What Is a Deed of Trust?

Quick Answer

A deed of trust is a legal document that establishes property as collateral for a home loan. Deeds of trust are used when you purchase or refinance a home and describe what happens if you default on the loan.

A deed of trust is used in many states to establish a property as collateral for a loan. It outlines the agreement between you, the lender and a third-party trustee. Deeds of trust function similar to mortgages: Both are used to secure a loan with real estate. Some states use mortgages, while others use deeds of trust, or both.

What Is a Deed of Trust?

A deed of trust is a legal document used in real estate to secure a home loan. It's different from a property deed, which establishes or transfers property ownership. Instead, it's more like a mortgage agreement: It secures the property being purchased as collateral and allows the lender to claim it if the borrower fails to pay the loan.

How Does a Deed of Trust Work?

A deed of trust works as an agreement that obligates the borrower to repay their home loan, or else the lender can foreclose on the home.

There are three parties named on a deed of trust:

- Lender or beneficiary: The institution providing the loan.

- Trustor or borrower: The person borrowing money and pledging property as security. The borrower agrees to repay the loan as outlined in a promissory note.

- Trustee: A neutral third-party who holds the legal title to the property until the loan is repaid.

Alongside the deed of trust, the borrower also signs a promissory note. This is a legally binding promise to repay a loan. It typically includes:

- Name of the lender

- Loan amount

- Interest rate

- Repayment schedule

Deed of Trust vs. Mortgage

A deed of trust and a mortgage both allow a lender to foreclose on a property if the borrower defaults. However, they have some differences in structure and foreclosure process.

| Deed of Trust | Mortgage | |

|---|---|---|

| Parties involved | Borrower, lender and trustee | Borrower and lender |

| Who holds the title | A third-party trustee, usually a title company | Usually the borrower (the lender is a lienholder) |

| Foreclosure process | Nonjudicial: no court involvement | Judicial in many states: court order required |

A mortgage only involves two parties: the borrower and lender, or the mortgagor and mortgagee. Either the lender or the borrower may hold the title, depending on the state. A deed of trust includes an extra party, the trustee, who's responsible for holding the title.

In a deed of trust, the trustee can initiate the foreclosure process and sell the home without going to court if the borrower defaults. This is called a nonjudicial foreclosure. Certain states also provide for nonjudicial foreclosures with a mortgage (if a power of sale agreement is included in the loan terms), but others require the lender to file a lawsuit in court to foreclose. This is a longer process with more legal steps.

Learn more: What's the Difference Between a Title and a Deed?

Which States Use a Deed of Trust?

Many states allow either deeds of trust and mortgages, but some favor one over the other.

States that commonly use deeds of trust:

- California

- Colorado

- District of Columbia

- Georgia

- Idaho

- Maryland

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Mexico

- North Carolina

- Oregon

- Tennessee

- Texas

- Utah

- Virginia

- Washington

- West Virginia

How to Get a Deed of Trust

When you purchase a home, the lender's legal team or the title/escrow company usually prepares the deed of trust during closing. You'll sign both the deed of trust and the promissory note. Once signed, the deed of trust is recorded with the county recorder's office. This creates a public record and places a lien on the property.

You can request a copy of a deed of trust from your local county recorder's office. Many counties offer uncertified copies online for free, but you may need to pay a fee for an official or certified copy.

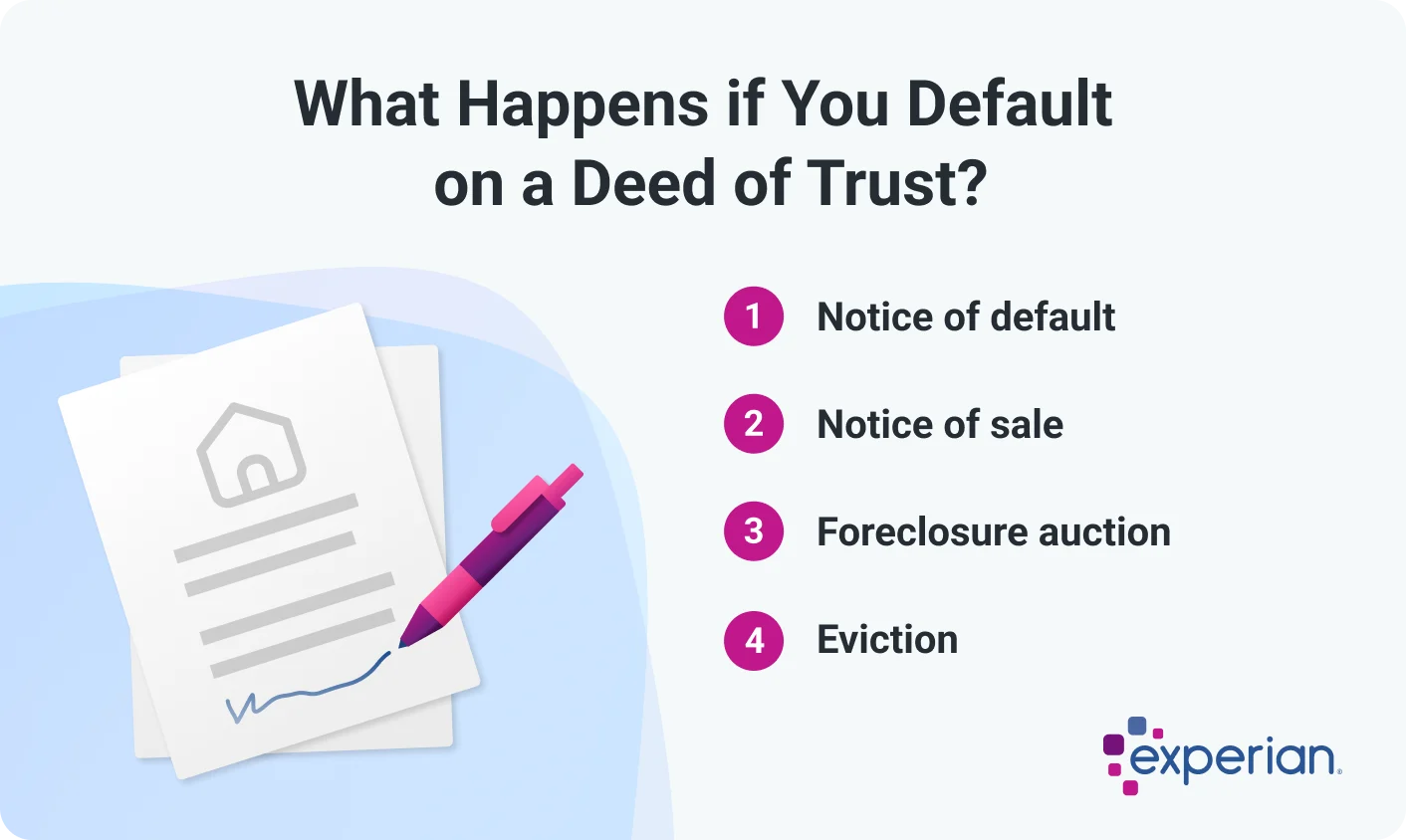

What Happens if You Default on a Deed of Trust?

If you stop making payments or violate the loan agreement, you're considered in default. The trustee can then initiate a nonjudicial foreclosure to recover the property for the lender.

1. Notice of Default

The trustee initiates the foreclosure process by filing a Notice of Default with the county and sends a copy to you. In some states, you may have time to reinstate the loan by catching up on payments and fees.

2. Notice of Sale

If the loan isn't reinstated, the trustee issues a Notice of Sale, setting the date, time and location for the property auction. The trustee must publicly advertise the sale of the property.

3. Foreclosure Auction

At the foreclosure sale, the property is sold to the highest bidder. This person is the new owner and receives a trustee's deed. If no one bids, the lender may take possession of the property.

4. Eviction

The new owner can start the eviction process if you haven't already left the property.

Tip: You may be able to avoid foreclosure by exploring options like a loan modification, forbearance or short sale.

What Happens After You Pay Off a Deed of Trust?

Once the loan is fully paid off, the lender notifies the trustee. The trustee issues a deed of release or deed of reconveyance, depending on the state. This document releases the lender's lien and transfers the full legal title to you. It's then filed with the county recorder's office to update the public record.

The Bottom Line

If you live in a state that uses deeds of trust, it's important to understand how they work, especially if you're buying, selling, refinancing or at risk of foreclosure. They're similar to mortgages, but a key difference is the option to foreclose without going through the courts. This can speed up the foreclosure timeline if you default.

The deed of trust is just one of several important documents you'll sign at closing. As you move through the mortgage process, be sure to keep an eye on your credit report. Staying proactive can prevent significant changes that could affect your loan approval and delay closing.

Curious about your mortgage options?

Explore personalized solutions from multiple lenders and make informed decisions about your home financing. Leverage expert advice to see if you can save thousands of dollars.

Learn moreAbout the author

LaToya Irby is a personal finance writer who works with consumer media outlets to help people navigate their money and credit. She’s been published and quoted extensively in USA Today, U.S. News and World Report, myFICO, Investopedia, The Balance and more.

Read more from LaToya