How Utility Bills Could Boost Your Credit Score

Quick Answer

Utility companies typically don’t report your payment history to the credit bureaus. But paying utility bills on time can help your credit score when you use Experian Boost. This tool specifically integrates gas, electric, water and other utility payments into your Experian credit report and scores.

Utility bills could help your credit score when you use a service that specifically integrates them into your score, such as Experian Boost®ø. Otherwise, utility companies typically don't report your payment history to the credit bureaus.

Here's what to know about utility bill payments and your credit, and the steps you can take to let on-time payments give your score a boost.

Are Utility Bills Reported to the Credit Bureaus?

Utility companies don't regularly share your payment history with the credit bureaus (Experian, TransUnion and Equifax), so your credit reports won't automatically include that information.

Experian Boost, a free feature, will give you credit for making utility bill payments on time, which could help improve your credit score. It's only available for your Experian credit report and could boost your FICO® ScoresΘ based on Experian data. That means utility bills will continue to have no influence on your Equifax and TransUnion credit reports, or on your credit scores based on those reports.

How Paying Utility Bills Could Boost Your Credit

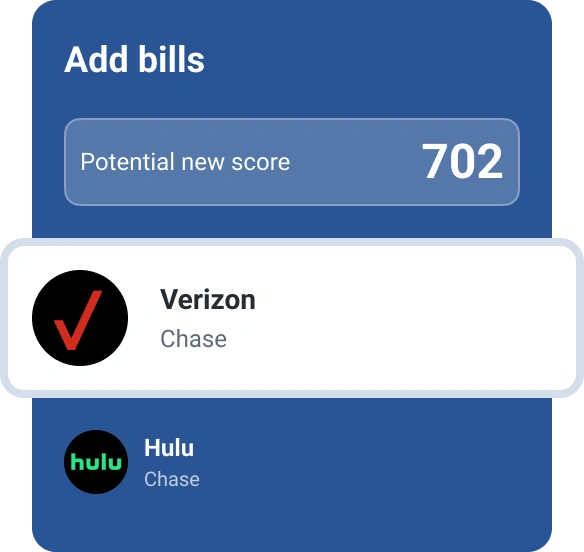

Experian Boost scans your credit card and bank account histories for on-time utility bill payments (plus eligible rent and streaming service payments, if you'd like to add those). If Experian Boost finds on-time bill payments, it adds those to your credit account at Experian, which could improve your FICO® Score.

Payment history is the most important factor in your credit score, so more on-time payments will give it a lift. Experian Boost only adds on-time payments to your credit report, so late payments won't affect your score. To set up an Experian Boost account:

- Sign up for Experian Boost for free on Experian's website.

- Provide your personal details like name, date of birth and email.

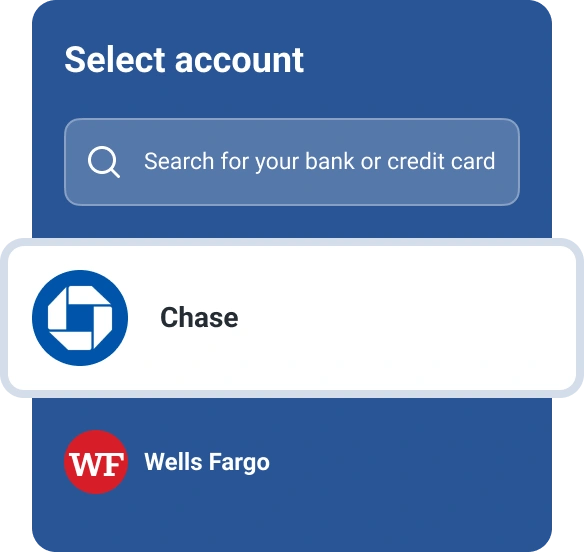

- Connect your credit card and/or bank accounts that you use to pay your bills.

- Verify the payments Experian Boost finds, and choose whether to add them to your credit file.

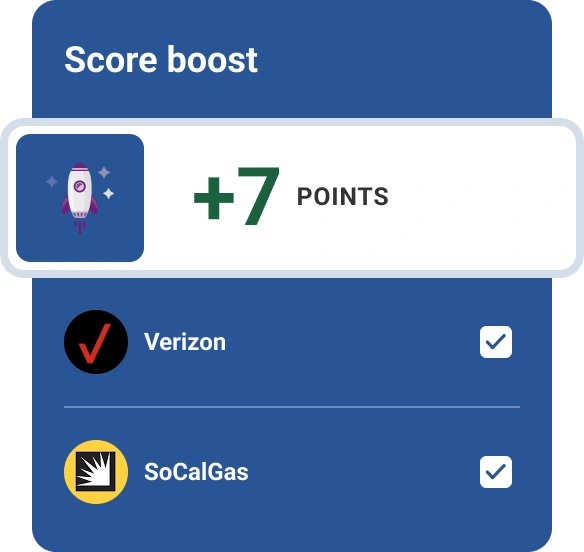

- Check whether your FICO® Score has increased. For many users, this happens immediately. On average, Experian Boost users who saw an increase saw their FICO® Score 8 from Experian increase by 13 points.

What Utility Bills Qualify for Experian Boost?

The following utility bills are eligible for Experian Boost:

- Mobile and landline phone

- Internet

- Cable and satellite

- Gas and electricity

- Video streaming services

- Water

- Power and solar

- Trash

Rent payments can also be included, as long as you've made at least three payments within six months, with one payment occurring in the last three months.

Will Lenders Use My Experian Credit Score?

There's no way to know which score a lender will use to determine whether to work with you. But since Experian Boost does not affect your credit files with Equifax and TransUnion, it's certain that if a lender uses a score based on data from those credit reporting agencies, your utility bill payments won't factor into the score they see.

Can Utility Bills Hurt My Credit?

Utility companies can send unpaid bills to collection agencies. This won't happen when one payment is slightly late; rather, if you miss multiple payments or leave a bill unpaid for months, the provider may hire a separate company to collect the debt. When you don't pay a bill for six months or more, the provider may charge off the account instead, assuming you're not going to pay. Both a charge-off and an account in collections will stay on your credit report for seven years and hurt your credit score.

Additionally, the National Consumer Telecom & Utilities Exchange (NCTUE) is a specialty consumer reporting agency that collects and shares customer data, including payment history, among its 95 utility and telecommunications company members. Say you have an unpaid balance with a natural gas provider. If it's a member of the exchange, it may share that information with other providers, which can affect whether another natural gas utility decides to do business with you—or require you to pay a deposit to do so.

The Bottom Line

Utility payments are a fact of life, but it's possible to put them to good use. Using Experian Boost could lead to a quick uptick in your Experian credit scores, if you have enough on-time payments to include in your credit report.

You also have the opportunity to save money on utility payments by using Experian's BillFixer tool, which will negotiate with your utility providers to lower your monthly bills.

Instantly raise your FICO® Score for free

Use Experian Boost® to get credit for the bills you already pay like utilities, mobile phone, video streaming services and now rent.

No credit card required

About the author

Brianna McGurran is a freelance journalist and writing teacher based in Brooklyn, New York. Most recently, she was a staff writer and spokesperson at the personal finance website NerdWallet, where she wrote "Ask Brianna," a financial advice column syndicated by the Associated Press.

Read more from Brianna