What Is Compound Interest?

Quick Answer

Compound interest is interest applied to a principal balance plus any interest already accrued. In this way, compounding earns interest on top of interest and builds exponentially over time.

Compound interest is interest that accrues on your principal and interest. Put simply, that means the interest you earn is earning interest on itself, which can dramatically impact your balance over time.

Understanding how compound interest works can help you make more money over time—or avoid paying more in interest.

What Is Compound Interest?

Compound interest is the interest you earn from your principal savings or investment amount plus any interest the investment earns. Consequently, your account earns interest on top of interest.

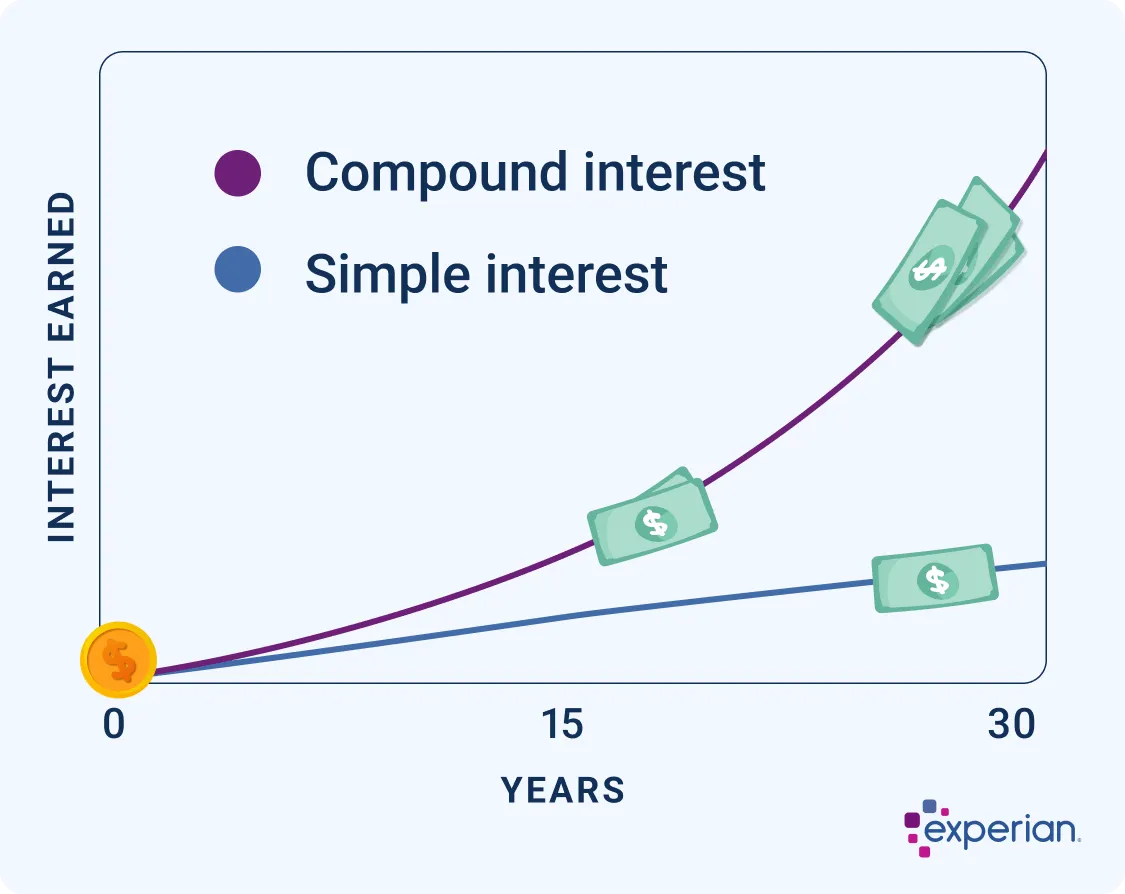

This is different from simple interest, which is interest that accrues solely on your principal balance; you don't earn any additional interest on your interest gains.

Compound interest is important because with savings and investments, it enables your money to grow exponentially. Whereas simple interest only allows you to earn interest on your initial investment, compound interest triggers a faster growth rate.

The tricky thing about compounding interest is that it can be good or bad, depending on which side you're on. If you're an investor, compound interest helps your investment grow faster; if you're a borrower, compound interest makes borrowing more expensive.

How Does Compound Interest Work?

Compound interest is the extra interest you earn on the interest that you've already earned. To better understand how compound interest works, here are the primary factors at play:

- Principal balance: This is the starting balance for your savings account or investment plus any additional contributions you may make. On a loan or credit card, it's the current balance minus interest charges.

- Interest: Interest is effectively the cost of borrowing money. In a savings or investment account, you can earn interest from the financial institution. With a loan, on the other hand, you pay interest to the lender.

- Compounding frequency: This feature indicates how often interest is compounded. Depending on the account and the financial institution offering it, your interest may be compounded daily, monthly, quarterly, semi-annually or annually.

- Duration: The longer you leave money in a savings or investment account, the more interest you'll earn. However, the opposite is also true for debt. For example, paying just the minimum amount due on your credit card instead of paying it off can result in ballooning interest charges due to compounding interest.

- Deposits and withdrawals: The more you put into your savings or investment account, the greater impact compound interest will have on your interest earnings. However, taking money from the account can reduce the impact of compound interest. Meanwhile, adding more to your credit card balance can result in increasing interest charges, while paying down your balance will do the opposite.

Learn more: What Is a High-Yield Savings Account?

Earn Money Faster

Compare high-yield savings accounts

Find a high-yield savings account with today’s APY. Compare current APY and offers to find the best savings account for you.

Simple Interest vs. Compound Interest

While compound interest applies to both the principal balance and previously accrued interest, simple interest only accrues based on the principal balance.

As an example, let's say you invest $10,000 in an investment that earns 10% a year in interest. Here's a comparison of the two options to show how impactful compound interest can be:

| Period | Compound Interest (Compounded Annually) | Simple Interest |

|---|---|---|

| 1 year | $11,000 | $11,000 |

| 2 years | $12,100 | $12,000 |

| 5 years | $16,105.10 | $15,000 |

| 10 years | $25,937.42 | $20,000 |

| 20 years | $67,275 | $30,000 |

| 30 years | $174,494.02 | $40,000 |

| 40 years | $452,592.56 | $50,000 |

As you can see, the compounding interest on your initial deposit grows exponentially. As a result, compound interest is better for savings and investment accounts, while simple interest is preferable on a loan.

How to Calculate Compound Interest

The massive growth resulting from compound interest can seem magical, but in reality, it all boils down to a simple mathematical formula:

- A = The final amount of money you will have (or owe) at the end of the time period

- P = Your principal, or how much you first invested or owed

- r = Interest rate expressed as a decimal. For example, if your interest rate is 4% per year, you would enter 0.04 into the formula here.

- n = The number of times your interest compounds each year

- t = The number of years the money grows

Compound Interest Example

If you're not a math person, you can easily use an online calculator to get an estimate of the interest you can earn through compounding. However, crunching the numbers on your own can help you get a better understanding of how compounding works.

Let's return to the example above and break down the results after two years using the formula:

A = $10,000 (1 + 0.1/1)1*2

A = $10,000 (1.1)2

A = $10,000 x 1.21

A = $12,100

As you compare different investment options and savings accounts, you can plug in different variables, such as interest rates and compounding frequencies, to see how your result changes. As an example, here's a quick comparison of different compounding frequencies:

| Period | Compounds Annually | Compounds Quarterly | Compounds Monthly |

|---|---|---|---|

| 1 year | $11,000 | $11,038.13 | $11,047.13 |

| 2 years | $12,100 | $12,184.03 | $12,203.91 |

| 5 years | $16,105.10 | $16,386.16 | $16,453.09 |

| 10 years | $25,937.42 | $26,850.64 | $27,070.41 |

Savings calculator

Examples of Compound Interest

There are many different types of financial accounts that offer compound interest on your investment or savings. In contrast, most loans charge simple interest, albeit with some exceptions.

Here are some places where you might encounter compound interest:

- Savings deposit accounts: Whether it's a traditional or high-yield savings account, money market account or certificate of deposit, you'll likely earn compound interest on your balance. In some cases, banks and credit unions compound interest as often as daily.

- Bonds: When you buy individual bonds or invest in a bond fund, you're essentially lending money to the bond issuer. In exchange, you'll earn interest on your investment. Bonds often compound interest on a semi-annual basis. Options include Treasury securities, municipal bonds and corporate bonds, along with exchange-traded funds and mutual funds that contain bonds.

- Credit cards: Credit card issuers typically charge compound interest on your balance with a daily compounding frequency. However, the good news is you can avoid interest charges entirely if you pay your balance on time and in full every month.

Note that you can also compound your earnings on other types of investments, such as stocks, exchange-traded funds, mutual funds and real estate investment trusts, if you reinvest dividends earned. However, you're not technically earning interest on these investments.

How to Take Advantage of Compound Interest

The accelerated growth from compound interest can generate passive income you don't have to work for. Consider the following strategies to maximize your gains through compounding interest:

- Start saving early. The longer you invest your money, the more opportunity it has to compound and grow.

- Minimize withdrawals. Withdrawing money reduces your principal and, consequently, your returns. Try to avoid taking money out of your savings and investment accounts to cover unnecessary expenses.

- Regularly contribute to your account. The more money you add to your investment account, the more you can build wealth over time.

- Shop around. Take your time to evaluate savings and investment options to maximize your chances of getting the best return possible. In addition to interest rates, it's also important to compare compounding frequencies, withdrawal penalties and other features that are important to you.

- Pay off high-interest debt. While most forms of debt typically use simple interest, credit cards typically compound the interest you owe. If you have some credit card debt, take steps to pay it off as quickly as possible to minimize your interest costs. Then, make it a priority to pay in full every month to prevent further interest charges.

Learn more: Best Compound Interest Investments

The Bottom Line

Compound interest can help you increase your savings and build wealth over time. However, it can also be a detriment to your financial well-being if you have high-interest credit card debt.

Take some time to evaluate your current financial situation and goals to get a better idea of how to make the most of compound interest for your financial plan.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben