What Is the Lowest Credit Score?

The lowest possible credit score for the two main scoring models, FICO and VantageScore®, is 300. However, it's very rare for someone to have a score that low.

Whether you're looking to better understand your credit or work on rebuilding your credit profile, here's what you need to know about credit scores, including what causes low scores, the drawbacks of bad credit and how you can improve your score.

What Is the Lowest Credit Score?

The lowest credit score you can get is 300 for standard FICO and VantageScore credit scores, both of which also go as high as 850. However, industry-specific FICO scoring models for mortgage loans, auto loans and credit cards can go as low as 250 and as high as 900.

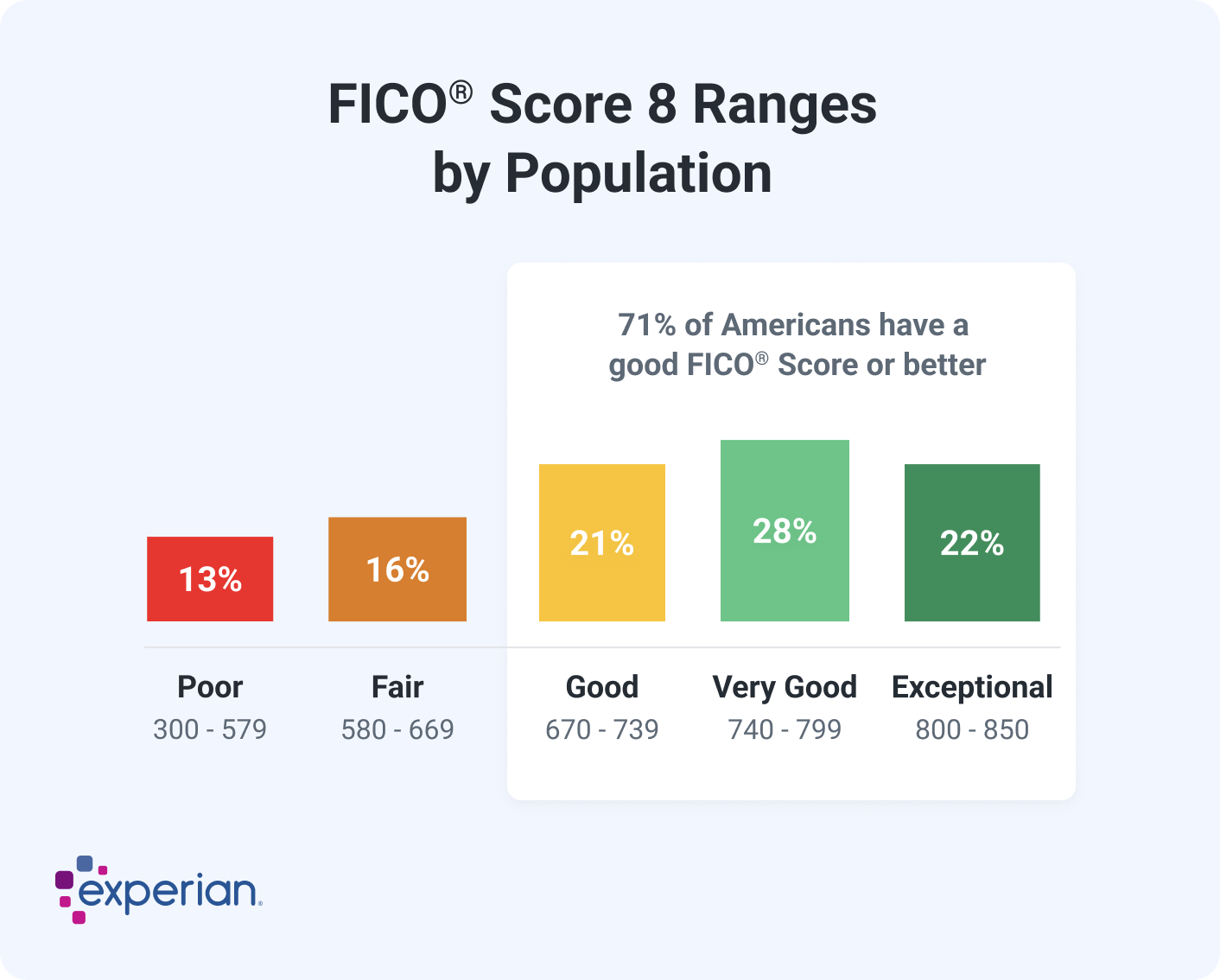

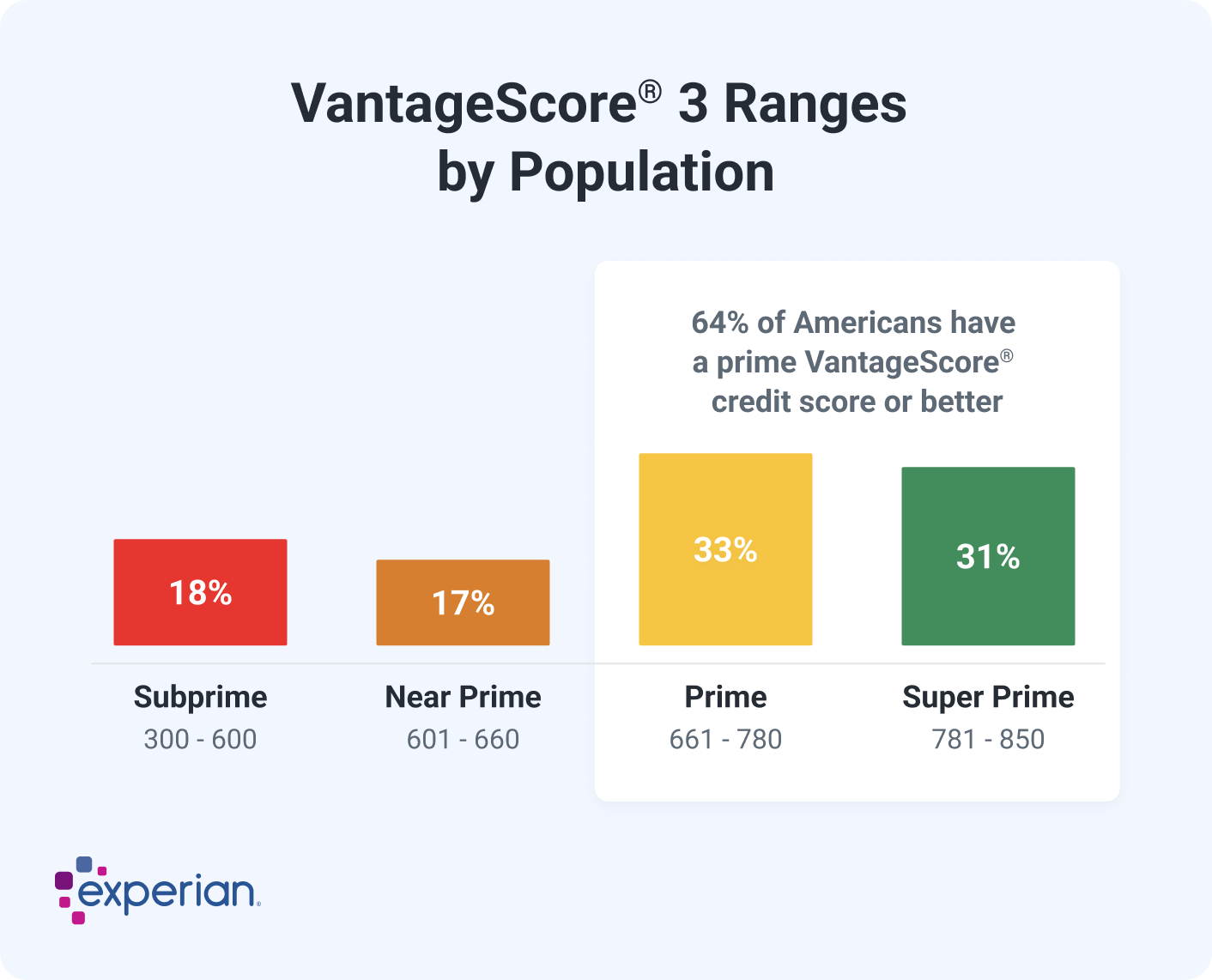

Here's a look at the different credit score ranges for FICO and VantageScore models and how Americans stack up:

What Causes a Low Credit Score?

A low credit score can be a result of many different factors. While reviewing your credit report can give you a better idea of what's influencing your score, here are some general things that can damage your credit:

- Missed or late payments: If you miss a single payment by 30 days, it could cause your credit score to lose a significant number of points. The more payments you miss, the more damage your score will sustain. Additionally, loan defaults and collection accounts may drive your score down even further.

- High credit utilization: Your credit utilization rate is the percentage of available credit you're using on your credit cards. A higher utilization rate typically corresponds to lower credit scores.

- Short credit history: As you start building your credit history from scratch, there isn't a lot of information for credit scoring models to assess your creditworthiness. As a result, it may take some time to establish a good credit score.

- Major negative items: If you've settled a debt for less than what you owe or filed for bankruptcy, your credit score may take a huge hit. The same is true if you've experienced a repossession or foreclosure.

Learn more: What Affects Your Credit Scores?

Disadvantages of Having a Low Credit Score

A poor credit score can hinder you financially in a variety of ways. Understanding these disadvantages can help you stay motivated to build and maintain good credit:

- Difficulty obtaining credit: Many lenders are unwilling to work with borrowers with low credit scores, limiting your options to get financing when you need it.

- Fewer housing options: The Federal Housing Administration (FHA) loan program is available to borrowers with scores as low as 500. However, most mortgage loans require you to have fair credit or better to get approved. Additionally, if you're trying to rent an apartment or home, you may have a harder time getting accepted if other applicants have better credit.

- Higher interest rates: Some types of loans, including auto loans, personal loans and credit cards, are available to borrowers with lower credit scores. However, lenders typically charge much higher interest rates to compensate for the risk, making borrowing less affordable.

- Higher insurance rates: Most states allow auto and homeowners insurance companies to use credit-based insurance scores when determining rates. While your consumer credit score isn't an exact correlation to your credit-based insurance score, having a low score and other factors working against you, could result in higher premiums.

- Possible employment issues: Some employers may choose to run a credit check on new job candidates, though this practice is illegal in some areas. While they can't see your credit score, they may still deny you employment if you have serious negative items on your credit reports.

Learn more: How to Build Credit: A Comprehensive Guide

How to Improve Your Credit Score

If you have a low credit score—regardless of the reason—here are some steps you can take to improve your credit score:

- Pay your bills on time. Your payment history is the most important factor in your credit scores, so it's crucial that you always pay your bills on time. If you have late payments, make a plan to catch up as quickly as possible. If you have debts in collections, pay them off.

- Keep your credit card balances low. There's no hard-and-fast rule for what your utilization rate should be. However, people with excellent credit tend to have a utilization rate below 10%.

- Become an authorized user. If you have a loved one with good credit, consider asking them to add you as an authorized user on one of their credit card accounts. Once you're added, the full history of the account will be added to your credit report, which could help bolster your score.

- Keep older accounts open. If you have open credit card accounts, consider keeping them open. It could help you improve your credit over time because the accounts can help extend your length of credit history.

- Limit new credit applications. Each time you apply for credit, the lender will typically run a hard inquiry on one or more of your credit reports, which can hurt your credit temporarily. Opening a new credit account will also reduce your average age of accounts, which can negatively impact your length of credit history. As a result, it's a good idea to space out credit applications by at least six months and avoid unnecessary applications altogether.

- Dispute inaccurate credit items. If you find inaccurate information on your credit reports, you have the right to file a dispute with the credit reporting agencies. If the credit bureaus agree with your assessment, they may update or remove the information, which could potentially help your credit score.

Frequently Asked Questions

Monitor Your Credit Score to Keep Track of Your Progress

As you work to build your credit, keeping track of your progress can make it easier to stay motivated and learn more about how your credit works.

With Experian's free credit monitoring service, you can get access to your FICO® Score and Experian credit report, as well as real-time alerts when changes are made to your report. Over time, these resources can give you insights into how you can develop good credit habits and maintain the progress you earn.

Instantly raise your FICO® Score for free

Use Experian Boost® to get credit for the bills you already pay like utilities, mobile phone, video streaming services and now rent.

No credit card required

About the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben