What Is Life Insurance?

Quick Answer

Life insurance is a contract that pays a financial settlement to your beneficiaries if the policyholder dies with the contract in force. Some kinds of life insurance also provide financial benefits while the policyholder is alive.

Life insurance is a contract that pays a financial settlement to beneficiaries if the policyholder dies with the policy in force. The payout from your life insurance policy can help support your family financially after you're gone, and some types of life insurance even offer financial benefits during your lifetime.

What Is Life Insurance?

Life insurance is a contract with an insurance company that provides a financial payout called a death benefit to your beneficiaries if you die while your policy is in force. This can help protect your loved ones financially when you're no longer there. In addition to the death benefit, some kinds of life insurance build cash value you can access during your lifetime.

Learn more: How to Buy Life Insurance

How Does Life Insurance Work?

Life insurance policies work similarly to other insurance policies, including homeowners and auto insurance: You pay an ongoing premium for a policy that provides specific coverage. In the case of life insurance, your coverage kicks in when you die. As long as the cause of your death is covered, the policy's payout is distributed to the beneficiaries named in your life insurance policy.

These are the key parts of a life insurance policy:

- Insurer: A company that sells life insurance.

- Insured: The person whose life is insured.

- Death benefit: Also called a settlement or payout, the death benefit is the money the insurer pays to the beneficiary if the insured dies with the policy in place.

- Claim: Beneficiaries must file an insurance claim to receive the death benefit. They can typically choose to receive funds in installments or as a lump sum.

- Beneficiary: The person or legal entity (such as a trust or charity) chosen to receive the death benefit. A life insurance policy can have more than one beneficiary (for example, the insured's adult children).

- Premium: The cost of life insurance, which can usually be paid monthly, quarterly, semiannually or annually.

- Term: The length of time the policy remains in force (assuming you keep paying your premiums). You choose the term when you buy the policy.

- Cash value: Some kinds of life insurance accumulate cash value in addition to the death benefit. You may be able to withdraw money from the policy's cash value, borrow against it or use it to pay your premiums.

- Rider: You can often add extra benefits to a life insurance policy by purchasing a rider at additional cost. For example, you might choose a rider that waives premiums if you become disabled.

When you sign up for a policy, you select the amount of death benefit you want and pay premiums on an ongoing basis. If your premiums are paid up and your policy is in force when you die, the insurance company pays the death benefit to your beneficiaries.

Learn more: Life Insurance Terms You Need to Know

Types of Life Insurance

The two main types of life insurance are term life insurance and permanent life insurance.

Term Life Insurance

Term life insurance lasts for a certain period, such as one, five, 10, 20 or 30 years. You select the term when you buy the policy; premiums usually stay the same for the entire term. When the term ends, your policy expires. At this point, you may be able to renew the policy or convert it to permanent life insurance, or you may have to buy a new policy to maintain coverage.

People usually buy term life insurance to protect their families financially during a certain life stage. For example, if you and your spouse have a 30-year mortgage, you both might buy 30-year term life insurance policies to cover the mortgage if either one of you dies.

Group Life Insurance

Group term life insurance is life insurance offered to members of a group, such as employees at a company or members of an organization. It usually provides a limited amount of coverage, perhaps $10,000 or $25,000. Group term life insurance typically costs less than buying the same amount of life insurance on your own, and the organization or employer usually pays at least part of the premiums.

Employer-provided group term life insurance usually ends if you leave the company, although you may have the option to convert it to individual coverage.

Voluntary or Supplemental Life Insurance

Employers who offer group term life insurance sometimes offer voluntary or supplemental life insurance as well. This gives you the option to buy additional life insurance to supplement your group term policy, typically paying via payroll deductions.

Tip: Supplemental life insurance can be useful if you can't qualify for individual life insurance due to your medical history.

Permanent Life Insurance

Permanent life insurance lasts your whole life or up to age 99, depending on your policy. It is much pricier than term life insurance, costing up to 10 times as much, according to Guardian Life. Permanent life insurance not only offers lifetime protection, but also builds cash value. When the cash value reaches a certain amount, the policyholder can withdraw from it, borrow against it or use it to pay your premiums. Withdrawing or borrowing against the cash account reduces the amount of the death benefit.

There are several variations of permanent life insurance.

Whole Life Insurance

Whole life insurance is the most basic kind of permanent life insurance (the terms are sometimes used interchangeably). A whole life policy's cash value grows at a guaranteed interest rate; some policies also pay dividends. The policy premiums and death benefit amount can't be changed.

Learn more: Which Is Better: Term or Whole Life Insurance?

Universal Life Insurance

Universal life insurance is permanent life insurance whose cash value typically grows at a money market interest rate. There's also indexed universal life insurance, where the cash value is based on the performance of a stock or bond index that you choose. Both types of universal life insurance may offer higher cash value returns than whole life insurance but are more complex to manage. Universal life insurance is sometimes called adjustable life insurance, because some policies give you the option to adjust your premiums and death benefit.

Variable Life Insurance

Variable life insurance is permanent life insurance that doesn't guarantee cash value returns. Instead, you can select different investment options for the cash part of your policy. You could earn higher returns than with whole life or universal life, but you could also lose money, and poor investment choices may even reduce your death benefit.

Variable Universal Life Insurance

Variable universal life insurance is permanent life insurance that combines aspects of variable and universal life insurance. You can select your own investment options for your cash and can adjust your death benefit and premium amounts.

Learn more: Why Is Whole Life Insurance More Expensive Than Term Life?

Final Expense Life Insurance

Final expense insurance is permanent life insurance that usually doesn't require a medical exam. It's sometimes called funeral insurance or burial insurance because the death benefit is intended for end-of-life expenses, although it can be used for any purpose. Death benefits generally range from $5,000 to $20,000.

No-Exam Life Insurance

If you want to avoid a medical exam, consider no-exam life insurance. You'll typically need to answer some questions about your health and medical history, though. No-exam life insurance comes in a few forms:

- Simplified issue life insurance requires checking your medical records and generally offers death benefits ranging from $25,000 to $300,000. It can be a term or permanent policy.

- Guaranteed issue life insurance typically offers coverage of $25,000 or less and usually costs more than simplified issue coverage. (Final expense life insurance is one kind of guaranteed issue life insurance.)

- Instant life insurance can be purchased online and is typically issued within 48 hours. It's generally a term life insurance policy. Death benefits usually max out at $1 million.

Tip: Instant life insurance can be convenient, but if you're healthy, it's generally much less expensive to buy standard term life insurance that requires a medical exam, which typically takes less than 30 minutes.

Summary of Types of Life Insurance

| How It Works | Cash Value? | Relative Cost | Best For | |

|---|---|---|---|---|

| Term life insurance | Coverage for a set term and policy expires at end of term unless renewed/converted | No | Lowest | Replacing income during high-expense years (mortgage, raising kids) |

| Group life insurance | Employer/association policy; limited death benefit, coverage ends when you leave the job/group | No | Very low/often free | Starter protection |

| Voluntary/ supplemental life insurance | Extra life insurance bought through work via a payroll deduction to boost group term limits | No | Low | Employees who need more coverage or can't qualify individually |

| Permanent life insurance | Lifetime coverage with cash value that the policyholder can withdraw, borrow against or use to pay premiums | Yes | High | Those wanting cash value they can tap into |

| Whole life insurance | Lifetime coverage with cash value that grows at a guaranteed interest rate; fixed premiums | Yes | High | Those wanting cash value and a fixed premium |

| Universal life insurance | Lifetime coverage with adjustable premiums/death benefit | Yes (variable growth) | High | Those wanting flexible payments and potential for higher cash growth |

| Variable life insurance | Permanent policy with investment subaccounts you choose; returns and death benefit vary with market | Yes (market-based) | High | Investors seeking higher returns and comfortable with market risk |

| Variable universal life insurance | Combines variable investing with universal flexibility; you can adjust premiums/death benefit and pick investments | Yes (market-based) | High | Savvy investors who want maximum flexibility and growth potential |

| Final expense life insurance | Permanent policy, usually no medical exam and a small death benefit | Yes (small) | Moderate | Seniors covering funeral or other end-of-life costs |

| No-exam life insurance | No medical exam, but there may be medical questions. Generally a term or permanent policy | Varies | Higher than standard | Applicants with health issues |

How Much Does Life Insurance Cost?

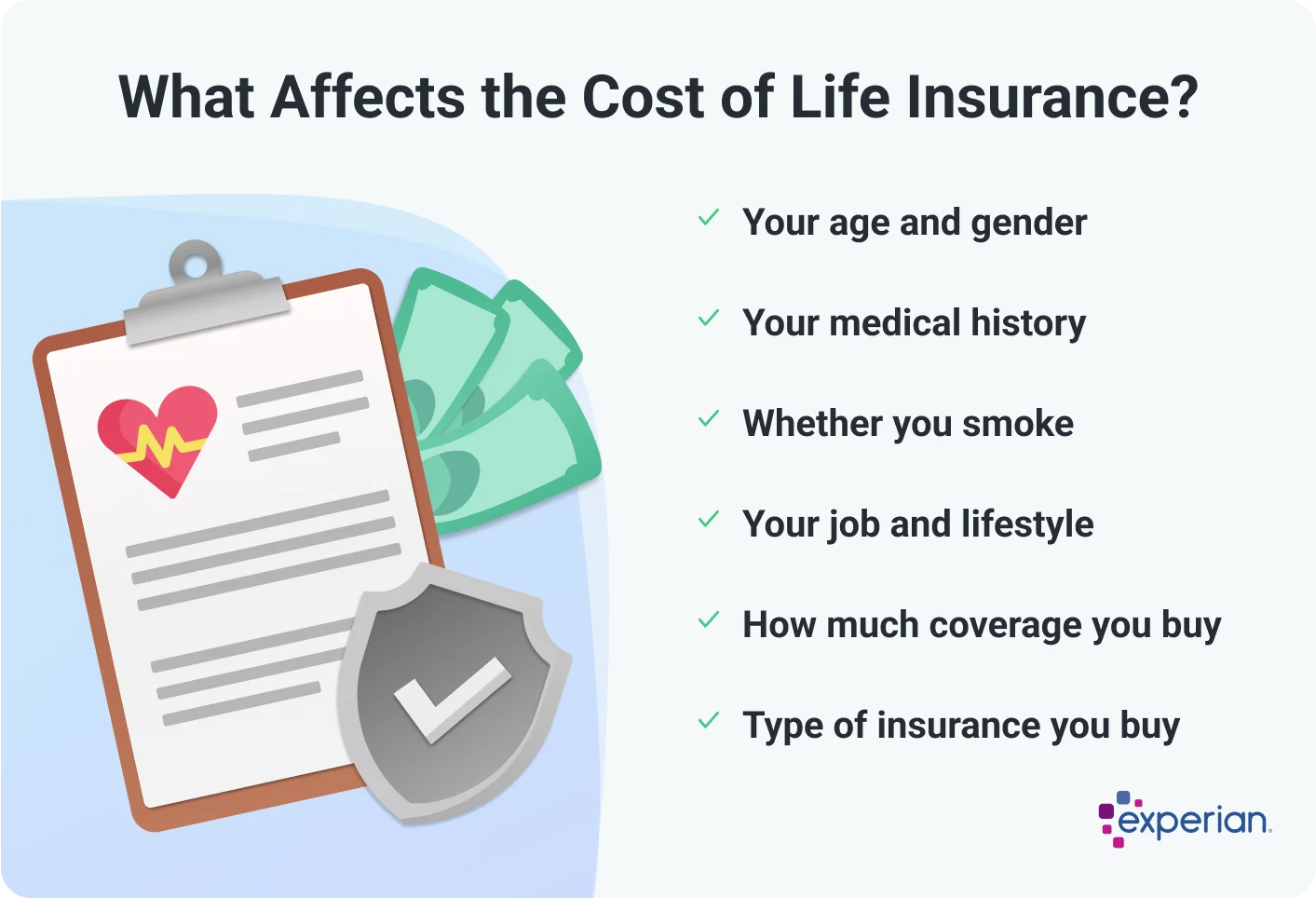

The cost of life insurance can vary depending on several factors, including:

- Your age: In general, you'll pay less for life insurance if you buy it when you're young. For example, average premiums for a 20-year, $500,000 term life insurance policy are $21.57 per month for a 25-year-old female nonsmoker but $78.81 per month for a 50-year-old female nonsmoker, according to Policygenius.

- Your gender: Women usually pay less for life insurance because they have a longer life expectancy than men. A 20-year, $1 million term life insurance policy costs an average of $43.58 per month for a 35-year-old female nonsmoker, while a 35-year-old male nonsmoker pays an average of $54.07, according to Policygenius.

- Your health and family medical history: Those in poor health or with a family history of issues such as cancer or diabetes may pay more for health insurance.

- Whether you smoke: Smokers typically pay much more for life insurance than nonsmokers. On average, according to Policygenius, a 30-year-old man buying a 20-year, $500,000 term life policy will pay $29.61 per month if he doesn't smoke and $82.60 if he smokes.

- Your job and lifestyle: Risky occupations such as firefighting or thrill-seeking hobbies like skydiving usually mean higher life insurance premiums.

- How much coverage you buy: The larger your death benefit, the more you'll pay. A 30-year-old nonsmoking male buying a 20-year term life insurance policy pays an average of $19.53 per month for $250,000 in coverage and $54.07 for $1 million in coverage, according to Policygenius.

- The kind of life insurance you buy: Permanent life insurance costs up to 10 times more than term life insurance.

Tip: Because life insurance premiums typically stay the same throughout the policy term, you can keep costs down by buying life insurance when you're young and healthy.

Learn more: How to Save Money on Life Insurance

Do I Need Life Insurance?

You may want to buy life insurance if:

- You have a spouse, children or elderly parents who depend on your income or care

- You're the only wage earner in your family

- You're a stay-at-home parent who handles child care and housekeeping tasks

- You own a business and want to provide funds so your partners or family members can handle business expenses or buy each other out

- You want to leave money to a cause or organization

Conversely, you may not need life insurance if you're young and single with no dependents.

Learn more: Is Life Insurance Worth It?

Benefits of Life Insurance

Life insurance offers many benefits for you and your loved ones.

- Replace income: Life insurance can help replace your wages after you're gone.

- Cover child care and related costs: Life insurance can cover the cost of child care and other services a stay-at-home parent formerly provided, allowing the remaining parent to keep working.

- Pay final expenses: A life insurance payout can cover the cost of cremation, burial and other end-of-life expenses.

- Give gifts: You can use life insurance to leave money to friends, charities or organizations you support.

- Protect your business: Life insurance proceeds can help a business owner's partners cover the cost of hiring your replacement. Your family or business partners can also use the death benefit to buy each other out.

- Pass on wealth: Death benefits typically aren't subject to taxes and are protected from creditors, making life insurance a good way to transfer wealth to your heirs.

- Supplement retirement income: You can tap the cash value of permanent life insurance for additional income after you retire.

Learn more: What Happens if You Die Without Life Insurance?

How to Get Life Insurance

To purchase life insurance, follow these steps.

1. Determine How Much Coverage You Need

Add up the costs your death benefit needs to cover, including your family's current living expenses, your debts (such as a mortgage) and your funeral expenses. Include future expenses, such as a child's college education.

Next, add up any assets your loved ones would receive when you die, such as savings, retirement funds or Social Security benefits.

Buy enough life insurance to cover any difference between your family's financial needs and these assets. Financial experts often advise purchasing coverage of 10 to 30 times your income.

2. Evaluate Insurance Company Ratings

It's important that any insurance company you're considering is financially stable and offers excellent customer service. Review insurance company ratings from independent agencies such as A.M. Best and check the National Association of Insurance Commissioners' complaint index.

3. Compare Life Insurance Quotes

You can get life insurance quotes by visiting insurance companies' websites, calling the companies or using life insurance comparison sites that collect quotes from several providers. Buying life insurance can be complex. To ensure you get the right amount and type of coverage, consider working with an independent insurance agent. These professionals sell policies from multiple insurance companies and can help you find the best policy for your needs.

4. Complete Life Insurance Applications

Once you've found the best policy, complete an application, which typically asks about your medical history, family health history, lifestyle and hobbies. A phone interview and a medical exam may also be required. Answer honestly and don't leave out any important information. If it's discovered that your application wasn't truthful or complete, your insurance policy could be declared invalid.

5. Purchase a Policy

Once your life insurance application is approved, activate coverage by accepting the policy terms, choosing a beneficiary and paying your premium. Consider setting up automatic payments so you don't miss a payment, which could cause your policy to lapse.

Tip: Review your life insurance coverage annually or after any major life change, such as getting married, getting divorced or having children, to ensure your policy still meets your needs.

Frequently Asked Questions

Protect Your Loved Ones With Life Insurance

It's challenging to fit one more expense into your budget, but if loved ones depend on your income or care, life insurance is essential. You may qualify for lower life insurance premiums by giving up smoking or losing weight.

Improving your credit score could also save you money on life insurance. Insurance companies in most states can review your credit-based insurance scores when setting life insurance rates. These differ from consumer credit scores but are calculated using much of the same information. Steps taken to help improve your consumer credit score, such as paying bills on time and paying down debt, could also improve your credit-based insurance scores, helping you pay less for life insurance.

Check your life insurance price for free

Get your term life insurance quote online in minutes.

See your priceAbout the author

Karen Axelton specializes in writing about business and entrepreneurship. She has created content for companies including American Express, Bank of America, MetLife, Amazon, Cox Media, Intel, Intuit, Microsoft and Xerox.

Read more from Karen