What Is a Mortgage Statement?

Quick Answer

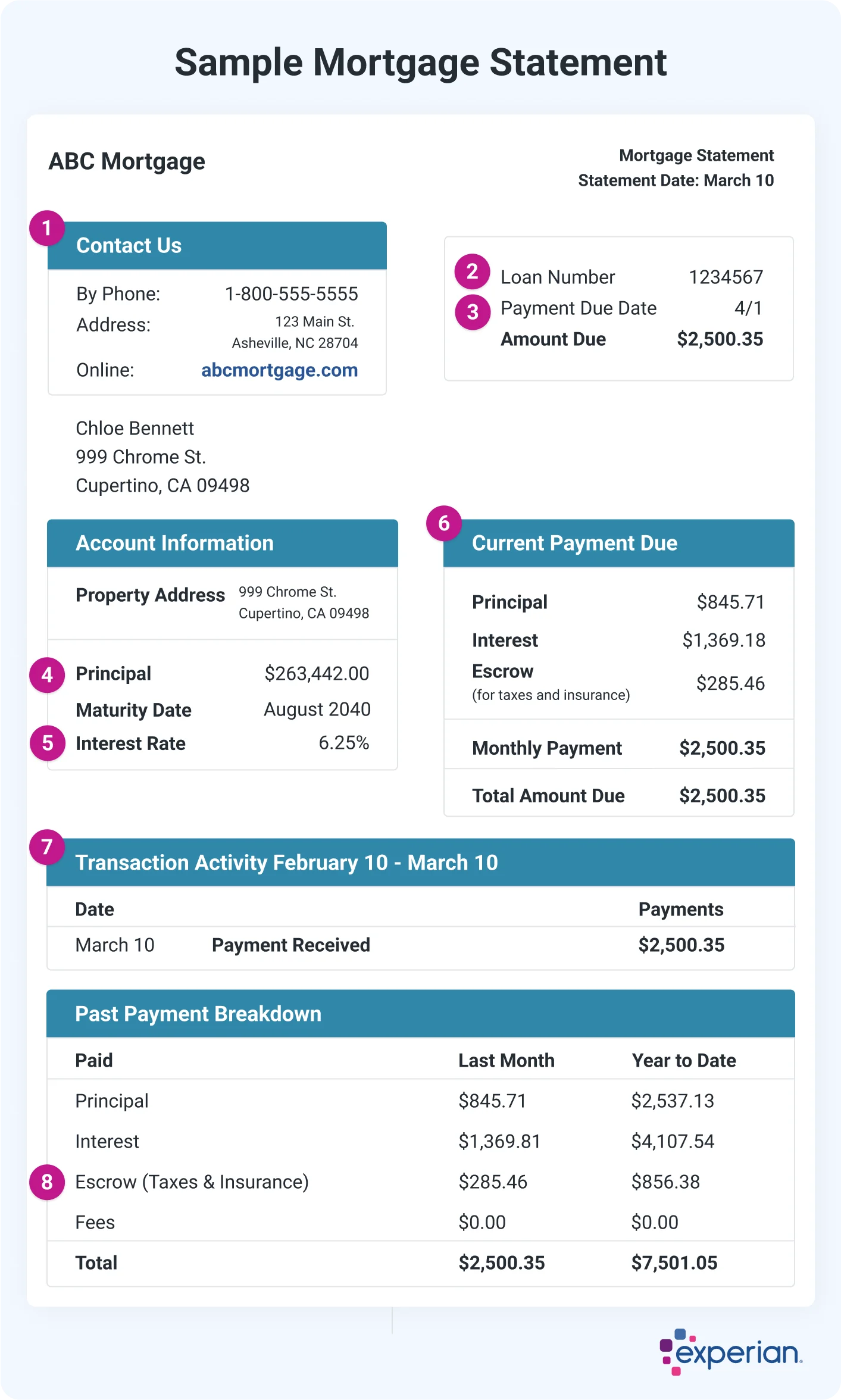

A mortgage statement lays out important details about the status of your home loan, including your account number, amount due, current loan balance, payment due date and interest rate.

If you have a home loan, your loan servicer should send you a monthly mortgage statement. This document is where you'll find key details about your mortgage, including your monthly payment amount and due date, as well as your payment history, interest rate and other important information related to your loan.

You can think of a mortgage statement as a snapshot of your mortgage. To help you understand the information found there and what it means, here's a guide to mortgage statements.

What Is a Mortgage Statement?

Your mortgage servicer is legally required to send you a statement each billing cycle. It serves as a detailed summary of your loan status, which can help you better understand the ins and outs of your mortgage. This is important, as your home may be your biggest financial asset. As you continue to make payments and reduce your balance, you'll build home equity and increase your net worth.

Learn more: What Is a Mortgage and How Does It Work?

What Does a Mortgage Statement Look Like?

A mortgage statement offers an overview of your most recent loan details. It's typically one or more pages long and highlights the following information.

1. Mortgage Servicer Information

This should include your loan servicer's name, address and customer service phone number. If you're paying by check, be aware that the address you send your payment to may be different from the main address listed at the top of your mortgage statement. Be sure to scan your statement to confirm the correct address before mailing your payment. You might also find separate addresses for inquiries related to:

- Fixing an error on your mortgage statement

- Insurance renewals or bills

- Tax notices or bills

- Bankruptcy notices

Learn more: Do Changes to My Loan Servicer Affect My Credit Score?

2. Account Number

This is a unique number that's linked to you, your home loan and your property. You'll likely see it at the top of your mortgage statement. It's wise to keep this number on hand for your records.

3. Payment Due Date

This is the last day to make your mortgage payment before it's considered late. A late payment could stay on your credit report for seven years and negatively impact your credit score. You can also expect a late fee from your mortgage servicer. Enrolling in autopay can help ensure that your payment goes through on time, every month.

4. Account Information

This is what you currently owe on your home loan—but keep in mind that this isn't the same as your loan payoff amount. If you choose to pay off your mortgage early, you'll need to contact your servicer to request the final amount due, which will include any interest that accrues between your last statement date and the day of your final payment. You'll also want to clarify if there are any prepayment penalties.

5. Explanation of Amount Due

Several different costs may be rolled into your monthly mortgage payment. Your mortgage statement should provide a clear breakdown of each one, along with the total amount due. The amount you owe may include:

- Loan principal: This goes toward repaying the original amount you borrowed to finance your home.

- Interest: Mortgage interest is what your lender charges you to borrow that money. Your rate will never change with a fixed-rate mortgage, but adjustable-rate mortgages (ARMs) are different.

- Property taxes: If you have an escrow account, you'll likely pay a portion of your expected property taxes each month. When the bill comes due, your mortgage servicer will use these funds to pay it on your behalf.

- Insurance: You might also use an escrow account to pay for homeowners insurance or mortgage insurance.

Learn more: What Is Principal, Interest, Taxes and Insurance (PITI)?

6. Transaction Activity and Past Payments

You'll likely find a recent payment history on your mortgage statement. That may show how much you've paid since the previous billing cycle, as well as the total amount paid year to date. That includes your principal, interest, taxes, insurance and any fees you've paid.

7. Interest Rate

Your mortgage rate will either be fixed or variable. With a fixed-rate mortgage, you'll have predictability and a rate that never changes. With an adjustable-rate mortgage, there's an initial fixed-rate period, followed by regular rate adjustments. As a result, your rate—and monthly payment—could change over time.

Learn more: What's the Difference Between Fixed-Rate and Adjustable-Rate Mortgages?

8. Escrow Balance

If your mortgage payment includes an escrow payment, you may see the escrow balance on your statement. Your escrow account balance should increase as you make your mortgage payments month after month—and decrease as funds are withdrawn to cover expenses like homeowners insurance and property taxes. Your loan servicer will conduct an annual review and should notify you if your escrow payments are expected to change.

Learn more: What Is an Escrow Shortage and How Can I Fix It?

How to Read a Mortgage Statement

Your mortgage statement should be a pretty straightforward document that summarizes your loan status. It's a good idea to review it monthly, keeping an eye out for the following details:

- Escrow charges: Has anything changed since your last statement?

- Fees: Are there any late charges or other fees listed on your statement? If you spot an error, be sure to contact your mortgage servicer.

- Delinquency notices: If you've missed a payment, the amount due should be listed on your mortgage statement. The account may go into delinquency status if your payment is 30 days or more past due—and that will count as a negative entry on your credit report. Defaulting on your mortgage can also lead to foreclosure.

Tip: While mortgage statements generally contain similar information, your mortgage servicer may format it differently from the examples you see online. Additionally, some information may be lacking, especially if you pay your homeowners insurance and property taxes separately. If you have questions, contact your loan servicer.

Where to Get a Mortgage Statement

Your mortgage statement may be available a few different ways:

- Online: Most likely, you can access your mortgage statements by signing in to your online account portal.

- By mail: Your mortgage servicer might mail you a physical copy of your monthly mortgage statement.

- Directly from your loan servicer: You can request a mortgage statement at any time, no matter where you are in your billing cycle. Your loan servicer is legally obligated to provide information about the servicing of your mortgage.

How to Pay Your Mortgage

There are several ways to go about paying your mortgage. What matters most is picking a method that's compatible with your budgeting style and helps prevent a missed payment.

- Set up autopay. With this hands-off approach, your monthly mortgage payments will happen automatically.

- Use calendar reminders. If you prefer to make manual payments, start by setting an alert on your phone or marking your calendar. Otherwise, life could get busy—and you might forget to make a payment.

- Pay by phone or mail. These options aren't as convenient, but they can still get the job done if you're in a pinch.

Learn more: What Are the 4 Parts of a Mortgage Payment?

Frequently Asked Questions

The Bottom Line

Think of your monthly mortgage statement as a rundown of your loan status. This is where you'll find your next payment due date, your current loan balance and other key details related to your mortgage. Being aware of these things can help you prepare your budget and better understand how your loan works.

Curious about your mortgage options?

Explore personalized solutions from multiple lenders and make informed decisions about your home financing. Leverage expert advice to see if you can save thousands of dollars.

Learn moreAbout the author

Marianne Hayes is a longtime freelance writer who's been covering personal finance for nearly a decade. She specializes in everything from debt management and budgeting to investing and saving. Marianne has written for CNBC, Redbook, Cosmopolitan, Good Housekeeping and more.

Read more from Marianne