Can You Apply for Two Credit Cards at Once?

Nothing is stopping you from applying for two or more credit cards in a short period of time, or even at the same time. But multiple credit card inquiries can hurt your credit score and raise a red flag for future creditors.

If you're considering getting multiple credit cards, here's what you need to know about how doing so could affect your credit.

How Multiple Credit Card Inquiries Affect Your Credit Score

Whether you're trying to quickly build your credit or take advantage of various benefits or welcome offers, it can be tempting to apply for more than one credit card in a short period. But depending on your situation, it could have negative consequences for your credit score.

When you shop around for a mortgage, auto loan or even private student loan, it's common to get quotes from multiple lenders to ensure you're getting the best terms. And if you do this within a short period—typically 14 to 45 days depending on the credit scoring model—all the hard inquiries that pop up on your credit reports will count as just one when calculating your credit score.

With credit cards, however, you won't get that same benefit. In most cases, each card account you apply for will result in a separate inquiry, and each will factor into your credit score.

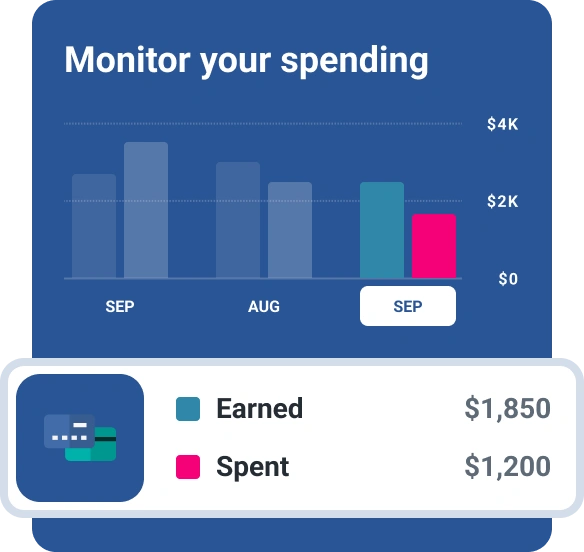

How those inquiries affect your credit scores depend on the credit scoring model. With the FICO® ScoreΘ, for example, one additional inquiry will usually decrease your credit score by fewer than five points. However, multiple inquiries in a short period may have a compounding effect.

What's more, data shows that people who have several inquiries on their credit reports in a short period are more likely to overextend themselves and default on their debts. As a result, even if your credit score doesn't drop by much, future creditors may offer you higher interest rates or deny your application altogether because of the added risk.

How Long Should You Wait Between Card Applications?

There's no magic number for the amount of time you should wait before you apply for an additional credit card. In fact, the right amount can vary based on your credit history and situation:

You Have a Limited Credit History

If you're just starting to build credit, a second credit card can improve your credit utilization ratio—how much of your available credit you're using—and offer another opportunity to establish positive payment history. These benefits may outweigh the potential negative impact of a second hard inquiry. That said, if you want to be safe, consider waiting three to six months between applications.

Just make sure you're applying for starter credit cards that are designed for people in your credit situation. Otherwise, you may get denied and still have a new hard inquiry on your credit report.

You're Rebuilding Your Credit

If your credit is in poor shape and you want to use credit cards to rebuild, every effort counts. In this case, it may be best to wait several months between card applications. Also, adding new credit card accounts may not help much if you're behind on payments on another credit account. Instead, look to other areas for credit improvement, such as paying down debt to help lower your utilization ratio. Once you've had a chance to positively impact your credit, then you might consider applying for a new card.

You've Been Denied Recently

Hard inquiries happen during the application process, so they'll ding your credit score whether or not you're approved for a card. If you've been denied recently, take a step back before you apply for another one. Look at your credit situation to determine if you need to make some changes before you apply again.

Also, make sure you're applying for cards that are targeted to your credit score. Experian's card comparison tool can help you get personalized offers based on your credit score with just a soft inquiry, which doesn't affect your credit scores. While there's no guarantee you'll get approved, it can help you focus on cards where your approval odds are higher.

Your Credit History Is Well-Established

If you've been using credit for a long time and have a stellar track record, the impact of two or three credit inquiries in a short period likely won't be as drastic.

And if you don't have trouble managing your existing credit cards—you're spending only what you can afford and paying your bill in full each month—the benefits of getting another card may outweigh the drawbacks.

Next Steps

If you're considering getting more than one credit card in the near future, you can check your FICO® Score to see where you stand. As you consider your situation, think about the benefits and drawbacks of having multiple inquiries on your credit reports in the short term.

Don’t apply blindly

Apply for credit cards confidently with personalized offers based on your credit profile. Get started with your FICO® Score for free.

See your offersAbout the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben