Credit-Builder Loans vs. Secured Credit Cards: Which Is Better?

Quick Answer

Credit-builder loans and secured credit cards can both be effective tools for building or improving credit. Secured credit cards require that you have cash for a deposit, and credit-builder loans tend to work best for people who don’t have existing debt.

Credit-builder loans and secured credit cards are both options that can help get you on the credit radar to start building credit or help you recover from credit missteps. Here's how credit-builder loans and secured credit cards compare, plus how to choose the best option for you.

What Is a Credit-Builder Loan?

A credit-builder loan is exactly what it sounds like—a loan whose purpose is to help you build credit. But it turns the traditional lending process upside down. You make payments, which can be reported to the credit bureaus, and, once the loan has been repaid, you get access to the money minus any fees and interest.

The loans typically have terms of six to 24 months. Payments could be as little as $10 a month. It is smart to choose a credit-builder loan with a payment that you can easily afford. A late payment can do serious damage to your credit. If your goal is to build a record of on-time payments, it's better to make small payments on time than to have larger late payments.

You'll also want to shop carefully, comparing fees, interest rates and annual percentage rates (APRs), which combine all the loan costs to calculate a rate. Interest rates and overall costs can vary widely. You'll also want to be certain that the loan you choose reports to all three major credit bureaus (Experian, TransUnion and Equifax) to ensure you're building credit across the board.

A 2020 Consumer Financial Protection Bureau study found that credit-builder loans were most useful for people who did not have existing debt. Those without debt saw credit scores increase 60 points more than those who had debt when they took out a credit-builder loan.

Pros and Cons of Credit-Builder Loans

Credit-builder loans aren't the right choice for everyone. Here are some pros and cons to consider.

Pros of Credit-Builder Loans

- No security deposit required

- Easier to qualify for than traditional personal loans

- Can improve credit scores if you make payments on time, every time

- Offer access to a savings account, which could be the beginning of an emergency fund, at the end of loan term

Cons of Credit-Builder Loans

- Unavailable to people who have a history of banking problems as noted on their ChexSystems report

- Require that the borrower have a source of income

- Can harm credit if payments are 30 or more days late

- Likely not a good choice if you have debt already

What Is a Secured Credit Card?

A secured credit card is a credit card secured by a deposit that you make with the credit card issuer. That amount is typically your credit limit, or a significant portion of it. Because the issuer has access to the deposit in the event you do not pay, the risk is lower, so qualification standards can be more relaxed. A secured credit card can be a good choice if you have cash for a deposit and are looking to build or rebuild your credit.

As with credit-builder loans, paying on time, every time is crucial.

However, a secured credit card differs from a credit-builder loan in some important respects. Credit cards, secured or not, are revolving accounts and as such do not have a set borrowing period. Consumers have some say in how much they owe and how much they repay each month, once the minimum is covered.

Keeping balances low relative to credit limits—known as your credit utilization rate—and ideally paying your balance in full each month is the best way to use a secured credit card to improve credit. Maxing out a credit card or carrying a high balance, even if you pay the minimum on time, can hurt your credit.

Pros and Cons of Secured Credit Cards

Secured credit cards, managed responsibly, can help you build credit if you consistently pay on time and are able to keep balances low relative to credit limits. Here are benefits and drawbacks to consider.

Pros of Secured Credit Cards

- Can help build credit with both positive payment history and a low credit utilization

- Easier to qualify for than unsecured credit cards

- Can be used the same way as an unsecured credit card

- May not require a credit check

- May offer automatic conversion to an unsecured credit card and return of security deposit after a certain number of on-time payments

Cons of Secured Credit Cards

- Require a cash deposit

- May have a relatively low credit limit

- Typically have above-average interest rates

- Can hurt credit if you pay late or have a high credit utilization

Credit-Builder Loans vs. Secured Credit Cards: Which Is Better?

Both credit-builder loans and secured credit cards can help people build or rebuild credit. Secured credit cards can be a good choice if you have the money for a deposit and the skills to manage a credit card. But if you can't provide a security deposit, you might be able to qualify for a credit-builder loan.

Credit scores reward you for responsibly managing more than one kind of credit. A credit-builder loan is installment credit—a loan with payments that are the same for a set term. Credit cards are a type of revolving credit—credit lines that allow you to borrow and repay up to a certain limit. It's possible to have both a secured credit card and a credit-builder loan.

If you need to choose, consider which one you are more likely to qualify for. Consistent, on-time payments on a small credit-builder loan or secured credit card, used lightly and paid in full each month, can put you in a good position to build credit. If you already carry debt, a secured credit card may be better.

Other Ways to Build Credit

Credit-builder loans and secured credit cards are not the only ways to build credit. Others include:

- Getting added as an authorized user to a loved one's credit card, preferably one with a long history of on-time payments and a low credit utilization

- Using a rent-reporting service to report rent payments to credit bureaus

- Using Experian Go™ to create a credit file if you have never used credit of any kind before

- Using Experian Boost®ø, a free feature that can add household bill payments, such as utilities and phone, to your Experian credit report

- Getting a cosigner (who will be fully responsible for the loan if you don't pay) if you need a loan

The Bottom Line

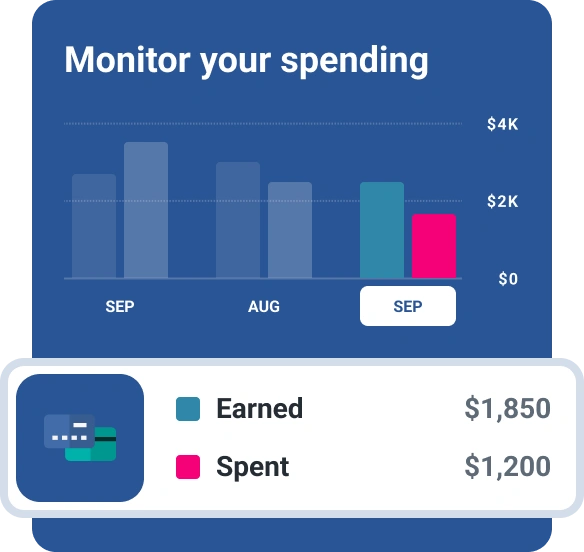

Building or rebuilding credit is a journey, and no matter which tools you use to get started, it's a good idea to check on your progress. You can check your credit report and score for free with Experian to be sure your payments are being reported and to keep an eye on your credit as you work to improve it.

Instantly raise your FICO® Score for free

Use Experian Boost® to get credit for the bills you already pay like utilities, mobile phone, video streaming services and now rent.

No credit card required

About the author

Bev O'Shea is a Georgia-based freelance journalist specializing in personal finance and consumer credit. Most recently, she was a staff writer at personal finance website NerdWallet, where she was an authority on credit reports, credit scores and identity theft.

Read more from Bev