825 Credit Score: Is it Good or Bad?

Your score falls in the range of scores, from 800 to 850, that is considered Exceptional. Your FICO® ScoreΘ and is well above the average credit score. Consumers with scores in this range may expect easy approvals when applying for new credit.

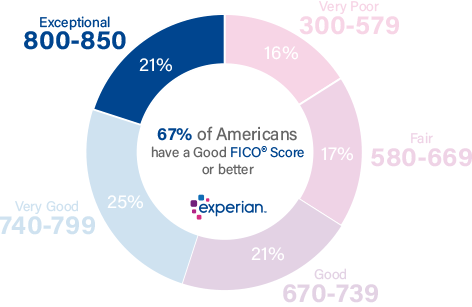

21% of all consumers have FICO® Scores in the Exceptional range.

Less than 1% of consumers with Exceptional FICO® Scores are likely to become seriously delinquent in the future.

How to improve your 825 Credit Score

A FICO® Score of 825 is well above the average credit score of 714. An 825 FICO® Score is nearly perfect. You still may be able to improve it a bit, but while it may be possible to achieve a higher numeric score, lenders are unlikely to see much difference between your score and those that are closer to 850.

Among consumers with FICO® credit scores of 825, the average utilization rate is 7.7%.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you'll receive a report that uses specific information in your credit report that indicates why your score isn't even higher.

Because your score is extraordinarily good, none of those factors is likely to be a major influence, but you may be able to tweak them to get even closer to perfection.

What’s great about an Exceptional credit score

Your 825 FICO® Score is nearly perfect and will be seen as a sign of near-flawless credit management. Your likelihood of defaulting on your bills will be considered extremely low, and you can expect lenders to offer you their best deals, including the lowest-available interest rates. Credit card issuers are also likely to offer you their most deluxe rewards cards and loyalty programs.

Late payments 30 days past due are rare among individuals with Exceptional credit scores. They appear on just 0.7% of the credit reports of people with FICO® Scores of 825.

An Exceptional credit score can mean opportunities to refinance older loans at more attractive interest, and excellent odds of approval for premium credit cards, auto loans and mortgages.

Monitor and manage your Exceptional credit score

To achieve a FICO® Score of 825, you've exercised discipline over time. Your Exceptional score attests to skillful management of the behaviors that influence credit scores. Being vigilant about those behaviors can help you hold on to your Exceptional score, and perhaps even improve upon it by a few points:

The average mortgage loan amount for consumers with Exceptional credit scores is $243,993. People with FICO® Scores of 825 have an average auto-loan debt of $20,064.

Credit utilization. Utilization rate contributes as much as 30% of your FICO® Score.

To calculate the credit utilization ratio on a credit card, divide any outstanding balance by the card's borrowing limit, and multiply by 100 to get a percentage. To calculate your overall utilization rate, add up the balances on all your credit cards and divide by the sum of their borrowing limits (remembering to include any cards with zero balances). According to most experts, if you keep utilization below 30%, on each card individually and on your revolving credit portfolio overall, you'll avoid lowering your credit score.

Late or missed payments. Paying bills consistently and on time is the single best thing you can do to promote a good credit score—and missing a payment is one of the easiest ways to tarnish a near-perfect score. Payment behavior can account for more than a third (35%) of your FICO® Score.

Length of credit history. All other things being equal, individuals with longer debt-management histories have higher credit scores than those with shorter histories. One of the rare perks of getting older, it reflects the fact that consumers with longer experience handling credit are less likely to default on debts than those with briefer experience. This factor can influence up to 15% of your FICO® Score.

Total debt and credit mix are responsible for up to 10% of your FICO® Score.

The FICO® credit scoring system tends to favor users with multiple credit accounts, and a variety of revolving credit and installment loans. In some instances, broadening your debt portfolio could help your credit score.

Recent credit activity. Credit applications trigger events known as hard inquiries, by which the lender obtains your credit score and often a credit report for purposes of deciding whether to lend to you. Hard inquiries can cause credit scores to drop a few points, but scores typically rebound within a few months if you keep up with your bills. (Checking your own credit is a soft inquiry and does not impact your credit score.) New-credit activity can account for up to 10% of your FICO® Score.

Shield your credit score from fraud

People with Exceptional credit scores can be prime targets for identity theft, one of the fastest-growing criminal activities.

Mortgage fraud occurs when a borrower, broker or an appraiser lies about information on the application for a mortgage loan. During the mortgage crisis, Experian estimated that first-party fraud—like loan stacking—may have accounted for more than 25% of all consumer credit charge-offs at the time.

Credit-monitoring and identity theft protection services can help ward off cybercriminals by flagging suspicious activity on your credit file. By alerting you to changes in your credit score and suspicious activity on your credit report, these services can help you preserve your excellent credit and Exceptional FICO® Score.

By using credit monitoring to keep track of your credit score, you'll also know if it starts to dip below the Exceptional range of 800-850, and you can act quickly to try to help it recover.

Learn more about your credit score

An 825 credit score is Exceptional. Get your free credit report from Experian and check your credit score to better understand why it’s so good, and how to keep it that way. Read more about score ranges and what a good credit score is.