What Is the Average Credit Score in the US?

Quick Answer

The average credit score was 713 as 2025 came to a close, a two-point drop from 2024.

The average credit score in the U.S. was 713 in 2025, according to Experian data. That marks a two-point decline from 2024 that ends a decade-plus streak without a decline in the average FICO® ScoreΘ. The September 2025 average marks the first annual decline in the national average FICO credit score since 2013.

Despite the recent dip, however, score increases over the years suggest that overall consumers are still generally regarded as better credit risks by lenders than they were 10 to 15 years ago.

Consumer credit score highlights this year include:

- A large majority (70%) of consumers have a good or better credit score (670 or higher). However, the percentage of consumers with a FICO® Score in the poor range grew to 15% in 2025 (more on that later). Better credit scores can mean lower borrowing rates, and credit score minimums must usually be met for most consumer loans.

- Average credit scores fell in most states in 2025. The steepest declines occurred in Louisiana and Washington, D.C., where average credit scores fell four points. Only three states saw their average credit scores unchanged. The average credit score didn't increase in any state.

- Average balances are growing slowly for most types of personal debt, while interest rates have declined. Meanwhile, continued inflation and rising unemployment rates suggest the downward pressure on average credit scores is due more to a more adversarial economy many consumers are facing. Unemployment levels and delinquency rates are both up, although both are climbing from historically low levels.

Average FICO Credit Score in the U.S. is 713

Consumers faced multiple challenges in 2025. Chiefly, continued higher prices—particularly for necessary expenses related to shelter and driving. Add to that changes to health care coverage and government programs and an economy that, while not shedding as many jobs, isn't adding many either. By the end of the year, economic commentators ultimately coalesced around "affordability" as a shorthand description of these shifts in spending.

And while these affordability challenges aren't yet impacting most consumers' ability to obtain new credit, changes and uncertainties are causing many to hesitate before asking for additional credit.

- The Federal Reserve Bank of New York noted last year that consumers expect a tougher job market and higher prices in 2026. Debt delinquency expectations (a measure of how likely consumers think they are to miss a monthly payment) increased in December to the highest level since the beginning of the pandemic in 2020.

- Consumers applying for credit last year experienced record high rejection rates. According to the New York Federal Reserve's consumer expenditure survey data in 2025, rejection rates were up for new and refinanced mortgages as well as auto loans.

- Credit card applications have softened in 2025, according to both Federal Reserve and Experian data. Applications for personal loans, however, are up.

- When consumers are obtaining new credit, it's often to refinance their existing debts. Personal loans, home equity lines of credit (HELOCs) and home equity loans all usually have lower interest rates than revolving credit card debt and are popular options for debt consolidation.

- Finally, consumer confidence indexes are making headlines because of record declines. While these indexes aren't necessarily indicative of measurable economic realities, the way consumers feel about the economy certainly sways their financial decisions.

Learn more: What Is a Good Credit Score?

Average Credit Scores by State

Average FICO® Scores fell in most—though not all—states last year. Washington, D.C., and Louisiana saw the largest dips of four points each in 2025. Meanwhile, Illinois, Maine and Vermont were the only states where average FICO® Scores remained unchanged.

Average FICO® Score by State

| State | 2024 | 2025 | Change (Points) |

|---|---|---|---|

| Alaska | 722 | 720 | -2 |

| Alabama | 692 | 689 | -3 |

| Arkansas | 695 | 693 | -2 |

| Arizona | 712 | 709 | -3 |

| California | 722 | 721 | -1 |

| Colorado | 731 | 729 | -2 |

| Connecticut | 726 | 724 | -2 |

| District of Columbia | 715 | 711 | -4 |

| Delaware | 714 | 713 | -1 |

| Florida | 707 | 704 | -3 |

| Georgia | 695 | 692 | -3 |

| Hawaii | 732 | 730 | -2 |

| Iowa | 730 | 728 | -2 |

| Idaho | 730 | 729 | -1 |

| Illinois | 720 | 720 | 0 |

| Indiana | 712 | 710 | -2 |

| Kansas | 722 | 720 | -2 |

| Kentucky | 705 | 704 | -1 |

| Louisiana | 690 | 686 | -4 |

| Massachusetts | 732 | 731 | -1 |

| Maryland | 715 | 714 | -1 |

| Maine | 731 | 731 | 0 |

| Michigan | 719 | 717 | -2 |

| Minnesota | 742 | 741 | -1 |

| Missouri | 714 | 712 | -2 |

| Mississippi | 680 | 677 | -3 |

| Montana | 732 | 730 | -2 |

| North Carolina | 709 | 707 | -2 |

| North Dakota | 733 | 730 | -3 |

| Nebraska | 731 | 728 | -3 |

| New Hampshire | 736 | 735 | -1 |

| New Jersey | 724 | 722 | -2 |

| New Mexico | 702 | 701 | -1 |

| Nevada | 701 | 699 | -2 |

| New York | 721 | 719 | -2 |

| Ohio | 716 | 713 | -3 |

| Oklahoma | 696 | 693 | -3 |

| Oregon | 732 | 730 | -2 |

| Pennsylvania | 722 | 720 | -2 |

| Rhode Island | 721 | 719 | -2 |

| South Carolina | 700 | 699 | -1 |

| South Dakota | 734 | 731 | -3 |

| Tennessee | 706 | 703 | -3 |

| Texas | 695 | 692 | -3 |

| Utah | 730 | 728 | -2 |

| Virginia | 723 | 721 | -2 |

| Vermont | 737 | 737 | 0 |

| Washington | 735 | 734 | -1 |

| Wisconsin | 738 | 737 | -1 |

| West Virginia | 702 | 699 | -3 |

| Wyoming | 725 | 722 | -3 |

Source: Experian data from September of each year

The slight declines among states suggest that despite other differences among the states, all are experiencing similar factors affecting their credit scores in the shorter term. Longer term, there's better news: Save for three states in the Northern Plains, average FICO® Scores are still higher than they were in 2020 in every state in the nation.

Change in Average FICO® Scores, 2020 to 2025

In the shorter term, there's suggestions that most consumers are retrenching their finances and are becoming more deliberate in both their everyday purchases as well as establishing new lines of credit. Refinancing of existing debt is now ascendant, with personal loans and HELOC applications growing—in many cases to refinance existing higher interest rate credit card debt.

Average Credit Scores by Age

Younger generations faced the brunt of the credit score declines in 2025. The average FICO® Score for millennials fell two points in 2025. Generation Z's average credit score fell three points.

As younger generations typically have fewer assets than older consumers, the deterioration in their collective credit scores causes even more strain since they are less likely to have home equity or savings to tap in the event of financial emergency or job loss.

In addition, these two generations are more likely to have student loan debt. In many cases, monthly payments for government-held student debt are set to rise, due to the ending of the SAVE student loan income-based repayment plan program in 2025. The ending of SAVE means interest will again accrue on nearly 8 million SAVE student loan income-based repayment plans. Student loan borrowers will also need to change to a less generous income-based repayment plan with higher monthly payments.

| Generation (Age) | 2024 | 2025 | Change |

|---|---|---|---|

| Generation Z (18-28) | 681 | 678 | -3 points |

| Millennials (29-44) | 691 | 689 | -2 points |

| Generation X (45-60) | 709 | 709 | unchanged |

| Baby boomers (61-79) | 746 | 747 | +1 point |

| Silent Generation (80+) | 760 | 760 | unchanged |

Source: Experian data from September of each year; ages as of 2025

Meanwhile, baby boomers continue to improve their position, as the generation's average credit score increased by one point to 747 in 2025. A longer credit history may explain some of the resilience but, in general, baby boomers have a different overall credit profile than working-age generations. Baby boomers are more likely to have paid-off or low-balance mortgages, empty (or emptier) nests that often mean fewer trips to the grocery and fewer needs for another vehicle to finance.

Despite the declines, average FICO® Scores for all generations are still in the good (670 to 739) or very good range (740 to 799) in 2025, which means borrowers with average credit scores may continue to be acceptable risks to lenders in 2026.

Distribution of Consumer Credit by Score Range

FICO® Scores are divided into five broad categories, ranging from poor to exceptional. Most consumers (70%) have good or better credit scores, according to Experian data. A significantly larger percentage of consumers are now in the poor (300 to 579) FICO® Score range in 2025 versus last year.

| FICO® Score Range | 2024 | 2025 |

|---|---|---|

| Poor (300-579) | 13.2% | 14.7% |

| Fair (580-669) | 15.5% | 14.9% |

| Good (670-739) | 21.0% | 20.1% |

| Very good (740-799) | 27.8% | 27.5% |

| Exceptional (800-850) | 22.5% | 22.8% |

Source: Experian data from September of each year

The increase in the percentage of consumers at either extreme seems to validate the buzzwordy explanation that the economy has become "K-shaped." Some brief background: The K-shaped economy refers to the phenomenon where highest income earners continue to spend while the remaining majority of consumers are either tightening belts or being priced out of some goods and services altogether.

In that context, if you look at the modest polarization in scores last year, K-shape may refer to credit as well. A larger percentage of consumers are now in the poor (300 to 579) FICO® Score range in 2025 versus last year. Meanwhile, the share of consumers who have ascended to the exceptional (800 to 850) credit score category is at an all-time high of 22.8% as of September 2025, according to Experian data. Naturally, the increase in the extremes were supplied by consumers migrating from fair, good and very good scores.

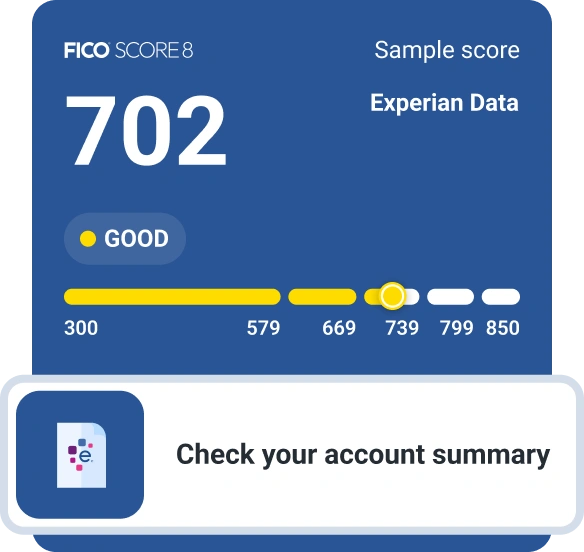

What Are the FICO® Score Ranges?

The base FICO® Score 8, a score widely used by lenders, ranges from 300 to 850.

| Range | Rating |

|---|---|

| 300-579 | Poor |

| 580-669 | Fair |

| 670-739 | Good |

| 740-799 | Very good |

| 800-850 | Exceptional |

Key FICO® Score Factors

- Payment history (35%): This is the biggest piece of the puzzle. Paying your bills on time, every time, does more for your FICO® Score than anything else. Conversely, even one missed payment is likely to leave a mark and depress your credit score.

- Amounts owed (30%): The second most important factor in your credit is how much you owe on your accounts and how much of your available credit you use. This includes not only the remaining balances on your installment loans, but your revolving credit balances as they relate to your credit limits (credit utilization). As a rule of thumb, keeping your balances below 30% of your credit limits can help protect your score, while higher balances can start to drag it down.

- Length of credit history (15%): Credit scores favor experience, and a longer credit history will work in your favor.

- Credit mix (10%): Lenders like to see that you can manage different types of credit, such as credit cards, auto loans and mortgages. Having a healthy mix can give your score a modest boost.

- New credit (10%): When you apply for new credit, lenders typically run a credit check that results in a hard inquiry, which can cause a small, temporary dip in your score. Opening a new account can also cause a negative impact on your scores.

Learn more: What Affects Your Credit Scores?

Average Credit Card Usage

As explained above, a key factor in your credit score is how much of your available credit you're actually using—especially on credit cards. Every card comes with a limit, and using only a small slice of that limit can work in your favor. That's why many consumers already pay close attention to their balances and try to keep them low relative to their available credit.

| 2023 | 2024 | 2025 |

|---|---|---|

| 29% | 29% | 29% |

Source: Experian data from September of each year

Despite the decline in credit scores, credit utilization remains in check, holding steady at 29% for the second consecutive year. This suggests that of the five components of a consumer's credit score, overuse of existing credit isn't a primary cause of the average decline last year.

Credit utilization above 30% is when it can have a negative impact on your credit score. Lower utilization ratios typically correlate to better credit scores.

| Average Credit Utilization by FICO® Score Range | |

|---|---|

| Poor (300-579) | 79% |

| Fair (580-669) | 61% |

| Good (670-739) | 39% |

| Very good (740-799) | 15% |

| Exceptional (800-850) | 7% |

Source: Experian data as of September 2025

Delinquency Rates by Account Type

Currently, delinquency rates are increasing for some types of consumer debt while slightly declining for others. Mortgage and auto loan delinquencies increased from their 2024 levels, while credit card and personal loans have similar to slightly lower percentage of delinquent accounts.

| Account Type | 2023 | 2024 | 2025 |

|---|---|---|---|

| Credit card | 2.45% | 2.40% | 2.31% |

| Mortgage | 1.88% | 2.24% | 2.45% |

| Auto loans | 3.51% | 3.68% | 3.78% |

| Personal loans (unsecured) | 3.89% | 3.86% | 3.76% |

Source: Experian data from September of each year

Survey: Interest Rates Weighing on Consumers

When asked about personal loans this year, consumers were much more likely to cite major purchases, emergency expenses, home improvement and vacations as reasons to want or need a personal loan versus 2024. In addition, consideration was up for most other categories, such as medical expenses and education.

Question: For which of the following reasons might you use a personal loan?

In addition, consumers say that economic conditions made it more likely they'll be borrowing this year, albeit perhaps for differing reasons. In perhaps another example of the K-shaped economy, consumers considering home improvement and vacation may be attracted by lower financing rates, while those who want or need a loan for an emergency or major purchase may have concerns about their economic footing.

Question: How have recent economic conditions over the past 12 months affected your likelihood of taking out a personal loan?

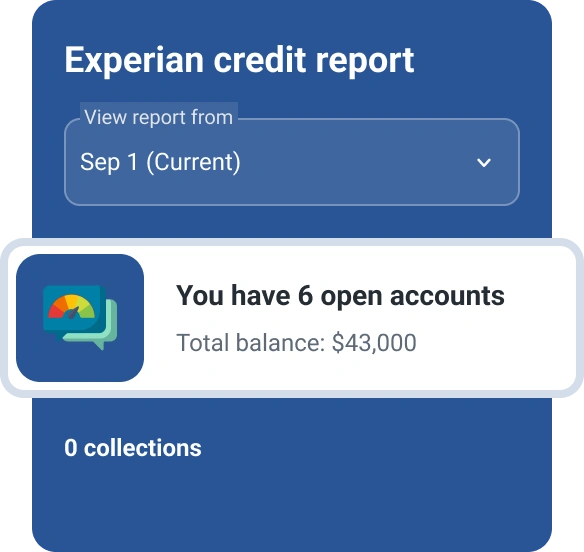

Tracking Your Credit Score

Whether your FICO® Score went up or down last year, knowledge of where you stand now can help you decide how or if you should be financing future purchases in the coming year. Understanding your credit score can also help you know if the offers you receive from lenders are favorable for someone with your score.

Of course, factors such as a missed monthly payment can blemish your credit score, but don't discount the role your credit card balances have in your score. Keeping your credit usage below 30% of your limit (for example, no more than $3,000 on a credit card with a $10,000 limit) isn't a silver bullet for assuring a high credit score, but it can signal to lenders that you're using your existing credit wisely.

There are some other more subtle ways credit use can impact your current FICO® Score as well. For example: Even if you haven't used credit for a while, closing a no-longer-needed credit card account or finally making the last payment on a car loan can change the makeup of your credit mix—which is another of the five attributes that feed into your credit score.

Broadly speaking, improving one's credit scores is often about the "slow and boring" factors, like the natural growth of your credit history and consistency in making on-time payments on mortgages, loans and credit cards each month.

Experian provides consumers with access to their credit report and FICO® Score for free. An Experian account also provides access to free credit monitoring that makes it easy to track FICO® Score changes, get alerted about new inquiries and stay on top of potential fraud.

Methodology: The analysis results provided are based on an Experian-created statistically relevant aggregate sampling of our consumer credit database that may include use of the FICO® Score 8 version. Different sampling parameters may generate different findings compared with other similar analysis. Analyzed credit data did not contain personal identification information. Metro areas group counties and cities into specific geographic areas for population censuses and compilations of related statistical data.

FICO® is a registered trademark of Fair Isaac Corporation in the U.S. and other countries.

What’s on your credit report?

Stay up to date with your latest credit information—and get your FICO® Score for free.

Get your free reportNo credit card required

About the author

Chris Horymski leads Experian Consumer Service’s data research for Ask Experian, where he publishes insights and analysis on consumer debt and credit. Chris is a veteran data and personal finance journalist and previously wrote the Money Lab column for Consumer Reports and headed research at SmartMoney Magazine.

Read more from Chris