How to Lock Your Credit

Locking your credit file is a procedure that can help protect against identity theft and credit fraud by limiting access to your Experian credit file. A credit lock, also known as a security lock, has the same result as a security freeze, sometimes known as a credit freeze, but it also comes with extra alerts when you sign up for Experian CreditLock through Experian's Premium membership.

Locking your Experian credit file limits lenders and others (with a few exceptions, as we'll discuss below) from accessing your Experian credit file or using it to get a credit score. Checking your credit is typically one of the first steps in processing a loan or credit application, so limiting access to your Experian credit file can stop fraudsters and thieves from opening new accounts or borrowing money in your name—a common consequence of identity theft.

Note that you must limit access to your credit files at all three national credit bureaus (Experian, TransUnion and Equifax). Locking your credit file at one bureau does not automatically lock it at the others.

How Does Locking Your Credit File Work?

Procedures for setting up credit-locking services vary among the three bureaus:

- Experian offers credit locking as part of its Premium membership, which also includes:

- Monthly access to updated credit reports from all three bureaus

- Notifications of new credit activity at any of the three bureaus (to help detect unauthorized actions)

- Up to $1 million in identity theft insurance

- Phone assistance from Experian credit and fraud resolution experts

- Equifax provides credit locks free to consumers through Lock & Alert™.

- TransUnion includes credit file locking in its free TrueIdentity subscription service, which includes monthly access to TransUnion credit files and up to $25,000 in ID theft insurance.

Each bureau requires proof of identity as part of its credit lock setup process.

What's the Difference Between a Credit Lock and a Security Freeze?

While the end results are similar, credit locks and credit freezes are different. The major differences are as follows:

- Credit freezes are free, and their availability is mandated under federal law. They may be obtained online, by phoning or sending mail to Experian, Equifax or TransUnion. Unlike credit lock services, you can request credit freezes for your children under the age of 16, as well as for yourself.

- The credit bureaus are required to complete a freeze on your credit file within 24 hours of receiving a phone request and must lift the freeze within one hour following a phone request.

- When managing your credit freeze from a given bureau, you will create credentials you must use when requesting the freeze's removal or temporary lift.

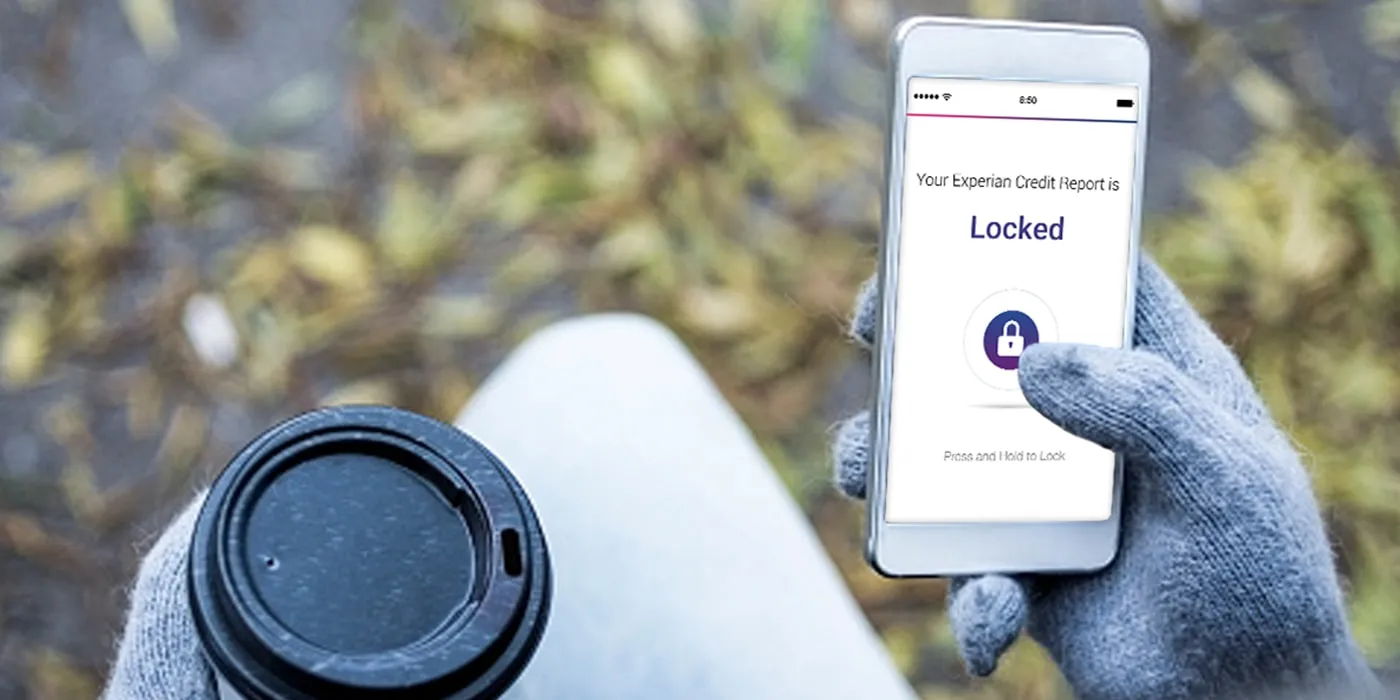

- Credit locks let you control access to your credit files directly, via smartphone apps or a secure website.

- After registering with Experian and verifying your identity with us, you can turn access to your credit file on and off instantly via smartphone app or online, as well as receive real-time alerts via CreditLock about attempted access to your credit, when you lock your credit.

When either a credit lock or credit freeze is in effect, access to your credit file is limited for purposes of credit checks related to loan and credit applications, but certain entities are still permitted to check your file, including the following:

- You (you can always view your own credit report)

- Creditors with whom you have a business relationship at the time the lock or freeze is activated

- Landlords or rental agencies conducting background checks

- Phone companies and utilities

- Debt collection agencies trying to collect payments

- Child support agencies seeking to set the amount of child support

- Lenders and credit companies who have prescreened you for credit offers

- Insurance underwriters acting with your authorization

- Potential employers you have granted permission

- Government agencies acting according to court orders or warrants

When Should I Lock My Credit File?

If you know or suspect your Social Security number or other personal identification information has been exposed in a data breach, consider locking or freezing your credit file. A credit lock with Experian may be preferable if you also want to receive real-time alerts if someone is trying to open credit in your name.

As long as credit fraud and identity theft remain causes for concern (and they won't be going away anytime soon), using Experian CreditLock is also a good precautionary move, even if you don't think your information has been compromised.

By limiting access to your credit files, a credit lock gives you the same benefits as a credit freeze in terms of pre-empting creation of new credit accounts in your name, but with access to alerts too. Signing up for CreditLock can keep you engaged with your credit down to the minute with real-time locking and alerts.

Monitor your credit for free

Credit monitoring can help you detect possible identity fraud, and can prevent surprises when you apply for credit. Get daily notifications when changes are detected.

Get free monitoringAbout the author

Jim Akin is freelance writer based in Connecticut. With experience as both a journalist and a marketing professional, his most recent focus has been in the area of consumer finance and credit scoring.

Read more from Jim