What Is a Home Warranty Plan?

Quick Answer

Home warranties are service contracts that help pay for repairing or replacing covered home systems and appliances that break down due to normal wear and tear. Home warranties can help cover costs that homeowners insurance doesn’t.

When your heater stops working or your dishwasher calls it quits, homeowners insurance won't pay to fix it, but a home warranty might. A home warranty is a service contract that covers repairing or replacing built-in home appliances and systems that break down in the course of normal use. Because home warranties can be complicated, it's important to understand what they cover and how they work before you buy one.

What Is a Home Warranty?

A home warranty is a service contract that covers the diagnosis, repair or replacement of major built-in systems or appliances in your home if they fail due to normal wear and tear. Because homeowners insurance doesn't cover wear and tear, a home warranty can provide complementary protection to help keep your home running smoothly.

You can buy a home warranty at any time, but they're often purchased by homebuyers or sellers as part of the sales process. Including a home warranty with a home purchase can help sellers entice buyers. Protection from the warranty eases the new homeowner's concerns that systems or appliances may break down at a time when they can ill afford the expense.

Tip: Homebuyers can sweeten their offer by purchasing a home warranty that covers the seller through the purchase process and transfers to the buyer once the sale goes through. The warranty helps protect the seller from unexpected expenses if systems or appliances break down before you close on the house.

Learn more: What Is Not Covered by Homeowners Insurance?

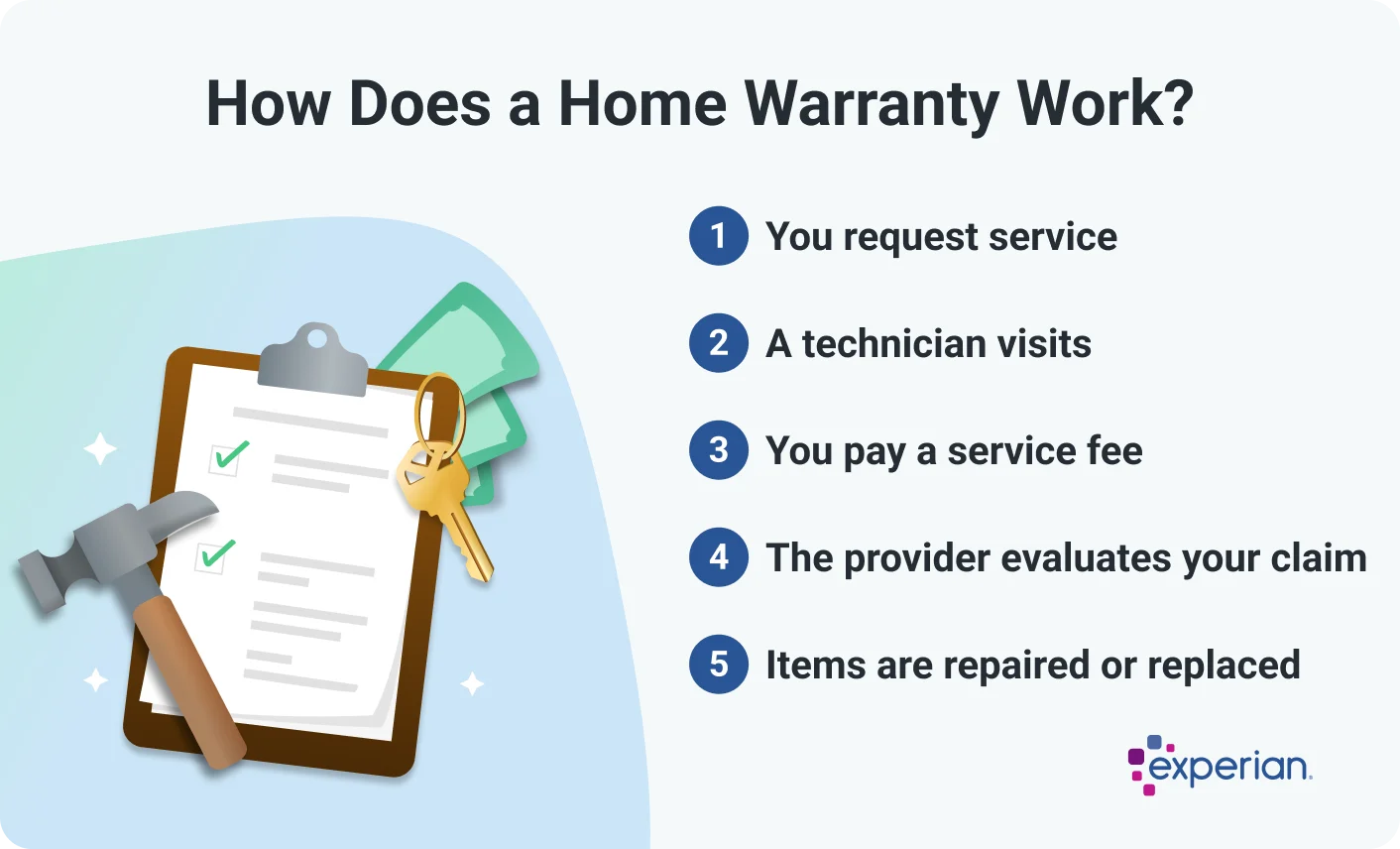

How Does a Home Warranty Work?

If an appliance or system covered by your home warranty fails in the course of normal use, here's how the coverage works.

- You request service. Contact the home warranty company to report the issue.

- A technician visits. The home warranty company sends out a technician to inspect the problem and assess the damage.

- You pay a service fee. Service fees are typically due when the technician visits.

- The provider evaluates your claim. Based on the technician's report, the warranty company determines whether or not your warranty covers the failure.

- Items are repaired or replaced. If your claim is approved, the system or appliance is repaired or replaced, up to the coverage limits of your policy. Depending on your plan, you may also be responsible for paying a deductible.

If your claim is denied, you'll need to start from square one and look for a home repair provider yourself.

What Does a Home Warranty Cover?

Home warranty companies typically offer plan options that include coverage for systems, appliances or both. Although specifics vary depending on your plan, provider and location, systems coverage typically includes:

- Plumbing

- Heating system

- Air conditioners

- Electrical system

- Ducts

Appliance coverage generally includes:

- Refrigerators

- Dishwashers

- Ovens and stoves

- Built-in microwaves

- Washers and dryers

- Ceiling fans or exhaust fans

- Garbage disposals

- Garage door openers

Many home warranty companies let you buy add-on coverage for spas, swimming pool pumps, septic systems, well pumps, sump pumps, second refrigerators, stand-alone freezers and roof leaks at additional cost.

What's Not Covered by a Home Warranty?

Home warranties generally don't cover your home's structure, foundations, walls or workmanship. However, if you buy a new home, the builder may warranty these elements for a certain period.

Home warranties typically don't cover home appliances and systems if:

- They aren't listed as covered in your home warranty contract

- The breakdown is due to a problem that existed before your coverage took effect

- The breakdown is due to anything other than normal wear and tear, such as insects, vermin or a natural disaster

- The item was installed incorrectly

- The item was modified

- You tried to fix the problem yourself and made it worse

Tip: Most home warranties only cover certain parts of your home's systems and appliances, so it's important to read coverage details carefully. For example, if your water heater breaks down, the warranty may cover mechanical parts but not the tank, drain pan or water lines.

How Much Does a Home Warranty Cost?

On average, a home warranty plan costs $1,049 annually, according to 2025 data from home service marketplace Angi. You'll also pay a service fee every time a technician visits your home, whether or not your claim is approved. The service fee generally ranges from $75 to $125, according to Angi data.

Your cost for a home warranty may vary depending on your location, level of coverage, coverage caps and service fee. (As with an insurance deductible, you can typically select a higher or lower service fee when you buy your policy.)

Learn more: Homeowner Costs Beyond Your Mortgage

Pros and Cons of a Home Warranty

Before buying a home warranty, it's important to consider both the advantages and disadvantages.

Pros

-

One-stop solution: Instead of hunting for a reliable plumber or electrician when a problem arises, you can just call your home warranty company.

-

May save you money: If the home warranty company determines your problem is covered, in the best-case scenario you'll only pay the service fee.

-

Peace of mind: When you're purchasing an older home, a home warranty can ease your worries over expensive repairs.

Cons

-

Coverage caps: Home warranties often cap coverage for each item at a certain dollar amount. If that isn't enough to cover the cost of replacement or repair, you're on the hook for the rest.

-

Limited options: You can't choose the contractor you want, but have to work with whoever the home warranty company provides.

-

Service fees: You'll pay a service fee when a technician visits. Even if it turns out the warranty doesn't cover the problem, this fee generally won't be refunded.

-

Limited reimbursement: Some home warranties may cover only the current, depreciated cost of an item, not its full replacement value.

-

Replacement restrictions: Home warranties replace your appliances or systems with a comparable model, not necessarily the make or model you'd prefer. For example, you might want to replace your 10-year-old dishwasher with the latest model, but you generally won't have that option.

-

Potential delays: Home warranty providers can't always send technicians out right away. Delays could mean spending several days with vital home systems not functioning. If you can't wait, you might end up paying out of pocket for repairs.

-

Exclusions: Home warranties typically have long lists of exclusions that can lead to claims being denied. For example, a covered problem with your air conditioner might be denied unless you can prove that maintenance was regularly performed according to the manufacturer's specifications.

-

Red tape: You may feel it's easier to make your own decisions about home repairs than to go through the process of filing a claim and getting approval.

Are Home Warranties Worth It?

Purchasing a home warranty might be a smart financial move, but it depends on the specifics of your situation.

When You Should Consider a Home Warranty

Buying a home warranty might make sense if:

- You want to attract buyers while selling your home

- You want to make your offer on a home stand out

- You own an older home with appliances and systems no longer under a builder's or manufacturer's warranty

- You don't want the hassle of finding and managing your own service providers

When You Shouldn't Consider a Home Warranty

Buying a home warranty may not be a good idea if:

- Your home or appliances are relatively new

- Your home or appliances are already covered by a builder's or manufacturer's warranty

- You prefer to save up the money to handle home repairs out of pocket

- You want the freedom to choose your preferred contractors or appliances

Learn more: Are Home Warranties Worth It?

How to Choose a Home Warranty

To get the right coverage for your home, follow these steps when choosing a home warranty.

- Evaluate your needs. This guide to how long you can expect home systems and appliances to last can help you identify items that may need repair or replacement soon and find a home warranty that covers them. If you're buying or selling a home, look for a policy that can transfer from the home seller to the buyer.

- Consider costs. Use a website like HomeAdvisor, Yelp or Thumbtack to get estimates of how much various home repairs cost in your area. This will help you decide if a home warranty is worth the expense.

- Compare coverage options. Evaluate coverage and exclusions, service fees, coverage caps and limits on replacement. Check whether the company offers a warranty on work done or guarantees a technician will be sent out within a certain time frame (such as 48 hours).

- Check ratings and reviews. Read online customer ratings and reviews of the companies you're considering. Visit the Better Business Bureau website and check with your state attorney general's office to see if there are any complaints against the company.

Don't be afraid to ask questions about anything you don't understand. The more you know about a home warranty plan, the better you'll be able to assess its value.

Alternatives to a Home Warranty

A home warranty company isn't your only option for covering the cost of home repairs. Here are some alternatives to consider.

- Manufacturer's warranty: If your appliances and systems are still covered by a manufacturer's warranty, a home warranty probably isn't necessary. You may need to register your purchases with the manufacturer to take advantage of the warranty.

- Extended warranty: You can usually buy extended warranties from the appliance's manufacturer. Some credit cards extend the manufacturer's warranty for free if you purchase an item with the card.

- Emergency fund: Even if you never use your home warranty, you'll have to pay the premiums every year. Putting money into an emergency fund to cover home repairs could make more financial sense and gives you the freedom to use the funds for other unexpected expenses.

- Credit cards: If you have good credit, you may qualify for a credit card with an introductory 0% annual percentage rate (APR) on purchases. Use the card for home repairs and pay it off before the introductory period ends, and you won't pay any interest.

- Personal loan: Personal loans generally charge lower interest rates than credit cards and are usually unsecured, so you don't risk any collateral.

- Home equity loan: If you have equity in your home and are facing major home repairs, a home equity loan could be a solution. Interest rates are generally lower than those for credit cards; however, your home is used as collateral and could be at risk if you can't make your loan payments.

- Home equity line of credit (HELOC): When you don't know how much repairs will cost, a HELOC offers flexibility, letting you borrow only what you need up to your credit limit. Equity in your home is required to qualify; as with a home equity loan, you could lose your home if you can't repay the loan.

Learn more: How to Pay for Emergency Home Repairs

The Bottom Line

Whether or not you have a home warranty, saving for home maintenance and repairs should be built into your budget. Stashing your savings in a high-yield savings account could help them grow faster. If you're facing a major repair your savings can't cover, a personal loan, credit card or home equity loan could fill the financial gap.

Good credit can help you qualify for credit cards and loans with low interest rates. Before you apply for credit, check your FICO® ScoreΘ, which you can do for free through Experian. If your score isn't where you'd like, take steps to improve your credit such as paying down revolving debt, bringing late accounts current and making payments on time.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Karen Axelton specializes in writing about business and entrepreneurship. She has created content for companies including American Express, Bank of America, MetLife, Amazon, Cox Media, Intel, Intuit, Microsoft and Xerox.

Read more from Karen