444 Credit Score: Is it Good or Bad?

Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 444 FICO® ScoreΘ is significantly below the average credit score.

Many lenders view consumers with scores in the Very Poor range as having unfavorable credit, and may reject their credit applications. Applicants with scores in this range may be required to pay extra fees or to put down deposits on credit cards. Utility companies may also require deposits on equipment or service contracts.

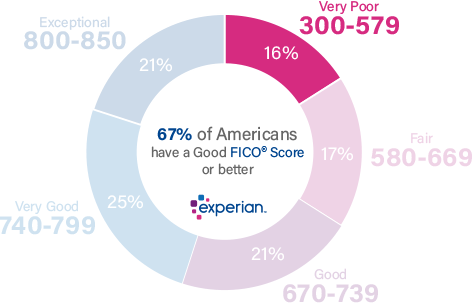

16% of all consumers have FICO® Scores in the Very Poor range (300-579).

Approximately 62% of consumers with a credit score under 579 are likely to become seriously delinquent in the future.

How to improve your 444 Credit Score

The bad news about your FICO® Score of 444 is that it's well below the average credit score of 714. The good news is that there's plenty of opportunity to increase your score.

100% of consumers have FICO® Scores higher than 444.

A smart way to begin building up a credit score is to obtain your FICO® Score. Along with the score itself, you'll get a report that spells out the main events in your credit history that are lowering your score. Because that information is drawn directly from your credit history, it can pinpoint issues you can tackle to help raise your credit score.

Building on a Very Poor credit score

FICO® Scores in the Very Poor range often reflect a history of credit missteps or errors, such as multiple missed or late payments, defaulted or foreclosed loans, and even bankruptcies.

Among consumers with FICO® Scores of 444, 27% have credit histories that reflect having gone 30 or more days past due on a payment within the last 10 years.

Once you're familiar with your credit report, its contents and their impact on your credit scores, you can begin taking steps to build up your credit. As your credit behaviors improve, your credit scores will tend to follow suit.

What affects your credit score

To work toward better credit scores, watch out for behaviors that can lower your credit score:

Late or missed payments. One of the most significant influences on your credit score is proven ability to pay bills consistently and on-time. Late and missed payments and accounts considered delinquent will hurt your credit score. A steady history of on-time payments will help your credit score. This can account for up to 35% of your FICO® Score.

Credit utilization. Lenders and credit scorers have a technical term for "maxing out" your credit cards by spending your entire credit limit. They call it pushing your credit utilization ratio to 100%. They consider it a very bad idea, and that’s why doing so can significantly lower your credit score. Most experts recommend keeping your utilization below 30% to avoid hurting your credit score. To calculate your credit utilization ratio, add up the balances on your credit cards and divide by the sum of their credit limits. Utilization rate is responsible for as much as 30% of your FICO® Score.

Credit history. The number of years you’ve been a credit user can influence up to 15% of your FICO® Score. All other things being equal, a longer credit history will tend to bring a higher credit score than a shorter history. This reflects lenders’ interest in borrowers with proven track records of debt repayment. If you’re relatively new to the credit market, there’s not much you can do about this factor, other than be patient and avoid missteps along the way.

Recent credit applications. If you’re continually applying for new loans or credit cards, you could be hurting your credit score. Applications for credit trigger events known as hard inquiries, which are recorded on your credit report and reflected in your credit score. In a hard inquiry, a lender obtains your credit score (and many times your credit report) for purposes of deciding whether to do business with you. Hard inquiries lower your credit scores temporarily, but scores typically bounce back within a few months as long as you keep up with your bills—and avoid making additional loan applications until then. (Checking your own credit is a soft inquiry and does not impact your credit score.) Hard inquiries can account for up to 10% of your FICO® Score.

Total debt and credit mix. It may sound odd, but taking on a new loan—if it’s the right kind of loan—could benefit your credit score. Credit scores reflect your total outstanding debt, and the types of credit you have. Credit scoring systems such as FICO® tend to respond well to a variety of credit types. Specifically, they favor a mix of revolving credit (accounts such as credit cards, that borrowing within a specific credit limit) and installment credit (loans such as mortgages and car loans, with a set number of fixed monthly payments).

Public Information: If bankruptcies or other public records appear on your credit report, they can have severe negative impacts on your credit score.

The average credit card debt for consumer with FICO® Scores of 444 is $1,517.

Improving Your Credit Score

Converting a Very Poor credit score to a Fair (580-669) or a (670-739) Good one is a gradual process. It can’t be done quickly (and you should avoid any business or consultant that tells you otherwise). But you can start to see some steady score improvements within a few months if you begin immediately to develop habits that promote good credit scores. Here are some good starting points:

Pay your bills on time. Yes, you’ve heard it before. But there’s no better way to improve your credit score. If you have accounts that are past-due or in collections.

Avoid high credit utilization rates. Try to keep your utilization across all your accounts below about 30% to avoid lowering your score.

Among consumers with FICO® credit scores of 444, the average utilization rate exceeds 100%.

Consider a debt-management plan. If you're having trouble repaying your loans and credit cards, a debt-management plan could bring some relief. You work with a non-profit credit-counseling agency to work out a manageable repayment schedule. Entering into a DMP effectively closes all your credit card accounts. This can severely lower your credit scores, but your scores can rebound from it more quickly than they would from bankruptcy. If this sounds too extreme for you, you may still want to consulting a credit counselor (not a credit-repair outfit) to devise a game plan for improving your credit.

Think about a credit-builder loan. Many credit unions offer these small loans, which are designed to help their members build up or rebuild their credit. There are several different types of credit-builder loan, but in one of the more popular ones, the credit union issues you a loan, but instead of giving you cash, they place it in an interest-bearing savings account. Once you've paid off the loan, you get access to the money plus the accumulated interest. It's partly a savings tool, but the real benefit comes as the credit union reports your payments to the national credit bureaus. As long as you make regular on-time payments, the loan can lead to credit-score improvements. (Before obtaining a credit-builder loan, make sure the credit union reports payments to all three national credit bureaus.)

Apply for a secured credit card. A secured credit card typically has a small borrowing limit—often just a few hundred dollars— and you put down a deposit in the full amount of that limit. As you use the card and make regular payments, the lender reports those activities to the national credit bureaus, where they are recorded in your credit files and reflected in your FICO® Scores. By making timely payments and avoiding "maxing out" the card, use of a secure credit card can promote improvements in your credit-score.

Try to establish a solid credit mix. The FICO® credit-scoring model tends to favor users with multiple credit accounts, and a blend of different types of loans, including installment loans like mortgages or auto loans and revolving credit such as credit cards and some home-equity loans.

Learn more about your credit score

It's never too late to start working toward a better FICO® Score, and your 444 FICO® Score is as good a starting point as any. Bringing your score up into the fair range (580-669) could help you gain access to more credit options, lower interest rates, and reduced fees. You can get begin right away with your free credit report from Experian and checking your credit score to learn what's needed to help your score grow. Read more about score ranges and what a good credit score is.