Experian Mobile App: Instant Access to All Your Credit Needs

Credit monitoring services are easy to find, but it can be challenging to decide on one with all the features you need to manage your credit well.

The Experian mobile app is a one-stop shop for monitoring your credit. Its selection of free tools makes it easy to keep track of your credit score in real time and gives you the information you need to build and maintain excellent credit.

How the Experian Mobile App Can Help You With Your Credit

If you have an iOS or Android device, you can download the Experian mobile app and take advantage of its suite of free features. The app has 4.8 out of 5 stars in the iOS App Store and 4.7 out of 5 stars in the Google Play Store. Many of the positive reviews mention experiencing success with the Experian Boost®ø feature, the ease of credit monitoring and progress made improving their credit score using knowledge gained from the app.

Here's what you can do with the app and how it can help you build a solid foundation with your credit history and personal finances.

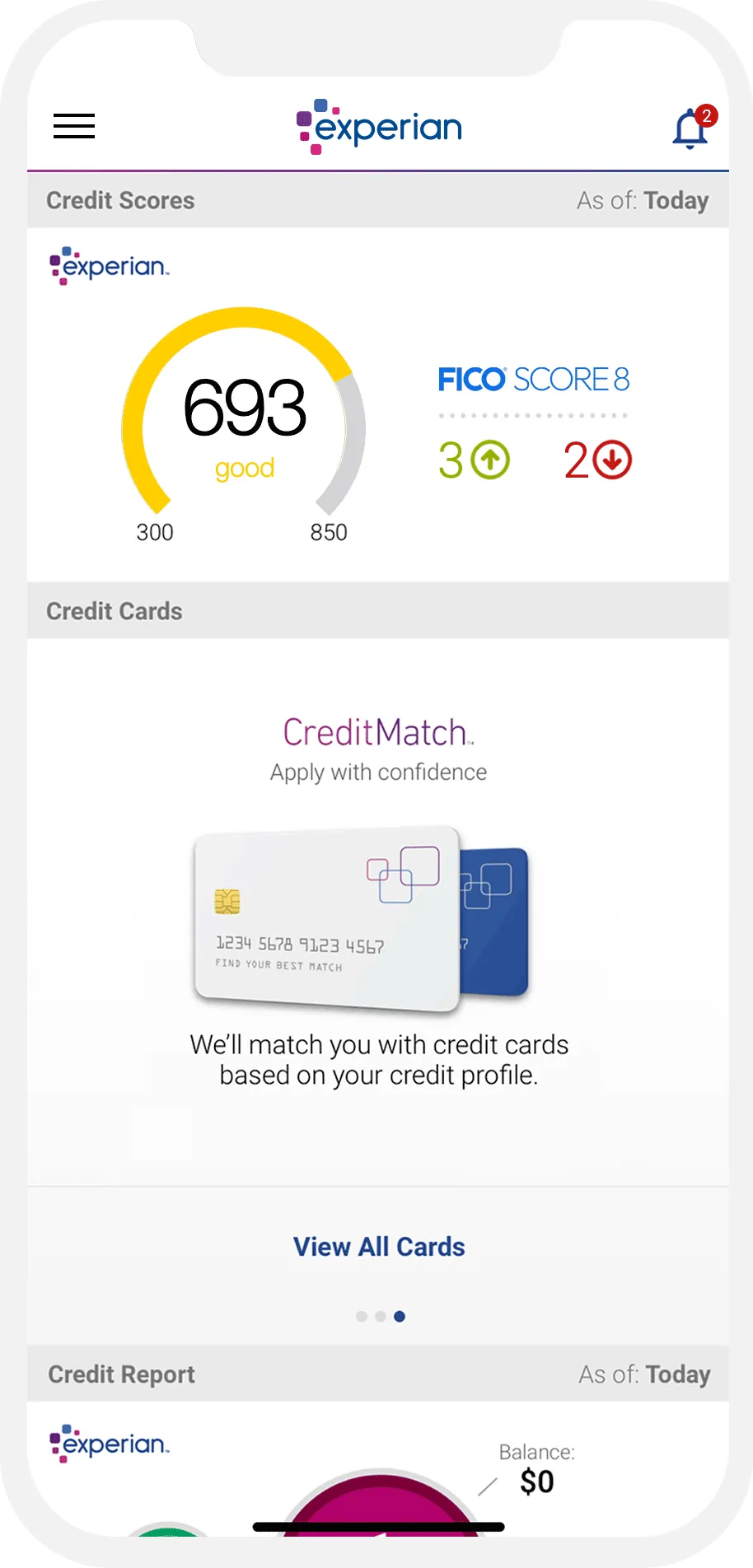

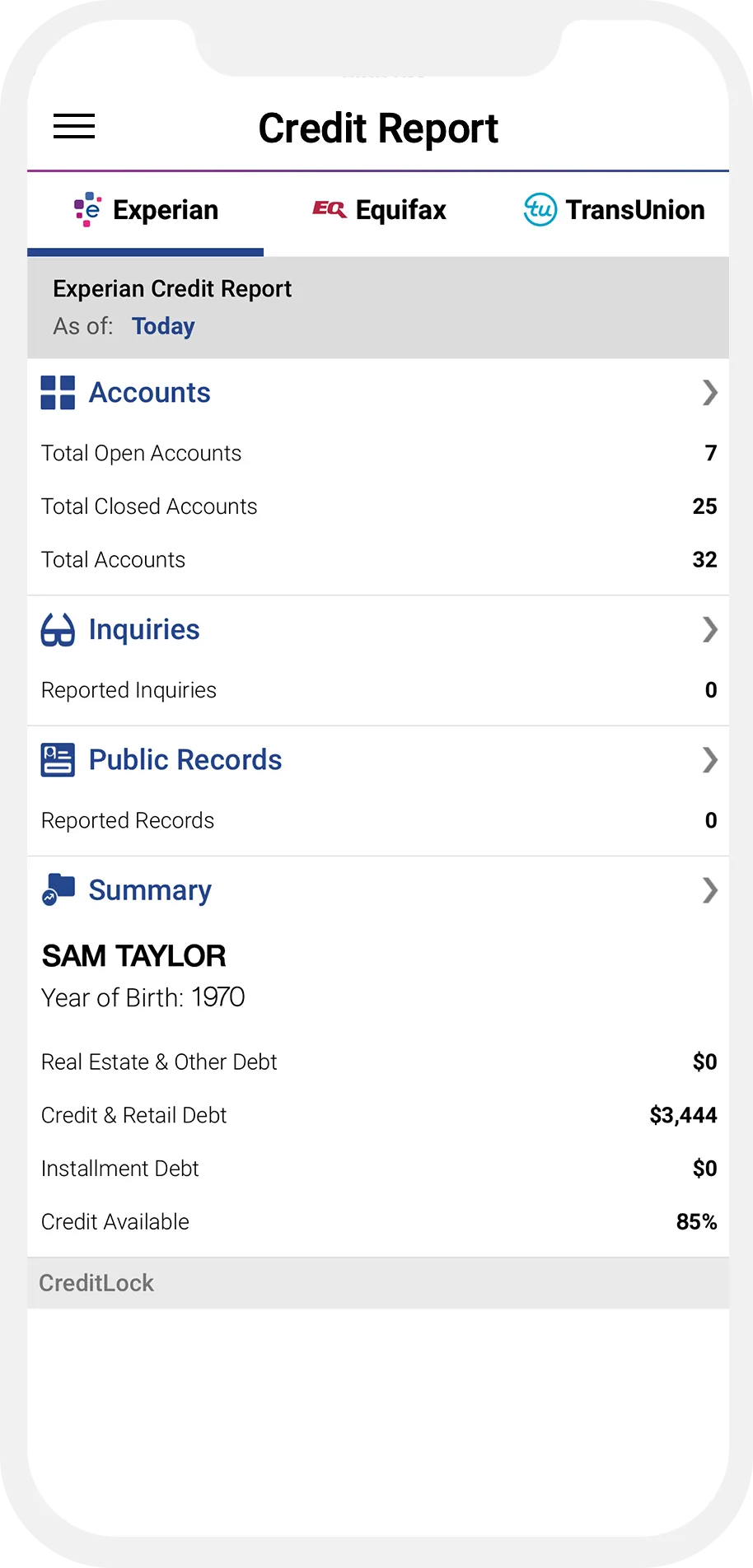

Free FICO® ScoreΘ and Experian Credit Report Access

The Experian mobile app provides a free FICO® Score powered by data found in your Experian credit report. (Most lending decisions are based on FICO® Scores.) What's more, you'll get free access to your Experian credit report, which is updated every day to reflect new information reported by your creditors. At a glance, the app will show your total debt on open accounts, revolving credit balances, the number of open accounts and more.

With both your FICO® Score and Experian credit report, you'll have all the information you need to understand which factors are going into your credit score and which areas you might need to address to improve it.

Real-Time Alerts and Easy Disputes

While your full credit report gets updated once per day upon sign-in, you'll receive notifications anytime new credit accounts, hard inquiries, public records, fraud alerts and personal information updates are added to your credit report.

These real-time alerts will make it easier to monitor your report for potential fraud and identity theft. And if you do find fraud or any other inaccurate information on your Experian credit report, you can use the app to dispute the information.

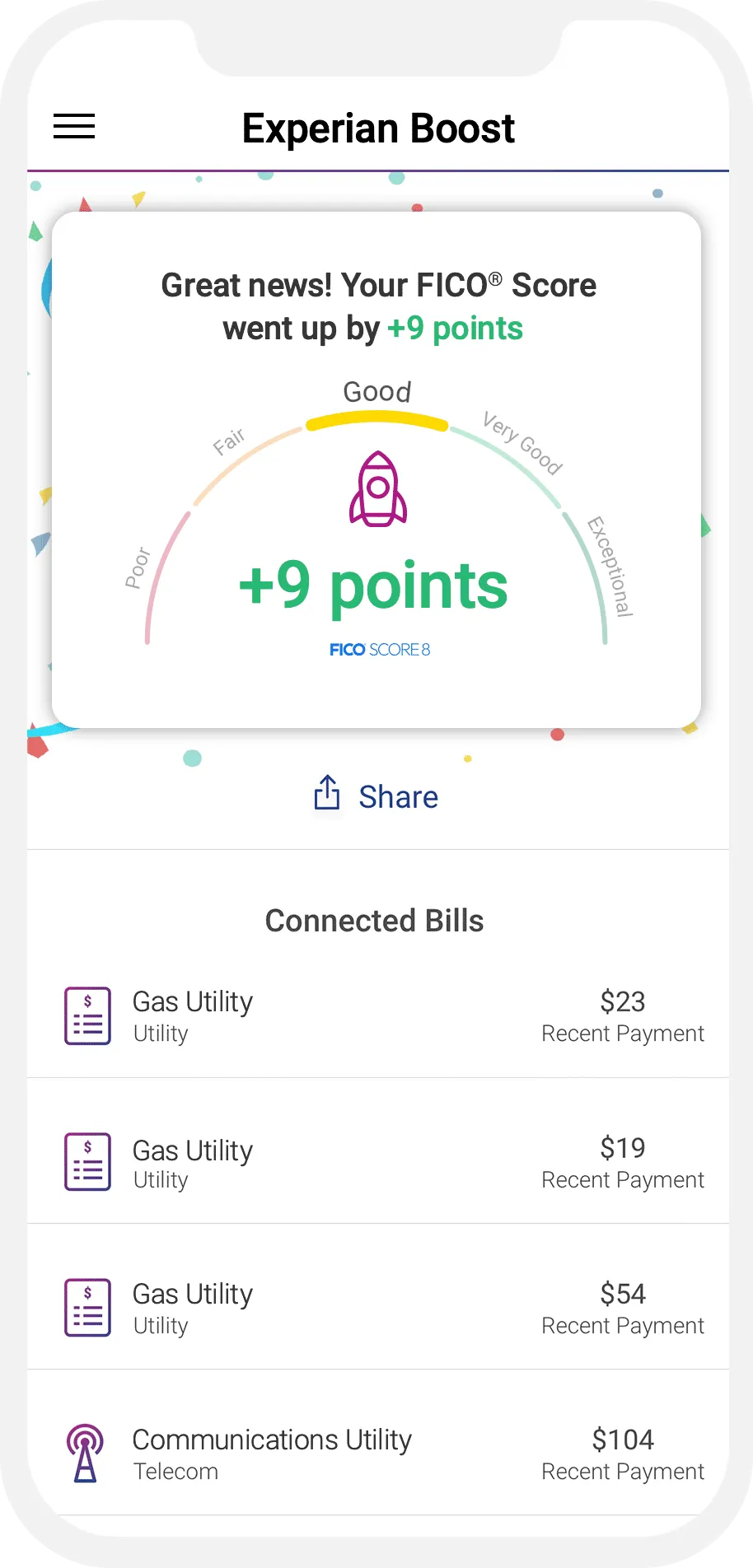

Experian Boost and Personal Finance Tools

Experian Boost is a tool that allows you to add your positive payment history from utility, phone and Netflix® bills to your Experian credit file. To use Experian Boost, you'll opt in, connect the bank account you use to pay your bills and confirm eligible payments. Since these bill payments wouldn't otherwise be on your credit report, Experian Boost can help increase your credit score.

If you're not already an Experian Boost user, you can sign up for the program directly through the mobile app. Once you've joined, you'll be able to view which recent payments were added to your credit report.

The Experian mobile app can also help you get a clearer view of your finances. When you connect your bank and other financial accounts, the Experian Personal Finances tool will show you where your money's coming from and where it's going. You can even use the tool to track your spending by category, which can help you make more informed choices about your current financial situation and goals.

View Loan and Credit Card Offers Tailored to Your Credit Score

Lenders don't always provide credit requirements upfront, so if you're thinking of applying for a loan or credit card, you may wonder whether you're likely to qualify.

With Experian's comparison tool, accessible through the Experian mobile app, you can compare your loan offers and credit cards, which are personalized based on your credit file. You can see multiple loans or credit cards side by side to determine which might be the best fit for your situation.

Premium Services Offer Even More Perks

For most people, the Experian mobile app's free services are enough to manage credit effectively. But if you want to take it a step further, you can opt for upgraded services like CreditLock and an Experian Premium membership.

CreditLock allows you to use the mobile app to lock your Experian credit file, which can protect you from identity theft. And if you do fall victim to identity theft, Experian's Premium membership provides insurance coverage to protect your finances, along with providing other identity theft and monitoring services.

You may also choose to upgrade to also view your FICO® Score based on the reports from Equifax and TransUnion.

Is the Experian Mobile App Right for You?

The Experian mobile app may be right for you if you are interested in building or maintaining your credit, saving money, or protecting yourself from fraud and identity theft. Or maybe you're just curious to see what's in your credit report and how your credit score is doing. The Experian mobile app provides a suite of credit monitoring tools and services, most of which are free of charge. You can get all the information you need to stay on top of your finances and credit history without paying a dime, and you can do it anytime and anywhere from your mobile device.

Take your credit with you

Download our free app to access your Experian credit report & FICO® Score on the go!

Get the appAbout the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben