How to Build Credit Without a Credit Card

Quick Answer

Some of the ways you can build credit without using a credit card include:

Having solid credit is key if you ever need to borrow money, apply for an apartment or finance a car. Responsible use of a credit card is one surefire way to build credit, but there are several options to do it without one. Two methods include becoming an authorized user on someone else's card or considering a credit-builder loan that's specifically tailored to improve your credit.

If you need help establishing credit, here are some reliable ways to do it without having a credit card in your wallet.

Do I Have a Credit Score Without a Credit Card?

You can have a credit score even if you've never had a credit card. Credit scores are based on information in your credit reports, which come from a variety of credit accounts and other payment data. Installment loans, including student loans, auto loans and personal loans, can all help you establish credit.

If you've never used any type of credit account, though, you may not have enough data for the credit bureaus to generate a score. In that case, using tools like credit-builder loans or programs that report rent, utility or streaming payments can help you build a history that counts toward your score.

The key to maintaining a good credit score—whether or not you use a credit card—is consistent, on-time payments and responsible use of any credit products you have.

5 Ways to Build Credit Without a Credit Card

Before you make strides to improve your credit, first take a moment to check your credit report, which you can do for free through Experian or by visiting AnnualCreditReport.com. This will let you know where you stand, which not only makes it easy to track your progress but will also help inform what options will (or won't) be available to you.

1. Pay Your Bills on Time

If you have student loans, an auto loan, medical debt or a personal loan, it's important to be diligent about paying every bill by its due date. Each payment you make on an installment loan appears on your credit report and helps you establish a good credit score and healthy credit history over time.

Consistent, on-time payments can help steadily improve your score, while late or missed payments can cause it to drop quickly. If you struggle to stay organized, consider setting up calendar reminders or enrolling in automatic payments to avoid costly slip-ups.

If you're a college student, you may not be required to make payments on your student loans while you're still in school. But if you can afford it, even small payments will be reported to the credit bureaus and can help you build credit.

2. Become an Authorized User

If you're not yet eligible for your own credit card, becoming an authorized user on a loved one's account can be a smart way to start building credit. As an authorized user, you'll receive your own card and can make purchases, but the primary account holder remains responsible for payments.

Most importantly, the full history of the account will be added to your credit profile, which can benefit your credit score. That said, this approach comes with real risks. If you overspend or the primary account holder misses payments, both your credit and the primary account holder's credit can suffer, potentially straining your relationship. Likewise, their financial missteps can impact your credit even if you're careful.

Only take this route if you fully trust the person and are confident in your ability to use the card responsibly. If that's not an option, a secured credit card—designed for building credit and backed by a refundable deposit—may be a safer alternative.

Learn more: Do Secured Credit Cards Build Credit History?

3. Consider a Credit-Builder Loan

Credit-builder loans are designed specifically to help people establish or rebuild credit.

Unlike traditional loans, you don't receive the borrowed money upfront. Instead, the lender deposits a small amount (typically $300 to $1,000) into a secured account. Then, you make fixed monthly payments over a set term, usually six to 24 months, and the lender reports your payments to the credit bureaus. Once you've paid the loan in full, you receive the funds in the account.

This process helps you build a positive payment history while saving money at the same time. Just be sure your lender reports to all three credit bureaus and that you make every payment on time to get the maximum benefit to your credit.

4. Get Credit for Household Bill Payments

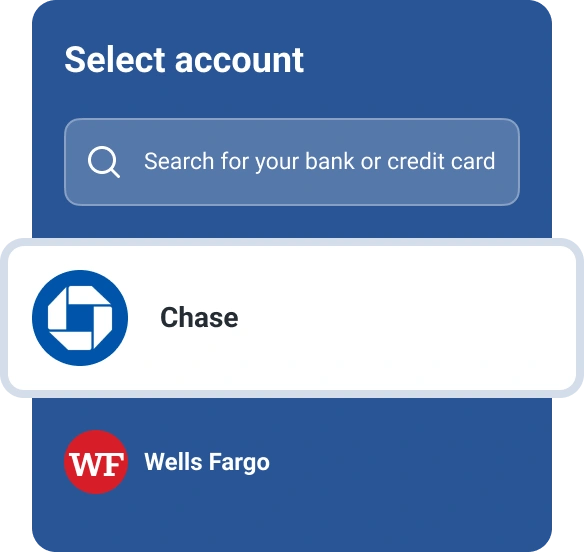

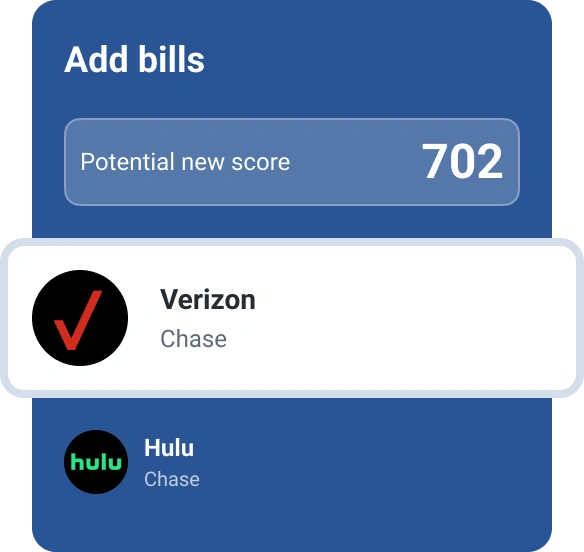

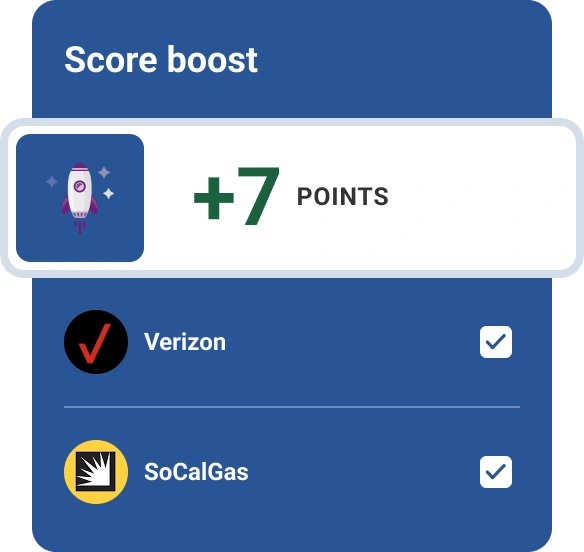

Experian Boost®ø is a free feature that lets you add your on-time payments for certain household bills to your Experian credit file, including eligible rent, utilities, phone, internet, streaming services and insurance. Those payments aren't typically included in credit reports.

When you sign up and connect your bank or credit card accounts, Experian locates eligible payments and asks your permission to include them in your Experian credit file. Once confirmed, you could see an increased FICO® ScoreΘ almost immediately.

Because payment history is the largest factor in your FICO® Score, adding these additional positive payment records can help, especially if you have a limited credit file.

Learn more: What Is Experian Boost?

5. Get a Cosigner for a Loan

If you're having trouble qualifying for a loan on your own, applying with a cosigner can help. A cosigner—who could be a parent or close friend with good credit—shares legal responsibility for the loan, making lenders more confident in approving your application.

Auto loans, private student loans and some personal loans may allow cosigners. Once approved, your on-time payments are reported to the credit bureaus, helping you build your own credit profile.

Just be cautious: Missed payments can hurt both your credit and your cosigner's credit. Before applying, be sure you can handle the payments and communicate openly about your repayment plan.

How to Build Credit Responsibly

As you continue on your credit-building journey and eventually qualify for a credit card, make sure you're following these best practices to keep your credit on the right track.

- Continue paying every bill on time. Whether it's a medical bill, credit card payment or student loan, ensure every payment is on time. Late or missed payments can hurt your credit, so do what you can to make sure you submit payments by their due dates.

- Don't overdo it with new accounts. Once your credit improves, you may be eager to apply for credit cards with perks. But don't get too excited; every application adds a hard inquiry to your credit reports, which can knock points off your credit score. It's best to apply for credit only when you actually need it.

- Keep your credit utilization rate low. As you get new credit cards, it's important to keep your balance low relative to your credit limit—this is known as your credit utilization rate. Higher rates can damage your credit and make you look overleveraged to lenders. Once your credit utilization nears and climbs above 30%, it can have a more pronounced negative effect on your credit scores. People with the highest credit scores generally keep their credit utilization in the single digits.

- Hold on to accounts in good standing. As you build credit, possibly adding in a credit card or two at some point, keep in mind that longevity of accounts is a factor in your credit score. The longer an account is on your credit report, the more it can help you. If you have an unused credit card, consider keeping it open and adding a small purchase that you pay off every month since open accounts help keep your credit utilization ratio lower and show longevity. It's worth noting that an account that's current when closed can stay on your credit reports for 10 years. Still, it's generally better to keep credit card accounts open for building credit.

Learn more: Is 0% Credit Utilization Good for Credit Scores?

Monitor Your Credit

To make sure your efforts are paying off, keep an eye on your progress with Experian's free credit monitoring service. You'll be able to track changes to your credit report, spot new accounts and see how your score improves over time.

As your credit strengthens, you'll have an easier time qualifying for credit cards, loans and other financial products. You'll also be better prepared for credit checks when applying for housing, jobs or new utilities.

Frequently Asked Questions

The Bottom Line

Building credit without a credit card may take patience, but it's absolutely possible, not to mention worthwhile. Every on-time payment, every account managed responsibly and every positive update on your credit report helps you move closer to a stronger financial footing.

As you try out different strategies for building credit, the most important thing to remember is that it's a marathon, not a sprint. It requires patience, consistency and responsible financial habits.

Focus on making every payment on time, keeping your debt manageable and monitoring your progress regularly. Over time, these small, consistent actions will compound into a strong credit profile that opens doors to better interest rates, housing opportunities and financial flexibility.

Instantly raise your FICO® Score for free

Use Experian Boost® to get credit for the bills you already pay like utilities, mobile phone, video streaming services and now rent.

No credit card required

About the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben