Why Is My Credit Score Different When Lenders Check My Credit?

The credit score you see and the one a lender uses may vary because they're based on information from different credit bureaus, credit scoring models or score versions.

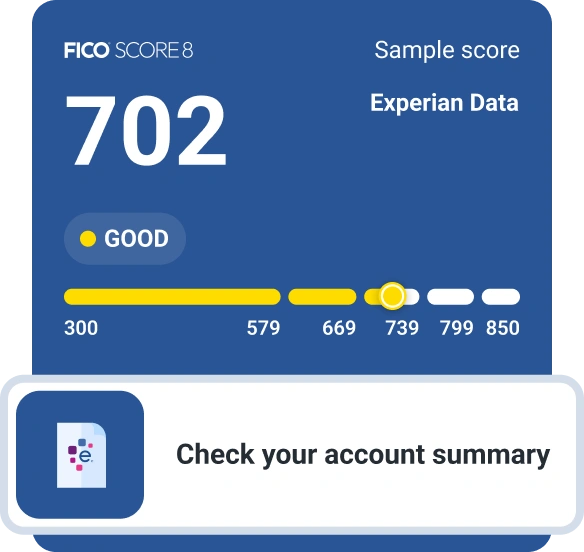

For example, when you check your credit score for free, you might receive a score calculated using the VantageScore® 4.0 model, but a lender might use the FICO® ScoreΘ 8 to assess your credit. There are minor differences in the way scores are calculated that can lead to variation in these scores.

Here's what to know about the multiple credit scores you have, and which are most important to keep an eye on when you're seeking new credit.

What Credit Score Do Lenders Use?

The two main companies that produce and maintain credit scores are FICO and VantageScore. Both have released updates to their basic scores over the years. FICO® Scores are used by 90% of top lenders to make lending decisions, and in particular, the FICO® Score 8 is a popular version for general use. If you want to know about the health of your credit and how lenders will view it, checking your FICO® Score 8 is a smart place to start.

Certain types of lenders may look at FICO's industry-specific scores, such as the FICO Bankcard Score (used to make credit card lending decisions) and the FICO Auto Score (used to make auto lending decisions). If you know you're interested in a certain type of credit, it could be worthwhile to check beforehand the specific score type you know a lender will look at.

Why Are My Credit Scores Different?

There is no single overarching credit score. You have multiple credit scores at any given time, and they're based on slightly different underlying information. Here are the three reasons why you have different credit scores, and why the one you've pulled to check your own credit may deviate from what a lender uses to evaluate your creditworthiness.

Different Scoring Models

The first reason your scores might vary is because you and your lender are looking at scores from different scoring models. The first FICO® Score was developed by the Fair Isaac Corp., known as FICO, in 1989 and the first VantageScore credit score was developed jointly by the three credit bureaus (Experian, TransUnion and Equifax) in 2006.

There are slight differences in the way VantageScore and FICO calculate your score.

- Credit history: You likely will not have a FICO® Score if you don't have a credit account that's older than six months. You can get a VantageScore credit score, however, if you have at least one account in your name—no matter its age.

- Credit utilization: While both scoring models heavily weight credit utilization, or the amount of revolving debt (mainly credit cards) you carry relative to your credit limit, the VantageScore 4.0 also takes into account your utilization over time. So if you usually pay your credit card bill in full—even if you carried a balance a few times—you'll be given credit for typically bringing your utilization to 0%. The most common versions of the FICO® Score, on the other hand, will assess your credit utilization based only on the time when your score was checked. The most recent FICO® Score 10 T model does consider utilization over time, but it hasn't yet been widely adopted by lenders.

- Score ranges: General FICO® Scores range from 300 to 850, and so do VantageScore 3.0 and 4.0 scores. But industry-focused FICO® Scores range from 250 to 900, and earlier VantageScore versions range from 501 to 990. Even though the precise ranges might vary, in practice, the differences aren't major: The higher your credit score, the better.

Various Score Versions

Both FICO and VantageScore regularly release updated versions of the scores they produce. A lender that uses a FICO® Score 2 to assess your creditworthiness may see a different number than a mortgage lender that uses the FICO® Score 4. The companies update their scoring systems based on data they gather on consumer credit behavior, and on what they believe will help lenders more accurately assess the risk a borrower won't repay a debt.

Additionally, federal regulations affect which scores lenders can or must use to evaluate borrowers, especially in the mortgage industry. The Federal Housing Finance Agency, for example, has updated its requirements to allow Fannie Mae and Freddie Mac mortgage lenders to use either the "classic" FICO® Score or the VantageScore 4.0 to make lending decisions, and to use the FICO® Score 10 T in the future too.

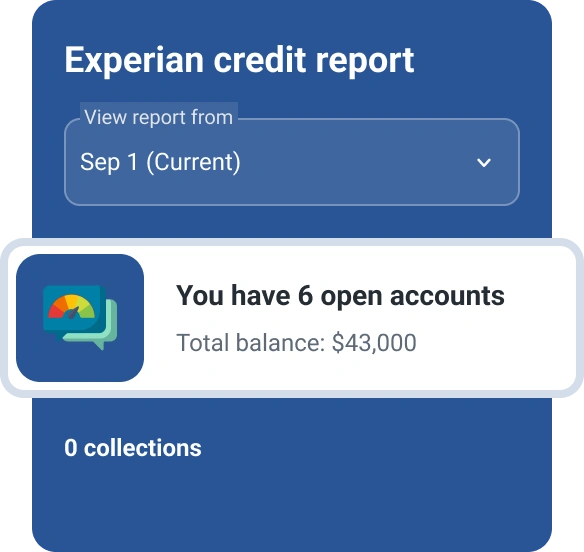

Multiple Credit Bureaus

Finally, credit scores are based on the information found in credit reports maintained by the three major consumer credit bureaus: Experian, TransUnion and Equifax. If those reports differ, a credit score based on one report will not be identical to a score based on another. They can differ because lenders are not required to report debt accounts to all three bureaus.

Plus, FICO develops scores specific to each bureau, so your FICO® Score 8 may be slightly different depending on the bureau. VantageScore credit scores, on the other hand, were developed cooperatively by the three credit bureaus, so tri-bureau scores that use the same VantageScore credit score iteration will be the same no matter which bureau you use.

Tip: Say your credit card company offers the option to view your credit score for free, and it's a FICO® Score based on your Experian credit report. A lender that pulls your credit score may see a different FICO® Score if their score was based on your Equifax credit report. You can check your FICO® Score for free from Experian anytime.

How to Improve Your Credit Score Before Applying for Credit

While you have many different credit scores, the same positive behavior will typically lead to a good or excellent credit score across the different models, versions and credit bureaus. Here's how to improve your credit score.

- Make all payments on time. One of the best ways to establish excellent credit is to pay all your bills on time across each of your credit accounts. This isn't a fast way to improve a credit score, but done consistently, it will strengthen your scores. That's because payment history is the most important credit scoring factor across models and versions.

- Pay down debt. Amounts owed is the second most important factor in your credit scores, after payment history. Paying down debt and avoiding taking on new debt will help your credit score stay strong.

- Limit applications for new credit. When you apply for new credit cards or loans, a hard inquiry appears on your credit report, alerting prospective lenders that you've requested to borrow money. While a single inquiry may only ding your account by a few points temporarily, too many recent applications can be a red flag for lenders. Only request credit when you truly need it, and avoid opening new accounts entirely for six to 12 months before applying for a mortgage. Aim to keep your oldest accounts open to lengthen your credit history, another factor that contributes to your score.

The Bottom Line

It can be overwhelming to parse out all the differences among your credit scores. There are some cases, such as when applying for a mortgage or car loan, when it's a good idea to view a specific score model and version beforehand. But in general, the differences among your credit scores are minor. Practicing smart credit habits—like monitoring changes to your score over time—can yield benefits across the many scores that belong to you.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Brianna McGurran is a freelance journalist and writing teacher based in Brooklyn, New York. Most recently, she was a staff writer and spokesperson at the personal finance website NerdWallet, where she wrote "Ask Brianna," a financial advice column syndicated by the Associated Press.

Read more from Brianna