absolutely need to. And before you apply, make sure you can afford the monthly payments associated with the new account.

- Get credit for non-traditional payments. Experian Boost®ø is a free feature that allows you to add certain bills to your Experian credit file that aren't traditionally included in credit reports. Eligible bills include rent, utilities, cellphone, insurance and even some streaming subscriptions.

- Ask for help. If your credit score is in poor shape or you have a limited history, consider asking a loved one for help. Options include adding you as an authorized user to one of their credit cards or cosigning a loan to help you secure a lower interest rate.

If you're just getting started with building credit, consider credit options that are designed for people in your situation. Examples include secured credit cards, debit-credit hybrid cards and credit-builder loans.

Learn more: How to Build Credit

Frequently Asked Questions

It's Never Too Late to Work on Your Credit

Building or rebuilding a strong credit history can take time, but the best time to get started is now. If you have negative items on your credit reports, their impact can diminish over time, especially as you add new, positive information.

As you work on your credit, Experian's free credit monitoring service can help you stay on top of your goal and track your progress. While it may take time to get to where you want to be, improving your credit score could save you thousands of dollars on future credit opportunities.

What’s on your credit report?

Stay up to date with your latest credit information—and get your FICO® Score for free.

Get your free reportNo credit card required

About the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben