What Is APY?

Quick Answer

Annual percentage yield (APY) combines the interest rate and compounding to calculate the actual earnings on a savings account, CD, money market or other interest-bearing account.

Annual percentage yield (APY) is your actual rate of return on a savings account, money market, certificate of deposit (CD) or other interest-earning account. APY uses the account's interest rate and compounding to determine the amount you stand to earn.

Knowing an account's APY can help you compare its returns on different accounts more accurately to see if you are receiving a high yield on your deposits. Here's more on how APY works.

What Is APY and How Does it Work?

APY uses compounding to determine your real annual return on a savings or other interest-bearing account. Compounding adds the interest you've earned to your principal balance, which means it then contributes to your future interest earnings. For example, if your savings account compounds interest daily and you earn $5 on your $50,000 balance today, tomorrow you'll earn interest on $50,005.

Different accounts may compound at different frequencies: daily, monthly or annually. At the same interest rate, an account that compounds daily will earn more money than an account that compounds monthly or annually.

Learn more: APY vs. Interest: What's the Difference?

Fixed APY vs. Variable APY

An account can also have a fixed or variable APY. CDs are a common example of accounts with fixed APYs. When you open a CD, you typically agree to leave your money in your account for a specified period of time in exchange for a fixed return, or APY. Although some CDs may adjust mid-term (for instance, bump-up CDs), most have a single APY that doesn't change.

Savings accounts, high-yield savings accounts and money market accounts typically have variable APYs. Their interest rates may adjust based on changes to the Federal Reserve's benchmark rates and other market factors.

Learn more: What Is a High-Yield Savings Account?

How to Calculate APY

Technically, you shouldn't have to calculate APY. Financial institutions are required by law to disclose both APY and interest rates, so this information is readily available from your bank or credit union—or any prospective financial institution advertising interest-earning accounts.

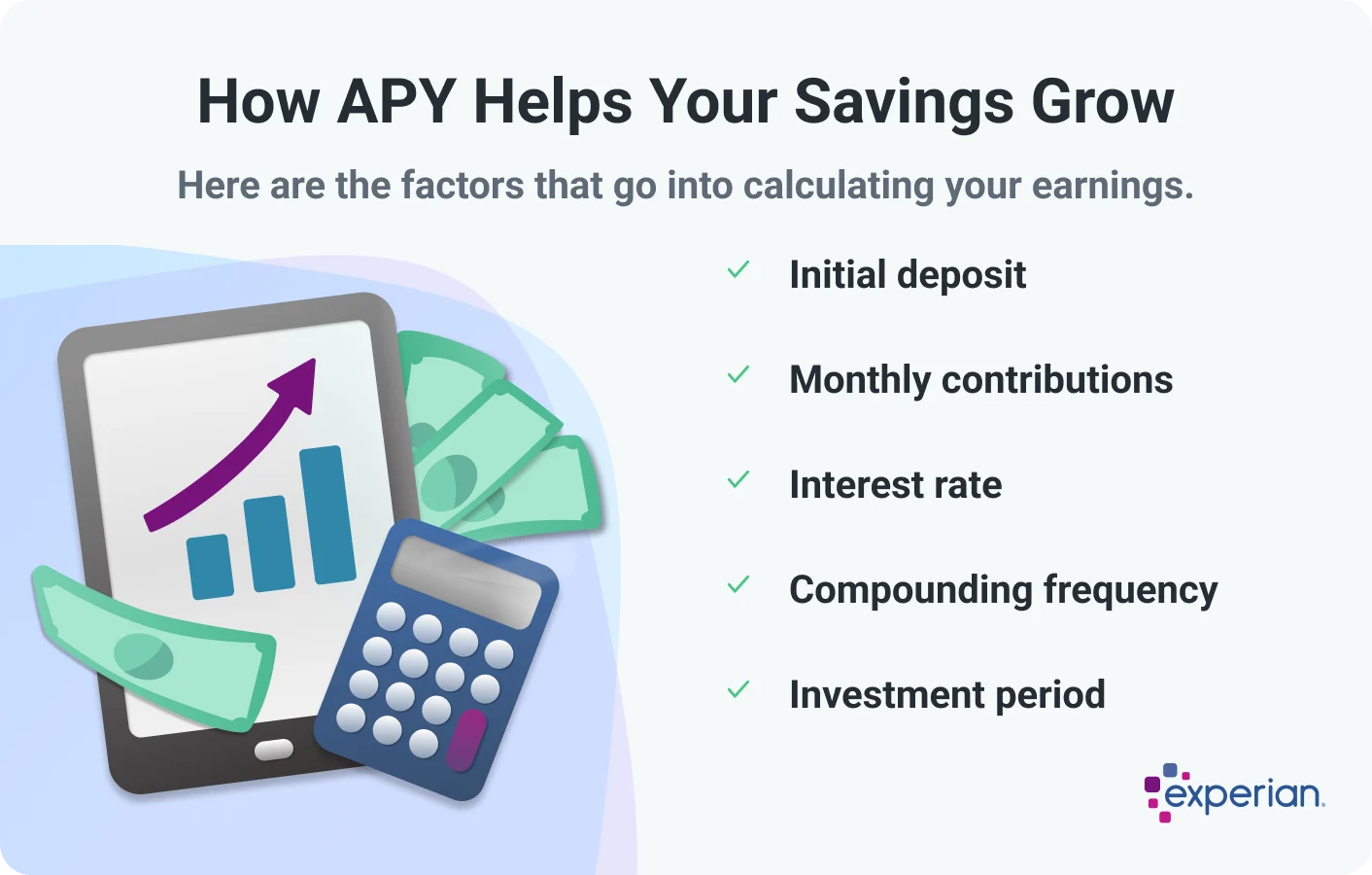

If you're looking for a high yield and you want to find out how much money you'll earn based on your savings balance and APY, you can use an online savings calculator. Enter your deposit amount, monthly contributions (if any), APY, compound frequency (such as daily, monthly or annually) and investment period to see your estimated return.

APY vs. APR

APY is the annual return on your savings; annual percentage rate (APR) is the annual cost of borrowing money on a credit card or installment loan. APR equals interest rate plus the annualized cost of fees (such as origination fees) associated with your loan or credit accounts.

Here's a quick side-by-side comparing the two acronyms:

| APY (Annual Percentage Yield) | APR (Annual Percentage Rate) | |

|---|---|---|

| Definition | Annual return on savings, based on interest rate and compounding | Annual cost of borrowing, including annualized interest rate and fees |

| Used for | Savings accounts, CDs, money market accounts and other interest-bearing accounts | Credit cards, mortgages, auto loans, personal loans and other installment loans |

| Purpose | Shows your annual rate of return on deposits like savings | Shows your total annual cost of borrowing on loans and credit |

How APY Affects Your Returns

APY shows a clearer picture of what you'll earn than interest rates alone. The key factor is compounding. The frequency with which your interest compounds affects how quickly your money will grow. APY can help you estimate what you'll actually earn, and that makes it easier to compare one account to another.

Here's how $25,000 increases at 4% interest, compounding daily, monthly and yearly.

| Compounding Frequency | 1 Year | 5 Years | 20 Years |

|---|---|---|---|

| Daily | $26,020.21 | $30,534.73 | $55,636.08 |

| Monthly | $26,018.54 | $30,524.91 | $55,664.55 |

| Annually | $26,000.00 | $30,416.32 | $54,778.08 |

The Bottom Line

APY acts as a clear indicator of what you're earning on savings accounts, CDs and other interest-earning accounts. Because it reflects the impact of both interest rates and compounding, APY is a more accurate measure of your return on deposits than interest rates alone—and is a great tool for comparing different types of accounts or monitoring your returns on variable accounts year over year.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Gayle Sato writes about financial services and personal financial wellness, with a special focus on how digital transformation is changing our relationship with money. As a business and health writer for more than two decades, she has covered the shift from traditional money management to a world of instant, invisible payments and on-the-fly mobile security apps.

Read more from Gayle