What Is a Second Mortgage?

Quick Answer

Second mortgages, including home equity loans and lines of credit, can give you access to cash, often with lower interest rates than other forms of credit.

A second mortgage is a loan or line of credit that allows you to tap into your home's equity to achieve various financial goals. Home equity is the amount of your home's value you own outright.

While a second mortgage can be a valuable financial tool, it's not without risks. These mortgages use your home as collateral, so your lender could foreclose if you fall behind on the payments. Here's everything you need to know about second mortgages, including how they work and their benefits and downsides.

What Is a Second Mortgage?

A second mortgage gets its name because it's a home loan you can take out in addition to your primary mortgage. While your first mortgage allows you to purchase the house, the second mortgage allows you to borrow against your home's equity.

For example, if your home is worth $500,000 and you owe $200,000 on your mortgage, you have $300,000 in equity. You may qualify for a home equity loan or home equity line of credit (HELOC)—two common types of second mortgages—to access some of that equity as cash.

Unlike other types of loans, such as personal, auto and student loans, you can use the money from your second mortgage for nearly any purpose. Your home secures the loan, which reduces the lender's risk. Consequently, these types of loans generally offer lower interest rates than credit cards and other loans. For this reason, a home equity loan or line of credit may be an attractive option for paying off high-interest debt, renovating your home or for other financial goals.

Learn more: Should You Tap Into Your Home Equity?

How Does a Second Mortgage Work?

When you take out a second mortgage, your lender places a lien against your property, just as your primary mortgage lender did. That means your lender has a legal claim against your property if you fail to repay as agreed. The lien is removed when the second mortgage loan is paid in full.

Lenders like you to keep at least 15% to 20% equity in your home, so you'll need at least that much to qualify. Using the example above, if your home is worth $500,000, you'll likely need at least $75,000 to $100,000 in equity to qualify.

Repaying your second mortgage may be different than paying your primary mortgage. With a home equity loan, for example, you'll make regular payments that include principal and interest over a specific term—similar to how most mortgages are structured. However, HELOC repayments are a little different because of their initial draw period when you make interest-only payments, followed by a repayment period when you pay down the principal and make full payments.

Interest rates are typically higher with a second mortgage because the lender carries more risk. This second mortgage is in "second position," meaning that in a foreclosure, the lender gets paid only after the primary lender is fully repaid.

Types of Second Mortgages

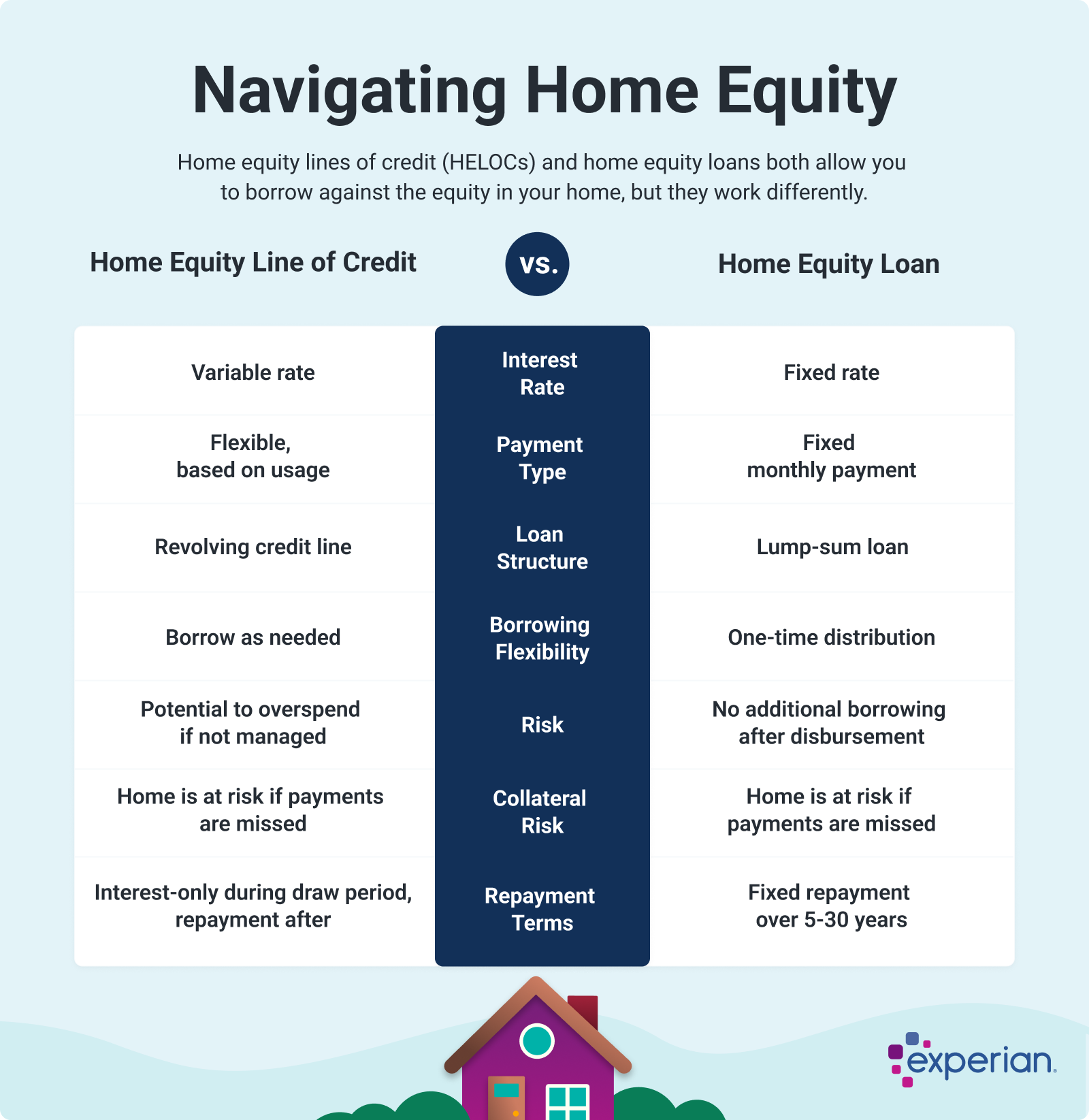

The two most common types of second mortgages are home equity loans and HELOCs. Each has its own benefits and terms depending on your financial needs.

Home Equity Loan

Home equity loans are disbursed in a single, lump-sum payment that you'll repay with a fixed interest rate for monthly payments that remain the same over the loan term, usually five to 30 years. The large, upfront amount may benefit you if you're facing a major expense like a home remodeling project or consolidating high-interest debt.

It's important to carefully assess your financial needs to avoid borrowing more money than is necessary. This type of loan can be particularly beneficial when you know exactly how much you'll need, even if your lender approves you for more. But it's important to borrow only what you need, especially since your home is on the line.

Home Equity Line of Credit

HELOCs work more like a credit card, where your lender approves a line of credit with a set limit. As revolving credit, you can use the funds as often and for as much as you need, up to the credit limit, as long as you repay the borrowed amount.

HELOCs generally come with variable interest rates, though some lenders offer fixed-rate HELOCs. Repayment typically spans 10 to 30 years and is divided into two periods:

- Draw period: The initial period is usually for 10 years, during which you can withdraw funds as needed while making interest-only payments.

- Repayment period: Once the draw period expires, you must repay the loan through principal and interest payments for 20 years, though some lenders may require you to make a single balloon payment.

Let's say your lender approves you for a $20,000 HELOC. You use $10,000 on home improvements. Once you repay the amount, you can use the full $20,000 again—as long as you're in the draw period.

Learn more: Home Equity Loan vs. HELOC: What's the Difference?

Requirements for a Second Mortgage

Lending criteria for a second mortgage can vary by lender, but here are the most common ones:

- Sufficient home equity: Lenders generally expect you to have at least 15% to 20% equity in your home.

- Good credit: Most lenders require a minimum credit score of 680, but the higher your credit score, the better your approval odds and potential interest rate.

- Stable income: You'll need to show proof of income, such as recent pay stubs and W-2s, that you have enough consistent income to support new loan payments.

- Low debt-to-income ratio (DTI): This ratio represents the portion of your monthly income that goes toward debt payments. Lenders commonly require a DTI of 43% or less.

- Proof of homeowners insurance: Since your home serves as collateral, you must have a homeowners insurance policy to protect against damages or losses.

Pros and Cons of a Second Mortgage

A second mortgage can help you achieve various financial objectives, but borrowing against your home is a downside you must consider first.

Pros

- Potentially higher loan amounts: Depending on the amount of your available home equity, you may qualify to borrow more than you could with other types of loans.

- Lower interest rates: As a secured loan, second mortgages tend to offer lower interest rates than credit cards and personal loans.

- Flexible spending uses: You can use funds from a second mortgage for virtually any legal purpose, including paying off high-interest credit cards, covering medical bills, funding tuition or financing a home improvement project.

- Potential tax benefit: You may qualify to deduct the interest you pay on your home equity loan or line of credit on your annual income taxes. To qualify, you must use the funds to build, buy or substantially improve your qualified home.

Cons

- Risk of foreclosure: Your lender could foreclose on your home and sell it to recoup losses if you fail to make your monthly payments. Accordingly, you must ensure you can comfortably afford both the primary and secondary mortgage before taking out a second mortgage.

- Closing costs and fees: Closing costs on home equity loans and HELOCs range from 2% to 5% of the loan amount. These costs may include the loan's origination, appraisal and title search fees. Costs vary by lender, and some don't charge closing costs altogether, so it pays to shop and compare multiple loan offers.

- Must make an additional monthly payment: Adding another loan means adding another monthly payment. The additional debt could strain your budget, especially if you suffer a loss of income or face unexpected expenses.

Second Mortgage vs. Refinance: What's the Difference?

Second mortgages and refinances both involve getting approved for a new loan, but they differ in a few distinct ways. For starters, when you take out a second mortgage, you get an additional loan on top of your primary mortgage. However, with a refinance, you replace your existing mortgage with a new one.

These two loan types generally serve different purposes. For example, a home equity loan or HELOC can provide the necessary funds if you need money for a major home improvement project. On the other hand, if you want to change your loan term or secure a lower mortgage rate, a rate-and-term refinance modifies your existing mortgage without borrowing additional funds, which may save you money over time.

Another type of refinance, called a cash-out refinance, allows you to replace your existing mortgage with a larger one and pocket the difference as cash. A cash-out refinance can serve a purpose similar to a home equity loan or HELOC by providing funds for large expenses. It can also help you adjust your loan term or secure a lower interest.

Learn more: Should I Get a Second Mortgage or Refinance?

Should You Get a Second Mortgage?

A second mortgage can be beneficial in many scenarios, but it also comes with certain risks, namely that your home is used as collateral.

You might consider a second mortgage if you want to pay off high-interest credit cards with a lower-interest equity lending option. A second mortgage could also be helpful if you need a large lump-sum payment (home equity loan) for a significant expense, or if you need ongoing access to cash (HELOC) to cover recurring expenses like college tuition or a home project that will be completed over time.

On the other hand, taking on a second mortgage doesn't make much sense if you're struggling to make your primary mortgage payments or if your DTI is high. A second mortgage could also be risky if your income isn't stable or you have little equity in your home. If your home value drops, you could end up underwater on the loan. Finally, if the interest rates you qualify for are too high, combined with the additional costs like closing fees, the overall cost of borrowing may offset the benefits you'd gain from the second mortgage.

The Bottom Line

A second mortgage may help you achieve important financial goals, but it's imperative to borrow within your means. Make sure you're confident in your ability to keep up with the payments before proceeding. After all, the stakes are high with your home on the line.

If you decide to take out a home equity loan or HELOC, you may receive more favorable rates by improving your credit score. Check your Experian credit report and score for free to see where your credit stands and address any issues you find.

Curious about your mortgage options?

Explore personalized solutions from multiple lenders and make informed decisions about your home financing. Leverage expert advice to see if you can save thousands of dollars.

Learn moreAbout the author

Tim Maxwell is a former television news journalist turned personal finance writer and credit card expert with over two decades of media experience. His work has been published in Bankrate, Fox Business, Washington Post, USA Today, The Balance, MarketWatch and others. He is also the founder of the personal finance website Incomist.

Read more from Tim