Routing Number vs. Account Number: What’s the Difference?

Your routing number represents your bank or credit union, while your account number is unique to your specific checking or savings account. Both numbers are important for a variety of banking transactions, including direct deposit, bill pay, ACH transfers and wire transfers.

Here's what you need to know about routing and account numbers, how to find them and when you'll need to use them.

What Is a Routing Number?

A routing number serves as a nine-digit identifier that pinpoints which bank or credit union maintains your account. You'll often hear these called ABA routing numbers, named after the American Bankers Association that distributes them.

These numbers function exclusively within the U.S. Most banks and credit unions operate with a single routing number, though larger national and international institutions may use different routing numbers depending on your location or where you opened your account.

Learn more: How to Read a Check

What Is an Account Number?

While routing numbers point to your financial institution, account numbers distinguish your specific account from all the others that the bank or credit union manages.

If you maintain multiple checking accounts or both checking and savings accounts at the same institution, your routing number remains constant, but each account receives its own unique number. Since your account number essentially unlocks access to your funds, protecting this information is crucial.

How to Find Your Routing and Account Numbers

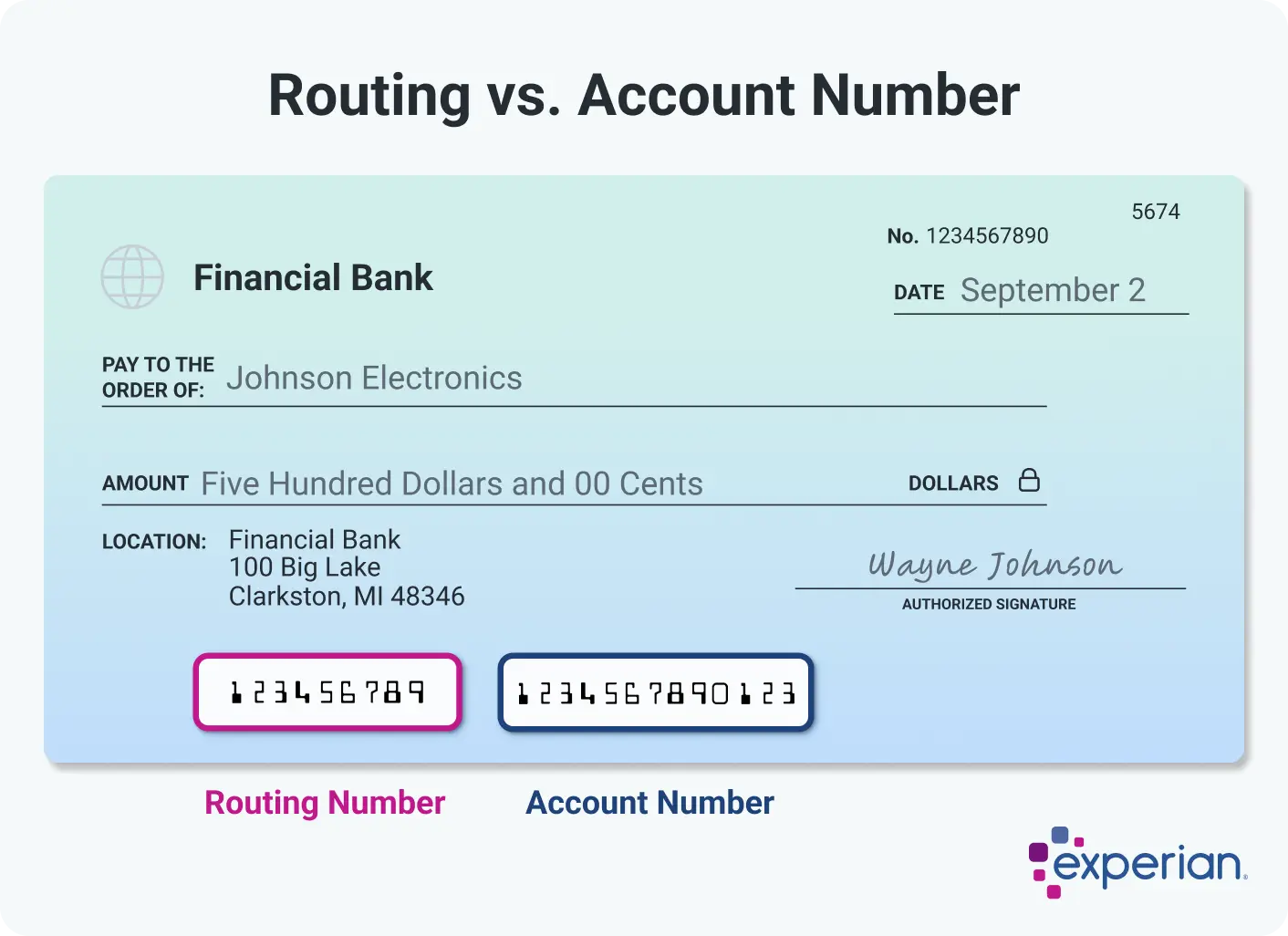

The easiest way to find both numbers is by examining the bottom of any paper check linked to your checking account. These numbers appear in a special magnetic ink using magnetic ink character recognition (MICR) technology, which helps financial institutions process checks efficiently.

Beyond paper checks, there are other ways you can access your account information:

- Check your account. Log in to your online banking portal or mobile app, where these numbers are typically displayed in your account details section.

- Call your financial institution. You can call your bank or credit union directly to request the information from a customer service representative.

- Check the bank or credit union's website. If you're just looking for your financial institution's routing number, you can often locate it through their official website.

While third-party sites compile routing numbers from multiple institutions for convenience, it's safest to verify the number directly through your bank or credit union's official channels.

When Do You Need Your Routing and Account Numbers?

You'll need your bank account details for various financial transactions that involve moving money electronically or setting up automated payments. Common situations include:

- Setting up direct deposit for your paycheck

- Paying bills online through your bank's website

- Setting up automatic bill payments

- Making wire transfers

- Opening new accounts at other financial institutions

- Setting up peer-to-peer payment apps like Venmo or PayPal

- Receiving government benefits or tax refunds

- Making ACH transfers between accounts

- Setting up automatic savings transfers

- Paying contractors or vendors electronically

When providing these numbers for any banking transaction, it's important to double-check every digit carefully. A single incorrect number will cause the entire transaction to fail. Many systems require you to enter your account number twice as a verification step, helping prevent costly mistakes.

Manage Your Finances

Compare checking accounts

Find a digital checking account with intro bonuses, low or no monthly fees and see current APY on checking.

Featured Account

ADDITIONAL FEATURES

- Build credit by paying bills like utilities, streaming services and rentø

- $50 bonus with direct deposit‡

- No monthly fees, no minimums‡

- Secure & FDIC insured up to $250,000§

- Zero liability for fraudulent purchases¶

- 55,000+ no-fee ATMs worldwide**

- Deposit cash at popular retailers#

- Live customer support 7 days a week

The Bottom Line

Your routing and account numbers play essential roles in numerous banking transactions. While it's wise to store these numbers in a secure, accessible location, they can be quickly located when needed.

Remember that routing numbers are publicly available information since they simply identify your financial institution. However, your account number is private and should be treated as confidential information. Share it only when absolutely necessary for legitimate banking purposes to prevent potential fraud.

Earn more with a high-yield savings account

Make your money work harder with a high-yield savings account—earn higher returns with easy access to your funds.

Compare accountsAbout the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben